The Bank Trader MT5 EA is marketed as a high level EA designed to replicate the discipline and strategies used by institutional traders. MetaTrader EA claims to deliver precision engineered trade execution by utilizing what the developers describe as “Market Microstructure Strategy”, a term that suggests an advanced interpretation of how prices truly form in the forex market. While these marketing claims are impressive at face value, it’s important to approach such tools with measured scrutiny, as not all advertised benefits are necessarily verified or backed by performance data.

Notable Features of Bank Trader EA

The Bank Trader EA includes several key features:

- Specific Lot Size Algorithm – Suggests a controlled approach to position sizing, perhaps based on account equity or volatility metrics.

- Dynamic Stop Loss & Take Profit – Promotes adaptability to shifting market conditions, although no clear explanation is provided on how these values are determined or adjusted.

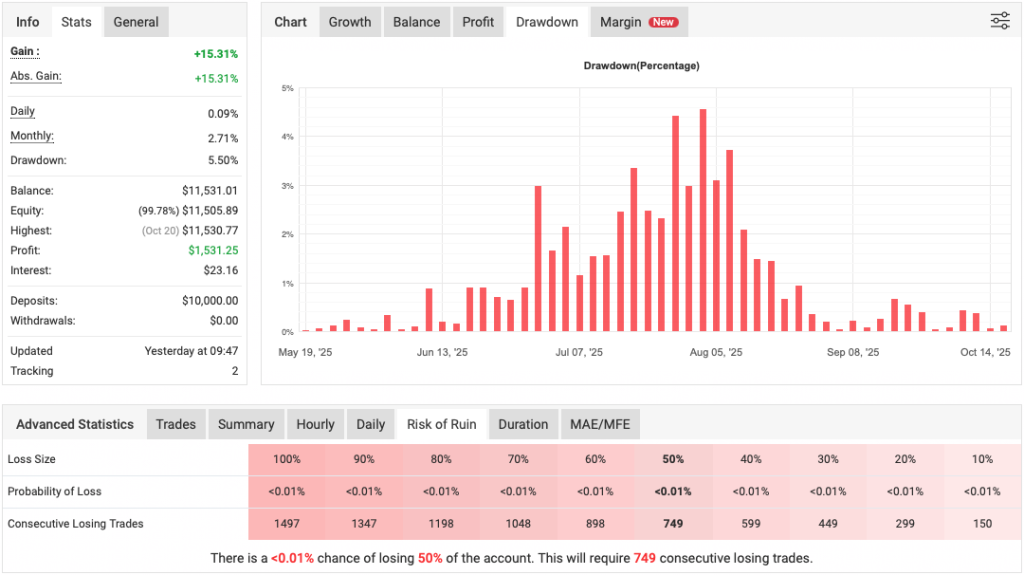

- Smart Drawdown Control – Its ability to manage drawdowns “in all market conditions” is a strong claim but one that is difficult to validate without user data or real world testing.

- Trailing Stop – A standard feature found in many MetaTrader EAs, helping to lock in gains as trades move in the favorable direction.

