WallStreet Recovery PRO is a sophisticated automated trading system developed for the MetaTrader 4 (MT4) platform. Building on the core architecture of the well-known WallStreet Forex Robot, this software introduces a distinct trade management engine known as the Advanced Recovery System.

This article provides a complete technical breakdown of its features, an objective analysis of its live performance, and a professional trader’s perspective on the risks involved. A WallStreet Recovery download link is provided at the bottom of this page.

Key Features of Forex Recovery EA

The Forex Recovery EA is not a standard scalper; it is a complete trading ecosystem designed to manage trades out of drawdown. Below is the full list of technical features integrated into the EA:

Core Trading Modules

- Advanced Recovery System – The system’s hallmark feature. Instead of accepting immediate losses, it uses a calculated recovery algorithm to transform temporary drawdowns into profitable outcomes without dangerous, uncontrolled grid expansion.

- Efficient Dynamic Trading Logic – The entry algorithm adapts to current market conditions, aiming to identify high-probability reversal points.

- Advanced Money Management – Automatically calculates and adjusts position sizes relative to your account balance and risk settings.

Risk Management & Protection

- Drawdown Protection System – A critical safety feature for funded traders (Prop Firms). It dynamically limits risk exposure to prevent the account from breaching maximum loss rules.

- High-Impact News Filter – Automatically pauses trading during volatile economic events (like NFP or FOMC) to avoid slippage and unpredictable spikes.

- Broker SPY Module – A unique tool that monitors your broker’s execution quality. It detects high negative slippage and delayed orders, protecting you from unethical broker practices.

- High Slippage & Spread Protection – Prevents the EA from opening trades when market conditions are unfavorable (e.g., during low liquidity sessions).

Exit & Profit Strategies

- Intelligent Dynamic Stop Loss & Take Profit – Exit levels are not static; they adjust based on market volatility to secure profits or limit losses effectively.

- Profit Protection System – “Locks in” gains once a trade moves into profit, ensuring a winning trade does not turn into a loser.

- Advanced Time Management – Gives users precise control over which trading sessions the EA is allowed to operate in.

Please test in a demo account first for at least a week. Also, please familiarize yourself with and understand how this WallStreet Recovery Robot works, then only use it in a real account.

Recommendations for WallStreet Recovery PRO

- Minimum account balance of 200$ for one pair.

- Timeframe – M15

- Supported Currency Pairs – EURUSD, GBPUSD, USDJPY, AUDUSD, USDCHF, USDCAD, NZDUSD.

- Withdraw Regularly – Because “Recovery” EAs carry hidden tail risks, treat your initial deposit as “at risk.” Withdraw profits until you have recovered 100% of your capital.

- To reach stable results, the WallStreet Recovery PRO should work on VPS without interruption. So we recommend running this automated trading system on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Use a low-spread ECN broker. With small average wins (~2 pips), high spreads will significantly damage your profitability. (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

