The foreign exchange market is famously accessible 24 hours a day, but successful traders know that not every hour offers the same potential. Mastering global Forex Market Hours is often the difference between struggling with stagnation and capitalizing on momentum.

Liquidity and volatility are not static; they shift significantly as financial capitals like Tokyo, London, and New York open and close. Trading outside of peak Forex Market Hours often results in wide spreads and erratic price action, while trading during the busiest sessions ensures the volume needed to move price to your target.

This guide explores the unique personality of each session, helping you identify the most lucrative Forex Market Hours so you can align your strategy with the market’s natural rhythm.

Table of Contents

The Anatomy of the Forex Trading Day

Before diving into specific regions, we must understand the “Big Three” sessions that dominate the $7.5 trillion daily turnover of the forex market. The market is generally divided into three major sessions: the Asian (Tokyo) session, the European (London) session, and the North American (New York) session.

The Cycle of Liquidity

Market liquidity the ease with which you can enter and exit trades without moving the price is highest when the most participants are active.

- Low Liquidity: Spreads widen, price movement is choppy or non-existent.

- High Liquidity: Spreads tighten, execution is instant, and trends are more likely to sustain.

The Role of GMT and EST

For the purpose of this article, we will use GMT/UTC as the standard anchor, as it does not change with daylight savings, though we will reference EST (New York time) for clarity.

- Note: Always adjust for Daylight Savings Time (DST) as London and New York shift clocks at different times of the year (March and October/November).

The Asian Session (Tokyo & Sydney)

Time: Approx. 00:00 – 09:00 GMT

Personality: The “Range Ranger”

The Asian session is often considered the start of the forex trading week. It kicks off with Sydney (22:00 GMT Sunday) followed closely by Tokyo (00:00 GMT). While often grouped together, Tokyo is the financial heart of this session.

Characteristics of the Asian Session

- Lower Volatility: Compared to London and New York, the Asian session is significantly calmer. Prices often consolidate within tight ranges.

- Key Players: The Bank of Japan (BoJ), Japanese exporters, and institutional investors in Hong Kong and Singapore.

- The “Safety” Zone: Because major European and US banks are closed, there is less speculative volume. Moves are often driven by genuine commercial flows (companies converting currency for business) rather than speculative attacks.

Best Pairs to Trade

- JPY Crosses (USD/JPY, GBP/JPY, AUD/JPY): Unsurprisingly, the Yen is the star.

- AUD/USD & NZD/USD: Australia and New Zealand are geographically active. China’s economic data is also released during this window, causing massive spikes in the Aussie and Kiwi dollars.

Who Should Trade This Session?

- Night Owls in the US: If you have a day job in New York, the Asian session opens in your evening (around 7 PM EST).

- Range Traders: Strategies that sell at resistance and buy at support work best here. Breakout strategies often fail in Asia (the “fakeout”).

