The Reversal Detector Indicator is a customizable technical indicator designed to help traders identify potential turning points in market trends by analyzing a user defined sequence of candlesticks. Rather than limiting itself to commonly used three bar setups, this candlestick pattern tool offers enhanced flexibility, allowing traders to modify how many bars are considered in a reversal pattern, thereby aligning the analysis more closely with individual strategy requirements.

Key Features of Reversal Detector Indicator

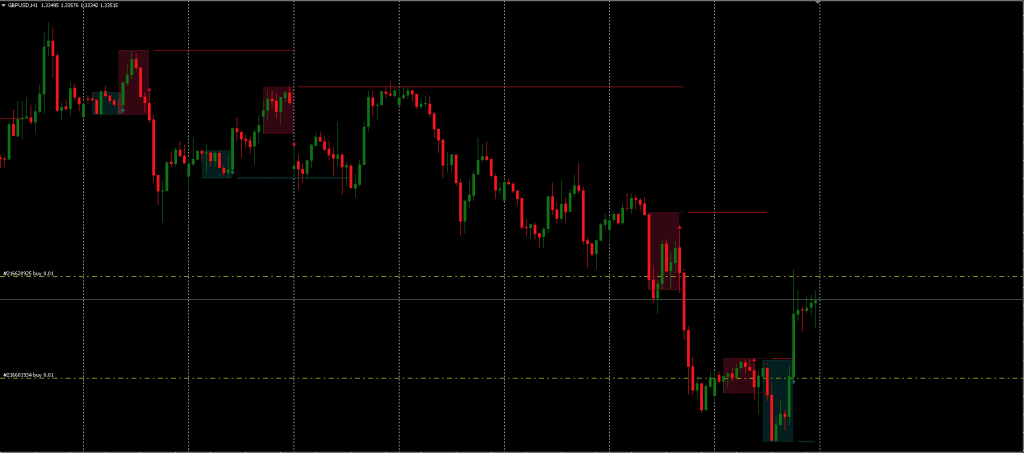

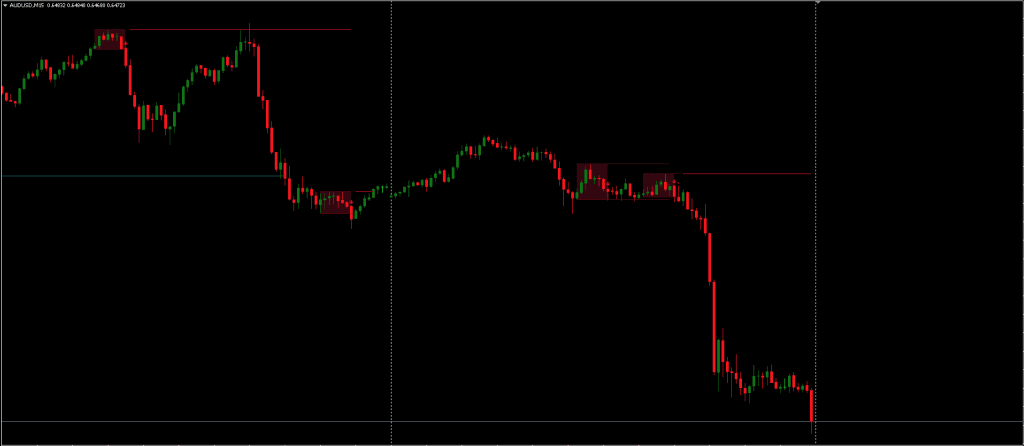

Reversal detector indicator operates by detecting reversal patterns that form over multiple candlesticks, defined by the user. By evaluating price actions across a sequence of candles, it aims to provide insight into potential pivot areas in a trend. Additionally, Candlestick pattern indicator marks high probability support and resistance levels based on pattern positions, aiding users in technical assessment and trade planning.

One of its notable additions is the ability to configure how many of the candles in the sequence must display a directional bias before validating a reversal. This “minimum percent confirmation” setting can help filter noise and improve pattern quality, adjusting to different market environments.

Reversal pattern indicator also integrates with trend-based filters to refine detection. Users can choose to see reversal setups aligned with the dominant trend or occurring in contrast to it, depending on how they want to approach risk and directionality in their trading logic.

