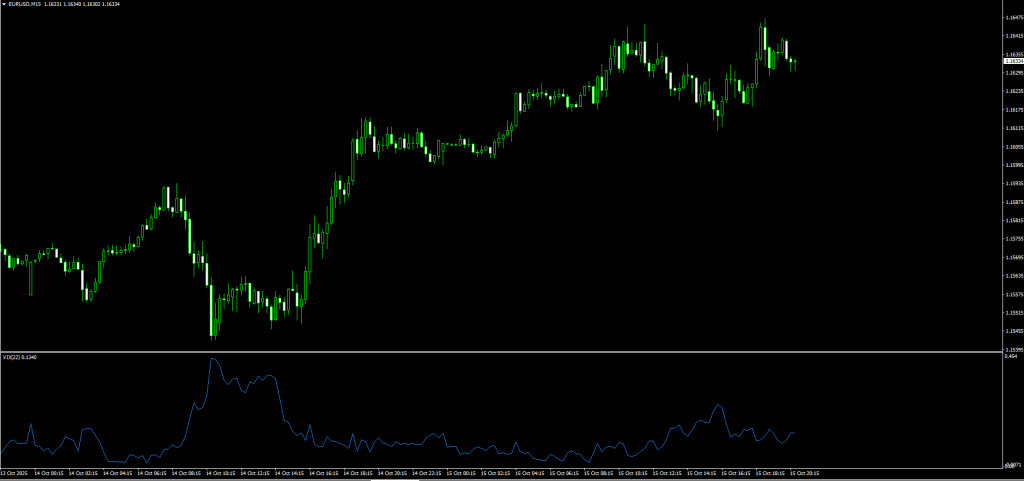

If you’ve ever wanted to gauge market volatility without using complicated tools, the Synthetic VIX Indicator for MT4/MT5 is your go-to solution. Originally designed to monitor the S&P 500’s volatility, this tool now works perfectly with forex pairs, commodities, and indices, giving traders a quick and reliable way to measure how volatile the market really is.

The Synthetic VIX doesn’t generate buy or sell signals directly; instead, it tells you when the market is calm or ready to explode, helping you anticipate big moves before they happen.

What Is the Synthetic VIX Indicator?

The Synthetic VIX (Volatility Index) measures how much price action fluctuates over time. It’s often called a fear and greed gauge, as it reflects traders’ emotions through volatility levels.

It’s calculated using a simple but powerful formula based on the last 22 periods of price data:

Synthetic VIX = [Highest(Close,22) – Low] / [Highest(Close,22)]

This value is then scaled (often multiplied by 100) to make the volatility level easy to interpret.

In simple terms:

- When the Synthetic VIX rises, the market is becoming more volatile (potentially bearish).

- When it drops, volatility is cooling off, often signaling a bullish sentiment.

How to Use the Synthetic VIX Indicator

Unlike momentum or signal-based indicators, Synthetic VIX focuses on volatility sentiment, not direction. It’s best used to confirm whether a market is gearing up for a breakout or staying range-bound.

Example: Spotting a Breakout Opportunity

Let’s say you’re watching EUR/USD consolidate in a narrow range for hours. You notice the Synthetic VIX value starting to rise sharply from near 0.0.

This signals that volatility is increasing, meaning a breakout might be imminent.

If the price breaks the range resistance , that move is more likely to sustain since volatility confirms momentum.

Example: Identifying Calm Market Conditions

When the Synthetic VIX value starts dropping from 1.0, it shows that market volatility is fading. This usually aligns with trend continuation or a cooling phase after strong momentum.

Download a Collection of Indicators, Courses, and EA for FREE

Best Ways to Combine Synthetic VIX with Other Indicators

While the Synthetic VIX strong on its own, using it with other indicators makes it even more powerful:

- Combine with Moving Averages (MA): Identify if volatility spikes align with trend direction.

- Use with Bollinger Bands: When both the bands and VIX widen, expect a breakout.

- Pair with RSI or MACD: Confirm whether high volatility aligns with momentum strength.

This makes it an excellent companion for both trend-following and breakout trading strategies.

Key Advantages of the Synthetic VIX Indicator

Real-time volatility reading – Quickly shows whether the market is heating up or calming down.

Works on all assets – Perfect for forex, indices, commodities, or even crypto.

Ideal for all traders – Simple enough for beginners, detailed enough for pros.

Predictive edge – Helps identify breakout zones and trend exhaustion points.

Compatible with any strategy – Trend, range, or news trading setups all benefit.

Tips for Traders

- Avoid using Synthetic VIX as a standalone signal indicator; instead, use it as a confirmation tool.

- Focus on divergences between price and VIX , they often hint at early trend reversals.

- The indicator shines during ranging markets where volatility compresses before major moves.

Free Download Synthetic VIX Forex Indicator

Read More ADX VMA Trend MT5 Forex Indicator Free Download

Conclusion

The Synthetic VIX Forex Indicator for MT4/MT5 is one of the simplest yet most effective ways to measure market volatility. Whether you’re trading currency pairs, gold, or indices, understanding volatility helps you time entries and manage risk like a professional.

By showing when the market is about to shift gears, it keeps you prepared for potential breakouts or reversals. Best of all, it’s free, lightweight, and easy to install.

Download the Synthetic VIX Indicator for MT4/MT5 today, and add professional-grade volatility analysis to your trading strategy.

Frequently Asked Questions (FAQ)

1. Does the Synthetic VIX give buy/sell signals?

No. It’s a volatility indicator, not a signal generator. Use it to confirm market conditions before entering trades.

2. What’s the best timeframe to use it on?

It works well across all timeframes from M15 intraday setups to D1 swing analysis.

3. Can I use it for crypto or stocks?

Yes, it can be applied to any market that has price data.

4. Does it repaint?

No, the Synthetic VIX is based on price history, so its values are stable and reliable.

5. What’s the ideal combination?

Combine it with RSI, MACD, or Bollinger Bands for confirmation of volatility-based breakouts.