In the next few minutes you’ll discover a six step price action blueprint built for today’s high volatility conditions complete with smart money concepts like order blocks, liquidity sweeps and fair value gaps and a free, beginner friendly candlestick pattern indicator that does the pattern spotting for you.

You’ll see exactly how to frame a high time frame bias, drill down to sniper entries, and manage risk so a single winner can pay for three losers. By the end, you’ll have a repeatable plan you can test on a demo tonight and a one click download that removes the busywork of scouring 28 pairs for the perfect engulfing candle.

Ready to trade where the institutions are lurking instead of reacting after the fact? Let’s dive in.

Why Price Action Is Even Stronger in 2025

1. AI-Driven Volatility

Central banks are ringing alarm bells: the Bank of England’s April 2025 report warns that copy and paste AI trading models can “act as a herd,” magnifying every surge or dump. When dozens of autonomous systems pull the trigger in the same direction, price races from level to level far faster than any moving average can react making raw support and resistance the safest compass. (PYMNTS.com, The Guardian, The Global Treasurer)

2. Smart-Money-Concepts (SMC) Boom

Retail traders chasing prop firm funding latched onto SMC late last year, and Google searches for “smart money price action” hit record highs in Q1 2025. Prop firm analytics sites now list liquidity grab and order block plays among their most passed challenge strategies, underscoring how mainstream these once “insider” ideas have become. (Technology.org, Prop Firm App)

3. Liquidity Sweeps & Order Blocks Front-and-Center

Modern price action trainers no longer obsess over RSI divergences; they map where big players park stop orders. Fair Value Gaps (FVGs), order blocks and engineered liquidity sweeps dominate 2025 playbooks, because they pinpoint the exact candle clusters institutions use to fill size. Educational hubs from broker blogs to ICT spin offs devote entire series to spotting these footprints. (eplanet Brokers, Maverick Currencies)

Bottom line: Machines accelerate every spike, but they can’t hide the footprints they leave behind. Traders who read naked price and smart money tracks get a split second edge that lagging oscillators will never provide.

Forex Price Action Strategy (6 Steps)

