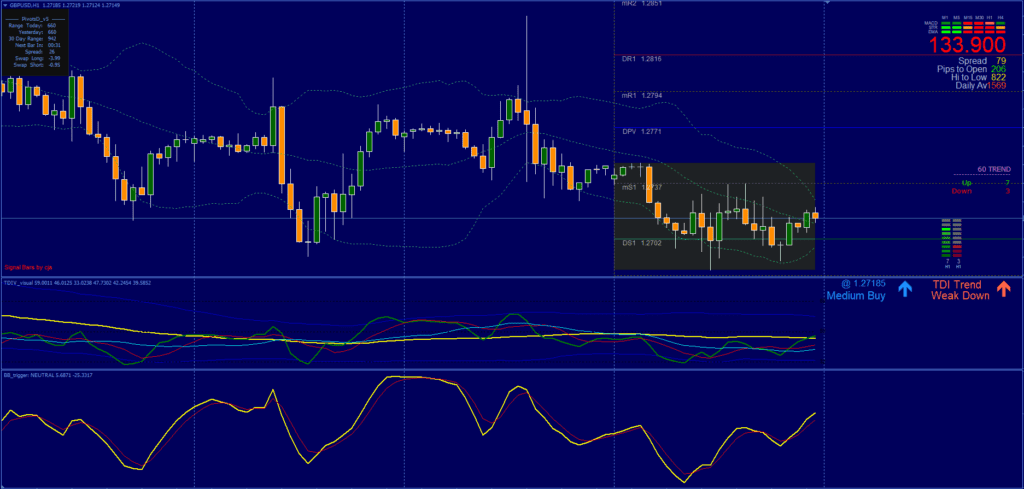

TDI with BB Trigger is a Trend Reversal Strategy that is free to download. TDI with BB Trigger system is an advanced trading template premised on three key indicators: Bollinger Bands, Trader Dynamic Index (TDI), and BB Trigger. This strategy identifies potential trend reversals based on the overbought/oversold price status within the Bollinger Bands. The TDI and the BB Trigger work in synergy to determine the right timing for market entry.

Indicators Used in this Trend Reversal Strategy

To grasp the complete picture of this strategy, let’s dive deep into each component and indicator.

Bollinger Bands

Bollinger Bands are a statistical chart characterizing a financial instrument or commodity’s prices and volatility over time. They consist of a simple moving average (middle band) and two standard deviation lines (upper and lower bands). When prices are highly volatile, the bands widen and move further away from the average, and during less volatile periods, the bands contract.

In this Trend Reversal Strategy context, the price’s interaction with the Bollinger Bands is vital. The strategy dictates that traders should wait for the price to bounce off or break the lower Bollinger Band before considering entry into the market.

Trader Dynamic Index (TDI)

