When it comes to trading forex, one of the biggest choices you’ll face is whether to rely on a Forex EA (Expert Advisor) or manual trading. On one side, EAs promise hands-free automation, running your strategy 24/5 without emotions or fatigue. On the other, manual trading gives you full control, letting you adapt to news events, market conditions, and intuition in real time.

Both approaches have clear advantages and drawbacks, and the right choice often depends on your goals, personality, and trading style. Do you want the consistency and speed of an algorithm, or the flexibility and judgment that only a human trader can bring?

In this guide, we’ll break down the pros and cons of Forex EA vs manual trading, explain how each works, and show you when it makes sense to use one or even combine both for the best results. By the end, you’ll have a clear framework to decide which path fits your trading journey.

Table of Contents

What is a Forex EA (Expert Advisor)?

A Forex EA (Expert Advisor) is a piece of software designed to trade on your behalf inside the MetaTrader platforms (MT4 and MT5). It’s written in the platform’s coding language (MQL4 or MQL5) and follows a set of predefined rules such as when to enter or exit trades, how much to risk, and where to place stop losses or take profits. Once installed, an EA can scan price data, analyze indicators, and even place and manage trades automatically, without any manual input.

This makes EAs especially attractive for traders who want to remove emotional decision-making and achieve consistent execution, since the program doesn’t get tired, distracted, or influenced by fear or greed.

How Forex EAs Work in MetaTrader

EAs run directly on the MetaTrader platform, the world’s most popular forex trading software. Once loaded onto a chart, they constantly monitor market conditions and trigger trades the moment their rules are met. Because they follow strict logic, they can respond faster than any human trader, making them ideal for strategies that require split-second execution.

Backtesting & Optimization

One of the biggest benefits of using an EA is the ability to backtest strategies. MetaTrader comes with a built-in tool called the Strategy Tester, which lets you run your EA against historical price data to see how it would have performed. MT5 even offers tick-by-tick accurate testing, which provides a more realistic view of slippage, spreads, and market conditions.

