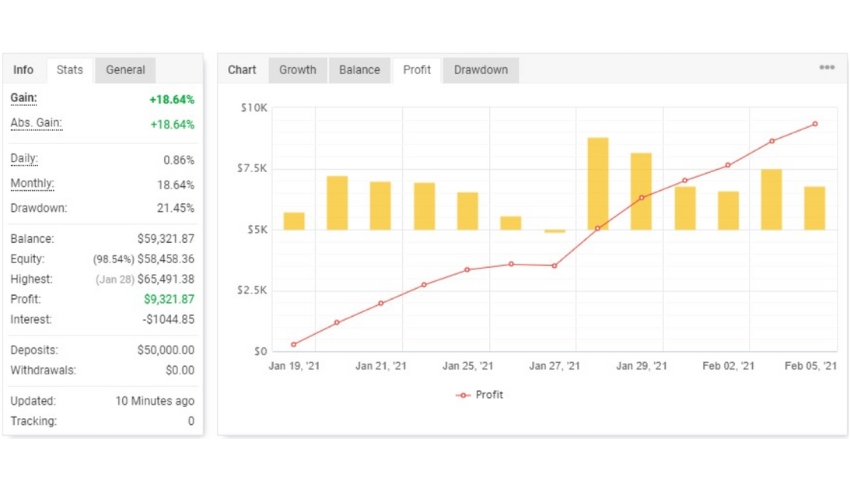

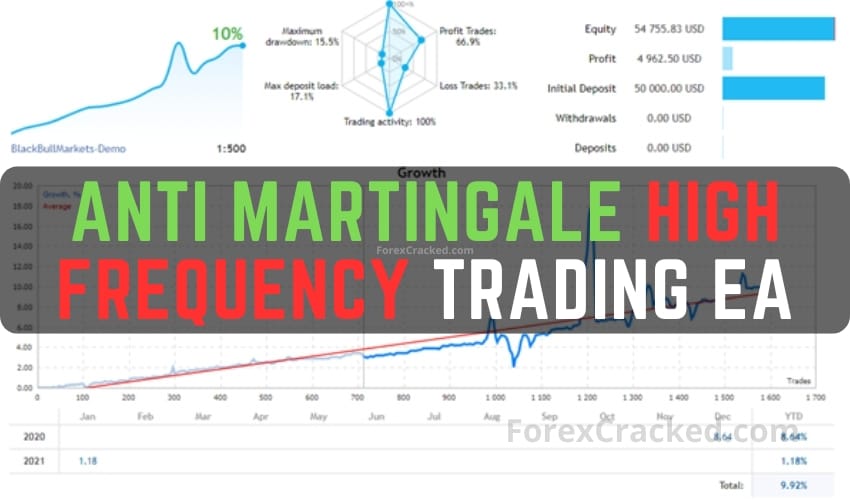

In the crowded landscape of forex trading robots, or EAs, different strategies exist to cater to a wide range of trader preferences and market conditions. One such entry is this Anti Martingale High Frequency Trading EA a tool that promotes an alternative approach to automated trading, offering both flexibility and targeted risk strategies.

The Core Approach – Anti Martingale meets High Frequency

Unlike the more common martingale systems that increase position sizes when losing trades occur, this Anti Martingale EA emphasizes an anti-martingale methodology. This typically involves increasing position sizes during winning streaks, with the aim of compounding gains when the strategy is working in its favor.

