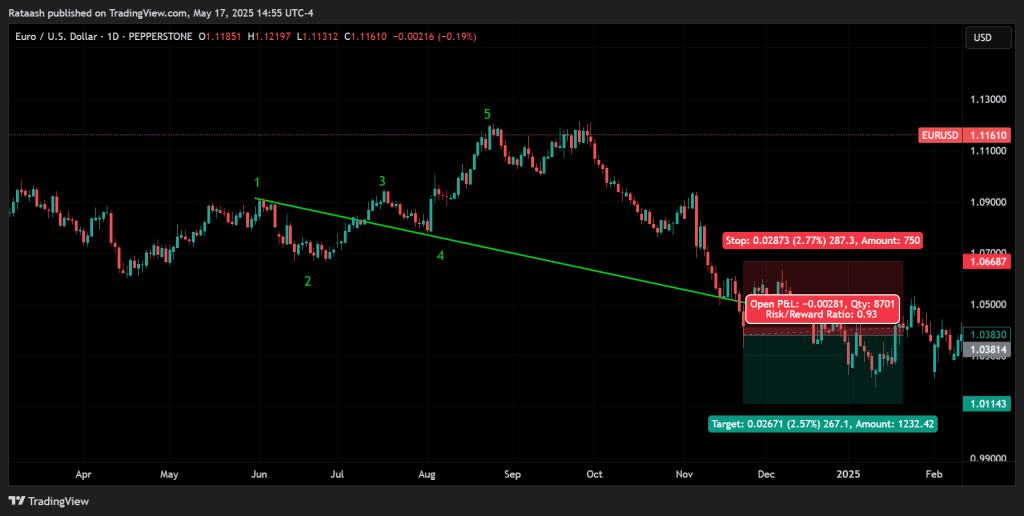

Have you ever watched price coil into a wedge, waited for the breakout, hit “Buy”… and then watched the market snap back and stop you out? The Wolfe Wave seeks to fix that heartbreak. Identified in the 1990s by veteran trader Bill Wolfe, this five-wave formation pinpoints the exact candle where a supply and demand tug-of-war ends and a powerful reversal begins. Today, an MT4 indicator does the heavy lifting, spotting the waves, drawing targets, and firing alerts so you can focus on execution rather than pattern hunting.

In this Wolfe Wave Forex Strategy deep dive, you’ll learn exactly how to:

- Recognise textbook bullish and bearish Wolfe Waves no guesswork.

- Install and configure the free Wolfe Wave Pattern Indicator on MT4.

- Execute a professional grade entry at point 5, place a safety net stop-loss, and ride price to the EPA line.

- Back-test, forward-test, and risk-manage the strategy so it fits your account.

Ready to trade sniper level reversals? Let’s dive in.

Table of Contents

Wolfe Wave – The Anatomy of a Five-Wave Reversal

A Wolfe Wave is a geometric, five-swing formation that maps the moment an overstretched trend loses balance and snaps back toward fair value. First documented by Bill Wolfe in the mid-1990s, the pattern has since been observed on stocks, futures, forex, crypto even 5-minute scalps because it reflects the universal rhythm of expansion (impulse) and contraction (correction) in order flow. When correctly drawn, the structure not only identifies where price is likely to reverse (the EPA line) but also when that move may unfold (the optional ETA intersection), giving traders both spatial and temporal targets.

Not Elliott Waves: Wolfe Waves share the “five-point” look of Elliott impulses, but they’re pure price-action geometry no Fibonacci counts or corrective legs required.

Construction Rules – Turning Price Swings into a Tradable Map

| Wave | What It Represents | How to Validate It |

|---|---|---|

| 1 → 2 (First Swing) | The last clean thrust in the prevailing trend. | Draw a line connecting the highs (bearish) or lows (bullish); this becomes the upper channel wall. |

| 3 → 4 (Second Swing) | A corrective move that stays inside the 1-2 channel, signalling waning momentum. | Point 3 should respect the opposite channel wall, and Point 4 must touch or nearly touch the 1-2 line to keep symmetry. |

| Point 5 (False Breakout) | A brief stab beyond the channel that flushes late breakout traders. | Price must pierce and close back inside the channel within a few bars no close, no pattern. |

| EPA Line (1 → 4) | The equilibrium price where the imbalance is expected to resolve. | Extend the 1-4 line forward; this is your primary take-profit target. |

| ETA Intersection (1-3-5 × 2-4) | Optional timing cue derived from the slope of the impulse and reaction lines. | Where these diagonals cross suggests when price might hit the EPA, but treat it as guidance not a stopwatch. |