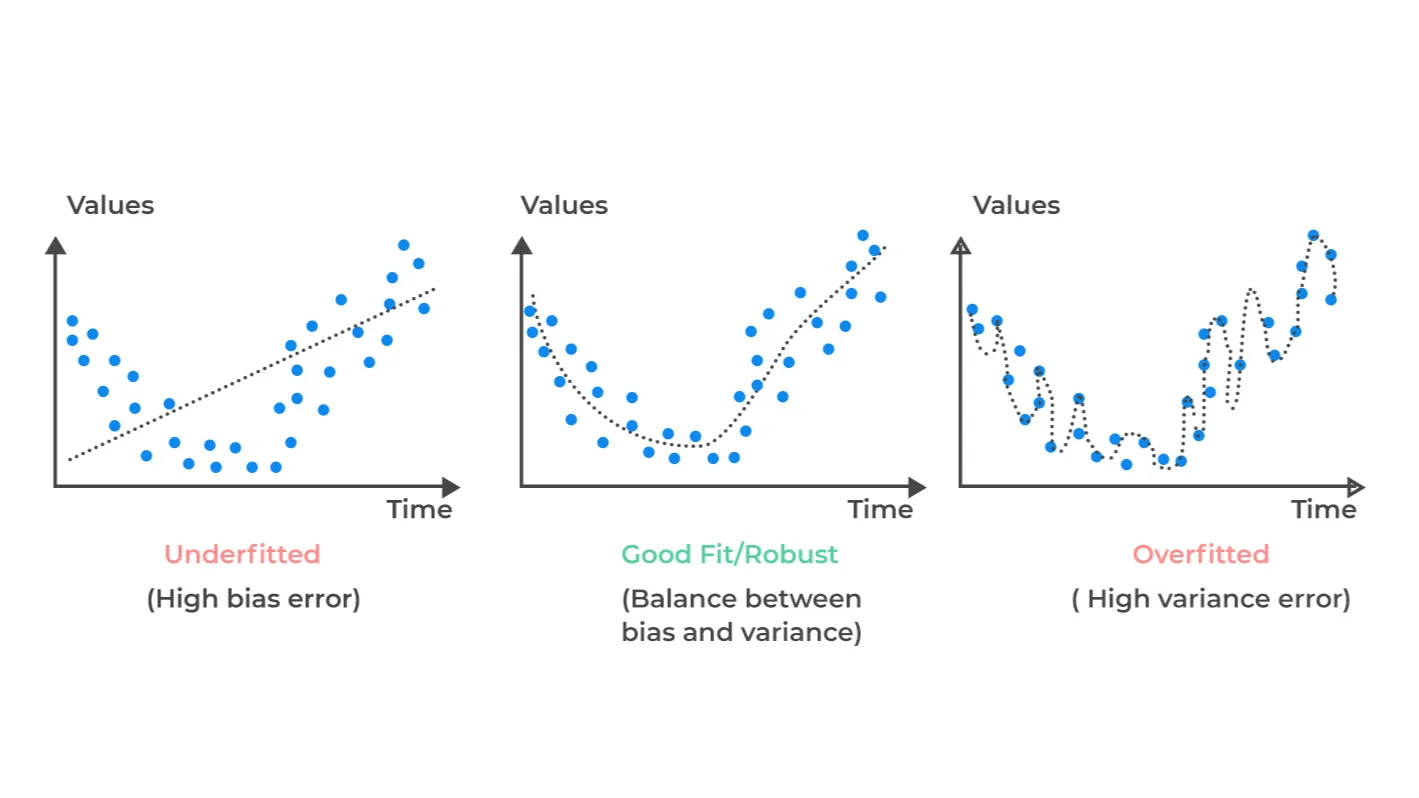

You can also optimize your EA by adjusting parameters (like stop-loss distance, indicator settings, or session filters) and re-testing them to find the most effective combination. However, this process comes with a warning: it’s easy to fall into overfitting where the EA looks perfect on past data but fails in real market conditions because it was “curve-fit” to history rather than built for adaptability.

Why Traders Use EAs

- To automate repetitive strategies (e.g., moving average crossovers, session breakouts).

- To trade 24/5 without needing to monitor charts constantly.

- To test and validate ideas quickly before risking real money.

In short, a Forex EA is like having a trading assistant that never sleeps, but its effectiveness depends on how well it’s designed, tested, and monitored.

What is Manual (Discretionary) Trading?

Manual trading sometimes called discretionary trading means you, the trader, are in complete control of every decision. Instead of relying on software or automation, you actively analyze the market, decide when to enter or exit, and physically place the orders yourself.

This approach often combines technical analysis (charts, indicators, price action), fundamental analysis (economic news, interest rates, geopolitical events), and sometimes even order flow or sentiment analysis. Because you’re making the call in real time, manual trading can adapt quickly to unexpected events, sudden volatility, or market conditions that a robot might misinterpret.

Strengths of Manual Trading

- Contextual judgment: You can factor in news events, unusual price behavior, or broader market conditions that an algorithm might miss.

- Flexibility: If the market suddenly shifts, you can choose to stay out, adjust your risk, or change strategies on the spot.

- Intuition and experience: Over time, traders develop a “feel” for the market something that can’t be fully coded into an EA.

Weaknesses of Manual Trading

- Human bias: Emotions like fear, greed, or impatience can lead to overtrading, hesitation, or ignoring your own rules.

- Inconsistency: Performance can vary depending on your mood, focus, or energy levels unlike a machine, people get tired and distracted.

- Time intensive: Watching charts, following news, and executing trades can feel like a full-time job, especially in fast-moving markets.

Why Traders Choose Manual Trading

Many traders prefer manual trading because it gives them a sense of control and connection with the market. It allows for creativity and discretion, which can be valuable in situations where strict rules aren’t enough. However, the trade-off is that success depends heavily on discipline, patience, and consistent execution.

In short, manual trading offers adaptability and control, but it also demands a high level of emotional discipline and time commitment to avoid mistakes that can erode long-term results.

At-a-Glance Comparison

| Area | Forex EA | Manual Trading |

|---|---|---|

| Execution | 24/5, no emotion; ideal for repetitive setups | Context-aware, but limited by attention & discipline |

| Research | Backtest + optimize quickly (danger: overfit) | Slower to test; relies on journaling & discretion |

| Risk | Code bugs, broker conditions, latency/slippage | Human error, FOMO/hesitation, inconsistency |

| Costs | VPS/hosting, development/purchase | Time cost; tools/data/news feeds |

| Robustness | Can break in regime shifts if not updated | Can adapt mid-trade, but may be inconsistent |

| Compliance | Needs proper controls if you’re a firm (algo trading) | Same general trading rules apply |

Notes:

- Slippage (expected vs executed price gap) hits both styles, but latency-sensitive EAs feel it more; VPS close to broker helps.

