Regarding edge trading in forex, currency correlation, and arbitrage strategies can offer some powerful opportunities—if you know how to spot them. That’s where the Arbitrage Scanner Indicator for MT4 comes into play. This isn’t your typical buy-sell signal tool. Instead, it gives you something even more valuable: real-time correlation insights between currency pairs.

And believe me, if you’re not already factoring correlation into your trades, you might be leaving money—and safety—on the table.

What Is the Arbitrage Scanner Indicator?

The Arbitrage Scanner for MetaTrader 4 is designed to detect correlated forex pairs based on a chosen leading currency pair. It runs a scan and displays a list of related pairs that move similarly—so if your lead pair moves, you have a high probability of the others following suit.

It doesn’t stop there. The indicator also shows:

- Correlation strength

- Swap rate

- Pip value

- Lot size

- Volatility data

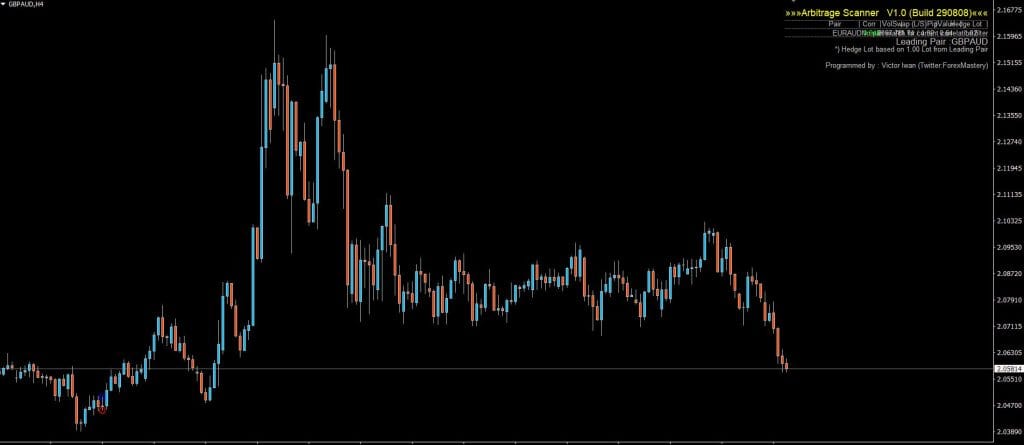

And it neatly displays all of this in the top-right corner of your chart.

So you’re not just guessing if EUR/USD and GBP/USD behave similarly today—you’re seeing hard data.

How I Use Arbitrage Scanner in Real Trading

I’ve always liked to watch how different pairs relate to each other. With the Arbitrage Scanner, it’s simple:

- Set a leading pair, like EUR/USD.

- The scanner automatically finds all other pairs moving in sync with it (default correlation setting is 0.90).

- Place trades on the correlated pairs in the same direction as your leading pair’s trend.

- Double-check swap and pip values to see if you have held positions longer than a day.

EUR/USD is in a solid uptrend. If GBP/USD and AUD/USD are highly correlated, I’ll also consider going long on them—only if the overall market structure supports it.

Adjusting the Correlation Threshold

By default, the scanner only shows very high correlation pairs (0.90+), but sometimes it’s worth tweaking that to 0.80 or even 0.75. This gives you more pairs to work with, especially on slower days.

Also, while the default timeframe is Daily, I’ve successfully run it on H1 and H4 charts for shorter-term setups, especially when scalping or day trading.

Download a Collection of Indicators, Courses, and EA for FREE

What the Output Looks Like

The scanner drops a comment panel on your chart showing:

- The leading pair

- A list of correlated pairs

- Real-time correlation coefficients

- Swap and pip data for each correlated pair

It’s like having your mini correlation dashboard, always updating behind the scenes. Clean and efficient—just how I like it.

Who Should Use the Arbitrage Scanner?

This tool is perfect for:

- Swing traders tracking macro correlations

- Intraday traders looking to hedge risk across multiple pairs

- New traders who want to learn about real-world price relationships

- Arbitrage strategy lovers who trade with multiple brokers or accounts

Just one thing—don’t use it blindly. Always confirm trades with your primary strategy or additional price action cues.

Free Download Arbitrage Scanner Forex Indicator

Read More Wolfe Wave Pattern Indicator FREE Download

Final Thoughts: Is It Worth It?

If you’re serious about technical trading and want to level up with market correlation insights, the Arbitrage Scanner Indicator for MT4 is a must-have.

It’s lightweight, free, easy to install, and can dramatically improve your understanding of how currencies move about one another.

I’ve used this on everything from trend-following systems to hedge strategies, and it continues to deliver value. Whether managing one pair or diversifying across five, this tool helps you trade smarter, not just harder.

Summary

- Detects real-time correlation between currency pairs

- Works on any timeframe

- Outputs data on swap, pip value, volatility

- Perfect for arbitrage and correlation-based trading

- Fully customizable for both newbies and pros

- Free to download and quick to set up