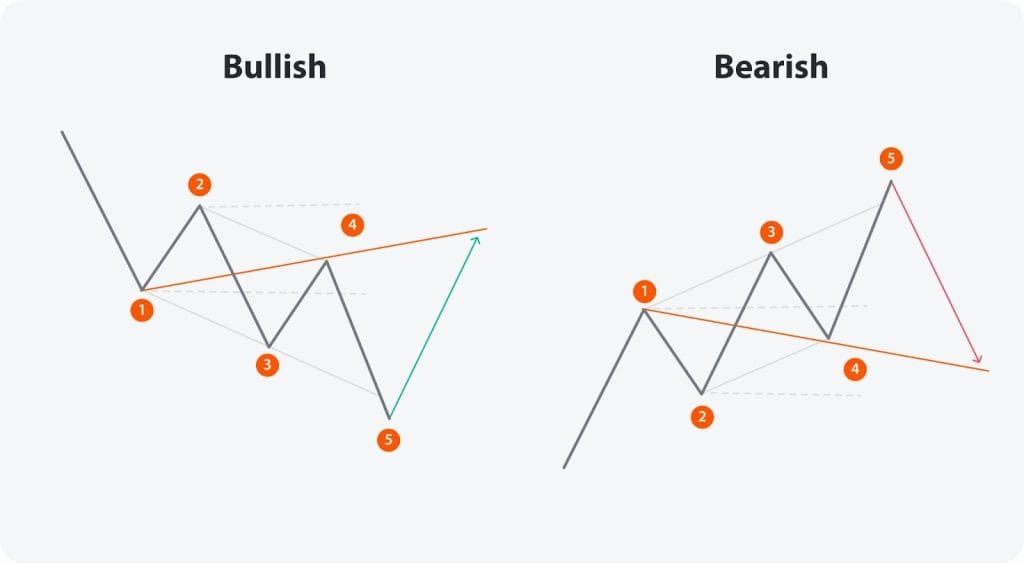

Bullish vs. Bearish Mirrors

- Bullish pattern – Points 1 & 3 form higher lows, Point 5 spikes to a marginal new low, then snaps upward toward the EPA.

- Bearish pattern – Points 1 & 3 form lower highs, Point 5 spikes to a marginal new high, then plunges toward the EPA.

Tip for Clean Identification

Count bars as well as price: ideal Wolfe Waves display near-equal time spacing between each swing. If Wave 3 → 4 drags on twice as long as 1 → 2, the edge deteriorates.

Why the Pattern Works – Physics Meets Order Flow

Bill Wolfe likened price to a coiled spring: “for every action, there is an equal and opposite reaction.” The first two swings (1-2-3-4) store potential energy inside a narrowing channel. Point 5 is the final over-extension often fuelled by stop-hunts or news spikes that releases that energy toward the EPA, where supply and demand rebalance.

Several mechanics reinforce the move:

- Stop-Run Vacuum – Stops clustered beyond the channel accelerate price past Point 5, but once consumed, there are few orders left to sustain the break, so price slingshots back.

- Mean-Reversion Flow – Algorithms monitoring deviation from a mid-line (VWAP, pivot, channel median) initiate counter-orders at extremes, adding momentum toward the EPA.

- Self-Fulfilling Geometry – Seasoned traders draw the same 1-4 target, stacking take-profits and limit entries near the EPA. Liquidity attracts price.

Because these forces are rooted in crowd behaviour, not asset-specific fundamentals, Wolfe Waves appear on any liquid market from EUR/USD to Bitcoin and on timeframes as small as M5 or as large as a monthly chart. The key is disciplined wave validation; force the pattern and you trade noise, not equilibrium.

Free Wolfe Wave Pattern Indicator for MT4

Manually scanning twenty charts for five precise swing-points is a fast track to chart fatigue. The Wolfe Wave Pattern Indicator, available free Here, turns that chore into a point-and-click workflow. Below is a deeper look at how it works, what you’ll see on screen, and the tweaks that make it sing.

What the Indicator Does Behind the Scenes

- Full-Market Scanner – As soon as you attach it to one chart, the script loops through every symbol and timeframe you allow (M1 up to Monthly). It tags all fresh Wolfe Waves, so you don’t have to flip through pairs.

- Pattern Validation Logic – After spotting a five-point structure, the code waits for a genuine breakout in the expected direction. Only then does it print an up- or down-arrow and fire an alert, filtering out half-formed or “looks-close” shapes.

- Smart Filtering – If price never breaks out, the pattern is discarded automatically. That built-in sanity check slashes the number of false positives you’d get drawing lines by eye.

