This multiple timeframe forex trading with a daily pin bar strategy is another way to trade a pin bar in forms on your mt4 chart.

Many new forex traders use multiple timeframe forex trading techniques to look for buy and sell entry signals, and this strategy is one way to trade in multiple timeframes.

You may also like to read about this: 200 EMA Multiple Chart Timeframe Forex Trading Strategy

Requirements

Timeframes: only daily chart

Currency Pair: Any

Indicators: Higher Timeframe Candlestick Overlay Indicator Mt4

Background Idea

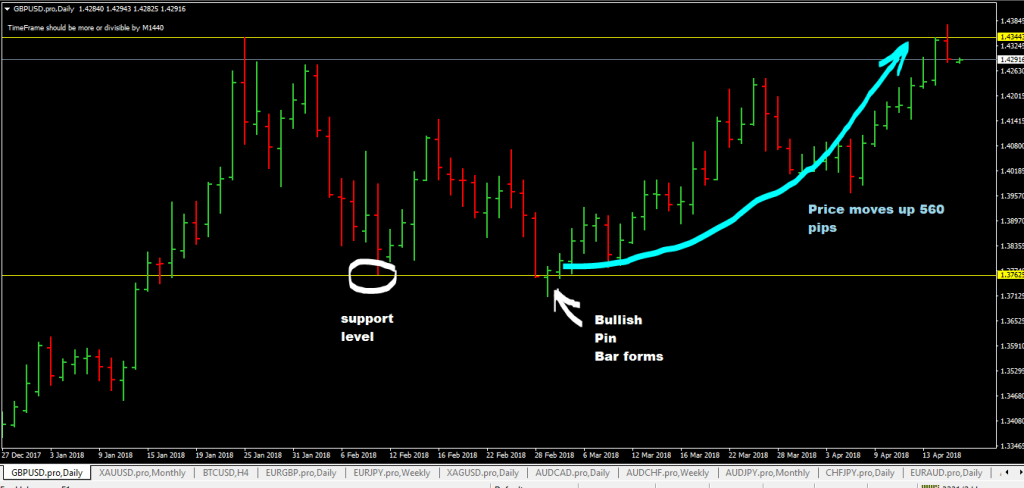

When a chart pin bar forms in the mt4 daily chart, especially in significant support and resistance levels, it signals a changing forex market sentiment and can lead to considerable price moves in the other direction when the chart low or high of the pin bar is broken.

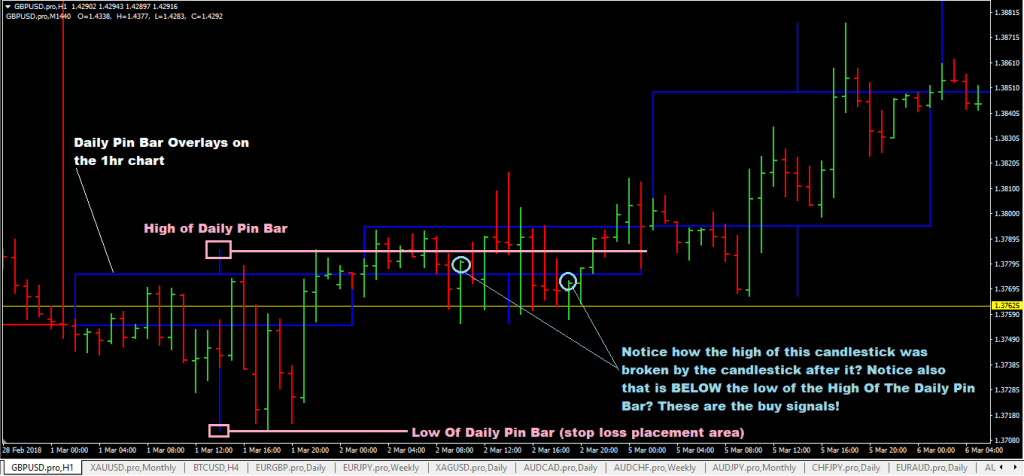

The good idea here is to get into a live trade before the high or the low of the chart pin bar is broken so that you can ride the increase in momentum to maximize profits when the low or the high daily pin bar is broken.

To do that, you must do multiple timeframe trading by switching to a smaller timeframe and looking for buy and sell entry signals there.