- If you operate as a regulated firm in the EU, MiFID II treats this as algorithmic trading with control requirements.

Pros & Cons of Forex EA vs Manual Trading

Forex EA: Advantages

- Consistency & Speed

A Forex EA follows the exact rules you program into it, executing trades instantly and without hesitation. This eliminates emotional mistakes and ensures your plan is carried out the same way every time. - Scalable Research

With MetaTrader’s Strategy Tester, you can backtest your EA on years of historical data across multiple currency pairs and timeframes. This allows you to evaluate hundreds of variations quickly, something nearly impossible with manual trading. - 24/5 Uptime

When hosted on a Virtual Private Server (VPS), your EA can run continuously, monitoring the market and placing trades even when your computer is turned off. This gives you true around the clock market coverage.

Forex EA: Disadvantages

- Overfitting & Curve Fitting

An EA might look flawless in backtests but collapse in live trading if it was over optimized to past data. To avoid this, traders should test out of sample data and use methods like the Deflated Sharpe Ratio or walk forward analysis. - Execution Frictions

Slippage, spread variations, and server latency can erode profits. Even the best-coded EA can fail if it doesn’t account for real-world execution costs. - Market Regime Risk

Markets change over time. An EA that thrives in trending conditions may struggle in ranging or highly volatile markets. Without active monitoring and updates, performance can degrade quickly.

Manual Trading: Advantages

- Context & Adaptability

Human traders can interpret news releases, unexpected volatility, and unusual price action in ways an algorithm cannot. This allows for flexible decision-making that can save capital during uncertain conditions. - Low Technical Overhead

Unlike EAs, manual trading requires no coding knowledge, programming updates, or VPS hosting. Your “system” is built on discipline, routines, and decision making, not software.

Manual Trading: Disadvantages

- Human Bias & Emotion

Fear, greed, and impatience often lead to overtrading, hesitation, or revenge trading. Unlike an EA, humans are not immune to psychological traps that can sabotage performance. - Slower Research & Testing

Validating an edge manually takes much longer, since backtesting requires significant chart review and journaling. Traders may rely more on experience and pattern recognition rather than statistically validated results.

Takeaway: Forex EAs excel at consistency, speed, and scalability, while manual trading shines in adaptability and context awareness. The best choice depends on your style but many traders combine both for a balanced approach.

When to Use Forex EA vs Manual Trading

When a Forex EA is the Best Choice

A Forex EA is ideal when your trading strategy is fully rule-based and does not require on-the-spot judgment. For example, session breakouts, moving average crossovers, or fixed pattern strategies can all be automated effectively. If you can define your system in clear “if-this-then-that” logic, an EA can run it with precision.

To get the most out of an EA, you’ll need:

- A Virtual Private Server (VPS) to keep it running 24/5 without interruptions.

- Regular performance monitoring, including drawdowns and live metrics.

- Periodic parameter updates or retraining to ensure it adapts to new market conditions.

This setup is best suited for traders who prefer consistency, speed, and scale, and who are comfortable maintaining the technical side of automation.

- Checkout our extensive list of free Forex EA to download

When Manual Trading is the Better Option

Manual trading shines when your edge relies on human discretion and context things that cannot easily be coded. If your strategy depends on interpreting news events, reading market sentiment, or spotting subtle price action nuances, you’ll benefit more from staying hands-on.

This approach requires:

- Strict routines to avoid missed opportunities.

- Emotional discipline to follow your trading plan and avoid overtrading.

- The ability to adapt quickly when the market shifts in ways no algorithm could anticipate.

Manual trading is often chosen by traders who want a closer connection to the market and who value flexibility over automation.

When a Hybrid Approach Wins

For many traders, the most effective path is a hybrid strategy. Here, an EA handles repetitive tasks such as scanning charts, placing entries, or managing stop-loss and take-profit levels while the trader adds a human layer of judgment.

Hybrid trading typically includes:

- Time filters (e.g., only trade during London or New York sessions).

- News filters to avoid high-impact events.

- A manual kill-switch, so you can pause the EA when market conditions change or volatility spikes.