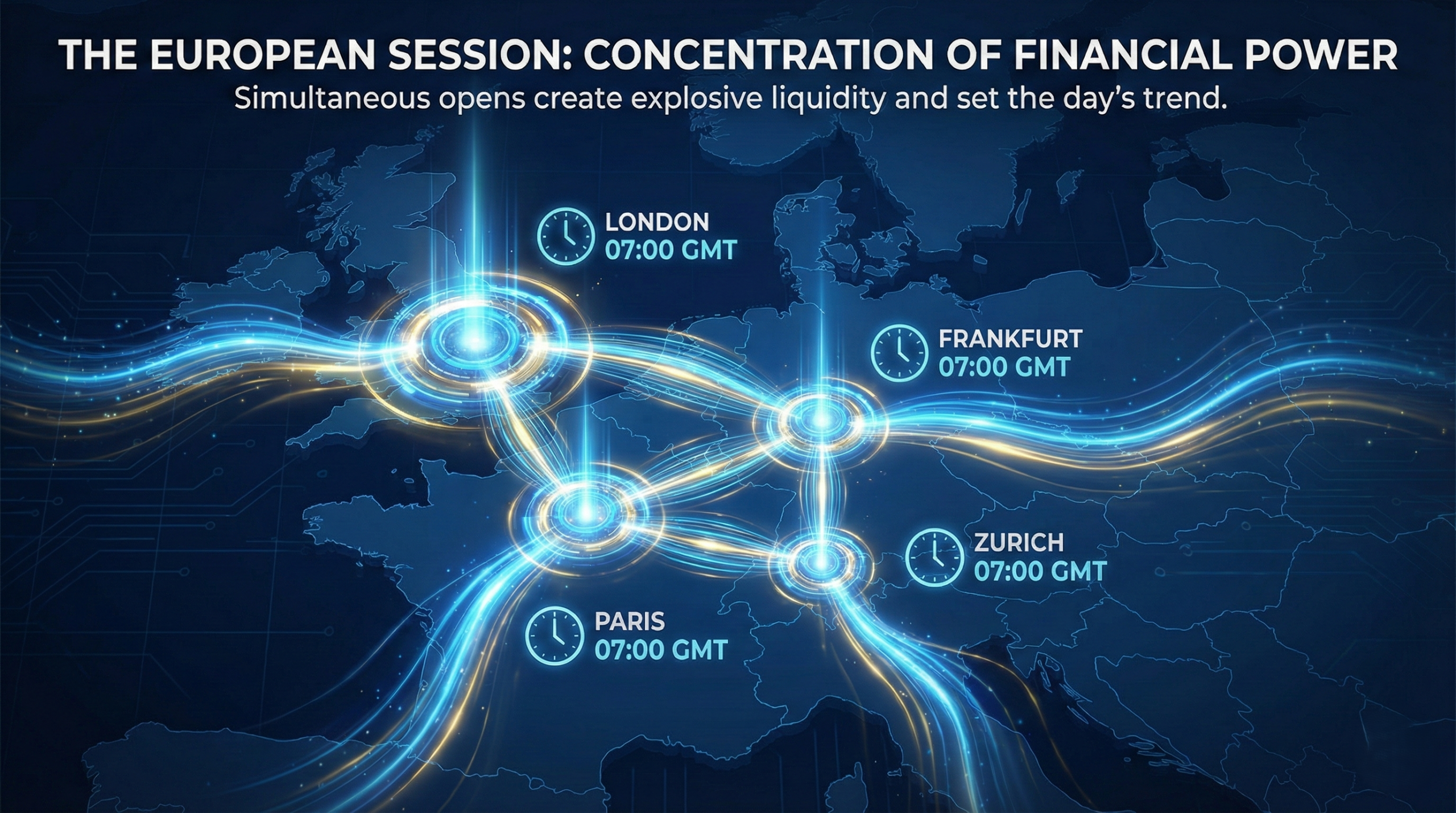

The European Session (London)

Time: Approx. 07:00 – 16:00 GMT

Personality: The “Trend Setter”

London is the undisputed capital of the forex world. Approximately 43% of all global forex transactions happen during this session. When London wakes up, the market truly begins.

Download a Collection of Indicators, Courses, and EA for FREE

Characteristics of the London Session

- Explosive Volatility: The transition from the quiet Asian session to the London open often sees massive breakouts.

- Trend Establishment: Trends formed during the London session often dictate the direction for the rest of the trading day.

- High Liquidity: Almost every pair is tradeable. Spreads on majors (EUR/USD, GBP/USD) are razor-thin.

The “London Breakout” Strategy

Many traders execute a specific strategy at 07:00-08:00 GMT. They look at the “box” formed during the quiet Asian hours and place orders to catch the price as it explodes out of that box when London bankers hit their desks.

Best Pairs to Trade

- The Majors: EUR/USD, GBP/USD, USD/CHF.

- The Crosses: EUR/GBP, EUR/CHF.

- GBP/JPY: Known as “The Beast” or “The Widowmaker,” this pair sees immense volatility during London hours.

Who Should Trade This Session?

- Trend Followers: If you want to catch the “big move” of the day.

- Day Traders: The volume ensures your orders get filled instantly.