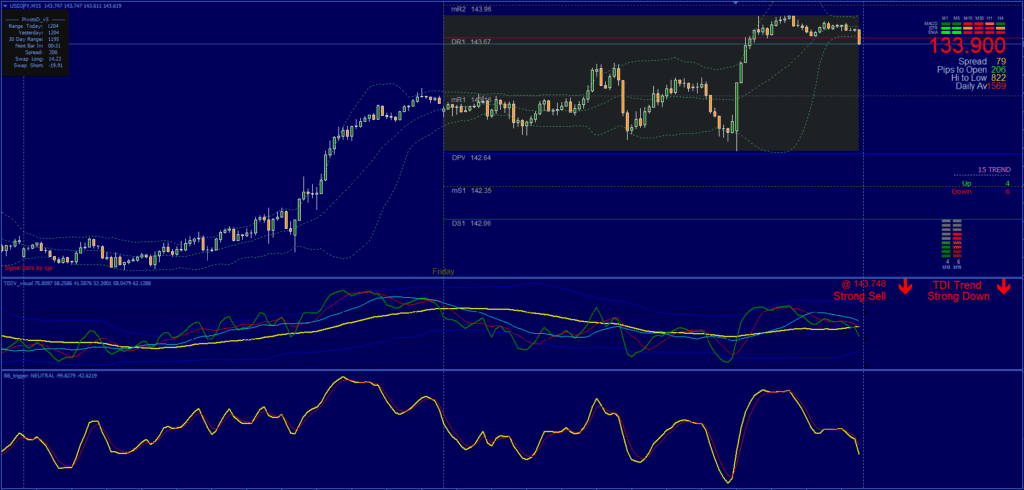

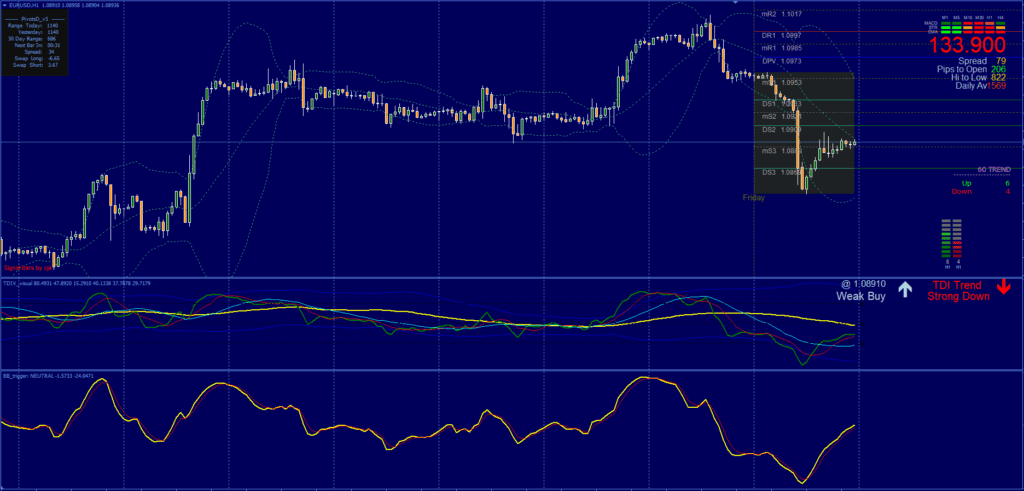

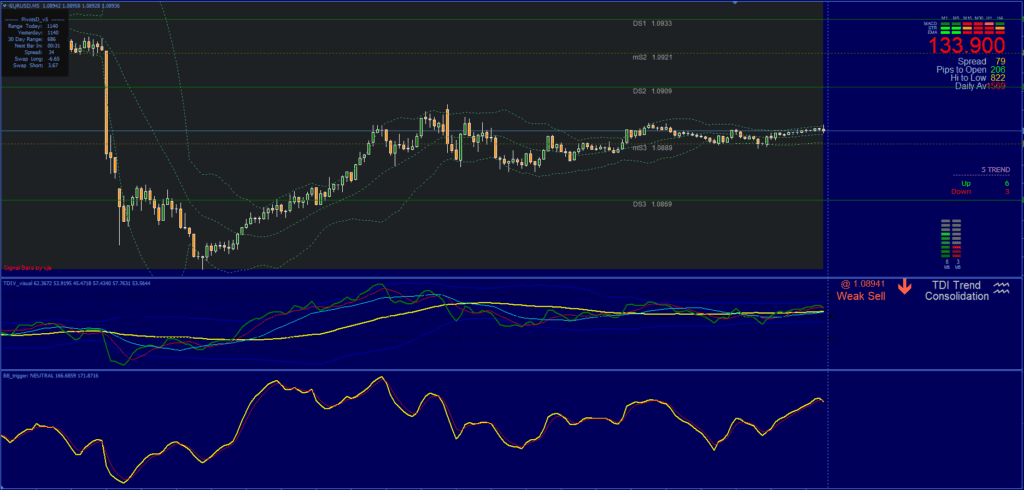

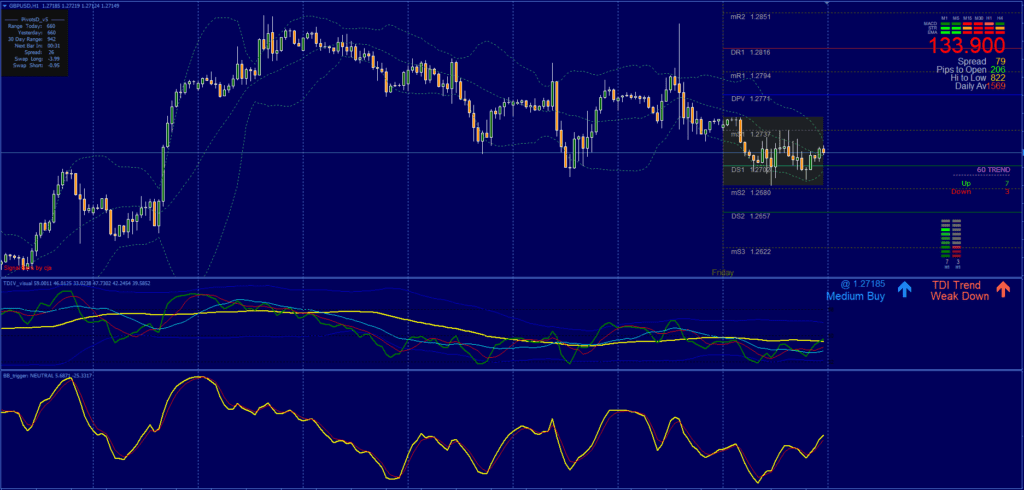

The TDI is an indicator that gathers information on price direction, volatility, and market sentiment. The TDI displays a Green line (fast-moving average), a Red line (slow-moving average), and a Blue line (market baseline). The crossover of the green and blue lines can often indicate potential market reversals.

With this strategy, traders should wait until the green line on the TDI indicator crosses upward over the blue line, signaling a potential increase in the price trend.

BB Trigger

The BB Trigger is another crucial aspect of this Trend Reversal Strategy. This momentum indicator can show when a particular asset is overbought or oversold within the trader’s chosen time frame. This, in turn, gives signals for potential trend reversals.

The BB Trigger is an additional tool used to confirm trading signals. It’s essentially an oscillator that helps identify whether market conditions are overbought or oversold, and as such, it serves to pinpoint optimal entry and exit points.

Pivot Points Levels

Pivot points are technical analysis indicators that provide a set of potential support and resistance levels. They are usually calculated from the previous trading session’s high, low, and closing prices. In this strategy, pivot point levels can be used as targets for taking profits.

This TDI with BB Trigger System is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

This System can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

Trend Reversal Strategy can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best, from the 1-minute through to the 1-month charts.

Download a Collection of Indicators, Courses, and EA for FREE

Trading rules for TDI with BB Trigger System

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using this TDI with BB Trigger System.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

Buy Position: Wait for the price to bounce or break the lower Bollinger Band. After this, look at the TDI indicator. You would want the Green line (representing the current market price) to cross upward over the Blue line (representing the market baseline). Meanwhile, the BB Trigger should indicate a long position. This confluence of conditions provides the go signal for a Buy position.

