The AlphaFlow EA is presented as a sophisticated EA that aims to improve trading performance through adaptability and market analysis. It boasts a range of features designed for strategic precision and adaptability, all driven by proprietary algorithms. Let’s break down what’s being offered and consider potential caveats.

Core Features

- Sophisticated Market Analysis – The AlphaFlow EA claims to combine technical and quantitative strategies. While this sounds advanced, the specifics of these methods aren’t detailed. “Advanced pattern recognition” can be a general term and its effectiveness depends heavily on the market conditions.

- Versatile Trading Strategies – The EA offers three pre-configured strategies, applicable to EURUSD, XAUUSD, and US500.

- Lightning-Fast Trade Execution (HFT) – The description uses “high-frequency trading” terminology. True HFT EA involves extremely rapid order placement and execution, and from testing, EA doesn’t seem to use that. I guess the execution speed is touted and attributed to “high-frequency trading (HFT) technology.

- Multi-Timeframe Analysis – Combining multiple timeframe analyses is a common practice and can improve perspective.

- Robust Risk Management – Volatility based sizing and dynamic trade management are standard risk mitigation tools.

- Algorithmic Trading Engine – The mention of statistical arbitrage, momentum, and mean reversion strategies indicates a quantitative approach. These strategies are often highly complex and require rigorous testing and parameter optimization.

- News Filter Integration – The AlphaFlow EA incorporates a news filter, designed to react to financial news releases.

- Custom Indicators – Integrates custom technical indicators, including adaptive moving averages, volatility channels, and market strength metrics.

Please test in a demo account for at least a week first. Then, please familiarize yourself with and understand how this AlphaFlow Robot works and only use it in a real account.

Recommendations for AlphaFlow EA

- Minimum account balance of 100$.

- Works best on XAUUSD, EURUSD, and US500. (Work on any Pair)

- Works best on H1 TimeFrame. (Work on any TimeFrame)

- When backtesting, turn off “display graphical elements”

- AlphaFlow EA should work on VPS without interruption and low latency to reach stable results. So we recommend running this EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread account is also Recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Conclusion

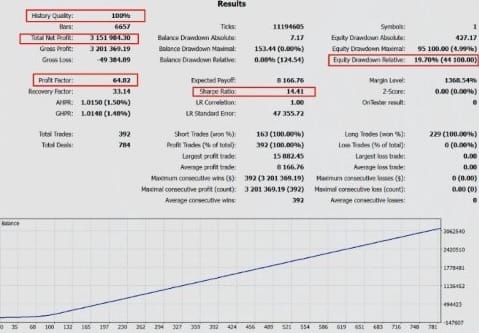

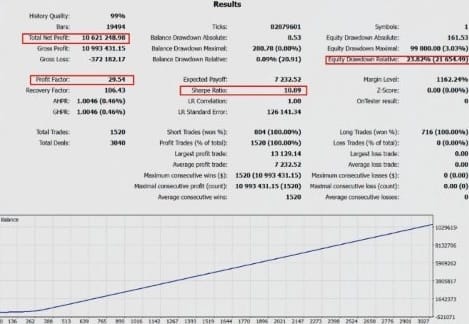

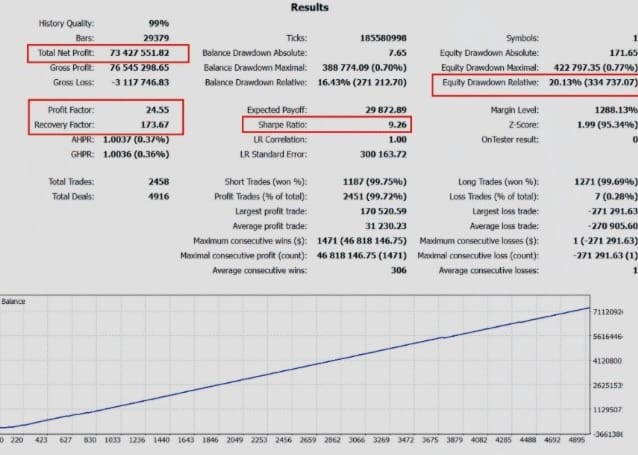

The AlphaFlow EA offers appealing features like a news filter and pre-set strategies for EURUSD, XAUUSD, and US500. However, the lack of specifics regarding its methods and limited strategy options raise concerns. Thorough testing is essential don’t take marketing claims at face value. Potential benefits remain unproven, requiring careful evaluation before deployment.

hello please provide this for MT5

not open any trade

Yes, I haven’t seen any orders either, suspected of backtesting fraud.

May I ask if the administrator has the source code for this EA? You can pay USDT to purchase.

please update ea alphaflow v1.2

Anyone have full version of Alphafalow EA

This EA is locked anyone have unlocked version