- Non-Standalone by Design – The developer labels it an analysis aid, not a magic bullet. Use it to highlight zones, then apply your own confirmation filters and money-management rules.

Visual Output – Reading the On-Chart Overlays

- Points 1-5 Labels – Each swing pivot is numbered so you can verify symmetry in seconds.

- EPA/ETA Lines – A diagonal from Point 1 → Point 4 projects your profit target; a second diagonal through Points 1-3-5 intersects 2-4 to suggest timing.

- Arrow Signal – Printed only once breakout conditions are met; colour-coded green (bullish) or red (bearish).

- Dashboard Panel – Pops up on the chart margin, listing every active pattern with columns for Symbol, Timeframe, Direction, and Age. Click a row to jump straight to that chart.

Tip: Hovering over a dashboard row shows a quick-view tool-tip of the swing distances and channel angle—handy for deciding whether the geometry is clean enough to trade.

Alert Suite – Trade Without Babysitting Charts

- Pop-Up & Sound – Ideal if you’re glued to the platform.

- E-mail – Have MT4 ping your inbox (or SMS forwarder) when a setup triggers.

- Push Notification – Link MT4 to the MetaQuotes mobile app and get real-time buzzes on your phone.

Set all three or mix and match. Many traders keep pop-ups off during news releases and rely on push alerts to avoid screen clutter.

Download & One-Minute Installation

- Click “Download” on the Wolfe Wave Pattern Indicator page (a ZIP package).

- In MT4 go to File → Open Data Folder → MQL4 → Indicators and drop the

.ex4file inside. - Restart MT4, drag the indicator onto any chart, tick “Allow DLL imports,” and hit OK.

Troubleshooting: If MT4 won’t compile, make sure you un-zipped the file and placed only the

.ex4(or.mq4) in the Indicators folder—no nested directories.

Settings That Matter

BackBars– How deep (in candles) the code scans. Default 300 is fine for intraday; bump to 1 000 for D1 or higher.MaxPatternAge– Patterns older than n bars are greyed out; keep this at 3-5 to focus on fresh breakouts.ShowDashboard– Toggle the multi-pair control panel without having to re-attach the indicator.AlertOn– Individually enable pop-up, e-mail, or push for fine-grained alert control.

Experiment on demo first: a low BackBars speeds scanning on slower PCs, while tight MaxPatternAge keeps your focus on current price action.

Best-Practice Workflow

- Morning Scan – Load one clean chart (e.g., EURUSD H1), attach the indicator, and let the dashboard populate.

- Short-List – Sort by Age to surface patterns signalled in the last two candles.

- Chart Audit – Click each candidate, zoom in, and eyeball wave symmetry. Delete any misshapen entries.

- Confluence Check – Layer your own EMA, RSI, or session filter.

- Plan the Trade – Calculate position size, set alerts, walk away.

With the heavy lifting outsourced, you spend time on decision-making rather than pattern-chasing the hallmark of a pro workflow.

The Wolfe Wave Forex Strategy – Step-by-Step Playbook

A strategy is only as good as its execution rules. Below you’ll find a field-tested, checklist-style workflow that you can rehearse on demo until it feels second-nature, then apply to a live account. Each step explains why the rule exists, so you can adapt intelligently rather than memorising by rote.

Market Selection – Trade Where the Edge Is Cleanest

Currency pairs & metals

Focus on instruments with tight, consistent spreads and deep liquidity:

- EUR/USD, GBP/USD, USD/JPY, AUD/USD

- XAU/USD (gold) for those who like one wild card

Tight spreads matter because the distance between point 5 and your stop is often small, every pip of friction hurts your risk-to-reward ratio (R:R).

Timeframes

- H1 – Sweet spot for intra-day traders; patterns appear a few times per week per pair.

- H4 / D1 – Better for swing traders who prefer quality over quantity and can stomach wider stops.

- Avoid M1–M15 – Micro-timeframes create look-alike formations that break prematurely; spreads and news spikes erase edge.

Pro tip: If you’re new, master one timeframe first (e.g., H1), then add others once your stats confirm an edge. Spreading yourself thin is a hidden form of over-trading.

Pattern Hunt – Let the Indicator Do the Heavy Lifting

- Attach the Wolfe Wave Pattern Indicator to a single chart.

- Wait 5–10 seconds for the multi-pair dashboard to populate every symbol/timeframe you’ve allowed.

- Sort by “Age.” Anything ≤ 3 bars after the arrow is classed as fresh; older patterns have already moved or failed.

- Click-through audit:

- Zoom in on each candidate.

- Check symmetry: does wave 3 respect the opposite channel? Does point 5 pierce and re-enter?