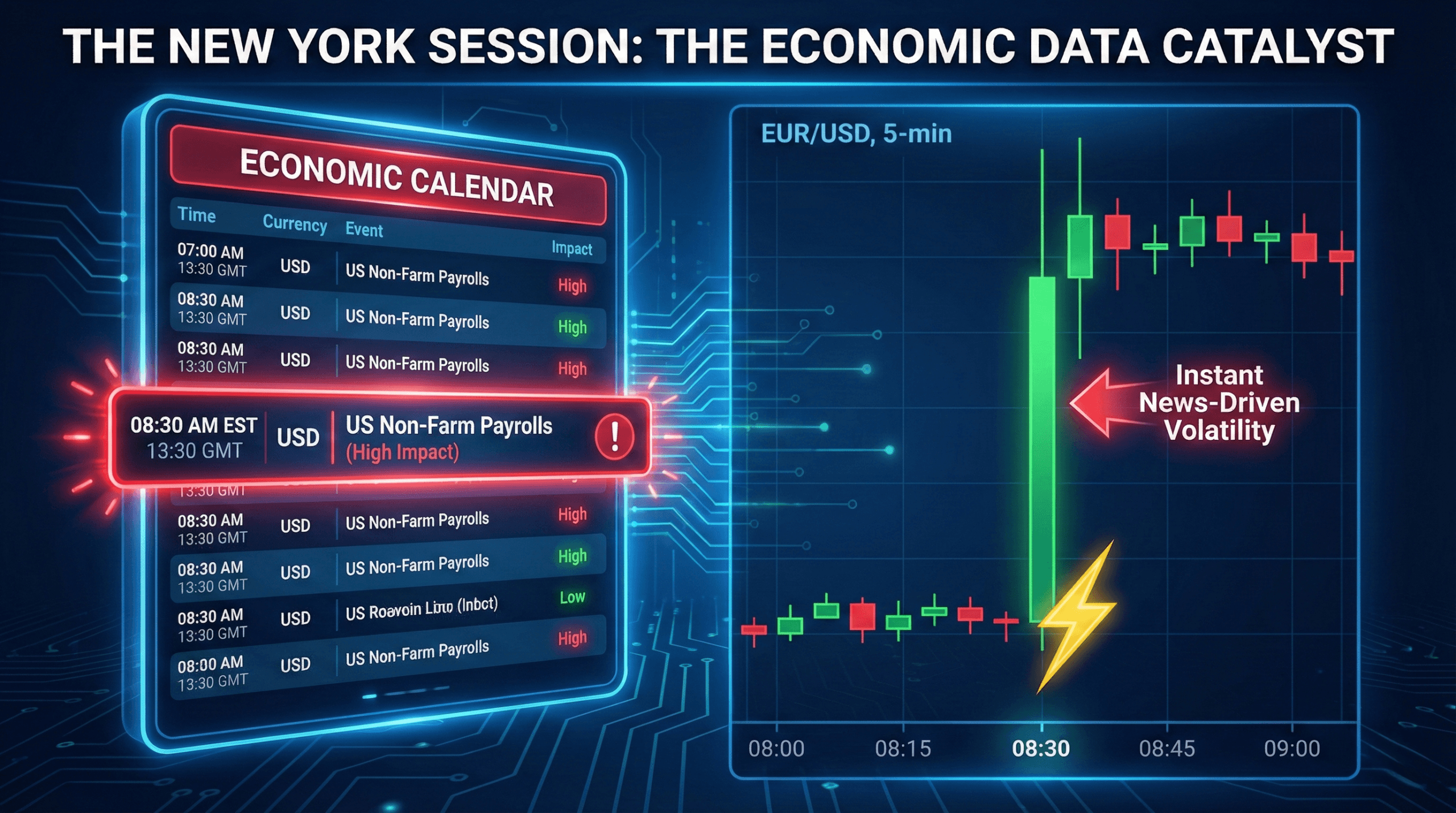

The North American Session (New York)

Time: Approx. 12:00 – 21:00 GMT

Personality: The “Volatility King”

New York is the second-largest forex center. The US Dollar is involved in 88% of all trades, making this session crucial.

Characteristics of the New York Session

- News Driven: Most high-impact economic data (NFP, CPI, GDP) is released at the start of the NY session (typically 13:30 GMT / 8:30 AM EST).

