The Fair Value Gap & Balanced Price Range Indicator for MetaTrader 4 and 5 platforms enters the scene as part of the broader Smart Money Concept (SMC) toolkit. This indicator aims to systematically identify key market structures related to volume imbalances and price dynamics, particularly through its detection of Fair Value Gaps (FVG) and Balanced Price Ranges (BPR).

Fair Value Gaps and Balanced Price Range

At the core of this BPR indicator are two specific chart patterns:

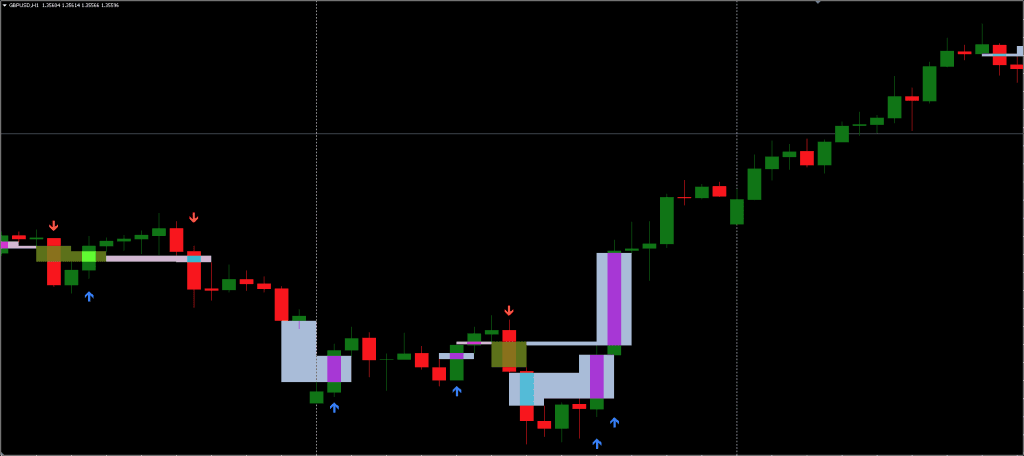

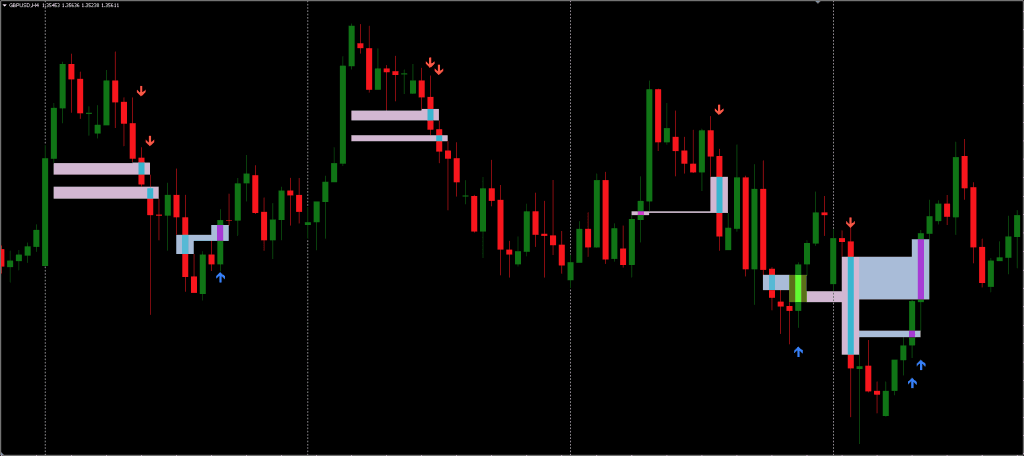

- Fair Value Gap (FVG) – Defined as a three candle formation where a gap forms between the first and third candles. This void in price movement suggests a lack of volume support and often indicates areas where price may return to “fill” the gap. FVGs serve as potential zones for corrections or reversals.

- Balanced Price Range (BPR) – Created by the overlap of two FVGs of opposite directions, forming a “bridge” in the price action. These areas typically represent zones where price temporarily stabilizes or revisits after an impulsive move, potentially offering opportunities for trade entries based on rebalancing dynamics.

These formations are commonly referred to in SMC frameworks and are increasingly used by traders who study institutional behavior and liquidity dynamics.

