This article provides a technical overview and performance analysis of a fully Automated Strategy designed for the MetaTrader 4 (MT4) platform. The Pullback Strategy functions as a scalper that capitalizes on “pullback” movements, specifically identifying price returns following sharp directional shifts.

While the algorithm is capable of trading various assets, Pullback EA is specifically optimized for currency pairs that exhibit frequent mean-reversion characteristics, primarily AUDCAD.

Trading Strategy of this Automated Strategy

The core philosophy of this Automated Strategy is based on the tendency of forex prices to retrace after significant volatility. To identify these high-probability entry points, the system utilizes a combination of technical indicators:

- RSI (Relative Strength Index) & ATR (Average True Range): Used to gauge market momentum and volatility, helping the system determine when a trend is overextended.

- Candle Patterns: Specific price action formations are analyzed to confirm reversal points before trade entry.

- Sentiment Analysis: The system integrates advanced sentiment analysis techniques to align trades with broader market positioning.

- Trend Following: Despite being a pullback system, it enters trades in the direction of the dominant trend during retracement periods.

News Filter Implementation: The Pullback Strategy includes a built-in news filter designed to pause trading during high-impact economic events. Users are advised to ensure this function is enabled to mitigate exposure to unpredictable volatility.

Please test in a demo account first for at least a week. Also, please familiarize yourself with and understand how this Pullback Robot works, then only use it in a real account.

Recommendations for Pullback Strategy

- Minimum account balance of 500$

- EA is specially made to work on AUDCAD.

- It works best on M15. (Work on any TimeFrame)

- Pullback Strategy should work on VPS continuously to reach stable results. So we recommend running this Pullback EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread account is also Recommended (Find the Perfect Broker For You Here)

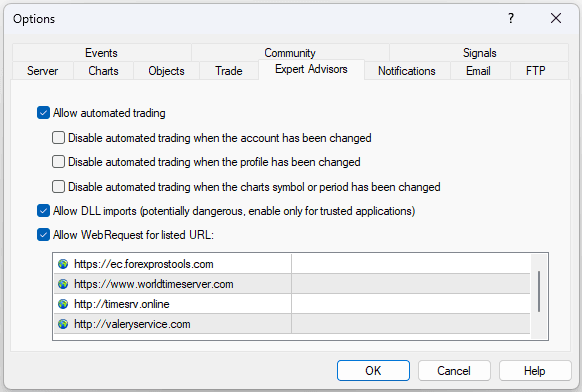

Open Tools –> Options –> Expert Advisors. Check the option “Allow WebRequests for listed URL” Add the “http://nfs.faireconomy.media/ff_calendar_thisweek.xml” and press “OK.” The EA takes news from the specified websites.