- The “Reversal” Risk: Sometimes, New York traders will look at the trend London established and decide to reverse it, cashing out profits and sending price the other way.

- The Friday Close: Friday afternoons in New York (approx. 16:00 – 21:00 GMT) are notoriously tricky. Liquidity drains away as traders close positions for the weekend, often leading to erratic, nonsensical price moves.

Best Pairs to Trade

- USD Majors: EUR/USD, GBP/USD, USD/CAD (The “Loonie” moves with NY as Canada is in the same time zone).

- Gold (XAU/USD): Gold is heavily traded during NY hours.

The “Sweet Spots” – Trading the Overlaps

If you take only one thing from this article, let it be this: The overlaps are where the money is.

An “overlap” occurs when two major financial centers are open simultaneously. This doubles the participants, doubles the money flow, and creates the highest volatility of the day.

1. The London / New York Overlap (The “Golden Window”)

Time: 12:00 GMT – 16:00 GMT

Why it’s the Best:

This 4-hour window is the holy grail of trading. The world’s two largest financial centers are active.

- London traders are finishing their day (closing positions).

- New York traders are starting their day (opening positions).

- Result: Massive liquidity and volatility. If you are a day trader, this is the time to work.

2. The Tokyo / London Overlap

Time: 07:00 GMT – 08:00 GMT

Why it Matters:

This is brief (often just one hour). It represents the hand-off from Asia to Europe.

- While less volatile than the US overlap, it is the prime time for the “London Breakout” strategy mentioned earlier.

- It is the best time to trade the GBP/JPY and EUR/JPY.

Best Trading Times by Your Region

How do you apply this global data to your life? Here is a breakdown for readers based on where they live.

If You Live in Europe (UK, Germany, France)

- Morning (07:00 – 11:00 GMT): You are in the prime seat. Trade the London Open. Focus on EUR and GBP pairs.

- Afternoon (12:00 – 16:00 GMT): The NY overlap. Perfect for catching the second wave of volatility.

- Evening: Relax. Markets quiet down significantly.

If You Live in North America (USA, Canada)

- Early Morning (7:00 AM – 11:00 AM EST): This is your Golden Window. You catch the end of London and the start of New York.

- Late Morning (11:00 AM – 12:00 PM EST): London closes. Volatility often drops.

- Evening (7:00 PM EST+): The Asian session begins. Good for slow, range-based trading if you are learning.

If You Live in Asia (Japan, Singapore, Australia)

- Morning: You trade the Asian session. It’s slower, but consistent. Focus on AUD, NZD, and JPY.

- Late Afternoon / Evening: The London Open (approx. 15:00 – 16:00 Tokyo time). This is your high-volatility window. Many Asian traders make their biggest profits here before dinner.

