Silicon Ex EA is a trading bot developed for use in the Forex market, designed with automation and algorithmic trading in mind. Offered as a free download, this EA aims to provide a range of features that enable traders to execute trades based on market trends and strategy parameters.

Features of this Trading Bot

- Reliability and Stability – Silicon Ex is built using what is described as “advanced technologies,” intended to ensure consistent performance across varying market conditions. While stability is a frequent concern with EAs, this platform appears to cater to that with a structured framework.

- Intelligent Risk Management – The Trading Bot includes a money management system that allows traders to set parameters for acceptable risk levels. Proper risk management is a standard component of most expert advisors, and Silicon Ex offers configurable settings in this area.

- Real time Market Analysis – According to its description, Silicon Ex evaluates multiple market metrics in real time. such as open, close, high, low, and volume, to identify current trends. This type of technical analysis is commonly employed by many other EAs as well and can be useful but also depends on market activity and trading style.

- Flexible Settings – Traders have the ability to customize a variety of parameters within the EA. This flexibility allows for adjustments based on personal strategies, though as with many expert advisors, this often requires a deeper understanding of the system for optimal results.

- Automated Buy and Sell Signals – The bot generates signals for trade entry and exit using built in algorithms. These automated decisions can be convenient, especially for those who prefer a hands off approach, but may not always align with manual strategies or unprecedented market shifts.

- Effective Trailing Stop – Trailing stop capabilities are built into Silicon Ex. These are commonly used to protect profits as trades move into favorable territory. The effectiveness of such features will depend on how well they are integrated with the overall strategy.

- Multi Level Protection – This EA claims to include spread protection and other risk controls to manage sudden market fluctuations. Protective elements like these are typical in EAs aiming to minimize high risk exposure.

- Ease of Use – Silicon Ex is marketed as accessible to users without advanced programming knowledge. While simplicity in setup can appeal to beginners, traders may still need to invest time in learning how to configure and monitor the EA to suit their needs.

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this trading bot works, then only use it in a real account.

Recommendations for Silicon Ex EA

- Minimum account balance of 100$.