- Trading profile – Swing to intraday

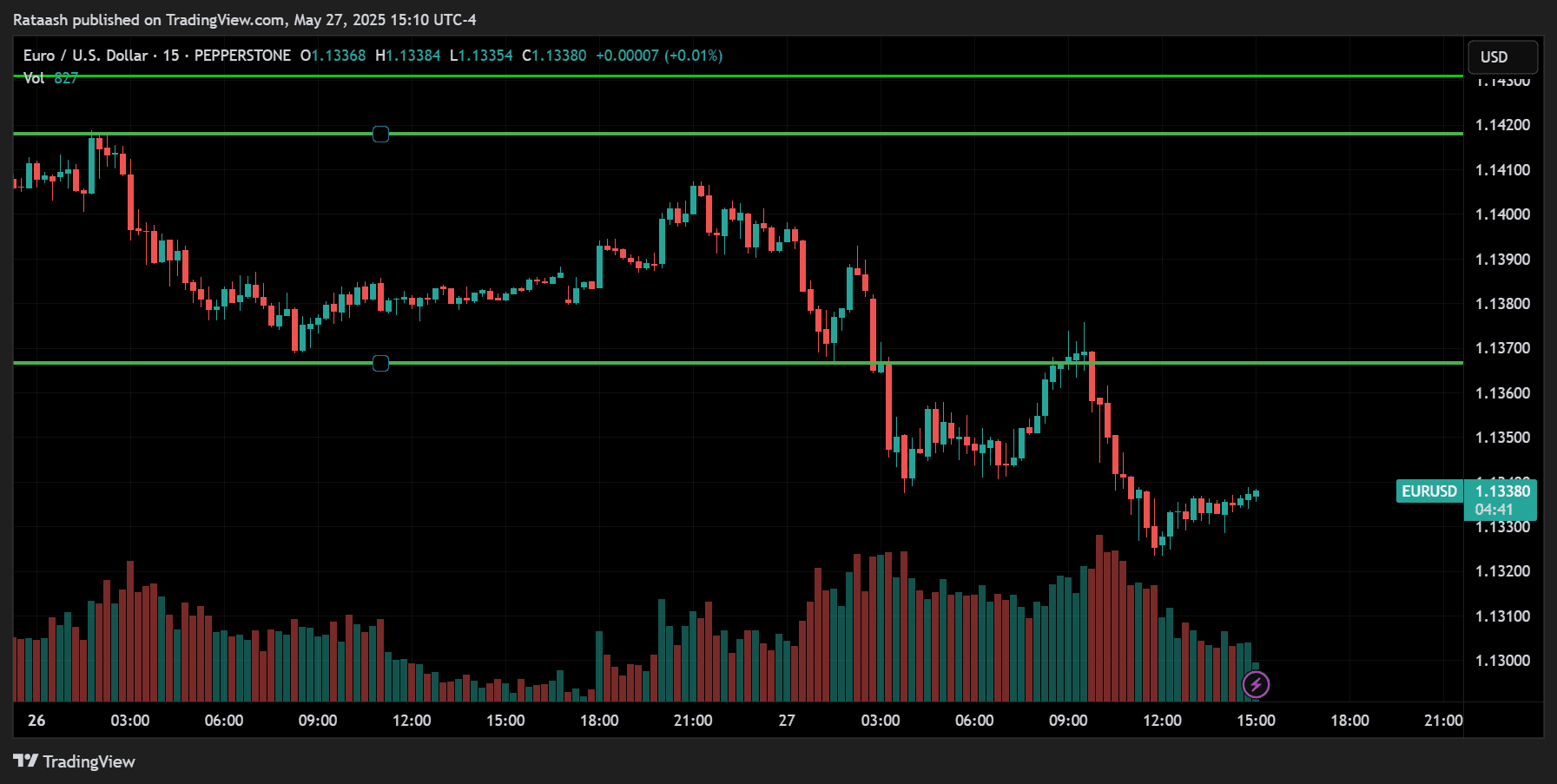

- Time-frame map – Daily (D1) for bias → 4-Hour (H4) for location → 15-Minute (M15) for entries

- Edge assumption – ~55 % win-rate, average risk-to-reward 1 : 3 → long-run expectancy ≈ +0.40; one clean winner wipes out three standard losers.

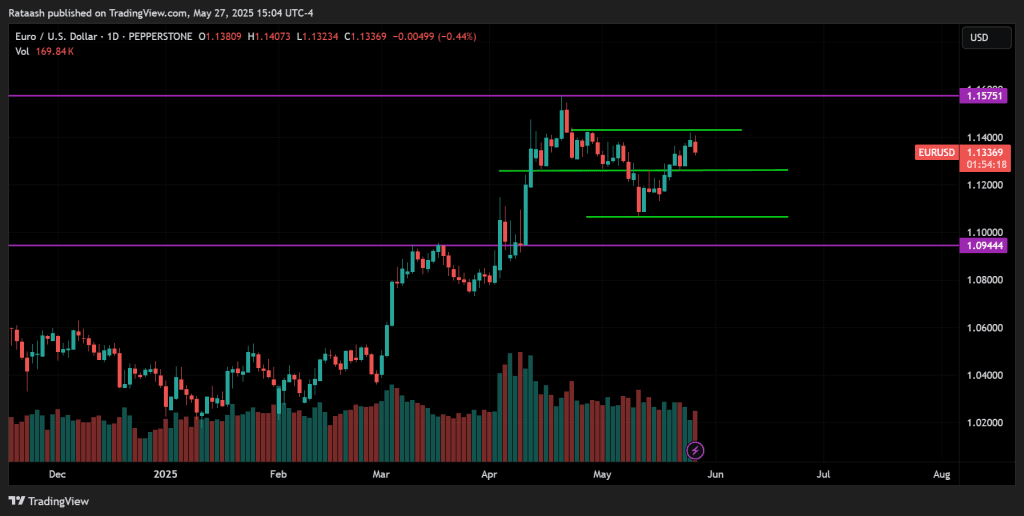

Step 1: Frame the High-Time-Frame Bias

Open a clean D1 chart no indicators, just structure.

- Spot the last Break of Structure (BoS) or Change of Character (CHoCH) –

Bullish BoS (price closes above the last swing high) hard wires a “buy-only” mindset until price invalidates the level with a decisive D1 close beneath it. - Project the macro target – Mark equal highs/lows, quarterly highs, month open, and last week’s high/low. These “external liquidity” pools are where smart money often completes moves.

- Add context, not clutter – One horizontal line for structure, one rectangle around the liquidity zone, and a single arrow for directional intent is usually enough. Anything more hides the story the candles are trying to tell.

- Read More – Forex Smart Money Concept Indicator FREE Download

Why it matters: When lower time frame noise tempts you to fade a rally, the D1 bias is the grownup in the room reminding you which trades have the institutional wind at their back.

