There are no hard and fast rules for trading in the CFD markets. You can use fundamental analysis, technical analysis, or a combination of both. Some traders like a buy-and-hold strategy, while others are interested in short-term trading signals. Using multiple trading strategies at one time can help you diversify your portfolio, just as trading multiple assets as CFDs could help balance out the risks of one area experiencing a sharp adverse move. You want to ensure that the trading strategies you choose are not aligned and have different mechanisms that govern how they perform. There are several pros and cons to using multiple systems. Here are a few.

Types of Strategies

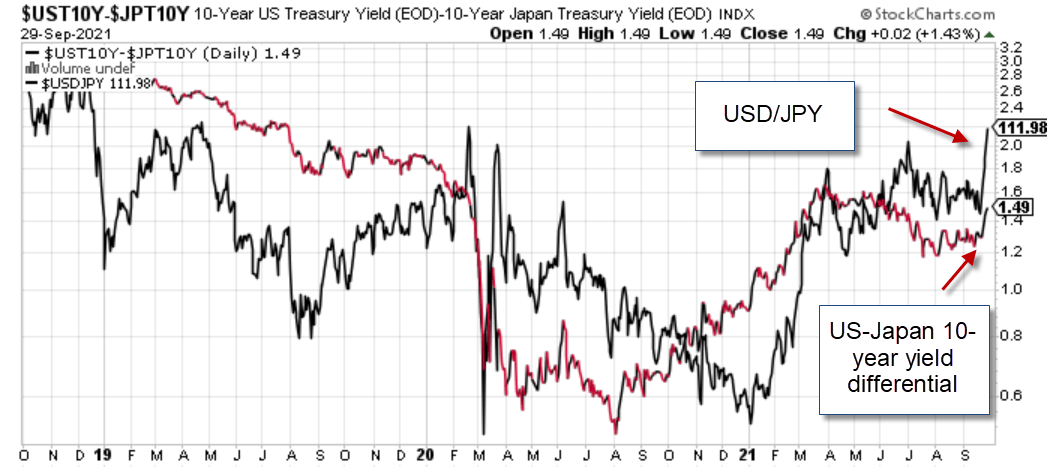

When you trade in the CFD markets, you can use several techniques. These methods include fundamental analysis, which uses either a macro or micro view of the economics that could help you determine the future direction of an asset. For example, if you are in forex trading, you might consider using the interest rate differential to evaluate the movement of a currency pair. If you look at the chart of the 10-year yield differential between the U.S. and Japan, you can see that the yield differential and the USD/JPY currency pair move in tandem, which is why this is used in forex trading.

Yield Differentials

If you plan to use this technique for forex trading, you need to view the direction of the yield differential and each component. You will need to follow the macroeconomic issues that impact the U.S. 10 year Treasury yield and the Japanese Government Bonds (JGB). To do this, you will need to follow the daily economic reports released by the government and private institutions that provide insight into the growth of each economy and inflation expectations. Your goal will be to determine how the central bank in each country could reach new pieces of data which may impact the change in the government bond yields.

Another type of fundamental analysis used in CFD trading is to evaluate a sector and determine how well that sector could perform during different economic conditions. For example, when interest rates are declining, the technology and cyclical sectors generally accelerate. When interest rates start to rise, defensive sectors such as consumer staples begin to outperform. Some CFD traders will also look at management and the individual company they are trading to analyze the target price.

Technical Analysis

An alternative to fundamental analysis is technical analysis. Technical analysis is the study of past price movements. If you are forex trading, this strategy can help you in many ways to determine trends of the market and momentum. You can find support and resistance levels to help you decide when to enter a position and when to exit. You might use a mean reversion strategy that shows you when an exchange rate is overbought or oversold. This type of strategy tells you when a currency pair has moved too far too fast and is poised to correct. The technical analysis incorporates trend-following trading strategies that help you evaluate both long-term and short-term changes to exchange rates. Momentum forex trading strategies show you how fast changes are accelerating.

Pros and Cons of Using Multiple Strategies

There are several different ways that you can design a trading strategy. You can use fundamental analysis only. You can use technical analysis only, or you can combine the two types of research. Even within each discipline, you can combine different types of analysis. For example, you can use trend following and momentum in forex trading.

Pros of Multiple Strategies

- By using multiple strategies, you can attain more insight into a view that you have

- You can diversify your methodologies, which is similar to diversifying your assets

- You can use fundamental analysis for a macro view and use technical analysis for entry and exit information

- You can use accelerating momentum in conjunction with trend following to find an accelerating trend

- You can find undervalued assets using fundamental analysis and use mean reversion technical analysis to gain insight into your belief

Cons of Multiple Strategies

- By using multiple strategies, you need to pay attention to several different concepts as opposed to focusing on one or a few

- You might not be able to follow different strategies if they point to various movements of an asset

- You might find that your strategies are correlated, and your losses and gains for different methods all come at the same time

The Bottom Line

The upshot is that there are both pros and cons to employing multiple forex trading strategies. While using many trading strategies could help you diversify your losses and gain insight into your views, it can also be challenging to manage if you have too many strategies. The benefits of using multiple strategies outweigh the cons if you combine the two to generate uncorrelated gains and help you hone in on your trading view.