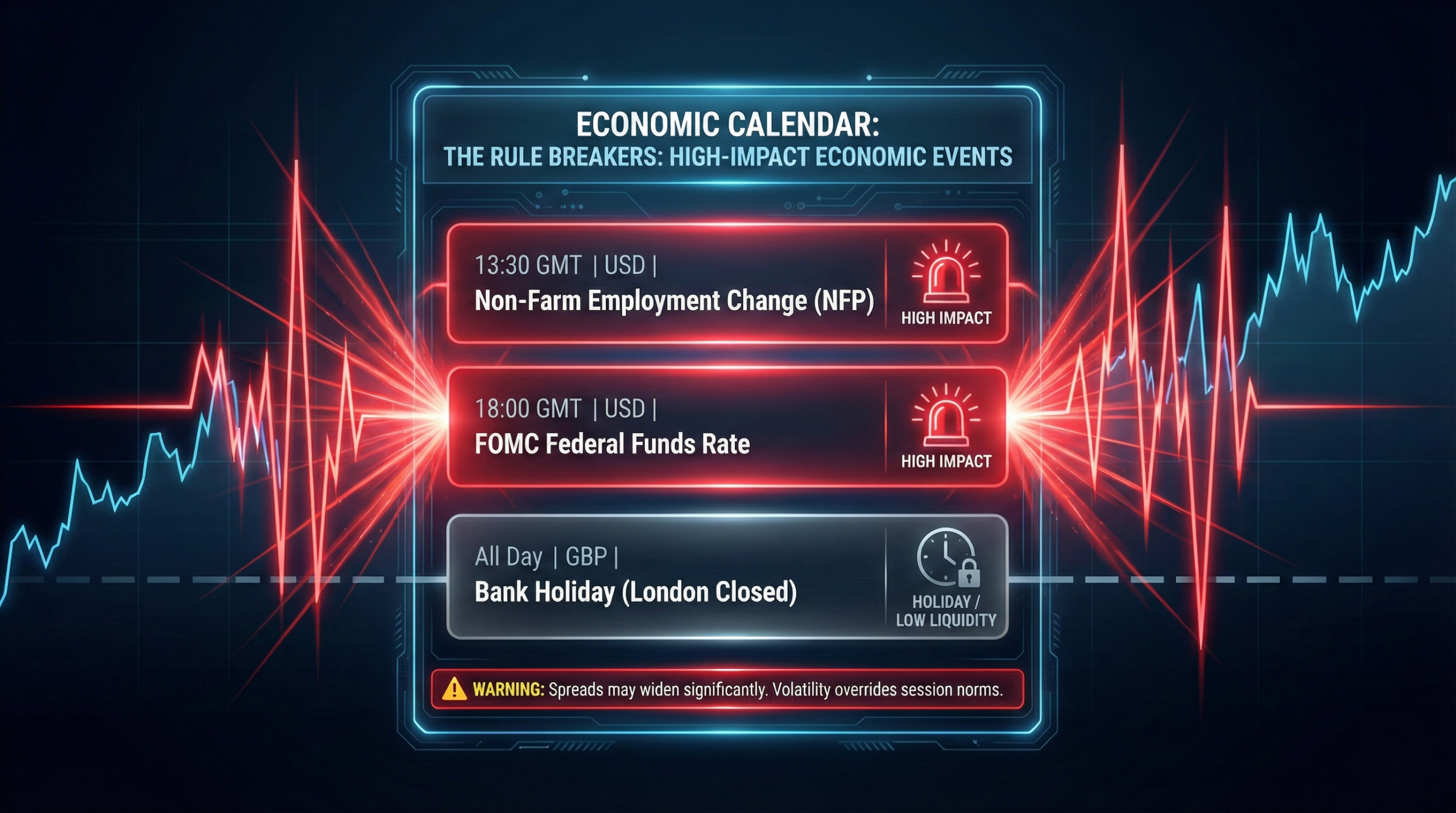

Factors That Break the Rules

While the clock dictates the potential for movement, news dictates the direction. Even the quietest Asian session can turn into a war zone if a major geopolitical event occurs.

1. Economic Data Releases

- Non-Farm Payrolls (NFP): Released first Friday of the month at 8:30 AM EST. It affects everything.

- Central Bank Rates: FOMC (USA), ECB (Europe), BoE (UK). When these banks speak, the market listens.

- The Rule: Don’t trade blindly during these times. Spreads can widen by 500% in seconds.

2. Bank Holidays

If London is on a Bank Holiday, the liquidity during the European session will vanish, even if Frankfurt is open. Always check a “Forex Holiday Calendar” at the start of your week.

3. The “Sunday Scaries”

When the market opens on Sunday night (Monday morning in Asia), spreads are often massive due to low liquidity. It is generally advised to wait 2-3 hours after the Sydney open before entering a trade to let spreads normalize.

Conclusion: Building Your Personal Trading Schedule

There is no single “best” time to trade for everyone. The best time is the intersection of market opportunity and your availability.

- If you want chaos and big moves: Trade the London/NY Overlap (12:00 – 16:00 GMT).

- If you want calm, range-bound markets: Trade the Asian Session.

- If you want trends: Trade the London Open (07:00 – 10:00 GMT).

Actionable Advice:

Don’t try to trade all three sessions. Burnout is a real danger in forex. Pick the one session that fits your lifestyle, master its specific “personality,” and specialize in the currency pairs that move most during those hours.

The market will always be there tomorrow. Your capital and your sanity must be preserved.