Forex trading, also known as foreign exchange trading, is the largest and most liquid financial market globally, with trillions of dollars traded every day.

In the previous articles, you learned about what forex is and what currency pairs are. Now, what are you going to do if you want to exchange one currency for another?

Well, to learn how to trade forex, you must understand the market structure of the foreign exchange world.

Forex Market

The forex market is an OTC market, which stands for over-the-counter. This means there’s no central exchange where transactions take place.

Unlike the stock market, where each stock is listed on a specific exchange like NASDAQ or NYSE, in the forex world, you don’t have to go to a particular place to buy or sell currencies.

For example, if you want to buy US dollars, you don’t have to visit the Federal Reserve; you can do it anywhere with anyone, making it an over-the-counter market.

Since it’s over the counter, prices for transactions can differ. For instance, if you’re headed to India and want to buy Indian rupees, the exchange rate at the airport might not be favorable because they’re aware of your needs. However, before your trip, you can check with local currency exchange services and negotiate a better rate.

When trading online, prices tend to be very competitive, but you might find better rates depending on the source. Therefore, it’s crucial to understand that rates won’t be consistent across all sources.

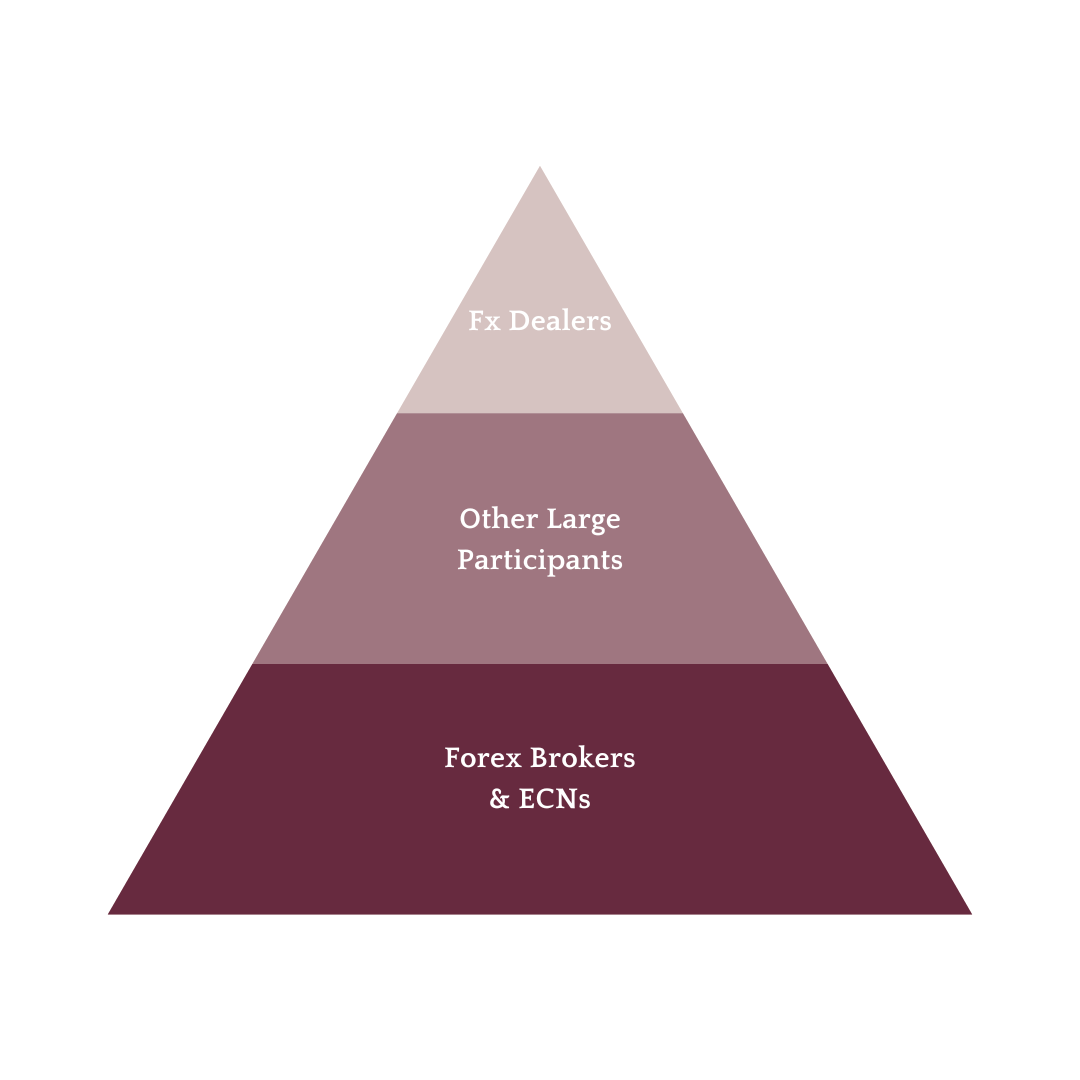

Now, let’s discuss the basic market structure of forex. There’s the interbank market, where big banks trade with each other. These banks can make transactions using electronic broking services like EBS or Thompson Reuters. These platforms basically offer an order book for all the major banks.

Major banks, such as CitiGroup, UBS, RBS, HSBC, and JP Morgan, are the big players in the forex market. They handle most of the trading volume in this market.

They use this order book to trade directly with each other. However, it’s only accessible to major banks because the transactions involve billions of dollars per second.

These major banks are also known as FX Dealers because they are the top players. Other participants can’t directly trade with them because they’re too small. So, if they want to trade forex, they have to go through one of the FX Dealers.

In the second tier of this structure, we have other smaller banks, large companies, and hedge funds—still significant participants who go to one of the FX Dealers to trade.

In the third tier, we have forex brokers and ECNs (Electronic Communication Networks), who are responsible for executing trades for you.