Download a Collection of Indicators, Courses, and EA for FREE

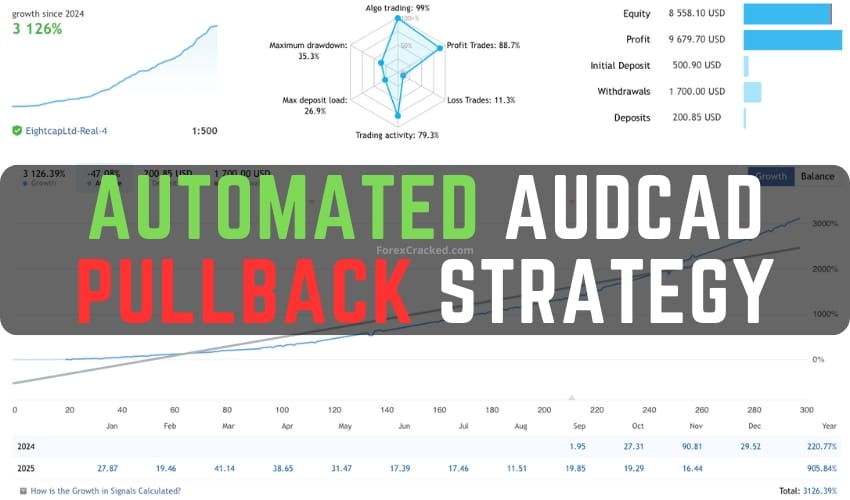

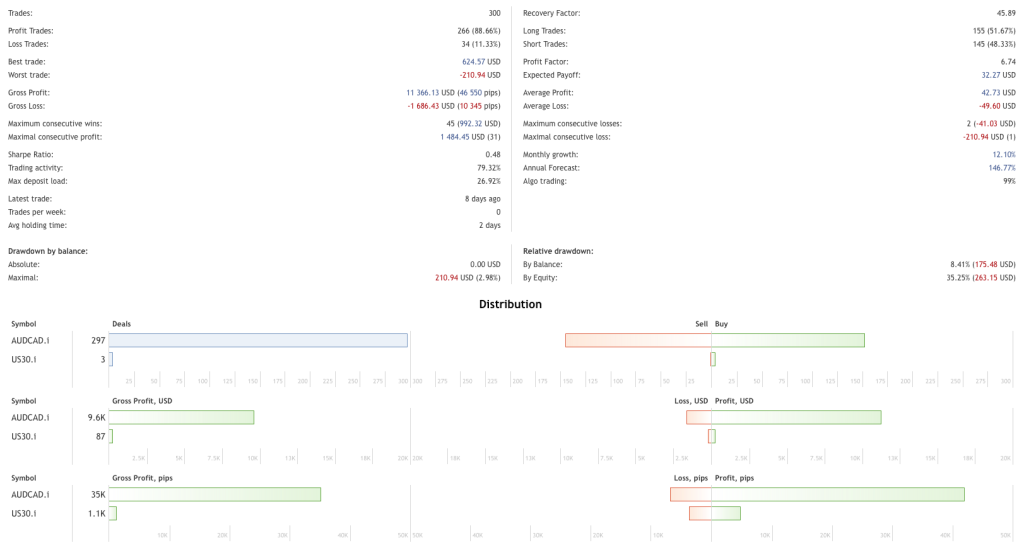

Performance & Risk Analysis of Pullback EA

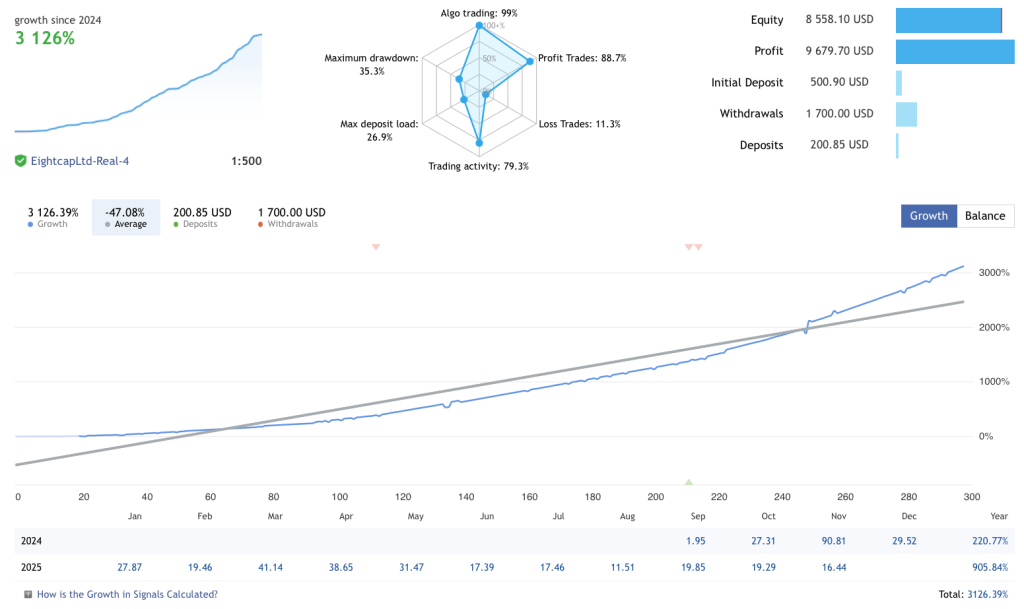

An analysis of the Pullback EA’s track record reveals a strategy that prioritizes high accuracy and rapid recovery, though with a distinct risk profile.

The Pullback Strategy demonstrates high efficiency with a Profit Factor of 6.74 and a Win Rate of approximately 88%, indicating a selective entry mechanism that filters out low-probability setups. However, this automated strategy performance is paired with an aggressive risk profile; the data shows a Maximum Drawdown of roughly 35%, suggesting the strategy holds positions through significant volatility. While the recovery factor is strong, indicating rapid returns to profitability after losses, the drawdowns require a risk-tolerant approach. The trading style is balanced, with a near-even split between long and short positions and an average holding time of two days.

Conclusion

The Pullback EA presents a high-variance trading solution that pairs exceptional recovery capabilities with significant risk exposure. While the high win rate and strong profit factor indicate a robust underlying logic for identifying reversals, the historical drawdown suggests this automated strategy is best suited for traders who understand the volatility inherent in mean-reversion strategies. Success with this pullback strategy likely depends heavily on strict adherence to the recommended broker conditions (low spreads) and proper capital management.