- If a swing looks forced, delete it and move on skipping trades is a skill.

Diagnosis in 30 seconds: If you can’t decide whether a pattern is valid in half a minute, it probably isn’t.

Download a Collection of Indicators, Courses, and EA for FREE

Entry Trigger – From Pattern Recognition to Position Ticket

Primary (conservative) entry

Enter at the close of the arrow candle that confirms breakout from point 5. You get:

- Proof buyers/sellers have stepped in.

- A fixed stop distance you can calculate immediately.

Aggressive (limit) entry

Place a limit order 3–5 pips inside point 5’s spike. If price retests the extreme, you gain a fatter R:R. Downsides:

- You might miss the trade if price never comes back.

- Fake retests can tag the stop instantly accept the risk.

Optional confluence filters

- RSI divergence at point 5 (price makes a new extreme, RSI does not).

- 20-EMA slope pointing toward the EPA line (keeps you aligned with imminent momentum).

- Session timing: London open, New-York overlap, or early Asia for JPY pairs. Low-liquidity hours breed whipsaws.

Stop-Loss Placement – Define the Pain Before the Gain

- Default placement – 5–10 pips beyond the wick of point 5. Small enough for sharp R:R, large enough for normal spread widening.

- Channel-based alternative – Outside the line joining points 1-3. Useful on higher timeframes where a 10-pip buffer is irrelevant.

- Never shrink the stop until price has travelled at least half-way to the EPA. Moving a stop too soon converts winners into breakeven frustration.

Position sizing tip

Calculate lot size so the distance between entry and stop represents a fixed % of account equity (1 % is industry standard). Tight stops do not mean bigger positions risk stays constant.

Take-Profit Logic – Cashing Out Like a Pro

- TP1 – EPA line (1 → 4): The classic Wolfe target; hit-rate is highest here because that’s where order-flow seeks equilibrium.

- TP2 – Extended ride: If you like to let winners run, trail the remainder with:

- A 20-EMA on the execution timeframe, or

- Swing-high/low structure until price intersects the ETA timing line.

Scaling at EPA banks guaranteed profit and gives psychological breathing room to manage the runner objectively.

Putting It All Together

- Pre-session scan (5 min) – Let the dashboard surface fresh patterns.

- Quality check (1–2 min each) – Symmetry, volume session, divergence.

- Order placement (30 sec) – Entry, stop, lot size, TP(s).

- Set alerts and walk away. Obsessing over every tick ruins execution discipline.

Stick to this flow for at least 30 demo trades before risking real capital. Track metrics (win-rate, average R, max drawdown). Once the sample proves positive expectancy, flip the switch to live with the same rules and the same patience.

Master these mechanics and you’ll transform the Wolfe Wave from an intriguing chart doodle into a repeatable, numbers-backed edge.

