The Trend Indicator for MT4 and MT5 is a trading tool designed to simplify the process of identifying and analyzing market trends. Built around the concept of real-time linear trend estimation, it attempts to eliminate common challenges found in traditional indicators, such as backpainting or repainting, which can distort historical interpretation. By using linear trend projections and channel boundaries, Linear Trend Indicator aims to offer structured insights into price dynamics.

Core Functionality of MT4 Trend Indicator

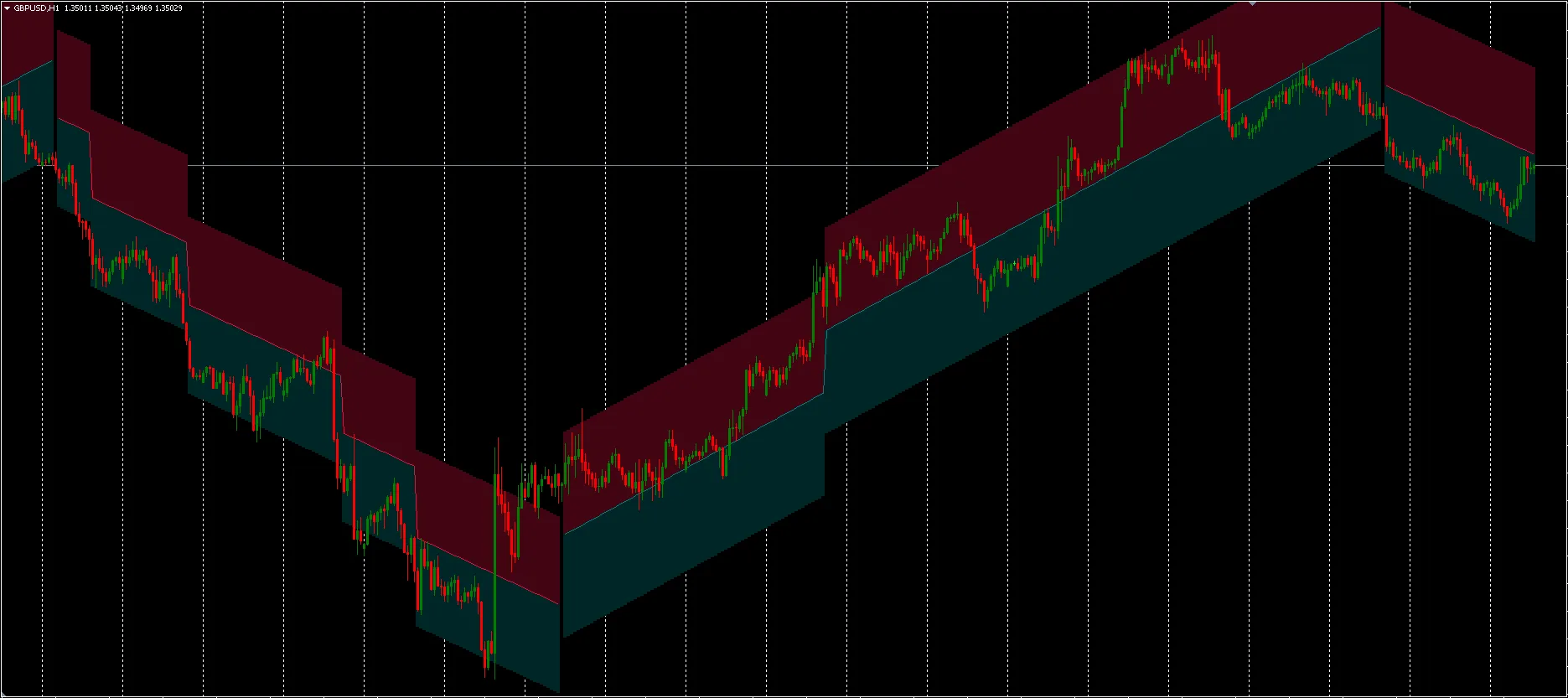

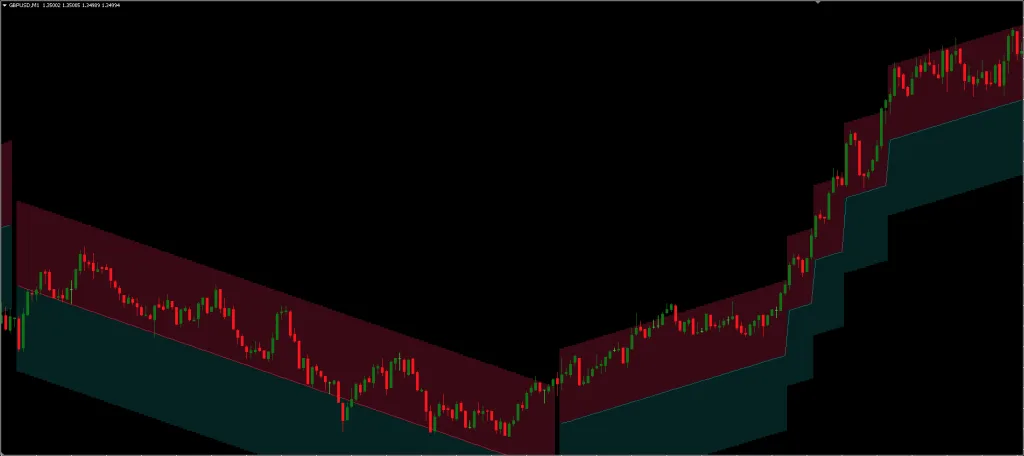

At its foundation, the MT4 Trend Indicator utilizes linear trend estimation to calculate an average price path, which it refers to as the “channel average.” It then constructs upper and lower channel boundaries around this average, which are interpreted as potential resistance and support zones, respectively.