This model combines the consistency of automation with the intuition of manual trading, giving you the best of both worlds.

Key Takeaway: Use an EA when your strategy is clear-cut and rule-driven, go manual when discretion matters most, and consider hybrid trading if you want automation without losing human oversight.

Download a Collection of Indicators, Courses, and EA for FREE

The Hybrid Framework: What Most Pro Traders Actually Do

Most experienced traders don’t rely 100% on EAs or manual trading they combine both into a hybrid framework. This approach keeps the efficiency of automation while adding the judgment of human oversight, giving the system strength in both stability and adaptability.

Step 1: Codify What Can Be Automated

Start by translating the mechanical parts of your strategy into code:

- Entries and exits (e.g., breakout triggers, indicator signals).

- Position sizing rules to keep risk consistent.

- Time filters (only trade during specific sessions).

- Risk caps to limit per-trade and daily losses.

This ensures the EA handles repetitive, rule-based decisions with no hesitation or emotion.

Step 2: Backtest and Validate the Strategy

After coding, run the EA through a structured testing process:

- Backtest on historical data to measure performance.

- Use walk-forward analysis to simulate changing markets.

- Perform a forward test on demo accounts before going live.

Always include out of sample data and track metrics like the Deflated Sharpe Ratio to avoid selection bias and curve fitting. This step ensures your EA isn’t just “cherry-picked” for past market conditions.

Step 3: Deploy on a VPS for Reliability

Once validated, deploy the EA on a Virtual Private Server (VPS) close to your broker’s servers. This minimizes latency, reduces slippage, and ensures the bot runs 24/5 without interruptions. Keep an eye on spreads, fills, and execution quality to confirm live performance matches your tests.

Step 4: Maintain Human Oversight

Even the best EA needs supervision. Pro traders use discretion to:

- Pause trading during major news releases that could cause unpredictable volatility.

- Reduce risk or stop the bot after structural market changes (e.g., central bank surprises, major geopolitical events).

- Step in with a manual override if the EA is underperforming or conditions are unusual.

Step 5: Apply Governance & Documentation

Treat your EA like a professional trading system:

- Use version control to track parameter changes.

- Keep a trading journal with live results and adjustments.

- Monitor drawdowns and stick to predefined risk rules.

This discipline ensures you know exactly what changed and why critical for long-term consistency.

Step 6: Manage Risk at All Times

Finally, risk management is the backbone of the hybrid model:

- Keep risk per trade around 0.5–1% of account balance.

- Define a maximum drawdown limit; if breached, cut or retire the EA immediately.

- Never rely on automation alone capital protection always comes first.

Key Takeaway: The hybrid framework blends automation for consistency with human judgment for flexibility. By codifying rules, testing rigorously, and maintaining oversight, you can create a trading system that adapts, scales, and survives in real-world market conditions.