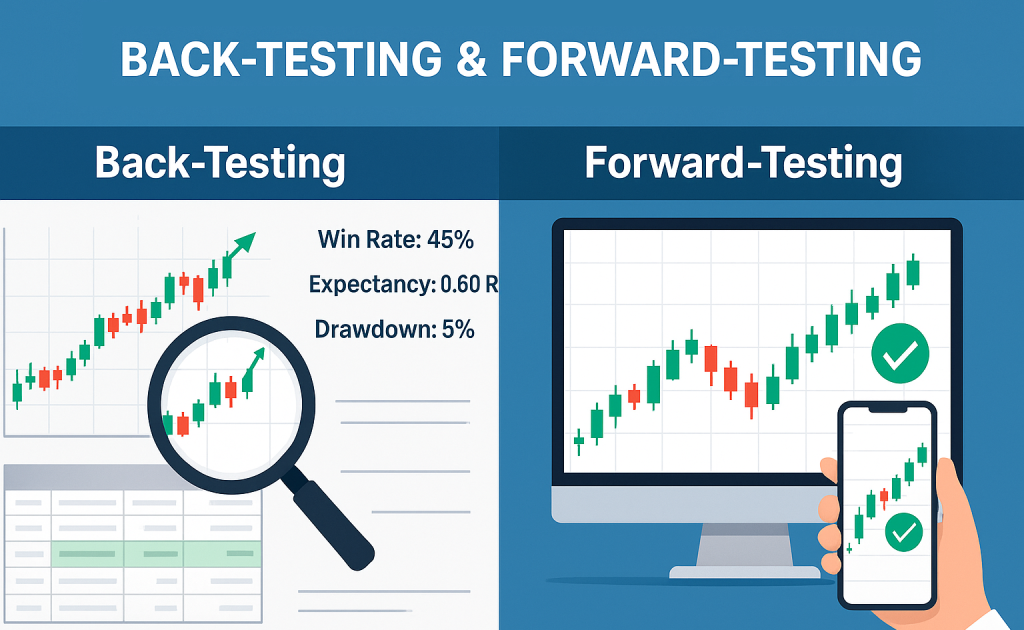

Back-Testing & Forward-Testing Proving the Edge Before Going Live

A strategy only graduates from “Idea” to “Edge” once the numbers say it does. Back-testing reveals if the Wolfe Wave rules produced profit in the past; forward-testing shows whether they still deliver under live market frictions like spread, slippage, and adrenaline. Follow the roadmap below and you’ll know statistically, not emotionally whether the setup deserves capital.

Why Test at All?

- Confidence: Numbers trump hunches when the first losing streak arrives.

- Calibration: You’ll discover realistic win-rates, drawdowns, and how many consecutive losses your psyche (and bank roll) must survive.

- Continuous Improvement: Testing pinpoints which filters add value and which are dead weight.

Historical Back-Test Digging Through Two Years of Candles

- Fire up MT4’s Strategy Tester in Visual Mode.

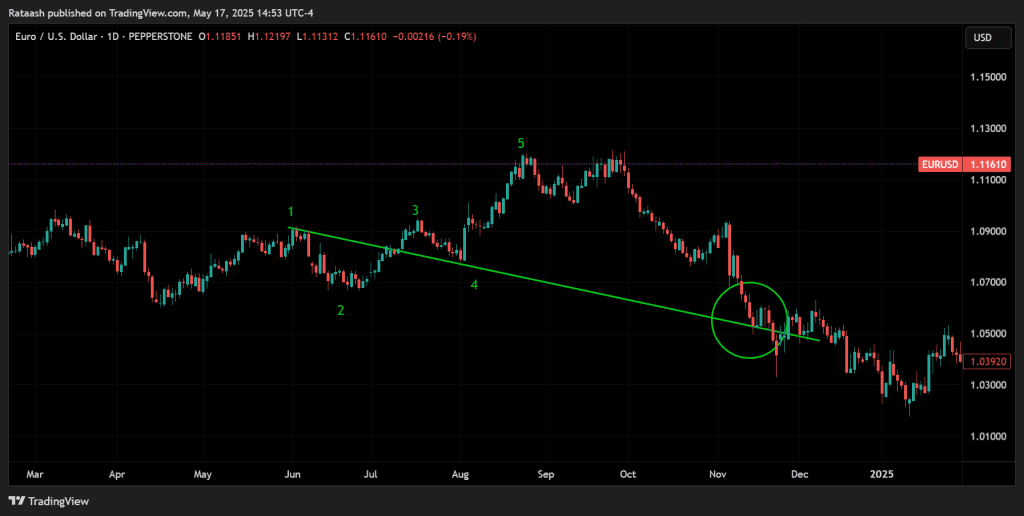

- Load the Wolfe Wave Pattern Indicator on your chosen symbol and timeframe (start with EUR/USD H1).

- Scroll back roughly 24 months. Tap “Start” and let the chart replay one candle at a time.

- Pause at every arrow signal. Ask:

- Does the pattern respect the construction rules?

- Are my optional filters (RSI divergence, London/New-York session) present?

- If yes, log the trade; if no, skip.

- Record entry price, SL, TP, result (win/loss), and R multiple in a spreadsheet or journal software (Edgewonk, TradeZella, a simple Google Sheet—anything you will actually update).

Sample-size rule of thumb: Aim for at least 100 qualified trades before drawing conclusions. Less than that and variance can lie to you.

Journal Metrics, Turning Rows of Data into Insight

Track the following five stats; they tell almost the whole story:

- Win-rate (PW): winners ÷ total trades.

- Average Win (AW): mean R-multiple of all winners.

- Average Loss (AL): mean R-multiple of all losers (usually –1.0 R if you hold discipline).

- Expectancy: (PW × AW) – ((1–PW) × AL). A positive number = statistical edge.

- Max Consecutive Losers: stress-tests your emotional and financial endurance.

Target Benchmarks: ≥ 35 % win-rate and ≥ 3 R average win typically yields an expectancy north of +0.40 R per trade—a healthy cushion against randomness.

Forward Simulation. Demo Trading

Back-testing assumes perfect trade execution; reality sneaks in latency, partial fills, and news whipsaws. Bridge that gap here:

- Open a demo account mirroring the leverage and lot-increment of your future live account.

- Trade the next 20–30 fresh patterns in real time with the exact rules and position-sizing you plan to use for cash.

