Every experienced forex trader knows the sinking feeling: you are in a drawdown, the market is moving against you, and you are trying to do complex math in your head. If I add another position here, where is my new breakeven? Will I hit a margin call before the price reverses?

In the high-stakes world of Grid, Martingale Strategy, and Averaging systems, guessing is the fastest way to blow an account. Most traders fly blind, adding positions until their broker forcibly closes them out.

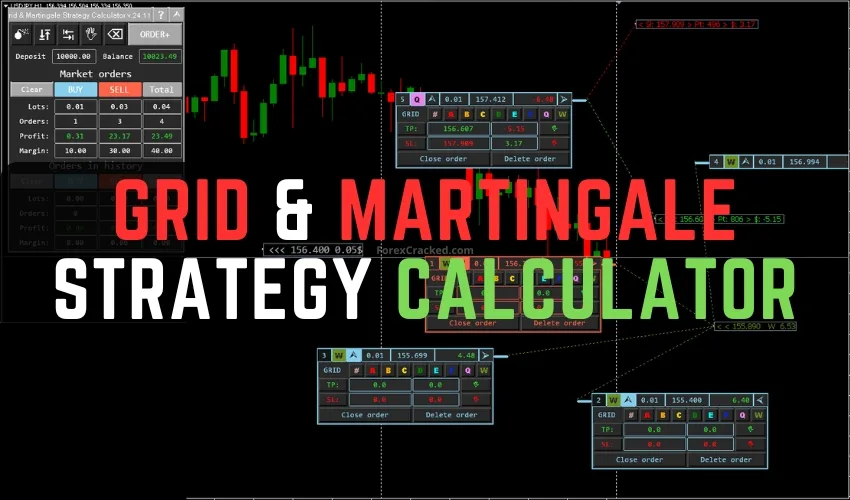

Enter the Grid & Martingale Strategy Calculator, a professional utility for MetaTrader 4 and 5 that acts as a “flight simulator” for your trades. It replaces messy Excel spreadsheets with visual, drag-and-drop virtual orders directly on your chart.

In this guide, we won’t just review the tool; we will show you three specific strategies to use it to protect your capital and master the art of Safe Forex Trading.

Table of Contents

What is the Grid & Martingale Strategy Calculator?

At its core, this tool is a risk calculator, not an automated trading bot. It allows you to place virtual orders (both Buy and Sell) on your chart to simulate how they would perform if they were real.

Unlike backtesting, which looks at the past, this tool helps you plan the future. You can adjust lot sizes, place virtual Take Profits and Stop Losses, and instantly see the mathematical outcome for your deposit, margin, and profit. This forward-looking approach is the cornerstone of a successful Martingale Strategy.

Why You Need It

- Safe Forex Trading: Eliminate the guesswork that leads to blown accounts by visualizing risk before you take it.

- No More Spreadsheets: Calculate averaging formulas instantly without leaving the terminal.

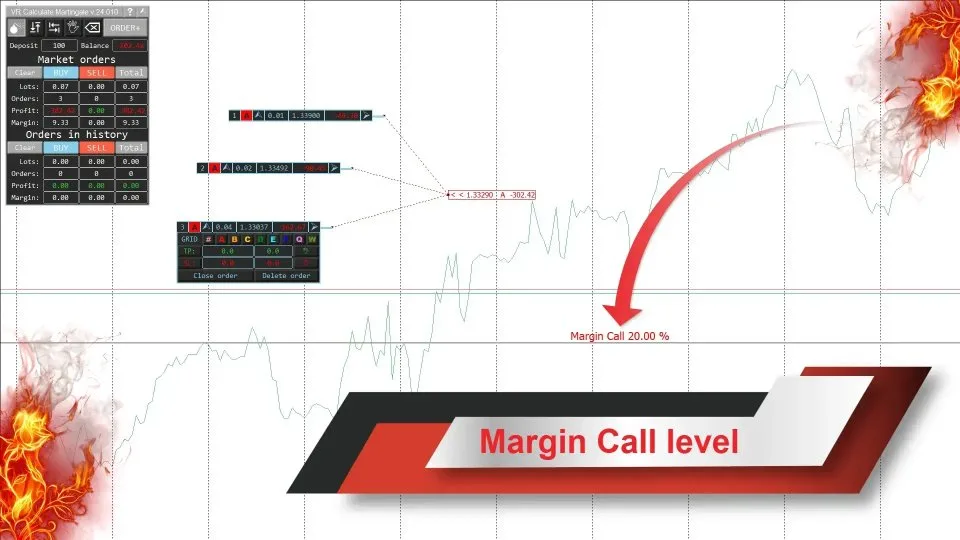

- Visual Risk: See exactly where your Margin Call will trigger on the chart.

- Strategy Validation: Test a potentially risky Martingale Strategy sequence before risking a single cent.

Strategy #1: The “Stress Test” (Pre-Trade Simulation)

- Best For: Traders planning a new Martingale Strategy or Grid setup.

Before you open a real grid of orders, you must know your “death line” the price at which your broker closes your trades due to lack of margin.

The Execution Plan

- Launch the Simulator: Drag the Grid & Martingale Strategy Calculator onto your chart.

- Build Your Grid: Use the panel to place virtual “Buy” or “Sell” arrows. Space them out exactly as your strategy dictates (e.g., every 20 pips).

