The bear trap pattern forex trading strategy is based on the bear trap chart pattern. If you don’t know what a forex bear trap pattern is, you will also learn that and see what it looks like, especially its characteristics.

Let’s get started.

What Is A Forex Bear Trap Chart Pattern?

A bear trap forex chart pattern is a bullish reversal chart pattern. The best way to trade a bear trap chart pattern is on chart support levels.

Here’s what happens during a forex bear trap situation:

- You will see the price break a major chart support level and go down.

- the bears think that now the chart support level is broken, they all start selling

- Then suddenly, instead of chart price continuing to fall further, the bulls (buyers) come in and start buying and drive prices up.

- The bears (the sellers) are now all trapped. Their trade entry positions are now becoming negative and eventually will hit their stop losses as bulls continue to drive prices further up.

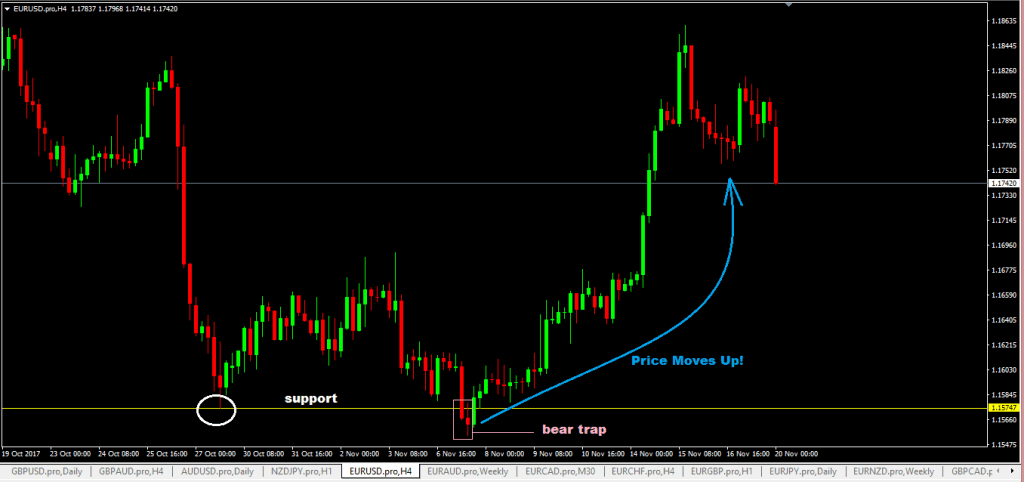

Bear Trap Chart Example

This chart below shows an example of a bear trap situation:

- A notice support level is broken, and the price heads down.

- and then suddenly reverses and heads up

Now, there are three important things in a bear trap pattern:

- the support level must be obvious

- the price must break the chart support level (the candlesticks can close below it or sometimes break the chart support level but then close above it, like a chart bullish pin bar)

- the pattern reversal (this is when you see a bullish reversal chart candlestick form or the high of the previous chart candlestick is broken and prices start heading up from there)

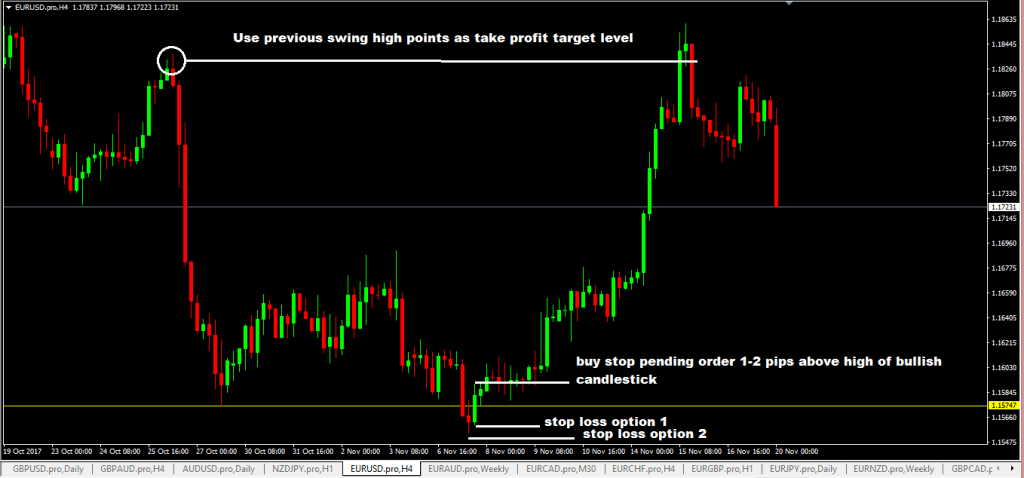

Bear Trap Pattern Forex Trading Strategy Rules

- put a buy stop order 1-2 pips above the high of the bullish reversal chart candlestick pattern

- place your stop loss(SL) at least 2-5 pips below the low of that bullish reversal chart candlestick pattern or if that is too close, use the nearest swing low (see stop-loss option two below on the chart)

- To take profit(TP), you can use previous chart swing highs or calculate it based on risk: reward(R: R) of 1:3

Disadvantages of The Bear Trap Pattern Forex Trading Strategy

- If you don’t anticipate that a forex bear trap will form, you will not see the buy entry opportunity coming.

- many new forex traders may tend to be reluctant to buy entry when all they see is that price has broken the chart support level, and any bullish reversal chart patterns after that would tend to get ignored

Advantages of The Bear Trap Pattern Forex Trading Strategy

- Potential to produce 100 pips plus moves!

- reasonable risk: reward outcome

- stop-loss is tight, which can allow you to trade a lot more trades without risking more of your real trading account

- Knowing what a bear trap chart pattern is will help you quickly decide to liquidate a losing sell entry trade (if you were trading the breakout of a support level) and then buy.

- the trading rules are straightforward to execute