In-Depth Performance Review

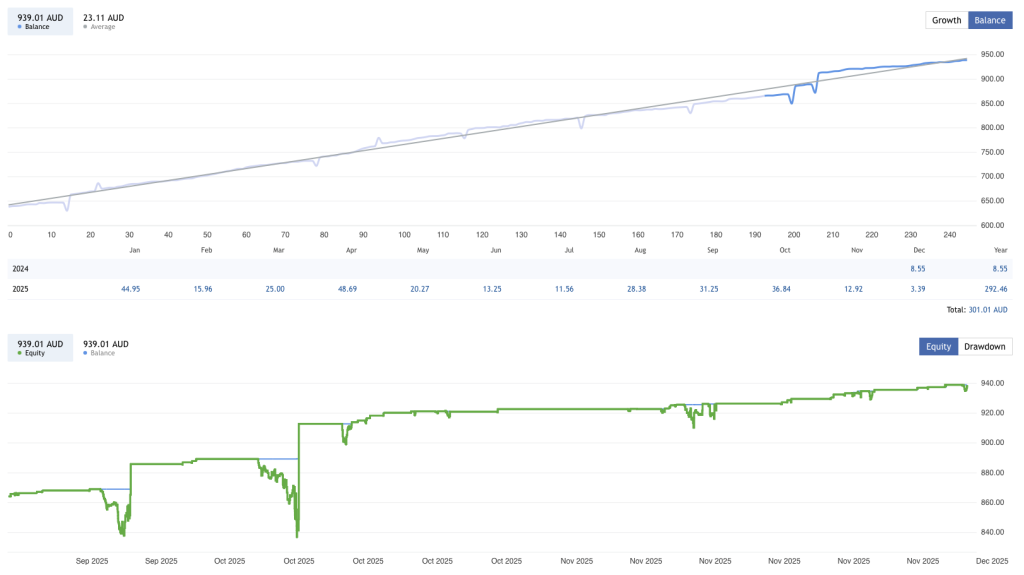

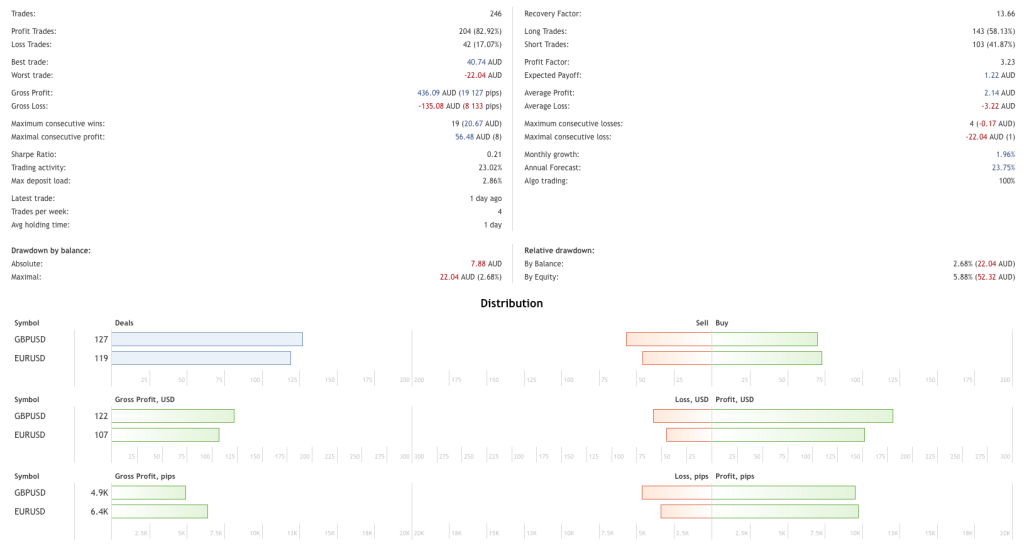

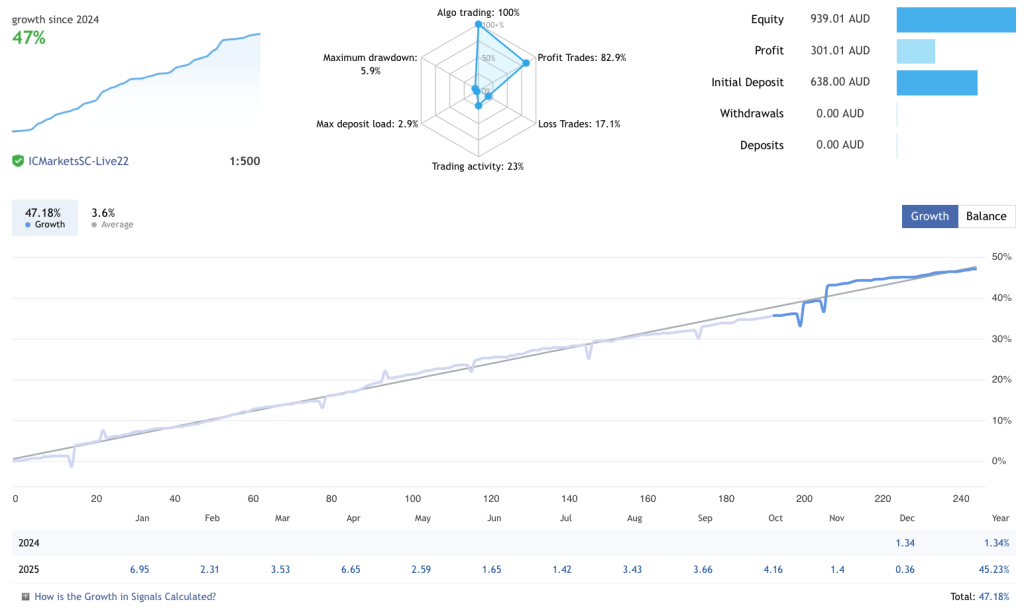

Data from the live tracking signal provides a transparent view of how the Forex Recovery EA performs in real market conditions.

Performance Statistics

- Total Growth: 47.18% (2024–2025 period).

- Win Rate: 82.92% (204 wins out of 246 trades).

- Profit Factor: 3.23 (The system earns $3.23 for every $1 lost).

- Drawdown: 5.9% (Maximum tracked drawdown).

Performance Summary

While the green numbers look attractive, a deeper technical look reveals specific behaviors that traders must understand:

- The “Floating Risk” (Equity vs. Balance) Looking at the detailed balance chart, the Balance (blue line) moves upwards in steps, while the Equity (green line) frequently dips below it. This gap represents open trades currently in loss.

- Analysis: This behavior confirms the EA holds onto losing positions to recover them. While the closed profit (Balance) looks smooth, the dipping Green line reveals the true risk the system carries “floating drawdown” to achieve those results. This requires careful monitoring during strong trends.

- Negative Risk-Reward Ratio With an Average Profit of $2.14 and an Average Loss of -$3.22, the system relies heavily on its high win rate (82%) to stay profitable. If market conditions change and the win rate drops below 65%, the mathematical edge could erode quickly.

- The Recovery Factor The high Recovery Factor of 13.66 indicates the system is aggressive in defending against losses. It likely uses a “soft martingale” or averaging approach to turn losing baskets into winners. This works exceptionally well in ranging markets but carries tail risk during “Black Swan” trending events.

This Forex Recovery EA is available for MT4 and comes pre optimized for EURUSD, GBPUSD, USDJPY, AUDUSD, and other major pairs. We strongly recommend testing on a demo account first to verify execution speeds.

Conclusion

WallStreet Recovery PRO is a high-efficiency income tool designed to deliver consistent monthly profits. With an impressive 82% win rate and a Profit Factor of 3.23, it excels at grinding out gains in normal market conditions.

However, the “Recovery” logic comes with a cost: Floating Drawdown. The system achieves its smooth balance curve by holding losing trades until they recover. This makes it a powerful cash-flow generator, but it is not “risk-free.”

The Winning Strategy: Use this EA for income, not long-term savings. The best approach is to withdraw your initial deposit as soon as you have doubled your account. Once you are trading with “House Money,” you can let this automated trading system run with confidence.

Link isn’t correct. It gives DIAMOND EA, not WALLSTREET EA

hey man, not sure what you are saying, but i clicked on the free download button, and it downloads wallstreet ea for me

Please make a version of this for mt5. Thanks!