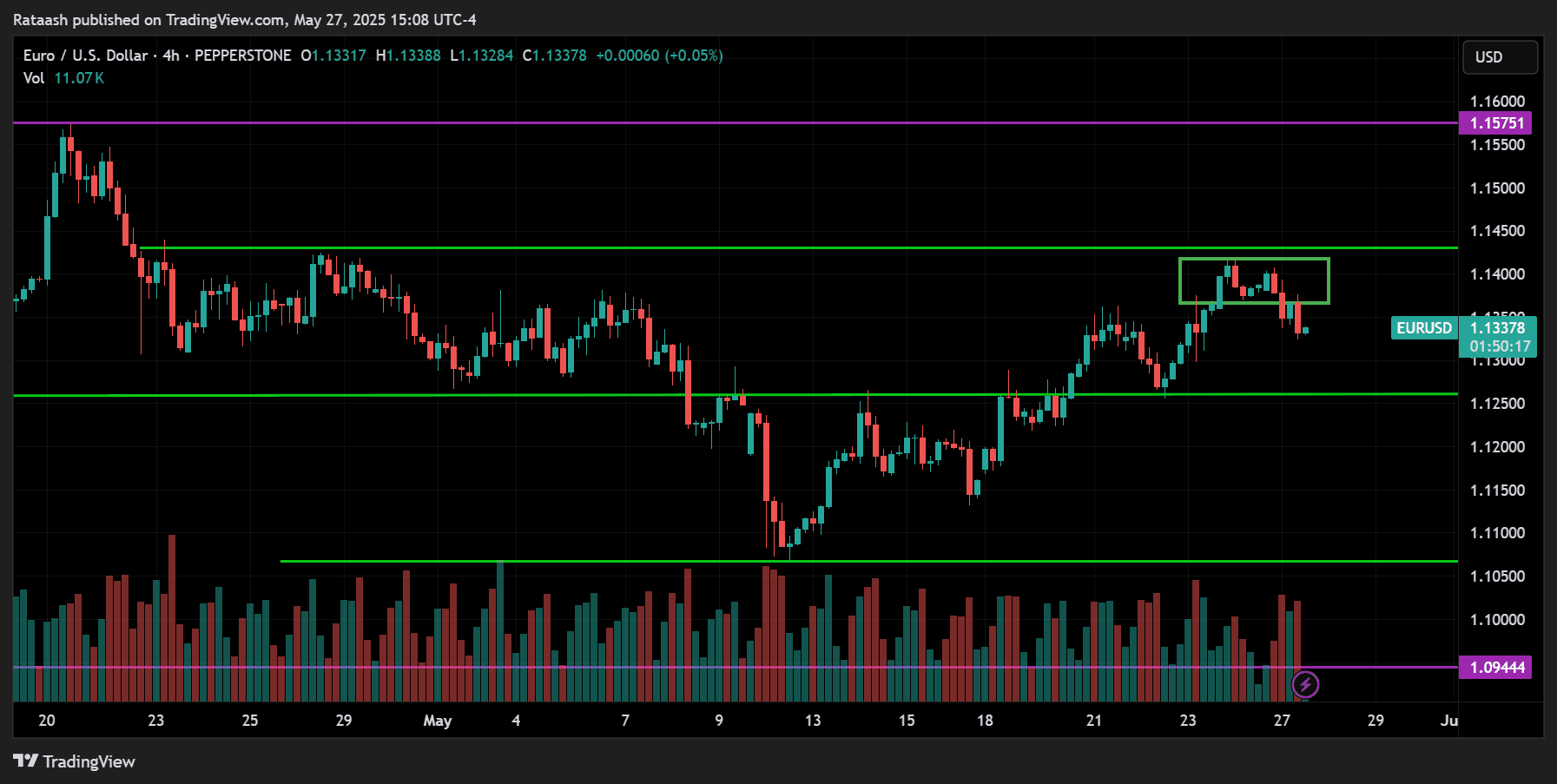

Step 2: Refine an Order-Block Zone

Drop to H4 to isolate the institutional order block that aligns with the D1 story,

- Definition refresher – In a bearish leg, the order block is the last bullish candle before the impulsive sell off (and vice versa for bulls).

- Confluence test – The best blocks overlap the HTF liquidity you drew on D1 and sit inside a clear Fair Value Gap (thin liquidity void created by an imbalance).

- Premium/discount check – In an uptrend, favour blocks that form below the 50 % retracement of the current swing (the “discount” zone) institutions love a bargain, too.

Draw the rectangle from candle open to candle close, extend right, and do not resize it unless price closes beyond it on H4; wicks alone are normal liquidity probes.

Step 3: Drill Down to the Execution Chart

Slide to M15 (or M5 during London New York overlap).

- Patience principle – Sit on your hands until price raids liquidity a sharp wick that tags stops under equal lows (bulls) or above equal highs (bears) inside the H4 block.

- “Three minute rule” for wick confirmation – wait for the candle to close; never enter mid-spike.

- Alert hack – Set MT4 price alerts at the top and bottom of the block so you’re summoned to the screen only when it matters.

By forcing every trade to originate from a higher time frame decision point, you automatically dodge 80 % of chop.