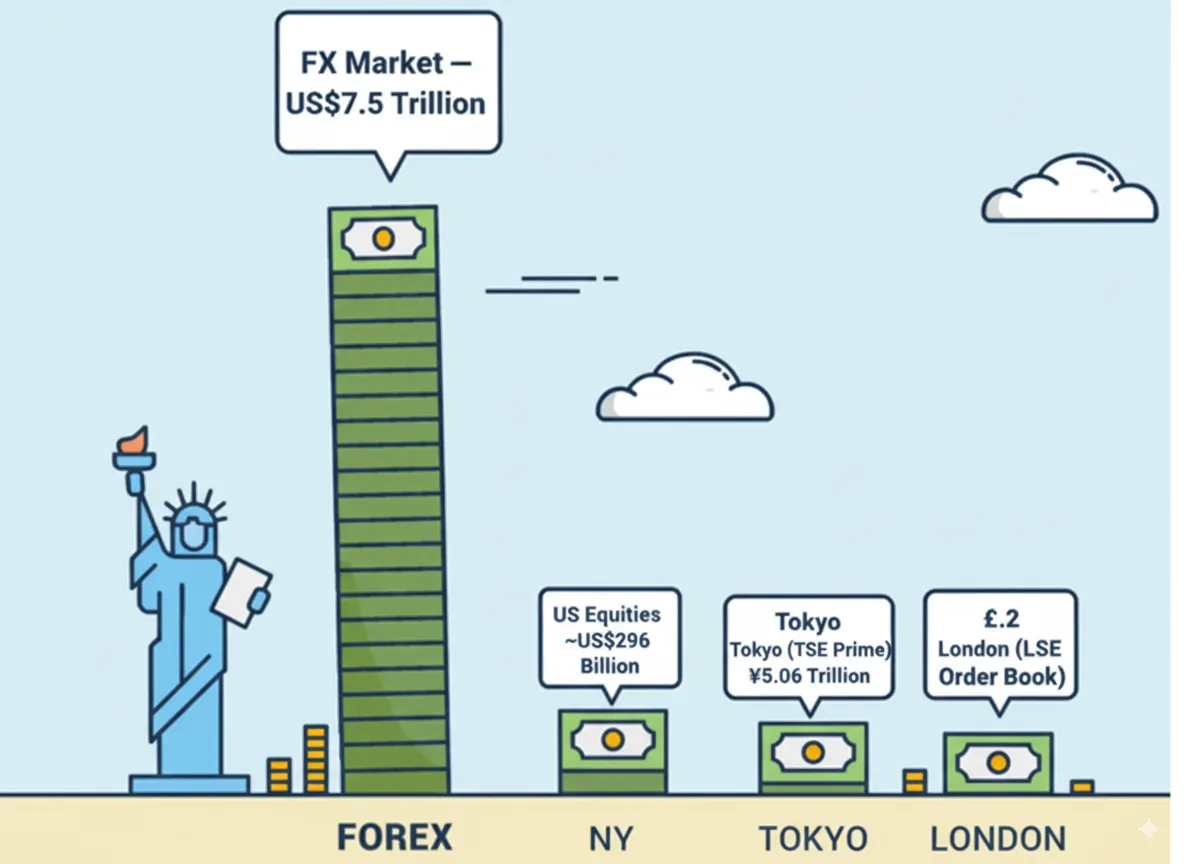

How Big Is the FX Market (and Why This Matters)

The foreign exchange (FX) market is the largest financial market in the world. According to the Bank for International Settlements (BIS), the market averaged over $7.5 trillion in daily turnover in April 2022. That’s larger than the stock and bond markets combined, making forex the most liquid market on the planet.

Why Market Size Matters for Traders

This scale means there’s always a buyer and seller liquidity is almost never a problem. But it also means the competition is intense, with major banks, hedge funds, and high-frequency trading firms all active in the market. For retail traders, this translates into:

- Tight spreads on major pairs, but variable costs during volatility.

- Constant price movements, creating endless opportunities—but also risks.

- High competition, since you’re effectively trading in the same arena as large institutions.

The Impact on Forex EAs

Because so much of today’s forex trading is electronic and increasingly algorithm driven, execution quality becomes critical for traders using EAs:

- Latency (speed of order execution): A few milliseconds can change outcomes for scalping or high-frequency strategies.

- Slippage: Fast-moving markets can cause orders to fill at worse prices than expected, which may erode an EA’s edge.

- Spreads: Even small spread differences can make or break profitability for strategies with tight targets.

Why Manual Traders Care Too

While these issues affect automated systems most, manual traders aren’t immune. During news releases or sudden spikes in volatility, spreads widen, slippage increases, and execution can deviate from what you see on your screen. The key difference is that manual traders can decide to sit out, while an EA will execute unless you intervene.

Key Takeaway: The FX market’s size and liquidity create massive opportunities, but also fierce competition. For EAs in particular, execution quality latency, spreads, and slippage matters just as much as the trading strategy itself.

Avoid the #1 EA Killer: Overfitting (and How to Test Correctly)

One of the biggest mistakes traders make when building or buying a Forex EA is overfitting. On paper, the backtest looks perfect smooth equity curve, high win rate, zero drawdowns. But when taken live, the strategy collapses. Why? Because it was “trained” to fit past data too perfectly, rather than being robust enough to survive real markets.

Overfitting happens when you tweak parameters endlessly until the system performs flawlessly on historical data but fails to adapt to new, unseen conditions. The key to avoiding this trap is to test your EA the right way.

Split Your Data: In-Sample vs Out-of-Sample

Always divide your historical data into two sets:

- In-sample data → used to design and optimize your strategy.

- Out-of-sample data → completely untouched until testing; this shows how the EA performs on new conditions.