Trend Detection and Filtering Tools

To reduce false signals and keep focus on high probability setups, users can integrate trend following indicators:

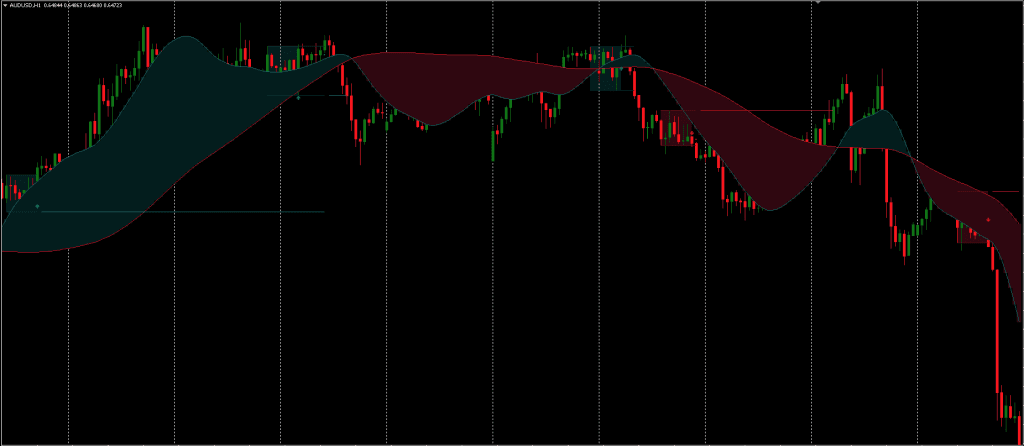

- Moving Average Cloud – Choose SMA, EMA, or other common averages. Adjustable fast and slow lengths allow responsive or smoothed trend guidance.

- Supertrend – Modify ATR period and multiplier to suit market volatility, helping identify and follow prevailing momentum.

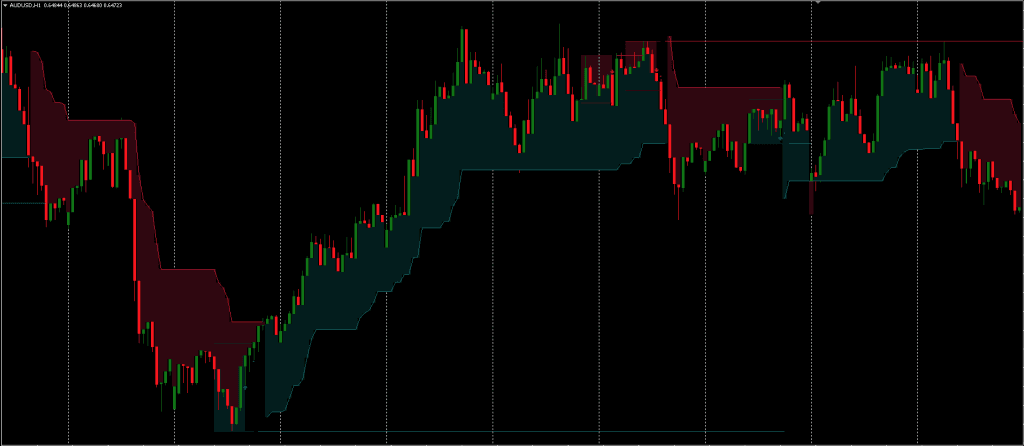

- Donchian Channels – This optional filter helps capture breakouts or rejections tied to broader range structures. Length customization tunes sensitivity to historical highs and lows.

Reversal pattern indicator isn’t a standalone trading indicator System. Still, it can be very useful for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

Customization of Candlestick Pattern Indicator

Traders can fine-tune the Candlestick pattern indicator in multiple ways:

- Support/Resistance Visualization – Toggle horizontal levels on or off based on where reversals occur. These can act as future reference points for entries, exits, or risk placement.

- Pattern Type – Choose between “Normal”, “Enhanced”, or both. “Normal” captures instances where only a price breach occurs, while “Enhanced” ensures that not only is the level exceeded, but the bar closes beyond it for added confirmation.

- Sequence Length Adjustment – Customize how many bars to include in the pattern. A longer sequence might offer fewer signals but with potentially increased reliability, whereas shorter sequences may provide quicker entries with greater frequency.

Download a Collection of Indicators, Courses, and EA for FREE

Application Considerations

Reversal pattern indicator does not guarantee accuracy across all conditions, and like all tools, functions best as part of a comprehensive trading system. It provides flexibility in configuration but also means traders are responsible for determining suitable settings for their market environment.

The visual nature and varying input sensitivity of the reversal detector indicator make it potentially suitable for both discretionary and systematic traders, although candlestick pattern indicator requires mindful configuration and backtesting to deliver reliable performance tailored to one’s strategy.

Understanding the Reversal Pattern Indicator

- Bullish Scenario

A bullish pattern begins with an initial high point in the sequence, usually indicating ongoing selling pressure. If the last bar in the set moves upward and breaks above that initial high, it suggests a possible reversal. A stronger signal appears if this final candle closes above that threshold. - Bearish Scenario

A bearish pattern works in the opposite manner: starting with a low bar amid a rising sequence. Reversal is hinted when the final candle dips below the initial low, with confirmation gaining strength if the close follows suit.

- Read More Silicon Ex Trading Bot FREE Download

Conclusion

Reversal detector indicator provides a flexible way to identify potential trend reversals through customizable candle patterns and built-in trend filters. While it can enhance technical analysis when used correctly, Reversal pattern indicator most effective as part of a broader trading strategy, not as a standalone signal tool.

Thanks admin will try it graph looks good!

Sorry admin its a PDF