Download a Collection of Indicators, Courses, and EA for FREE

Step 4: Candlestick Confirmation

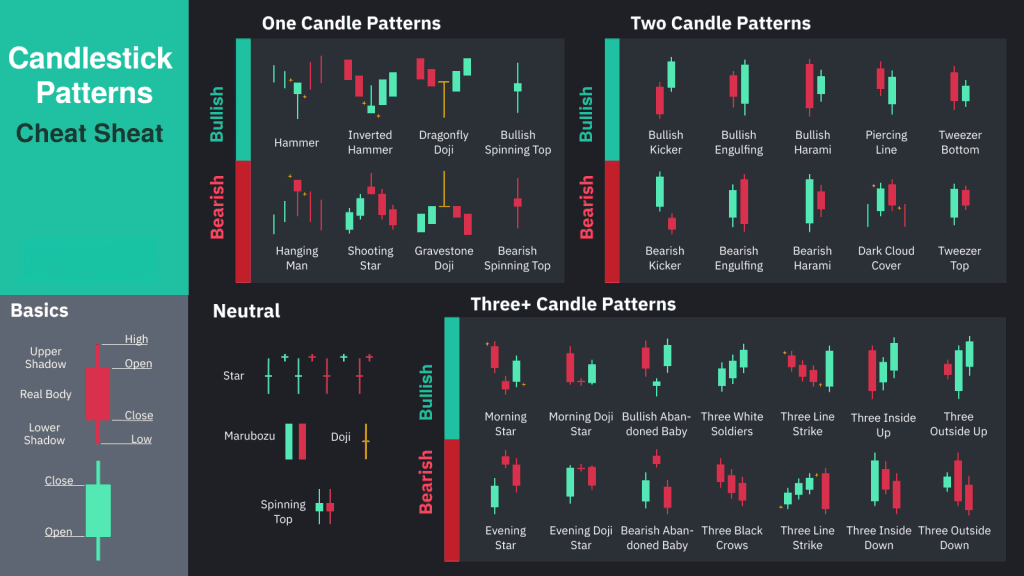

Enter only if a high probability pattern prints inside your block and let the Price Action Candlestick Patterns Indicator do the spotting:

- Primary patterns (stronger) – Bullish/Bearish Engulfing, Morning/Evening Star, Three-Bar Reversal.

- Secondary patterns (contextual) – Pin Bar, Inside Bar Break.

- Dashboard workflow – Keep the symbol list filtered to pairs that match your D1 bias; mute the rest to preserve focus.

Rule of thumb – Take the first qualifying pattern in the zone. Skip the setup if the spread widens to > 1.5× its 30 day average thick spreads often signal news spikes, not genuine liquidity vacuum.

A single glance at the dashboard tells you when confirmation has arrived; no need to cycle through 28 charts like it’s 2013.

Step 5: Risk Management

This blueprint’s mechanical risk discipline is the secret sauce:

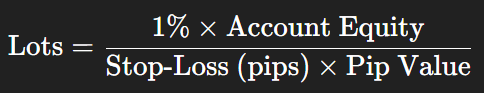

- Position-sizing formula –

- Stop-loss logic – Two choices,

- Conservative – a few pips beyond the wick that grabbed liquidity.

- Aggressive – just under the body of the pattern (tighter RR, higher chance of noise hit).

- Target setting – Measure projection to the next HTF liquidity. Do not cap runners before at least 1 : 3; scale half at 1 : 2 to smooth the equity curve when markets stall.

- Max pain rule – Hard stop trading for the day after three losses or -3 % equity fresh eyes beat revenge clicks.

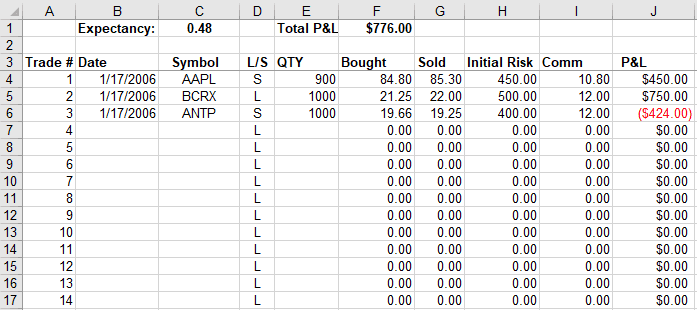

Step 6: Metric Tracking

Treat your strategy like a startup:

- Spreadsheet essentials – Date, pair, session, pattern, HTF context, lot size, SL / TP pips, actual R:R, outcome.

- Win-rate vs. expectancy – After 50 trades, rank setups. If Bullish Engulfings in bullish order blocks show 70 % wins while Pin Bars limp at 40 %, reallocate capital accordingly.

- Monthly review ritual – Print equity curve, annotate emotional spikes, revisit screenshots of each A- and F-grade trade. Refinement beats reinvention.

A data driven feedback loop converts a “strategy” into a scalable trading business.

- Put together, these six layers act like a filter stack – Macro structure → institutional price zone → liquidity raid → candle trigger → quantified risk → audited feedback. Strip any layer away and edge leaks out; keep them all and you’re trading on the same footprints institutions leave every day.

Indicator Overview: Price Action Candlestick Patterns (MT4)

Name:

Price Action Candlestick Patterns Indicator (MT4)

Release Date:

April 3, 2025

Pattern Detection:

Scans over 30 reversal and continuation candlestick patterns across all currency pairs and timeframes. Key setups include Morning Star, Evening Star, Bullish/Bearish Engulfing, and Three Black Crows.

Dashboard Functionality:

Displays a centralized panel showing the symbol, timeframe, detected pattern, and how long ago it occurred. Click any listing to instantly open the chart.

