In the previous article, you learned about what forex is and how to make money in the forex market. Now, in this article, we will delve a bit further and understand what currency pairs are and what they represent.

What are Currency Pairs?

If you’ve had any previous experience with forex trading, you probably saw something like EUR/USD, GBP/USD, or AUD/CAD. These are called currency pairs. Currency pairs represent the quotation of two different currencies traded in the forex market.

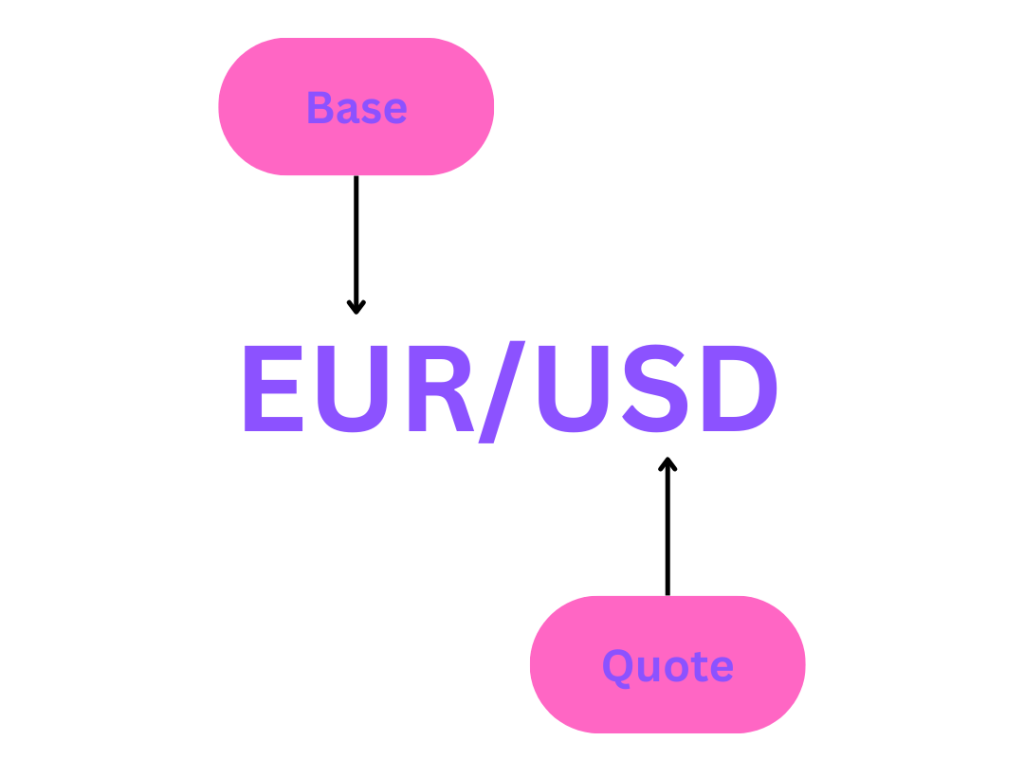

Base Currency and Quote Currency

Each currency pair consists of a base currency and a quote currency. The base currency is the first currency listed in the pair, while the quote currency is the second. For instance, in the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency.

For example, if EUR/USD is trading at 1.07762, that means 1 euro is worth 1.07762 US dollars. So, the base currency is always going to represent 1.

So, the first one, the base currency, is the one we’re talking about in relation to how much it’s worth in the other currency. And the second one, the quote currency, is the one we’re quoting, so we’re giving a price for it. We’re saying, for example, that we’re quoting a price of 1.07762 dollars for a euro.

ISO Currency Code

ISO currency codes are three-letter alphabetic codes that represent specific currencies. These codes are defined by the International Organization for Standardization (ISO), an independent, non-governmental organization that develops and publishes international standards.

ISO currency codes are used globally in financial and commercial transactions to ensure uniformity and consistency when referring to different currencies. Each currency code consists of three letters, where the first two letters represent the country or region and the third letter represents the initial letter of the currency’s name.

For example:

- USD represents the United States dollar.

- EUR represents the euro used by the European Union.

- JPY represents the Japanese yen.

- GBP represents the British pound sterling.

If you have a currency pair like USD/CAD and it’s trading at 1.35, you’d say the base currency is the US Dollar, and the quote currency is the Canadian Dollar. This 1.35 means one US dollar can be exchanged for 1.35 Canadian dollars.

Not all currencies are the same, especially when it comes to trading activity or liquidity. Some currencies are traded more frequently than others. You’re probably aware that the most traded currency is the USD, followed by the EUR, which is the second most traded. The USD is actually traded three times more than the EUR.

Major Currencies

The currencies that are traded the most are called major currencies, and here they are:

- USD (US dollar)

- EUR (Euro)

- JPY (Japanese yen)

- GBP (British pound)

- AUD (Australian dollar)

- CAD (Canadian dollar)

- CHF (Swiss franc)

Now, because of that, we have major currency pairs, which are highly liquid and widely traded pairs.

- GBP/USD

- USD/CAD

- AUD/USD

- USD/CHF

- USD/JPY

- EURUSD

- NZD/USD

You’ll see these pairs often and probably start by trading one of these currencies.

Now, you might be wondering why they have USD/CAD and not CAD/USD, or why USD comes first in USD/JPY and second in EUR/USD? Well, there’s a convention, and it goes like this:

- EUR

- GBP

- AUD

- NZD

- USD

- CAD

- CHF

- JPY

They follow a rule: if there’s EUR in the pair, EUR goes first as the base currency. Then, it’s GBP. If both EUR and GBP are in the pair, EUR comes first, and GBP is second. But if there’s no EUR, then GBP goes first. If neither of those is present, AUD comes first. If not AUD, then NZD, and if not that, then USD, following the list mentioned above.

Minor & Cross Pairs

Now, other currencies like INR, LKR, or PESO, which we call minors, are usually quoted against the USD. So, you’ll often see them listed next to the USD.

If you’re not trading them against the USD, we call this pair a cross pair. So, a cross pair is any pair that doesn’t include the USD. For example, CAD/JPY.

Conclusion

In summary, currency pairs are fundamental in forex trading, representing the value of two different currencies. Major pairs, like USD/EUR, dominate trading, while minors and cross pairs offer additional opportunities. Understanding their structure and conventions is crucial for informed trading decisions. Overall, currency pairs provide a standardized framework for expressing currency values, facilitating efficient trading in the global forex market.

Thanks Admin please send best scalper indicator please