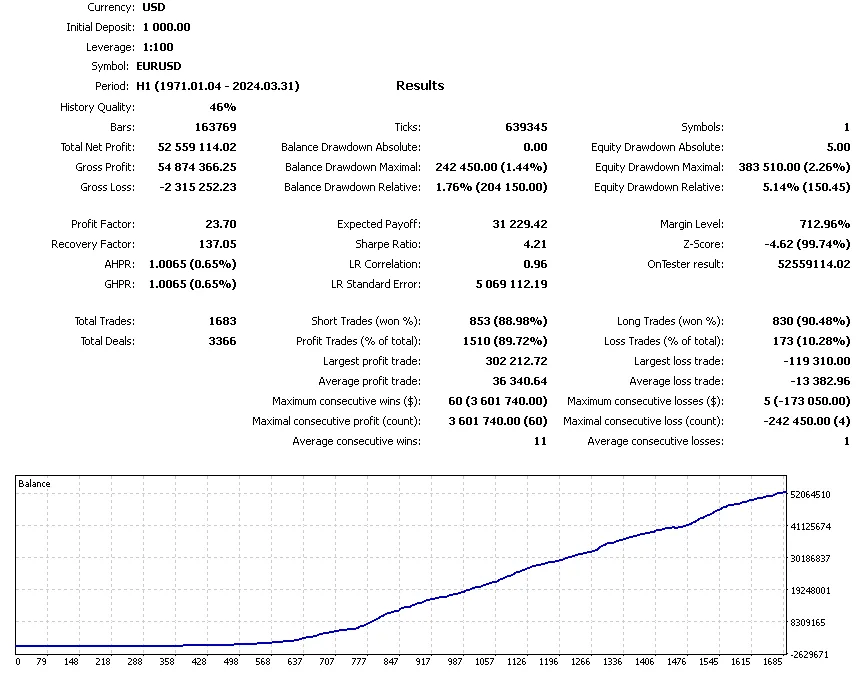

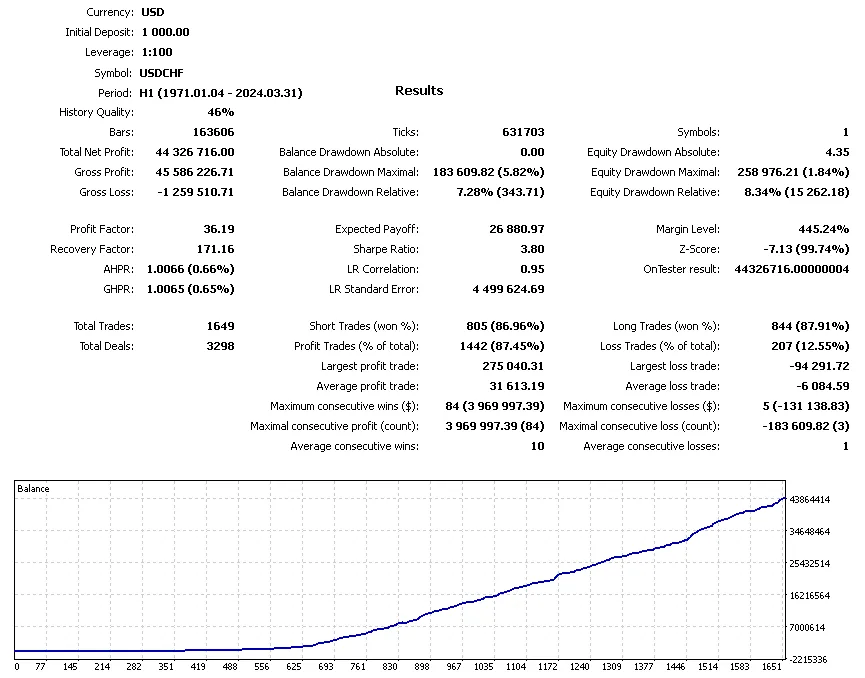

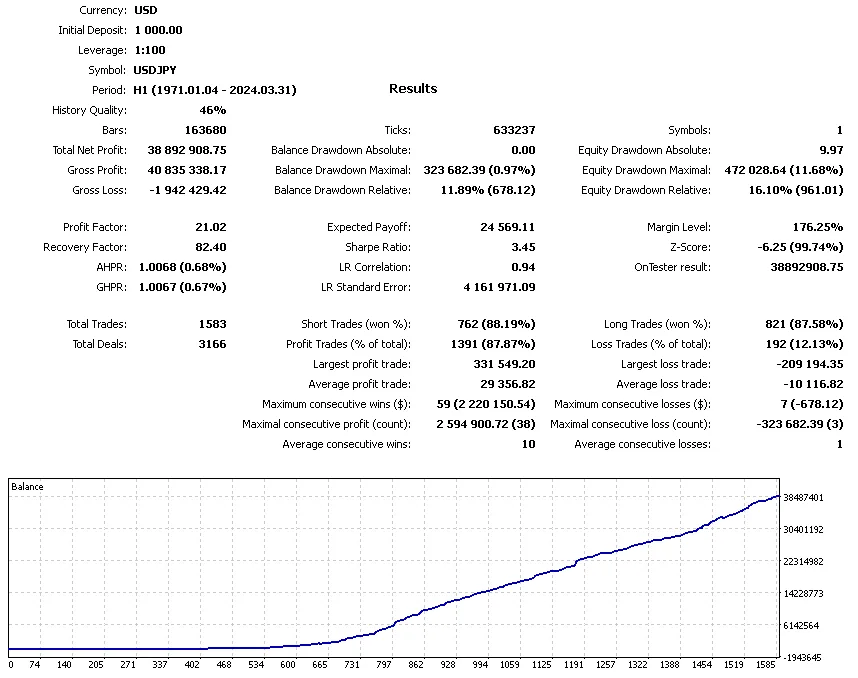

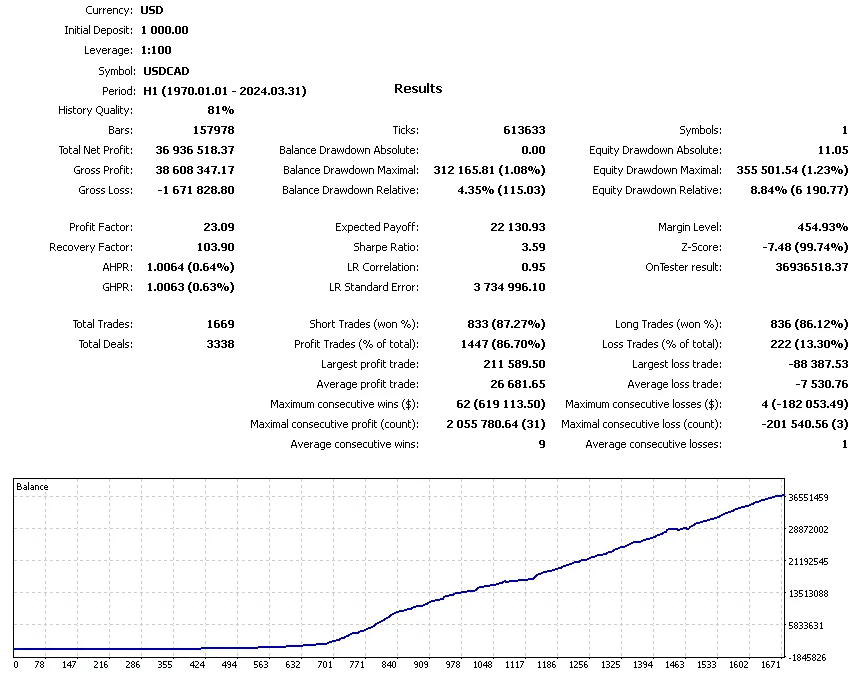

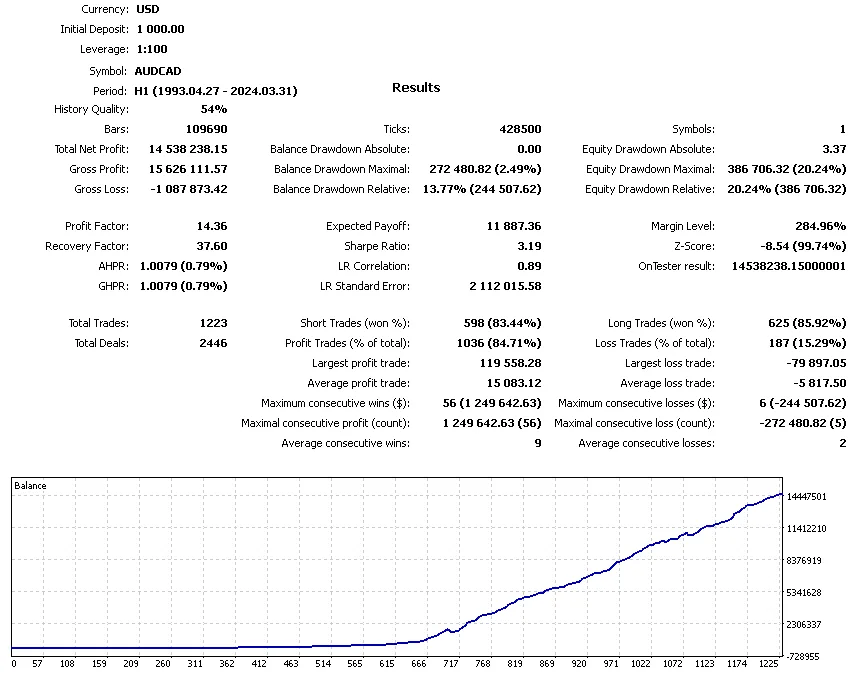

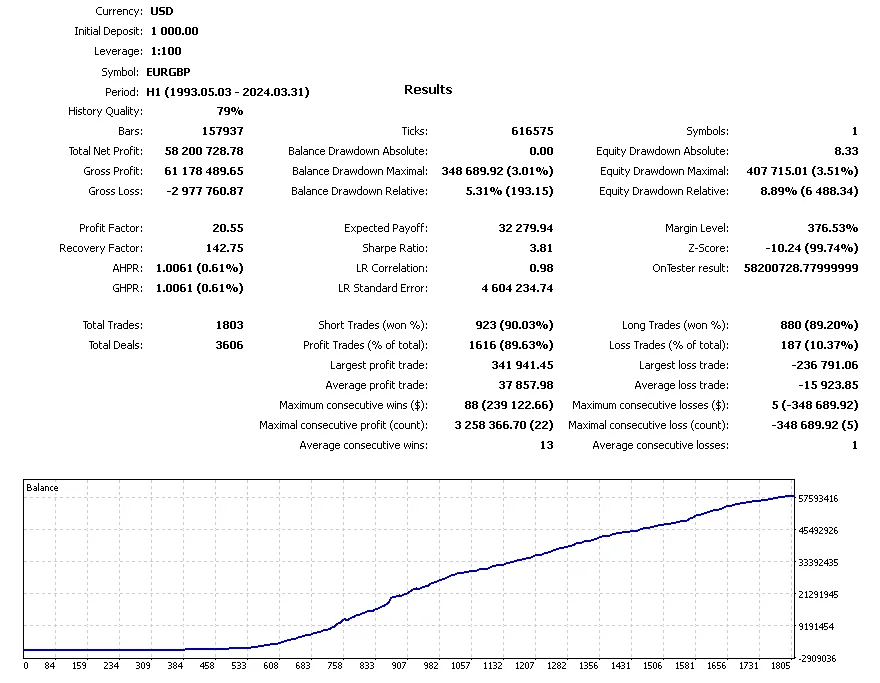

- Works best on EURUSD, USDCHF, USDJPY, USDCAD, AUDCAD, EURGBP. (Work on any Pair)

- It works best on H1. (Work on any TimeFrame)

- Silicon Ex EA should work on VPS continuously to reach stable results. So we recommend running this Trading Bot on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- This EA is NOT sensitive to spread and slippage. But we advise using a good ECN broker (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

- Read More XTrader Pro Gold EA FREE Download

Conclusion

Silicon Ex positions itself as a fully automated trading solution for the Forex market that includes many of the standard features found in modern algorithmic trading tools. Though the trading bot is available for free, traders should approach any EA with due diligence, testing in demo