Alert System:

Supports email, push notifications, and pop-ups. Users can customize which patterns trigger alerts based on their strategy.

Compatible Assets:

Works seamlessly on forex pairs, indices, precious metals, and even individual stocks.

Skill Level:

Built with simplicity in mind ideal for beginners. Even complete novices can use this tool to identify potential setups and start trading with confidence.

Installation:

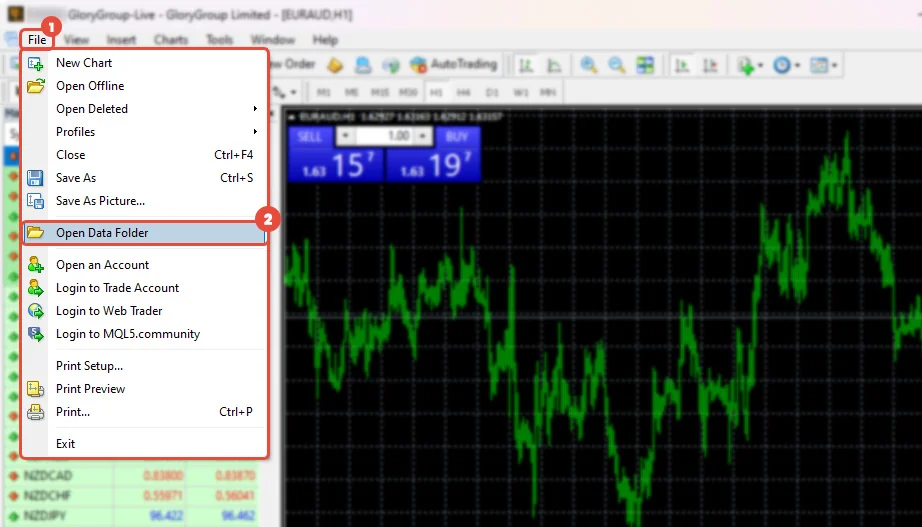

MT4 → File → Open Data Folder → MQL4 → Indicators → paste .ex4 → restart MT4 → Insert → Indicators → Custom → Price Action Patterns

Best practice – Use the dashboard as confirmation, not a signal machine. Let strategy logic (HTF bias + order block) filter which alerts earn your attention.

Advanced Tweaks

You already have a robust six step scaffold. The refinements below sharpen that edge for traders who crave tighter entries, quicker prop firm passes, and data driven self coaching.