The indicator is particularly focused on its real-time applicability. This emphasis on up-to-date trend detection, aiming to offer quicker cues on price movement without relying on post hoc data adjustments.

This Trend Indicator isn’t a standalone trading indicator System. Still, it can be very useful for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

Input Parameters of MT5 Trend Indicator

MT5 Trend Indicator offers several adjustable inputs to tailor trend analysis to different strategies or timeframes:

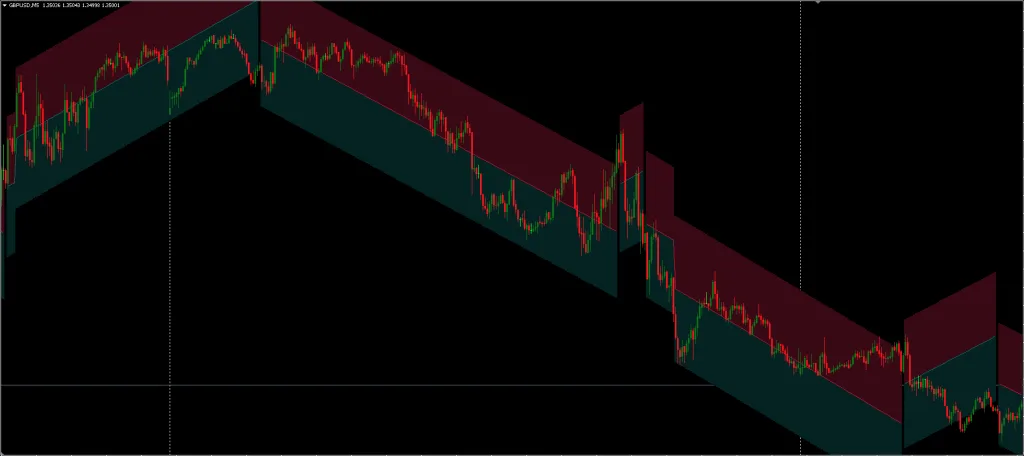

- Multiplicative Factor – Determines how far the price can stray from the average before triggering a new channel. Higher values can make the indicator less reactive to short-term fluctuations, which may be useful for traders focused on longer-term trends.