- Note slippage and spread costs—do they materially dent the average R?

- Screenshot every setup and annotate feelings (hesitation, excitement). Psychology is part of forward-testing data.

If your live-demo stats echo or exceed the back-test, proceed. If not, dig into why often the culprit is sloppy execution rather than the pattern itself.

Refinement Loop. Make the Edge Sharper

While reviewing both test phases, ask:

- Does RSI divergence boost win-rate more than it trims frequency?

- Do New-York-session trades outperform Asia?

- Would scaling out 50 % at midway to EPA stabilise the equity curve?

Change one variable at a time, re-test for at least 30 trades, and keep only what improves expectancy and emotional ease.

When to Go Live

- Verified sample: 100+ historical trades plus 20–30 forward trades.

- Positive expectancy: > +0.25 R per trade after real-spread deductions.

- Acceptable drawdown: Max losing streak fits your risk tolerance (e.g., six straight losses at 1 % risk = –6 % account dip).

- Process mastery: You can recite the rules under pressure and place orders in under 60 seconds no second-guessing.

Once those boxes tick green, reduce your demo size to 0.01 lots, flip the account to live, and start building position size slowly, scaling risk only after another 30 live trades confirm that the edge survived the transition.

Back-testing shows probability, forward-testing proves practicality; together they form the bridge between theory and profitable execution. Walk that bridge methodically, and by the time you trade real dollars, the Wolfe Wave will feel less like a pattern and more like a trusted business process.

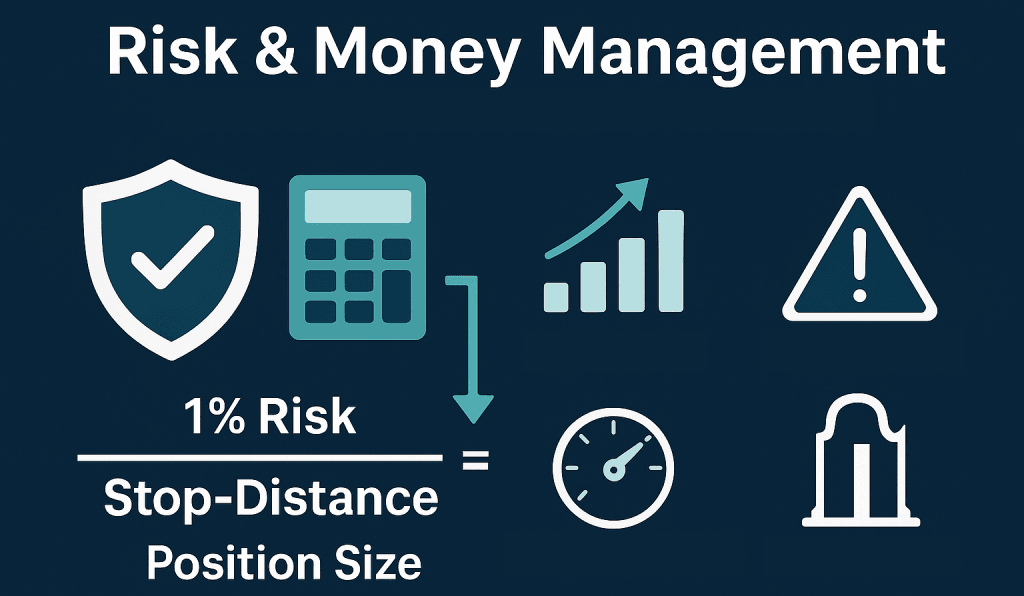

Risk & Money Management

The Wolfe Wave’s geometry nails high-probability reversals, but probability ≠ certainty. News algos, central-bank surprises, or plain old market noise can turn a textbook pattern into a stop-out. Treat risk as your first trade one you must win every time so you’re still standing when the edge plays out over dozens of setups.

The 1 % Rule Position-Sizing Without Guesswork

- Define the slice you’re willing to lose – 1 % of equity per idea keeps you solvent through inevitable losing streaks.

- Translate that into lots –

$Risk per Trade / (Stop-Distance × Pip-Value) = Position Size (lots)Example: $10 000 account, 1 % risk = $100.

EUR/USD pip value ≈ $10 per standard lot.

Stop-loss distance = 20 pips → 20 pips × $10 = $200 per lot.

Position size = 100 ÷ 200 = 0.50 lots. - Adjust for cross pairs – A GBP/JPY pip is ≈ ¥1 000 per lot—use your broker’s pip calculator or a mobile app to avoid eyeballing errors.

Pro tip: Fix risk in dollars, not lots. Lot size should float with stop distance; risk stays constant.