If your system only works on in-sample data but breaks on out-of-sample, it’s likely overfit.

Limit Parameter Hunting

The more parameters you test, the higher the chance you’re just “lucky fitting” noise in the data. This is called the Probability of Backtest Overfitting (PBO). Keeping parameter adjustments limited and logical reduces the risk of creating a curve-fit system that looks good only in theory.

Use the Deflated Sharpe Ratio (DSR)

Traditional Sharpe Ratios can be misleading when you’ve tested many variations. The Deflated Sharpe Ratio adjusts for multiple trials and non-normal returns, giving you a more realistic view of whether your EA truly has an edge.

Walk-Forward and Forward Testing

Instead of one big backtest, use walk-forward analysis: optimize on one chunk of data, then test on the next chunk, repeating the process over different periods. This simulates real market adaptation.

After that, run the EA on a demo account for forward testing. This shows how it performs under live spreads, slippage, and broker execution.

Stress-Test with MetaTrader Strategy Tester

The built-in Strategy Tester in MetaTrader 5 lets you go beyond simple backtests. You can simulate:

- Random execution delays

- Spread variations

- Multi-currency tests

These stress tests help reveal whether your EA can handle real-world trading frictions.

Key Takeaway: Backtests are just the first step. To avoid overfitting, use out-of-sample testing, limit parameter tweaks, validate with Deflated Sharpe, and stress-test across different scenarios. An EA that passes these hurdles has a much higher chance of surviving in live markets.

Execution Reality: Slippage, Spreads & VPS

Even the best trading strategy can fail if execution isn’t handled properly. In forex, slippage, spreads, and server reliability directly affect whether your trades end up profitable. This is especially true for automated EAs that depend on speed and precision.

Slippage: The Hidden Cost of Fast Markets

Slippage is the difference between the price you intended to trade at and the price you actually get. It usually happens when:

- The market is moving fast (during news events or high volatility).

- You use market orders that don’t guarantee a fixed entry price.

For scalpers or EA strategies with tight take-profits, slippage can wipe out the entire edge. That’s why it’s important to test your system with slippage modeled in, and use limit or stop-limit orders when possible.

Spreads: The Cost of Every Trade

The spread (difference between bid and ask price) is the built-in cost of every forex trade. While spreads are tight on major pairs during normal conditions, they can widen significantly during low liquidity or news spikes.

- EAs: Need spreads factored into backtests to avoid unrealistic results.

- Manual traders: Should be aware of widening spreads before executing trades in volatile markets.

Ignoring spreads can make a profitable-looking strategy unprofitable in real life.

VPS Hosting: Keeping Your EA Online

A Virtual Private Server (VPS) is almost essential for running Forex EAs. Hosting your EA on a VPS close to your broker’s servers ensures:

- Lower latency (ping time): Faster trade execution and fewer missed opportunities.

- 24/5 uptime: Your EA runs continuously, even if your personal computer is off or your internet disconnects.

- More stability: Less downtime, fewer connection issues, and more consistent performance.

Most brokers even recommend VPS hosting for traders using automation, since execution quality is as important as strategy design.

Key Takeaway: In forex trading, execution is everything. Slippage, spreads, and server speed can make or break your system so plan for these costs in your model and use a VPS to give your EA the best chance to succeed.

Safety & Scams: Vendor EAs and “AI Bots”

The forex industry is full of legitimate tools and strategies but it’s also a hotspot for scams and misleading products, especially when it comes to vendor EAs and so-called “AI trading bots.”

The Problem with “Too Good to Be True” EAs

If you see a trading robot advertised with:

- Guaranteed profits

- Risk-free claims

- Perfect equity curves with no drawdowns

…it’s almost always a red flag. Real trading always involves risk, and no EA can promise consistent profits across all market conditions. Many vendor bots are simply curve-fitted to historical data, which makes them look amazing on paper but fail quickly in live markets.

“AI Bots” and Influencer Hype

In recent years, some marketers have started selling “AI-powered trading bots” with claims that artificial intelligence can predict the market with pinpoint accuracy. The U.S. Commodity Futures Trading Commission (CFTC) has even issued warnings about these products and the influencers promoting them. In reality, most of these so-called AI bots are either basic algorithms dressed up with flashy marketing or outright scams.

How to Protect Yourself

To avoid being caught by vendor scams or fake AI bots:

- Verify registrations: Check if the company is regulated or if the seller is registered with recognized financial authorities.