Under the Hood: Institutional Inspiration

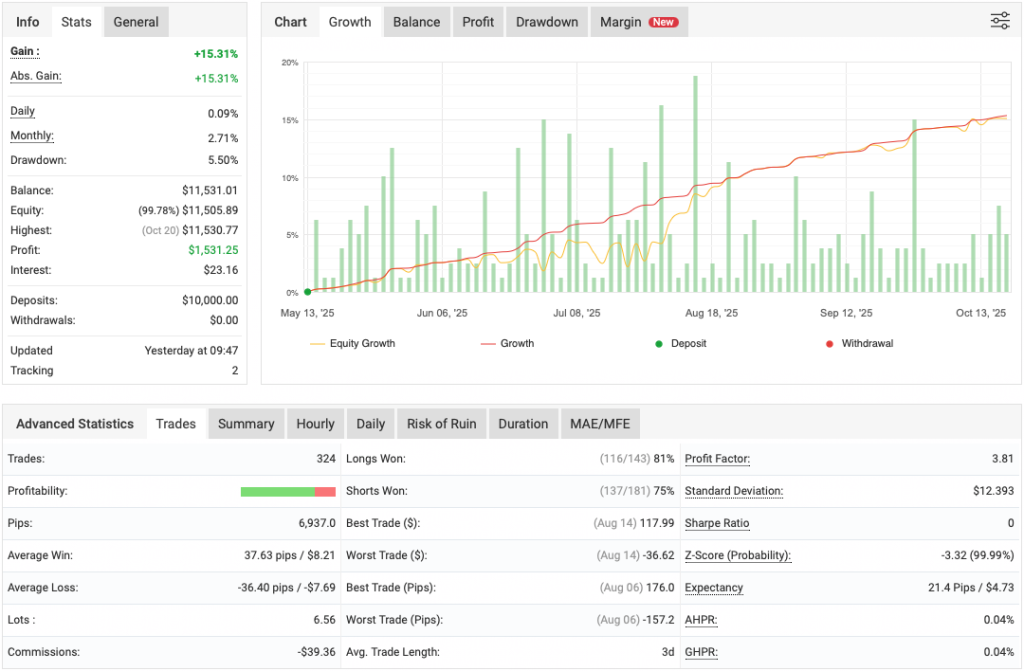

According to its promotional material, Bank Trader VIP was developed through collaboration with institutional traders and “quant experts” who have firsthand experience within global financial institutions. The EA reportedly emphasizes strategic discipline and trade precision, largely guided by algorithms focused on risk management. Each trade is said to be calculated and safeguarded through “dynamic SL (stop loss) algorithms,” implying the system adjusts to market conditions on the fly.

Whether or not such functions operate as effectively in live trading as claimed, however, remains unclear absent any independently verified performance records or third-party backtesting.

MetaTrader EA Strategy: Market Microstructure

This MetaTrader EA selling point is its use of a “Market Microstructure Strategy,” which represents a deviation from traditional technical indicators or fundamental analysis. This approach supposedly focuses on evaluating the underlying architecture of the forex market, particularly liquidity zones, stop-loss aggregations, institutional order flows, and so on. In theory, this kind of strategy should allow for more informed trade entries and exits that align with how professional institutions behave.

While this idea is compelling on paper, it’s worth noting that terms like “institutional footprints” and “order flow pressure points” are often abstract and hard to quantify within most retail trading platforms. Without transparency on how these factors are measured and implemented in the EA, such descriptions may serve more as marketing talking points than testable performance features.

Please test in a demo account for at least a week first. Then, please familiarize yourself with and understand how Scalper MetaTrader Robot works, and only use it in a real account.

Recommendations for Bank Trader VIP EA

- Minimum Account Balance of $1500 or a equivalent cent account.

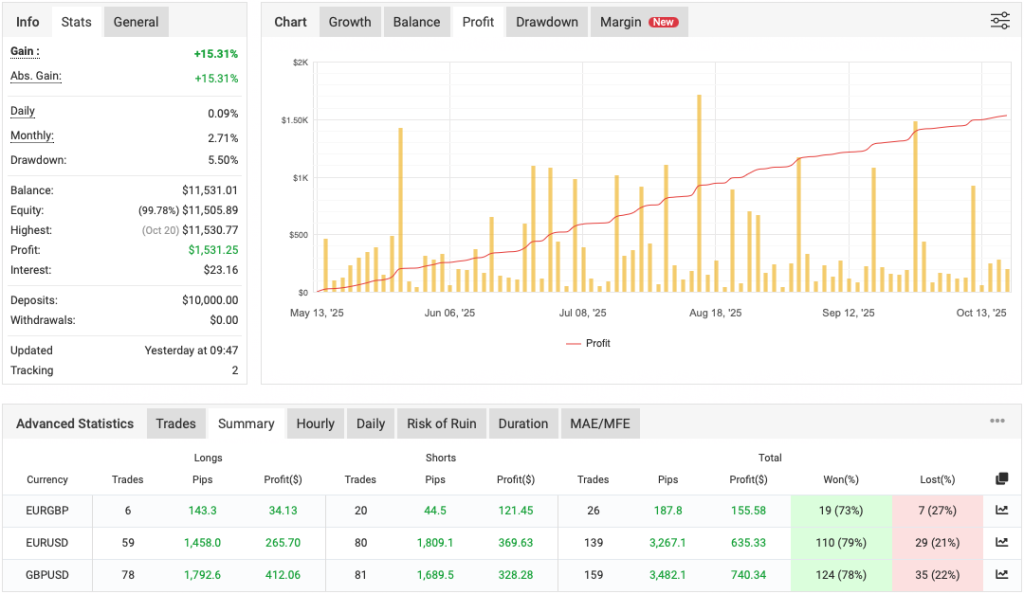

- Designed to work on EURUSD, GBPUSD, and EUR/GBP.