Use our free calculator for this job.

Correlation Radar One Dollar, Three Trades, Triple Trouble

Wolfe Waves often cluster when USD flips trend across the board. Going long EUR/USD, GBP/USD, and XAU/USD simultaneously multiplies the same macro bet. A single dollar rally can turn three “independent” trades into a hat-trick loss.

- Rule of Thumb – If two instruments share > 70 % rolling 30-day correlation, treat them as one risk unit. Either:

- Split your 1 % across them (0.33 % each), or

- Pick the cleanest pattern and skip the rest.

Exposure Guardrails Weekly & Daily Circuit Breakers

- Weekly risk cap – Total open exposure on all Wolfe trades ≤ 6 %. If you’re long EUR/USD (1 %), short GBP/JPY (1 %), and three other setups trigger, you still have 3 % headroom.

- Daily loss stop – Two full-stop hits or –3 % equity in a single day? Close the laptop. Data shows revenge trades after a bad day rank among the top account killers.

Dynamic Stop Discipline Let Winners Breathe, Cut Losers Fast

- Static initial stop – Set it at trade entry, walk away.

- Halfway milestone – When price travels 50 % to the EPA, consider moving the stop to breakeven or scaling out 25 % to bank a “free ride.”

- Elastic trailing – After TP1, trail the remainder with a 20-EMA or recent swing structure never a fixed pip count so the stop adapts to volatility.

Risk of Ruin Why 1 % Beats 5 % Hands-Down

A 35 % win-rate at 3 R payoff is mathematically solid, yet losing streaks of 6–8 trades still occur. At:

- 1 % risk/trade – –8 % drawdown (annoying, survivable).

- 5 % risk/trade – –34 % drawdown (psychologically brutal; you need +52 % just to break even).

Sticking to 1 % or less pushes your Risk of Ruin the probability of hitting a bankroll wipe-out to near-zero, letting the law of large numbers showcase your edge.

Edge Scaling Earn the Right to Increase Size

- Rule – After every block of 30 live trades, if your equity curve is up > 10 R and the largest drawdown ≤ ½ that gain, you may bump risk by 0.25 %.

- Reverse gear – Should drawdown exceed 10 R at any point, cut risk in half until you claw back to prior equity highs.

This “equity staircase” keeps growth steady and emotions in check.

Bottom line: The Wolfe Wave pattern gives you where to trade; money management dictates whether you’ll still be capitalised when the next A grade setup appears. Nail the latter and even a modest edge can snowball into exponential account growth over time.

Common Mistakes to Avoid

- Forcing Lines – Scrap the idea if the highs/lows don’t create two near-parallel channel walls. “Close enough” geometry breeds low probability trades that drain confidence and capital.

- Ignoring the Point-4 Touch – Wave 4 must hit (or kiss) the 1-2 trend-line; otherwise, the wedge lacks the tension that makes Point 5 pop. Skip patterns that miss this checkpoint.

- Trading into Red-Folder News – CPI, NFP, or rate decisions can shatter even textbook Wolfe Waves. Check the calendar; if a release is due within two candles of entry, wait it out.

- Shrinking the Stop Too Soon – Pulling SL to breakeven before price covers at least 50 % of the distance to the EPA invites normal volatility to kick you out. Give the trade room to mature.

Keep these pitfalls front of mind, and you’ll filter out most “pretty but deadly” setups before they ever hit your ticket.

