The Opal EA is a fully automated Expert Advisor that integrates several technical and Trading Psychology concepts. Drawing inspiration from the characteristics of the gemstone it’s named after, Opal’s creators highlight decision making, careful strategy, and capital protection as foundational elements of this system.

At its core, Trading Psychology EA is structured to support traders with a range of features designed to accommodate various market conditions and user experience levels. According to its description, the EA incorporates a money management module aiming to protect capital while adjusting positions relative to market movement. It also implements a two-step trailing stop mechanism and customizable filters to manage risk and achieve stability in different market environments.

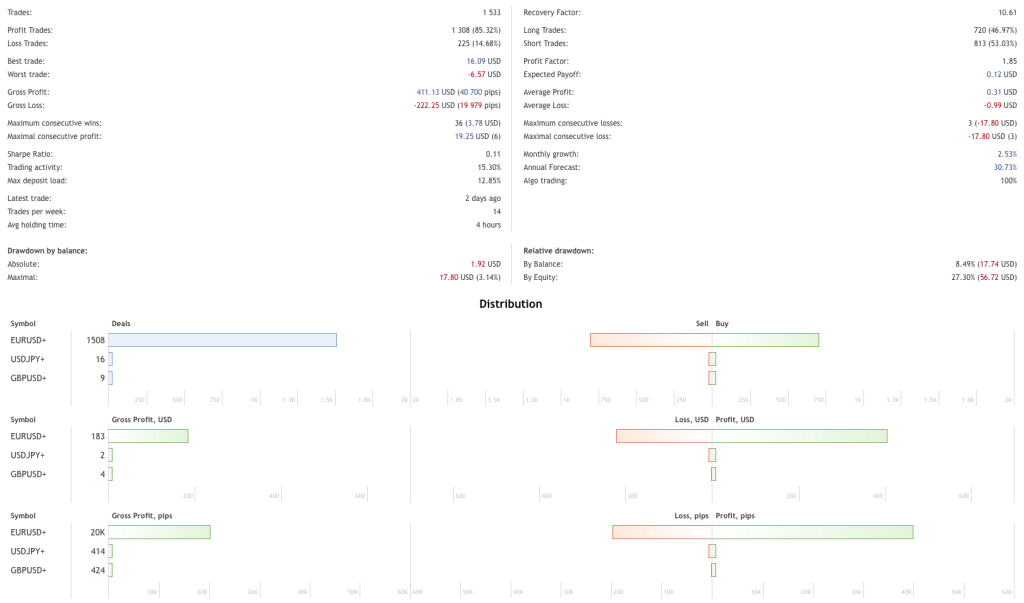

One of Opal EA distinguishing elements is its incorporation of psychological level analysis, based on the common tendency among traders to place orders near round numbers. The EA reportedly identifies these “round level” price points, which can influence short term market behavior, and uses them as part of its strategy. This approach seeks to reflect how trader behavior often clusters around whole numbers, such as 1.2000 or 113.00, in forex markets.

Key Features of Trading Psychology EA

- Built in Money Management Module

- Identification of Round Level Price Zones

- Time Based Trading Filter

- News Event Filter for Volatility Management

- Recovery System for Position Adjustment

- Simple, User Friendly Interface for All Experience Levels

The term “Recovery System” in Opal EA likely refers to a grid trading strategy, where the EA opens multiple positions at set intervals to recover from losing trades. This approach aims to average out entry prices and potentially return to profit without closing trades at a loss. While grid strategies can be effective in ranging markets, they also carry increased risk in trending or volatile conditions, especially without adequate risk controls in place.