- Demand transparency: Look for verified third-party results (such as MyFXBook or FX Blue) rather than screenshots or marketing slides.

- Use out-of-sample proof: Reliable EAs should show performance across both historical and forward (live or demo) testing.

- Test with small capital first: Never risk large sums before seeing how the system performs in real conditions with your broker.

- Be skeptical of hype: If someone claims their bot can “beat the market” with no risk, treat it as a warning sign.

Key Takeaway: In forex trading, if an EA or “AI bot” sounds too good to be true, it probably is. Protect yourself by demanding verified performance, starting small, and staying alert to marketing gimmicks.

Setup Checklists: Getting Started the Right Way

Whether you’re running a Forex EA or trading manually, success comes down to preparation and discipline. Below are two practical checklists one for automated systems (MT4/MT5 EAs) and one for discretionary trading that you can follow step by step.

EA Deployment Checklist (MT4/MT5)

- Document Clear Rules & Risk Caps

Define your entry/exit conditions, maximum risk per trade, and overall drawdown limit before coding or activating the EA. - Backtest with Accuracy

Run tick-accurate backtests and optimize parameters conservatively. Avoid overfitting by focusing on robustness, not just past performance. - Validate Out-of-Sample

Always forward test on demo accounts and check out-of-sample results to confirm your strategy holds up in different conditions. - Deploy on a VPS

Host your EA on a Virtual Private Server (VPS) near your broker to minimize latency, reduce slippage, and keep the system running 24/5 without interruptions. - Set Filters and a Kill-Switch

Use time filters to avoid low-liquidity periods and apply news filters to prevent trading during high-impact events. Always have a manual kill-switch in case of unexpected conditions. - Track Version Control

Keep a log of every parameter change, EA version, and optimization update. This helps you track performance shifts and avoid confusion later. - Apply Live Risk Controls

Limit risk to ≤1% per trade, disable DCA (averaging down), and use hard stop-losses. This keeps losses controlled even if the EA fails.

Manual Trading Checklist

- Write a Trading Playbook

Clearly outline your setups, invalidation points, risk rules, and reward-to-risk (R multiple) guidelines. This becomes your personal trading blueprint. - Pre-Session Checklist

Before the market opens, mark key levels, check economic news, and establish your directional bias. This preparation prevents impulsive trades. - Control Risk Consistently

Stick to fixed risk per trade usually 0.5–1% of account equity and record your trades in a journaling template. - Post-Session Review

Review all trades at the end of the session. Tag mistakes, note emotional triggers, and refine your playbook. Continuous feedback is key to growth.

Key Takeaway: Treat both EA deployment and manual trading like a professional process. By following structured checklists, you reduce errors, increase consistency, and build a trading routine that can stand the test of time.

