The idea that a business might be involved in the forex market is not one that many people without direct experience have considered. And to be clear, it doesn’t typically refer to someone using an exchange to directly conduct forex trades on behalf of a business. However, there are certain circumstances under which a given company can become involved in foreign exchange.

Small Biz Trends does a nice job of summing up why and how this can happen. Their article on the subject points out that business looking to expand to foreign markets need to make use of multiple currencies and employ the best exchange rates they can. Similarly, it notes that some businesses may use forex to reinvest existing capital into more liquid positions to direct said capital toward operations. In either of these situations, the business is technically conducting forex trades, of a sort.

Because these circumstances aren’t actually uncommon though, we’re posting a few tips for businesses that may find themselves engaging in forex.

1. Find the Right Trading Platform

When you’re conducting forex trades in the course of doing business, the platform you actually use to exchange currency when needed might be almost an afterthought. Really though, as is pointed out in the aforementioned article from Small Biz Trends, this is something you should take care to focus on. It’s not a big job, but doing the research to find a reputable broker will save you the headache of worrying after the fact about the security of your transactions, or the privacy of your account. Figure out a platform or broker you can trust, and you’ll have an easy way of managing currency exchange moving forward.

2. Consider Liability Protection

Liability protection is designed to keep your personal assets as a business owner separate from problematic issues that may arise within your business. Those issues can include unexpected debt or losses, which — while not likely — can occur due to foreign exchange. For this reason, it can be a wise idea for business owners involved in this kind of activity to establish liability protection. This sounds like it might be somewhat complicated, but in

actuality it can be as simple a matter as registering the company as an LLC. ZenBusiness explains that this structure essentially exists to make it such that owners “are not personally responsible for the company’s debt or liabilities.” This means that forming an LLC can keep you protected against any forex-related debts — and it’s not difficult to set up.

3. Prioritize the Mitigation of Risk

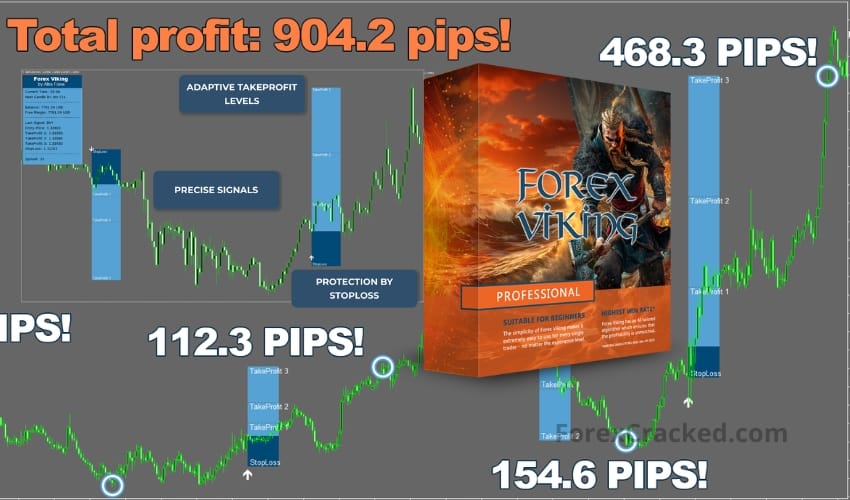

One fact that cannot be avoided is that forex — like other trading markets — is inherently risky. In fact, just to put things in perspective, The Balance revealed that a 2014 study showed nearly 70% of forex traders losing money in four consecutive quarters! This does not mean forex should be avoided; for the business purposes we’re discussing, in fact, it can’t necessarily be avoided. But steps should be taken to mitigate risk. This is a general concept we’ve alluded to before in articles like “A Low-Risk Approach For Better Profits — though the strategy in that piece is aimed more at regular traders. For businesses, we’d simply stress that exchanges should only be conducted when necessary and well planned and that funds shouldn’t be left in a currency aside from the business’s primary currency out of laziness or carelessness. Every exchange should have a purpose.

Keep these ideas at the top of your mind, and you should be able to effectively manage forex on behalf of your business. Done correctly, this can help you maximize your profits and avoid unnecessary losses due to exchange.