environments and understanding the logic behind its performance. Whether this particular EA aligns with an individual’s trading goals will depend on a range of factors, including personal strategy, risk tolerance, and market familiarity.

Amazing in back tests. Too nice to be true ?

will not attach to chart

I could attach it to a demo account without problem. Can you detail the kind of issue you met ?

Hmm … Large size .ex4 ( 1’306 KB ). Is it another history reader ?

Forward testing on a demo is mandatory before jumping for joy.

This EA’s strategy seems realistic and reasonable to me. Very promising. I’ll give it a try and attach it here on a live account chart.

Me too

How is it going ? On my demo account losses outweigh gains.

I tested it all week and found it to be a typical price-averaging robot. It uses candlestick resistance/support breakouts for entries and, if these fail, uses price averaging to correct losses. The drawdown of this type of EA is usually high, unlike what is shown in the backtest. Yes, it is a profitable EA because price averaging eliminates losses, but you need to have enough balance to withstand the drawdown. I recommend this robot only for medium/large accounts. And I recommend avoiding highly volatile pairs like USDJPY..

Got it.

Thank you for your advice

trash

I have a position that has not been settled, what do you think? Does this EA not settle unless the TP is touched?

If you’re using the default configuration and have open positions, it means the pair’s price trend is going against your order(s). In this case, the EA will continue opening orders with the same signal and lot size as your order. When the price returns in favor of your order, the EA will find the average price and close all positions. EA Silicon uses the averaging strategy to close orders. One way to visualize this process is to perform a backtest with the VISUAL MODE option selected. Good luck!

Now it has become a platform mt4 Updated for build 1457

Please update

EA / silicon Ex

Please address this as soon as possible, and thank you for your efforts