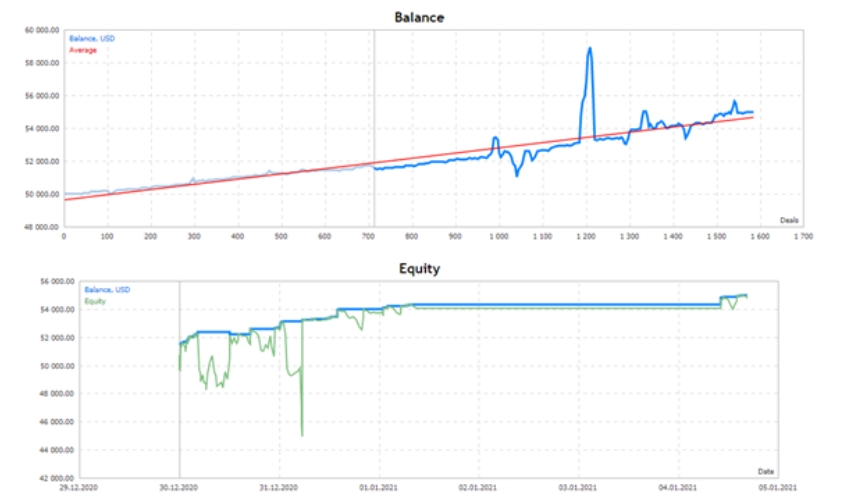

Layered on top of this is high frequency trading (HFT) logic. The High Frequency Trading EA is designed to execute a large number of trades in short timeframes, potentially increasing trading volume and rebate opportunities from brokers. For traders seeking to benefit from market volatility, Arin2 EA high frequency orientation may align with fast-moving conditions, including sudden price movements like flash crashes or major news events.

Key Features of Anti Martingale EA

Anti Martingale EA promotes a “set-and-forget” style, offering full automation and automatic lot-sizing. This makes it a plug-and-play solution for those who prefer less manual oversight in their trading.

It is versatile in execution, capable of handling any financial instrument, from currency pairs to metals and is compatible with any timeframe. The EA’s configuration options are extensive, allowing users to tailor it toward:

- Trend following (anti martingale) or trend reversal (traditional martingale like) strategies

- Different closing logic: fixed take profits, percentage targets relative to account balance, or stop loss based exits

- Operating continuously through the trading week or within specific time windows

- Running multiple instances at the same time with identical or contradictory strategies

While these options create space for customization and potential strategy diversification, they also introduce complexity that may require some understanding of market behavior to tune effectively.

Resilient by Design

According to High Frequency Trading EA design claims, Arin2 EA is built to be immune to several technical factors that typically affect automated systems, such as slippage, latency, requotes, or even temporary disconnections. For traders using VPS or trading across various brokers, this robustness could provide a layer of reliability in unstable network conditions.

Additionally, the Anti Martingale EA is said to handle extreme events well, like flash crashes or price gaps, which may appeal to those looking for a system that can endure volatile conditions.

Please test in a demo account for at least a week first. Then, please familiarize yourself with and understand how this Anti-Martingale Robot works and only use it in a real account.

Recommendations for High Frequency Trading EA

- Minimum account balance of 10,000$ or equivalent cent account(100$).

- Works on any currency or metal.

- Works the same on all timeframes.

- The High Frequency Trading EA should work on VPS continuously to achieve stable results. So we recommend running this Anti Martingale EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread, Slippage, and quick execution accounts that support hedging are Recommended. Low or no commission is also a plus. (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Considerations for Arin2 EA

Arin2 EA’s “anti-martingale” approach is less common in automated trading tools, and while it potentially limits exposure during losing streaks, the compounding during wins may just as easily result in elevated risk if the market quickly reverses. Paired with high frequency operations, the execution strategy may also be sensitive to broker execution quality, spread size, and commission structures.

While the High Frequency Trading EA is labeled as immune to certain technical issues, real world trading environments often present unpredictability. Users may still experience performance variances depending on broker infrastructure, liquidity conditions, and market gaps.

Conclusion

The Arin2 EA presents a non standard approach by combining high frequency trade execution with an anti-martingale strategy. For experienced traders looking to experiment beyond conventional systems, and those with access to favorable brokerage conditions, Anti Martingale EA offers flexibility and a wide range of parameters for customization. However, as with any automated system, success likely depends on understanding the underlying mechanisms and how they interact with dynamic market conditions.

this ea sucks 😀

tested it in real acct with $500, it was all gone in less than 1 hour, freak scam, don’t use at all cost

sorry Jigen “minimum account balance of 10,000$ or equivalent cent account(100$)”

dangerous EA

This EA works properly for me with the right settings