Visualization and Customization Features

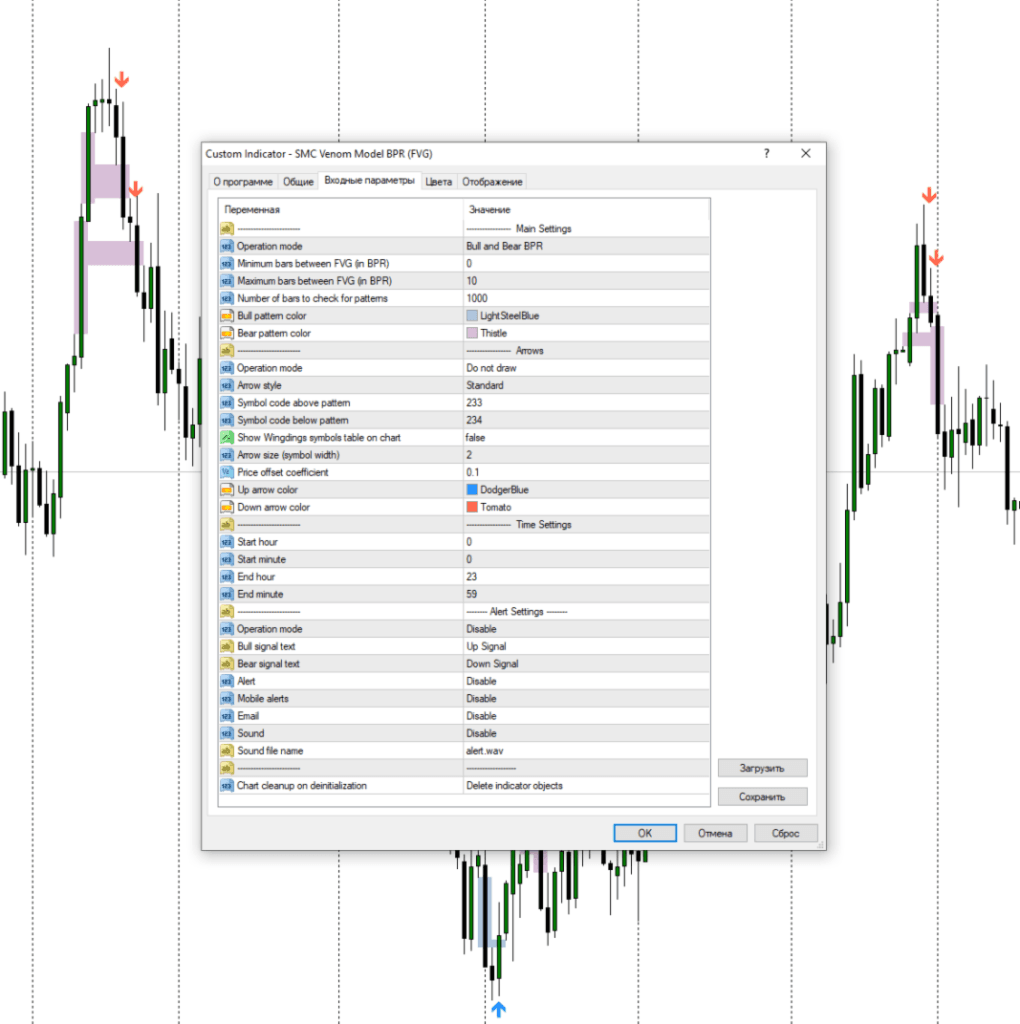

This Fair Value Gap Indicator includes a visual component that highlights the recognized patterns directly on the chart using rectangles for zones and arrows for directional signals. Users can toggle between display modes to show only FVG or BPR patterns. Further customization options include:

- Adjustable minimum and maximum distances between FVGs used in BPR detection.

- Several arrow styles to choose from (up to nine), or the ability to manually assign Wingdings icons for more personalized visuals.

- Full control over color, size, and offset of signals, with price-relative placement that accounts for volatility (via ATR settings).

Additionally, the indicator incorporates a time filter feature. This allows traders to limit indicator activity to specific trading hours, useful for session based strategies.

This Fair Value Gap indicator isn’t a standalone trading indicator System. Still, it can be very useful for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

Notification System

The BPR indicator supports a flexible alert system with several communication options:

- On-screen alerts

- Push notifications to mobile devices

- Email alerts

- Sound alerts (with customizable audio files)

- Editable message content (e.g., “Buy Signal” or “Sell Signal”)

These alert functions may assist traders who monitor multiple instruments or prefer to be notified passively.

Recommended Timeframes

The indicator can be used on multiple timeframes, although it may be most effective when viewed in conjunction with higher timeframe trends (H1 and above) to reduce noise and false positives. Lower timeframe signals that align with the higher timeframe trend are often considered more reliable by practitioners of Smart Money techniques.

Download a Collection of Indicators, Courses, and EA for FREE

How it’s Used in Trading

Within the context of SMC/ICT style analysis, the BPR serves a functional role by identifying zones of overlap between bullish and bearish Fair Value Gap indicator zones that may reflect a temporary rebalancing of price. These are interpreted as points where large market participants adjust positions or liquidity is absorbed.

Identifying BPR Zones:

- Bullish BPR – Formed when a bullish FVG overlaps a bearish one from bottom to top. This is considered a possible buy signal zone.

- Bearish BPR – Formed when a bearish FVG overlaps a bullish one, typically viewed as a sell opportunity.

In practice, Balanced Price Range zones often attract price revisits, retests that some traders use as trade entry points. Common strategies include entering on a retest of the BPR after a retracement, with stop losses placed just outside the zone, and take profit based on a risk/reward ratio of 1:2.

Comparison with Inversion Fair Value Gap (IFVG):

- A BPR is essentially a subset of IFVGs where two FVGs overlap.

- An IFVG itself implies invalidation of a previous FVG, generally used to rethink directional bias.

- Not every IFVG is a BPR, but every BPR falls under the broader IFVG category.

Practical Considerations for BPR indicator

While the BPR Indicator offers structural insights into price action and liquidity imbalances, its effectiveness largely depends on how it is combined with supplementary tools. Many traders pair it with volume analysis, traditional support/resistance zones, or market structure assessments.

Misuse or overreliance on visual signals, without broader context or confirmation can lead to poor trade entries, especially in choppy or consolidating markets. Trading against the dominant trend, even if BPR zones appear appealing, may carry heightened risk and is generally discouraged.

- Read More Gold Rain MT4 Gold EA FREE Download

Conclusion

The Balanced Price Range Indicator for MT4/MT5 provides a visual and automated method of spotting price imbalance zones commonly used in Smart Money frameworks. Its combination of alert functions, customizable visuals, and pattern detection aims to streamline the process of identifying potential trade zones. Ultimately, its value lies in the context of a broader strategy, emphasizing trend alignment, volume behavior, and discipline in trade execution.

where is the download? for fvg/bpr indicator?