Fair Value Gap (FVG) Micro-Sniping

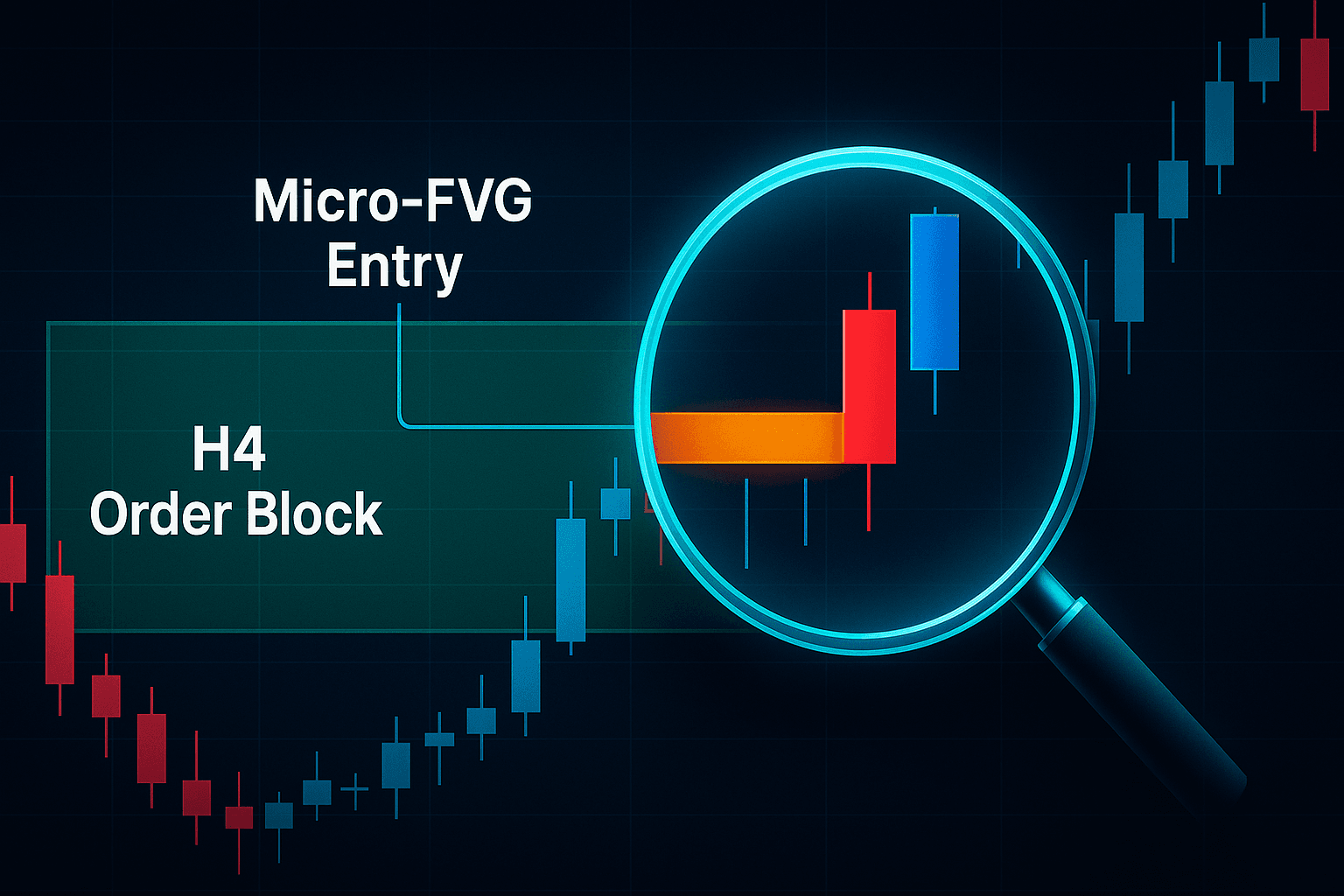

A standard 4 H order block can be 20–40 pips tall great for swing trades, but overkill if you want razor thin stops. Drill inside it:

- Drop to the 1 m or 3 m chart while price sits in your H4 block.

- Identify a micro-FVG: the middle candle of a three-candle sequence where the low of the third candle is higher than the high of the first (bullish) or vice versa (bearish). That empty stretch is a micro liquidity void.

- Wait for the engulfing pattern to close inside that gap. This proves smart money has filled the imbalance and is ready to expand away.

- Place stop loss 1–2 pips below the gap (bullish) or above (bearish). Typical risk plunges to 3–6 pips on majors, letting you keep the 1 % risk rule but scale up lot size dramatically.

Done right, you convert a 1 : 3 swing setup into a 1 : 8 + “sniper” without changing the higher time frame logic.