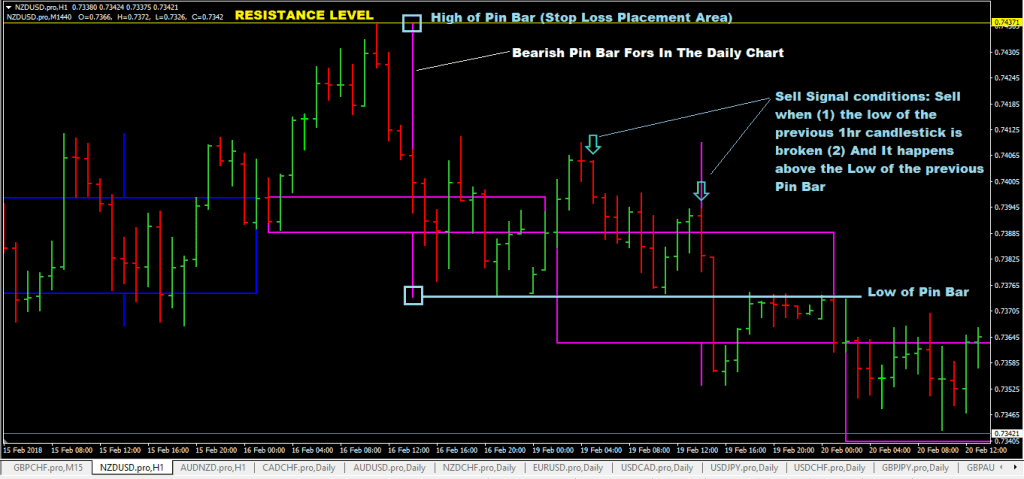

Sell Order Rules

For a sell entry signal, the following has to occur in order:

- A daily chart bearish pin bar has to form at a resistance level and close.

- When the current day’s chart candlestick starts, switch to the 1hr timeframe and wait for bullish 1 hr chart candlesticks to start climbing higher, making higher highs and higher lows.

- The sell signal comes when (a) a 1-hour candlestick breaks the low of the previous candlestick and (b) as long as this happens above the low of the previous day’s candlestick.

- Place your stop loss(SL) 1-2 pips above the high of the previous day’s pin bar.

- Take profit(TP): use 1:3 risk to reward(R: R) or aim for a previous chart swing low as long as the risk: reward(R: R) is above 1:2

Buy Order Rules

The buy entry order rules would be the opposite of the sell entry order rules.

- A daily bullish chart pin bar has to form in a chart support level and has closed.

- When the current day’s chart candlestick starts, switch to the 1hr timeframe and wait for bearish 1 hr chart candlesticks to start falling lower, making lower highs and lower lows.

- The buy entry signal comes when a 1-hour candlestick breaks the high of the previous chart candlestick as long as this happen above the last high of the last day’s candlestick.

- Place your stop loss(SL) 1-2 pips below the low of the previous day’s chart pin bar.

- Take profit(TP): use 1:3 risk to reward(R: R) or aim for a previous chart swing high as long as the risk: reward(R: R) is above 1:2

Advantages Of The Multiple Timeframe Forex Trading With Daily Pin Bar Strategy

- Potential to make 99 plus pips of profit on each open trade when trades go well as anticipated.

- tight stop loss(SL) as well as less chance of your stop loss(SL) being hit prematurely

- Opportunity to pyramid trade: chances of making more than one trade on each setup while having a reasonably small stop loss distance. Assuming that you have five sell signals in a setup and your account allows you to trade five standard contracts, and if the price moves more than 100 pips, let’s say that only one trade has the lowest floating profit of 99 pips, you can do the sums, right? Multiple open trades going right =multiplying your profits fast=your live trading account increases fast without risking too much.

- Trading on a larger timeframe, so you have the big picture, reduces a lot of noise in the smaller chart timeframe.

Disadvantages Of The Multiple Timeframe Forex Trading With Daily Pin Bar Strategy

- sometimes when the chart low or the high is broken, so there’s no chance of a small retrace to allow you to buy entry or sell

- If the chart pin bar is exceptionally long, the stop loss distance may also be incredibly long, so you may need to fix your trade sizes to keep your risk down.