- Slope – Adjusts how steeply the trend channels appear. Increasing the slope results in flatter channels, which may be preferable in sideways or consolidating markets.

- Width % – Controls the size of the space between the upper and lower channel lines. Tighter channels give more frequent touchpoints but may also result in more noise.

These settings allow traders to align the MT4 Trend Indicator with their analysis preferences, although the effectiveness of each parameter varies depending on market conditions and the asset being traded.

Channel Average and Trend Forecasting

The channel average, though less precise than a traditional linear regression line, serves as a guideline for trend direction and potential turning points. Its position between the upper and lower boundaries can also act as a dynamic support or resistance level.

Breakouts from the channel average, especially those that occur after several interactions with it, might suggest a shift in market sentiment. However, the predictive accuracy of such moves depends on various factors, including market volatility and external news flow.

Download a Collection of Indicators, Courses, and EA for FREE

Trading Approach with Linear Trend Indicator

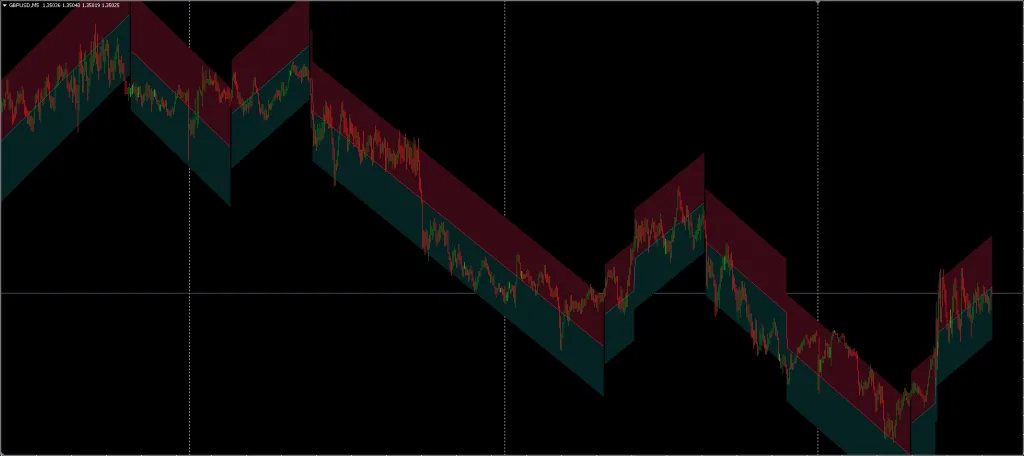

Trading with Linear Trend Indicator revolves around interpreting the slope of its trend lines. An upward-sloping average indicates an uptrend, while a downward slope suggests a downtrend. This slope based method simplifies trend assessment but may lack the contextual nuance of more complex models.

The interaction between price candles and the channel extremities (like the upper and lower boundaries) can signal potential market reactions. Candlestick wicks that touch or exceed these levels might be read as signs of possible pullbacks or reversals. However, such signals are not guaranteed, and like any technical method, should be weighed against other forms of analysis.

Practical Use Considerations

While MT5 Trend Indicator is designed to avoid repainting, a common issue with many technical analysis indicators. its utility still depends on the trader’s ability to interpret its signals in real-time and in relation to broader market factors. Like all technical tools, it operates best when used alongside other forms of analysis, whether fundamental, sentiment-based, or quantitative.

Furthermore, while it offers a visual framework for identifying potential support and resistance zones, the reliability of these areas is contingent on market context. False signals can occur, particularly during high volatility or news-driven price movements.

Make sure “Chart on foreground” tuned on.

Conclusion

The Linear Trend Indicator for MT4/MT5 platforms presents a visual and flexible method for analyzing market trends through linear projections. While it provides a streamlined approach to trend detection and offers customizable parameters for a tailored experience, it does not represent a standalone trading strategy. Its effectiveness, like most tools, largely depends on the trader’s broader methodology and understanding of the markets they operate in.