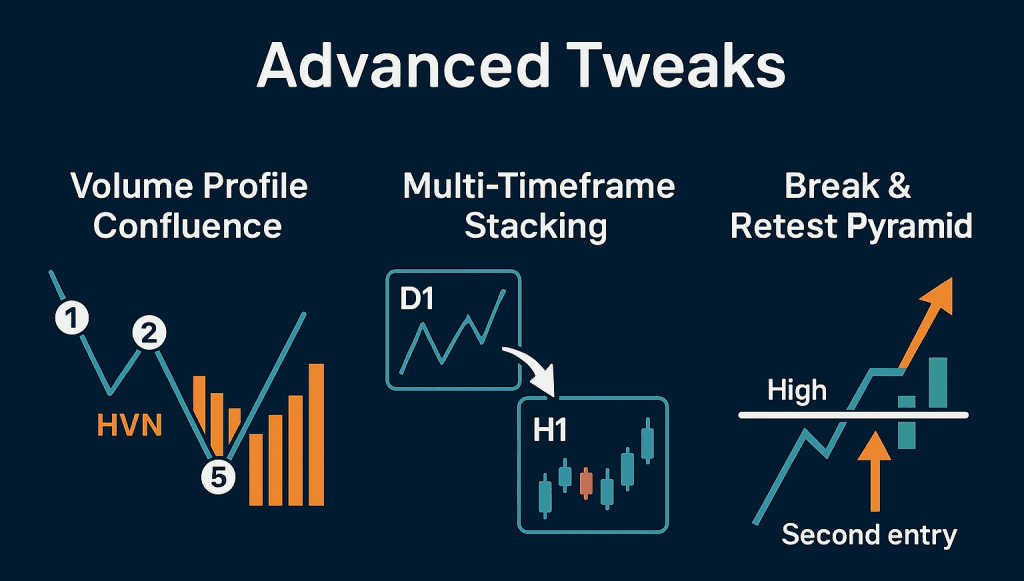

Advanced Tweaks – Turning a Solid Edge Into a Power Tool

Volume-Profile Confluence

Load a fixed range Volume Profile over the swing that forms points 3 to 5. If the Point 5 wick carves through a high-volume node (HVN), a price area where heavy two-way trade already occurred, it signals aggressive absorption of late breakout orders. The subsequent reversal tends to be cleaner and faster because liquidity has been cleared. Pass on setups where Point 5 lands in a low-volume gap; thin air makes for unreliable bounces.

Multi-Timeframe “Wave-Within-Wave” Mapping

Zoom out to H4 or D1 and mark any dominant Wolfe Wave already in play. Now drop to H1: if a fresh, lower-timeframe pattern forms in the same direction and Point 5 aligns near the higher-timeframe channel edge, you have confluence across scales. These nested structures often deliver oversized moves as momentum from both timeframes synchronises.

Pro tip: Set your MT4 chart to “Show Object Descriptions” so labels from higher frames remain visible when you drill down.

Stacking with the Break-and-Retest Play

Once price reaches the EPA, many traders bank profits and walk away but trends often continue. Watch for a breakout and retest on the same chart:

- Price busts through a recent structure high (bullish) or low (bearish).

- It then retests that level as support/resistance.

- Enter on the rejection candle, using the retest swing as your new stop reference.

Because the first trade already booked gains, you can pyramid with house money, compounding returns without inflating initial risk.

Integrate one tweak at a time, track the stats, and keep only what measurably lifts expectancy. Small, data driven refinements applied consistently turn a good Wolfe Wave setup into a professional grade system.

Pros & Cons – A Quick Reality Check

Pros

- Crystal-clear entry and exit.

The indicator prints an arrow the moment a valid Point-5 breakout occurs and projects the EPA line for take-profit. There’s no second-guessing where to get in or out. - Universal applicability.

Because the structure reflects basic supply and demand symmetry, you can deploy the strategy on any liquid instrument FOREX majors, gold, oil, even large-cap stocks without rewriting the rulebook. - Bias-free pattern detection.

Manual wave counting invites subjectivity; the MT4 add on handles all the geometry and waits for breakout confirmation before alerting you. Emotions and hindsight line redrawing are taken off the table.

Cons

- Scarcity on low timeframes.

Clean Wolfe Waves don’t show up every hour on M5 or M15. Expect long stretches of waiting or scan multiple pairs or higher timeframes (H1–H4) to keep opportunity flow without forcing trades. - False positives in chop.

During late-US or thin Asian sessions, the market can print look-alike waves that break down quickly. Adding a volume or session filter trade only in London or NY overlap helps weed these out. - Discipline required.

Entering early, sliding the stop too soon, or taking “almost” patterns destroys the edge. Keep a printed checklist, journal every deviation, and treat rule breaking like a trading loss to stay accountable.

Frequently Asked Questions

- Is the indicator really free?

Yes. ForexCracked offers the download at no cost. You’ll find the link below. - Best timeframe?

H1–D1. M5 and M15 produce too many fake waves. - Does it repaint?

The indicator prints arrows only after breakout confirmation, so signals do not repaint. Historical labels may adjust until the break occurs normal behaviour that filters noise. - Can I use it on MT5?

Not yet; this build is MT4-only. Porting is on the developer’s roadmap. - How many pairs can it scan?

Unlimited your PC’s CPU is the ceiling. The dashboard is light on resources, but don’t load every exotic if your hardware is modest.

Your Next Reversal Is One Download Away

You now have a professional grade blueprint: clear geometry, firm risk rules, and an MT4 tool that scouts the setup for you. The rest is practice.

Wolfe Wave Pattern Indicator

Ready to start spotting Wolfe Waves automatically? Download the free Wolfe Wave Pattern Indicator for MT4 here and put this strategy to work on your next chart.

Trade safe, trade disciplined, and let the pattern do the talking.