So, if we want to trade, we have to go through them. A broker will interact with second-tier participants, who then interact with top-tier FX Dealers. And to trade, we need to have an account with a broker.

Forex Brokers

A broker is an entity that facilitates the execution of your order, and an order is the instruction you give to your broker to buy or sell something.

So, if you want to trade forex, you need to pick a broker. But with so many options, how do you choose? Let’s explore the key points you should consider when selecting a broker.

You want your broker to be regulated, meaning they have oversight. The more regulation, the better. Some brokers aren’t regulated at all and could go bust anytime. Secondly, you want transparency; a broker that keeps you informed. Thirdly, look for low fees and good leverage. Also, a reliable trading platform and excellent customer support are important.

A Book Brokers vs B Book Brokers

Now, there are two types of brokers: A-book brokers and B-book brokers. So, what exactly are A-book and B-book means?

The A Book is the order book that has the major liquidity providers. When a broker uses this book, they send your orders to be executed with one of those liquidity providers. This is the order book used by ECN brokers.

The B Book is the broker’s in-house order book. When a broker uses this order book, they take the other side of your trade. This is the order book used by market maker brokers.

As you might expect, you want to go with a broker that uses the A Book. The spread in an A Book broker will be very tight, and you’ll experience very quick executions. On the other hand, in a B Book broker, the spread will be wider. The spread is the difference between the buy and sell price, and we’ll delve into it in the next article.

Conclusion

To sum up, if you want to trade forex, the first step is to open a brokerage account. This account serves as your gateway to the forex market, allowing you to buy and sell currencies. When choosing a broker, it’s advisable to select one that operates on the A Book model.

A Book brokers typically route your orders directly to liquidity providers, resulting in tighter spreads and faster executions. This can lead to lower trading costs and improved trading efficiency. So, if you’re serious about forex trading, opting for an A Book broker can enhance your trading experience and potentially increase your chances of success.

In the next article, you’ll learn about the orders you send to your broker and how they influence the price of the currency pair you’re trading.