Sell Position: Wait for the price to bounce or break the upper Bollinger Band. After this, look at the TDI indicator. You would want the Green line (representing the current market price) to cross downward over the Blue line (representing the market baseline). Meanwhile, the BB Trigger should indicate a short position. This confluence of conditions provides the go signal for a Sell position.

Initial Stop Loss: Once you’ve entered a long position, it’s essential to manage risk. Place the initial stop loss on the previous low swing or 10-15 pips (the strategy you choose depends on your risk tolerance and the volatility of the market you’re trading).

Take Profit Options: With the position open, the next step is to establish a strategy for taking a profit. You have three options for this:

- Middle Band: You can exit your position when the price reaches the middle Bollinger Band. This option is conservative, limiting potential losses and possibly limiting gains.

- Opposite Band: A more aggressive strategy would be to wait until the price reaches the upper Bollinger Band. This could maximize your profits, but it also carries the risk of the price reversing before it hits the upper band.

- Pivot Points Levels: A balanced approach could be to take profit at the pivot point levels, providing a good compromise between risk and reward.

Conclusion

In essence, the TDI with BB Trigger Trend Reversal Strategy works by combining the signals provided by these indicators. When the Bollinger Bands suggest that the price is overbought or oversold, the TDI verifies the market sentiment and trend direction. The pivot point levels provide support and resistance levels, while the BB Trigger ensures the timing for entry, signaling a trend reversal.

Intraday trading demands a strategy that combines precision, timing, and a keen understanding of market trends. The TDI with BB Trigger System ticks all these boxes, providing traders with a solid framework to navigate the fascinating yet unpredictable world of intraday trading.