Session Overlay Intel

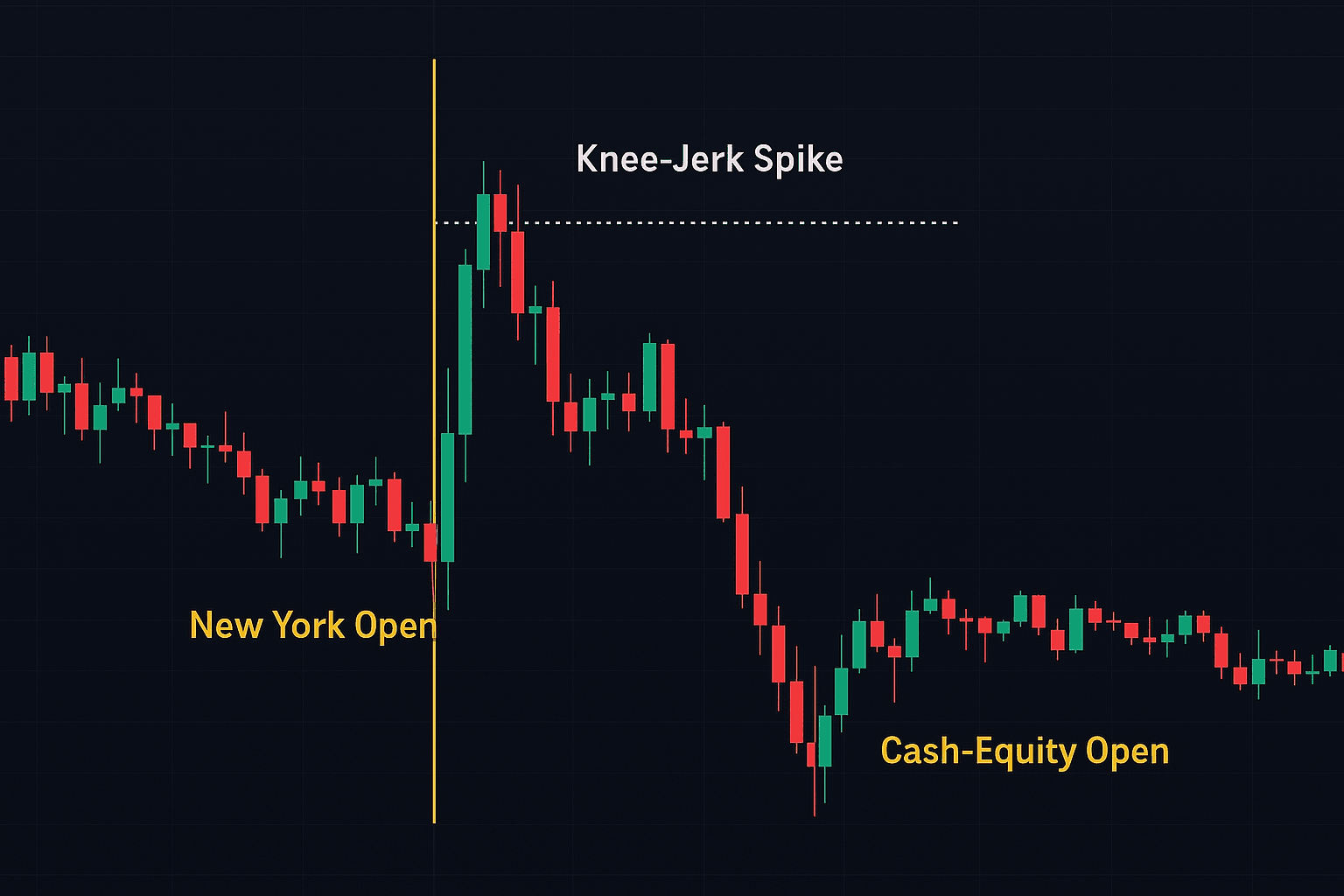

Internal backtests on EU and US majors show that New York open liquidity raids (14:30–15:30 UTC) delivered the widest average follow through in the first quarter of 2025 about 1.7 × the Asian session breakout distance. The reason?

- US data drops at 13:30 UTC, creating knee jerk spikes that sweep stops.

- Cash-equity open at 14:30 UTC sparks institutional hedging flows that reverse those spikes.

Overlay a vertical line or use a sessions indicator to highlight this hour. If your H4 order block sits just below Asian lows, patiently wait for that NY raid statistics say your risk to reward will be better than chasing a pre London fakeout.

Prop-Firm Optimization

Most 2025 prop firms cap daily loss at 5 % and total drawdown at 10 %. The blueprint’s ≤ 1 % risk and mandated 1 : 3 targets mean:

- Expected pass in ~20 net winners – At a 55 % hit-rate you need roughly 36 trades (20 W | 16 L) to gain 30 R, offsetting 16 R of losses → +14 R, or +14 %. That clears the 8–10 % profit target with slack for a bad day.

- Compounding hack – Leave the last scale-out runner to ride to HTF external liquidity; a single 1 : 6 or 1 : 8 winner can chop the pass count in half.

Keep a “prop firm mode” risk preset in MT4 so you never accidentally bump a lot size under challenge pressure.