- Input Real Lots: If your strategy uses a multiplier (e.g., 0.01, 0.02, 0.04), edit the virtual lots on the chart to match these values.

- Find the Red Line: The indicator will automatically calculate your collateral requirements and draw a line labeled “Margin Call”.

The Winning Move

Look at the distance between your last planned order and the Margin Call line. If that line is within the daily Average True Range (ATR) of the pair, do not take the trade. You have just saved your account from a potential blowout, practicing truly Safe Forex Trading without risking money.

Strategy #2: The “Rescue Mission” (Managing Drawdown)

Best For: Traders currently stuck in a losing position.

This is the most powerful use case for the tool. You have open positions that are in the red, and you are considering adding an “averaging” order to lower your break-even point. But is it safe?

The Execution Plan

- Sync Real Trades: The Grid & Martingale Strategy Calculator can read your existing live market positions. It will import your real trades into its calculation engine.

- Place the “Ghost” Order: Drop a virtual order at the next strong support or resistance level where you plan to average down.

- Simulate the Recovery:

- Drag the virtual order up or down to find the best entry.

- Watch the “Average Price” marker move in real-time.

- The Goal: Find a location where the new weighted average price (breakeven) is realistic for the market to reach.

The Winning Move

If the tool shows that adding a 0.10 lot trade only moves your breakeven point by 5 pips but brings your Margin Call 50 pips closer, abort the mission. The risk-to-reward is not in your favor.

Strategy #3: The “Hedge” (Using Groups)

Best For: Advanced traders using “Locking” or Hedging strategies.

Sophisticated traders often run a Buy Grid and a Sell Grid simultaneously to capture volatility in both directions. Managing the math on this is a nightmare in Excel, but the Grid & Martingale Strategy Calculator handles it using Groupings.

The Execution Plan

- Create Group A (Longs): Place your Buy orders and assign them to “Group 1.” The tool will show the Profit/Loss and averages only for the Buys.

- Create Group B (Shorts): Place your Sell orders and assign them to “Group 2.”

- Analyze Independently: You can now clearly see if your Short grid is profitable enough to close out your losing Long grid.

The Winning Move

Use this feature to perform “Partial Closes.” If Group B (Shorts) is making $50 profit, and the oldest trade in Group A (Longs) is losing $40, you can see clearly that closing both nets you +$10, reducing your overall exposure.

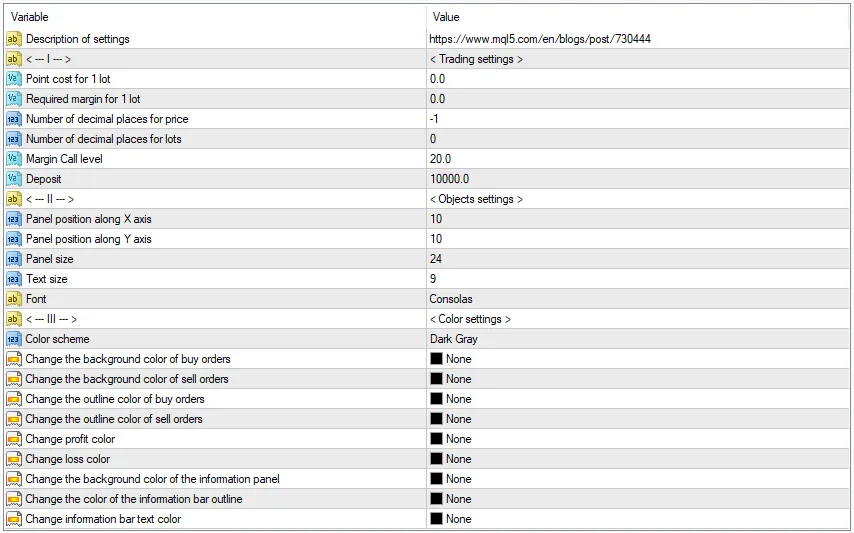

Installation & Critical Settings

To get accurate results, you cannot just drag and drop the tool; you must configure the “physics” of your simulator to match your broker.

- Configure Deposit: In the inputs, manually set the Deposit amount to match your balance (or the balance you plan to have).

- Leverage/Margin: Set the “Required margin for 1 lot”. This is crucial. If your broker offers 1:500 leverage, ensure this setting matches, or your Margin Call prediction will be wrong.

- Visuals: You can customize color schemes for Buy/Sell orders and text size to keep your chart clean.

Note: The tool is designed for live chart interaction and does not work in the Strategy Tester.

Grid & Martingale Strategy Calculator

A professional "flight simulator" for MT4/MT5 to plan grid entries and visualize margin call levels.

Summary

A must-have utility for quant traders. It replaces guesswork with mathematical precision, allowing you to "stress test" your account before a single dollar is risked.

Final Verdict: Is It Worth It?

If you trade strictly with fixed Stop Losses and single positions, you might not need this tool. However, for Grid, Swing, and Martingale Strategy traders, the Grid & Martingale Strategy Calculator is a mandatory safety belt.

It shifts your trading from “hope-based” to “math-based.” By visualizing your Margin Call and calculating your exact averages before you click “Buy,” you move from gambling to strategic planning, the very definition of Safe Forex Trading.