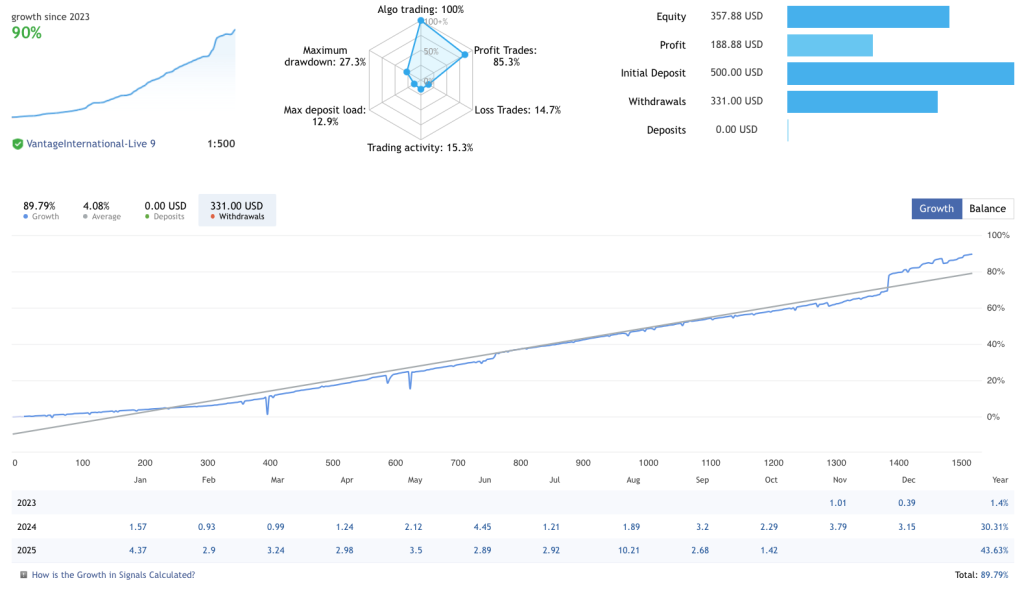

The Trading Psychology EA is designed with adaptability in mind, an aspect the developers emphasize in light of market changes since 2020. The Opal EA is intended more for live, active trading than optimized backtests, which can be misleading if overly curve-fitted. This statements suggests a focus on realistic trading conditions over simulated historical data performance.

- Learn More About Over/Curve fitting – Forex EA vs Manual Trading

Setup is advertised as straightforward, aiming to be inclusive for both novice and experienced traders. While the interface is meant to be intuitive, specific details about the strategies or underlying algorithms are not provided in the promotional text.

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this trading psychology based robot works, then only use it in a real account.

Recommendations for Opal EA

- Minimum account balance of 100$.

- Works best on EURUSD. (Work on any Pair)

- It works best on H1. (Work on any TimeFrame)

- Opal EA should work on VPS continuously to reach stable results. So we recommend running this Trading Psychology EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread, Slippage, and quick execution account is Recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Conclusion

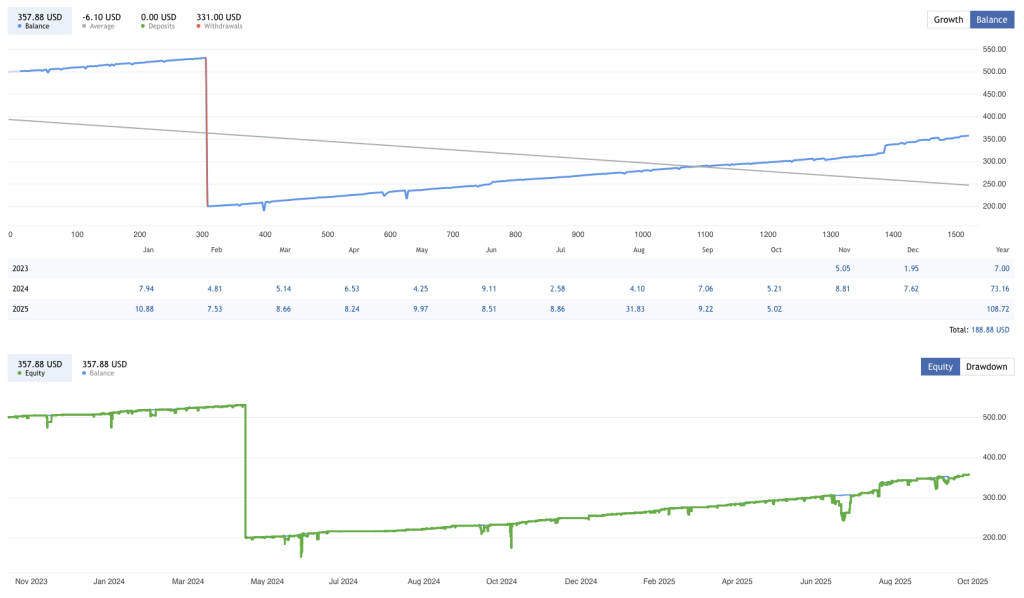

In conclusion, the Trading Psychology EA offers a bundle of protective and analytical tools with an emphasis on psychological market behavior and ease of use. As with any EA, traders should approach it with critical evaluation, testing the system under demo conditions prior to applying it in a live trading environment. The balance between automation, psychological insight, and functional filters positions Opal EA as an option for those exploring automated trading solutions, though effectiveness may vary depending on market conditions and individual trading goals.

Thanks admin will test it!