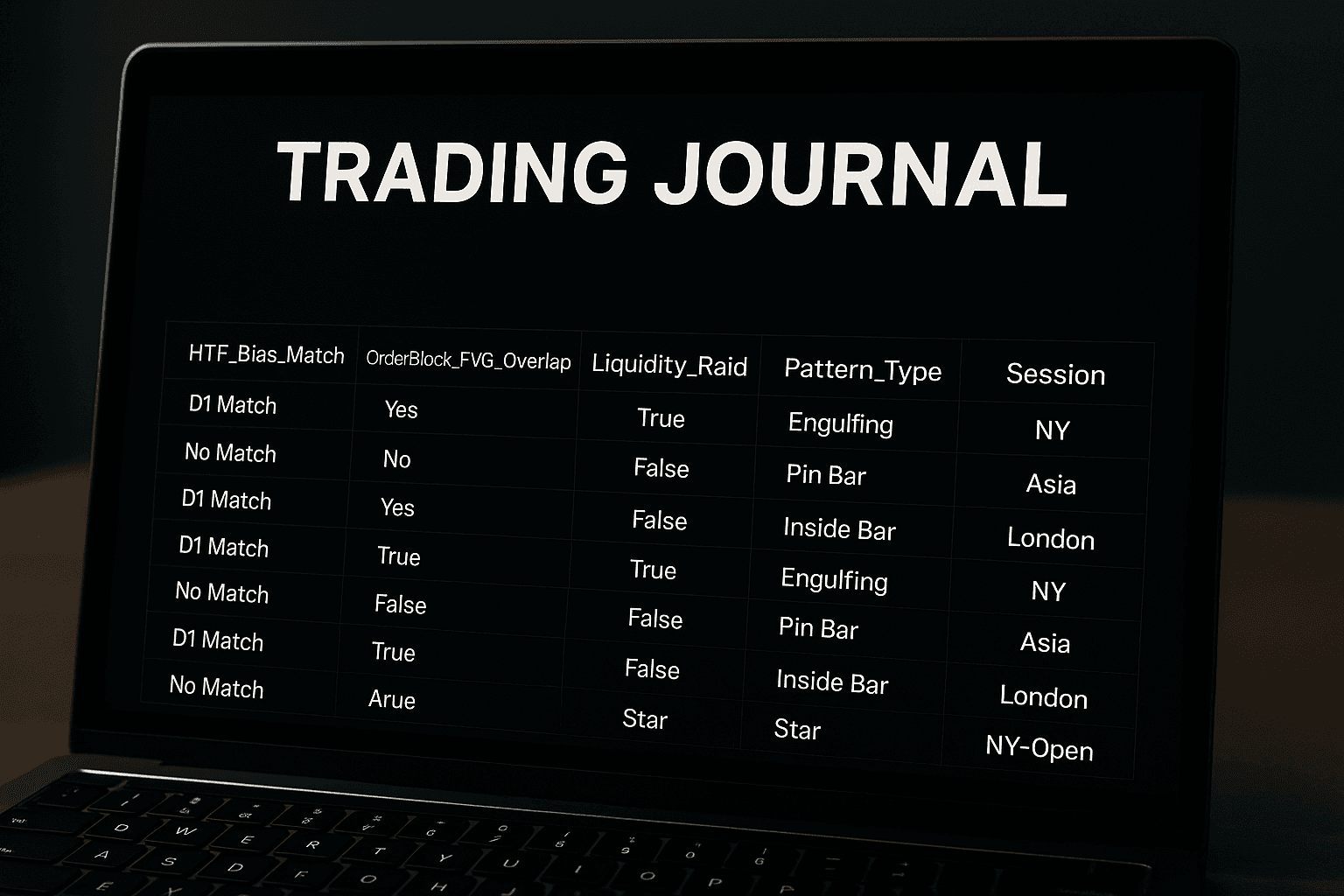

Hyper-Specific Journal Tagging

Journaling isn’t just record keeping; it’s model training for the trader’s brain. Add these Boolean tags to every entry:

HTF_Bias_Match– was the D1 direction still valid?OrderBlock_FVG_Overlap– yes/noLiquidity_Raid– wick ≥ 2 × average range into structurePattern_Type– engulfing, pin-bar, star, inside-bar breakSession– Asia, London, NY, NY-open

After fifty trades, filter combinations. You might discover that NY-open + Engulfing + Overlap wins 70 % while Asia + Pin-Bar + No Overlap wins 35 %. Prune the dead wood and watch expectancy climb without changing a single line of your plan.

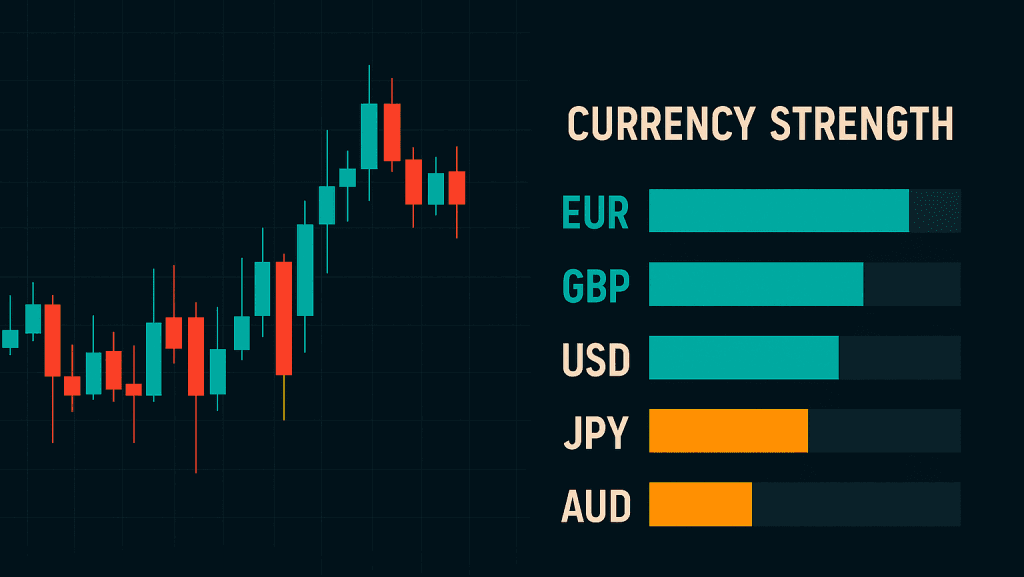

A Final Micro-Edge: Currency Strength Confirmation

If two major pairs signal at once say EUR USD long and GBP USD long pull up a real time currency strength meter. A stronger EUR vs. GBP implies EUR USD will expand faster. Route your limited risk capital toward the pair most likely to sprint, not jog.

- Bottom line – these tweaks don’t replace the core blueprint they compress risk, align you with the most explosive hours, and feed a feedback loop that evolves your unique “A setup.” Master them, and 2025’s AI driven bursts become precise revenue events, not heart-rate spikes.

Quick-Reference Checklist

- HTF bias confirmed (BoS / CHoCH)

- Liquidity pool mapped

- Valid order block/FVG overlap

- Dashboard pattern aligns with bias

- ≤ 1 % risk & ≥ 1 : 3 target

Pin this beside your monitor, discipline beats genius.

Final Thoughts

2025’s Forex landscape rewards traders who marry institutional concepts with streamlined tools. The blueprint above shows where banks move money and the indicator shows when a candlestick agrees. Master both, journal relentlessly, and the market’s new volatility becomes your profit engine.