- Work Best on M5 and M15. (Work on any Timeframe)

- Bank Trader VIP EA should work on VPS continuously to reach stable results. So we recommend running this MetaTrader EA Download on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- A Low Spread, Slippage, and quick execution account is recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Target Market: Major Currency Pairs

Bank Trader VIP is designed to work with three currency pairs: EURUSD, GBPUSD, and EURGBP. These pairs are indeed highly liquid, often featuring tight spreads and consistent institutional participation, making them a logical choice for strategies that depend on cleaner price action and depth of market.

However, this focus also means the MetaTrader EA may not perform consistently in more volatile or exotic pairs, which could limit its application for traders seeking broader diversification.

Conclusion

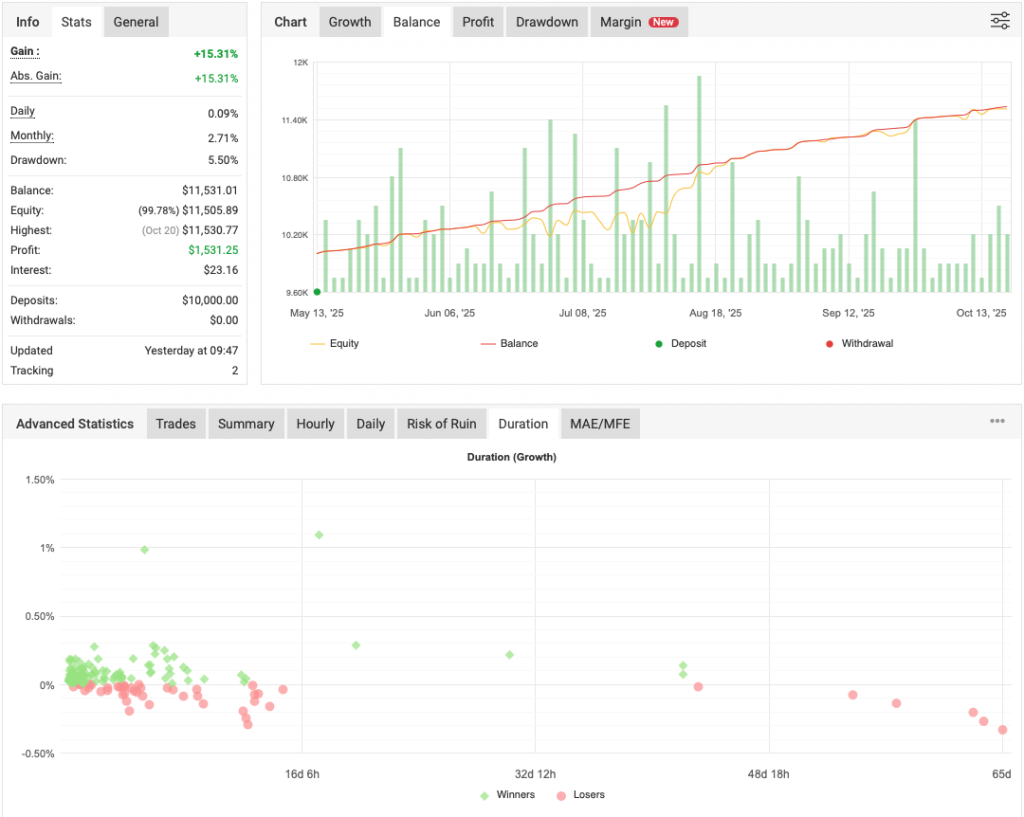

While the Bank Trader EA makes a number of sophisticated claims, such as utilizing institutional level logic and microstructure analysis, the lack of detailed technical documentation or third party validation makes it hard to assess whether the performance lives up to the hype. The language used in its description leans heavily on industry buzzwords and institutional jargon, which, while appealing, do not necessarily translate into consistent profitability for retail traders.

Anyone considering this MetaTrader EA should approach with caution, ideally testing it in a demo environment before committing capital. As with many EAs in this space, due diligence is crucial, marketing language is one thing, real-world trading performance is another entirely.

Admin please Crack VERTIGO EA .

Very good EA but the rental price is too high

dll file in Libraries not completed