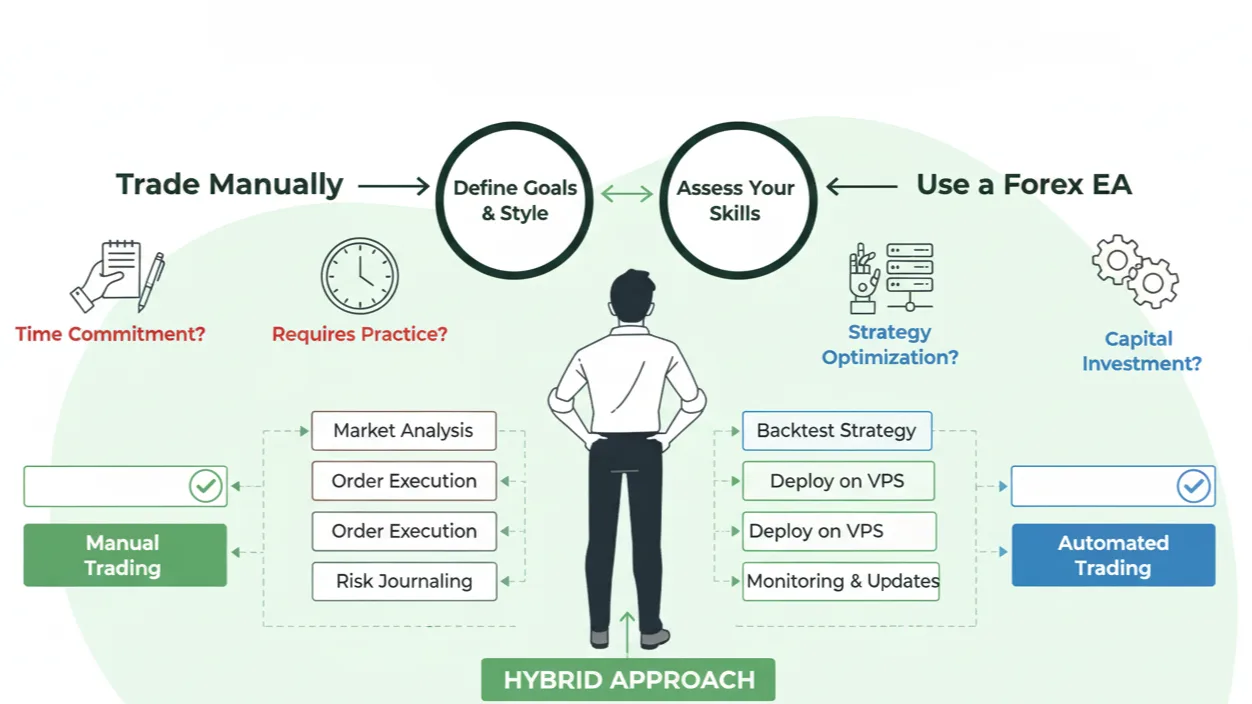

Decision Flow: Should You Use a Forex EA or Trade Manually?

Choosing between a Forex EA, manual trading, or a hybrid approach doesn’t have to be complicated. You can simplify the decision with a few key questions:

Step 1: Can Your Strategy Be Fully Coded?

- Yes: If your system is 100% rules-based (e.g., “enter when moving average A crosses B”), it can be automated. In this case, start with an EA, but keep hybrid oversight in place so you can pause or adjust during unusual conditions.

- No: If your edge depends on discretion like interpreting news events, reading market sentiment, or spotting unusual price behavior stick to manual trading or use semi-automation tools (alerts, scripts, one-click trade panels).

Step 2: Do You Have the Right Infrastructure?

An EA is only as good as its environment. Ask yourself:

- Do you have a VPS near your broker to minimize latency?

- Can you monitor performance and execution quality regularly?

If not, fix your infrastructure first. Running an EA on a home PC with unstable internet is a recipe for missed trades and bad fills.

Step 3: Does the Strategy Survive Out-of-Sample?

Even if backtests look amazing, the real test is out-of-sample performance. If your system breaks down when tested on unseen data, it’s a sign of overfitting. In that case, revisit your logic, reduce parameter complexity, and focus on robustness rather than perfection.

Quick Takeaway:

- Fully codable + good infrastructure + robust testing = EA with oversight

- Discretion-heavy or news-driven edge = manual or semi-auto

- Mixed approach = hybrid model (automation + human judgment)

FAQs

Are Forex EAs profitable?

Some are, many aren’t. Profitability depends on real execution (slippage/spreads/latency), robustness to regime changes, and avoiding overfitting. Verify with out-of-sample + live forward tests and track Deflated Sharpe.

Do I need a VPS for EAs?

Strongly recommended keeps the robot online 24/5 with low latency to your broker.

Is manual trading better than EAs?

It’s better when context matters (news, anomalies). EAs win on consistency for rule-based edges. Most traders do best with a hybrid.

What’s the biggest risk with EAs?

Overfitting in backtests. Use out-of-sample validation and limit parameter hunts to reduce the Probability of Backtest Overfitting.

5. What is slippage and why should I care?

It’s the gap between intended and actual fill price; it can make a “profitable” EA unprofitable if not modeled.

6. Are “AI trading bots” legit?

Be cautious CFTC warns about influencers and “guaranteed returns.” Do due diligence and test on demo/small capital first.

Conclusion

When comparing Forex EA vs Manual Trading, there’s no one size fits all answer. EAs offer consistency, speed, and scalability, while manual trading gives you adaptability, context, and human judgment. The best choice depends on your personality, strategy, and goals.

For many traders, the sweet spot lies in a hybrid approach letting automation handle repetitive tasks while keeping human oversight for big picture decisions. By balancing both, you can maximize consistency, manage risk effectively, and adapt to ever-changing market conditions.