The trendline trading forex strategy is a price action trading strategy where you need to first:

- identify the chart highs and lows of price

- and use the chart highs of price to draw downward trendlines

- and use the price lows to draw an upward trendline.

You need a minimum of 2 highs or lows and draw a trendline. As soon as the price heads to the trendline, you either buy or sell depending on the trendline drawn.

Suitable Timeframes to Use The Trendline Trading Forex Strategy?

You can use it at anytime frame.

But We suggest that you try to use 1hr timeframe and above.

Any Other Forex Indicators Required to Trade With The Trendline Trading Strategy?

No, there’s no need for any forex indicator. This trading system is sound as it is.

Read More: Non Repainting Supertrend Indicator Free

What Currency Are Pairs In Forex Suitable For The Trendline Trading Strategy?

Any currency pair is suitable. You would like to see those currency pairs that have good upswing and downswing characteristics in the trending market.

Why?

Because this will allow anyone to draw proper chart trendlines and trade when the price comes and hits those trendlines.

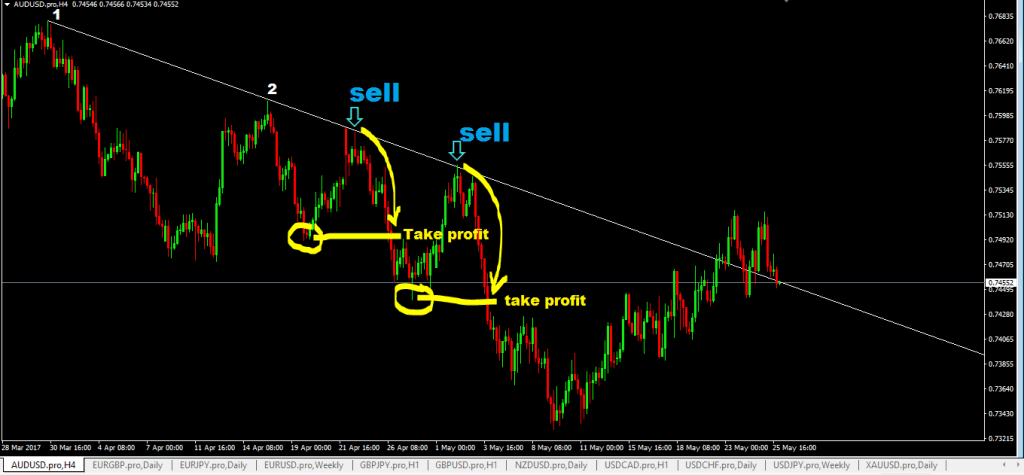

Trendline Trading Setup (SEll) Example

On this 4hr chart of the AUDUSD currency pair below, you will notice that a downward trendline was drawn based on two previous “high” price points.

Initiate a sell entry as soon as the price comes back up to hit the trendline.

Then again, the price rose again after a while and was initiated another sell trade.

Notice also that the take-profit targets are placed on the previous chart swing lows.

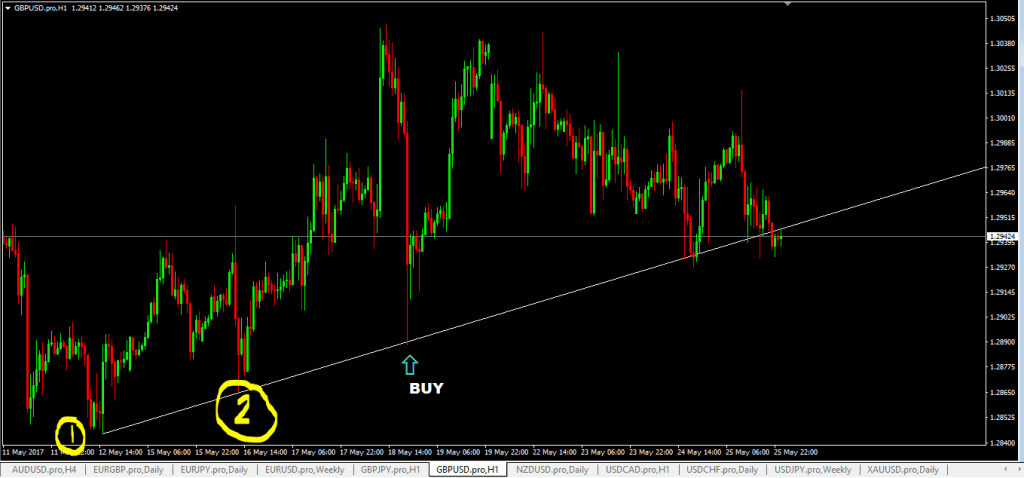

What about a strategy buy setup?

Well, for a buy setup, Do the exact opposite of the sell setup as seen above, like this:

Where To Place Your Trade Stop Loss?

You do have a few options where you can place your stop loss:

- place it 15-40 pips above the trendline

- Or you use reversal candlesticks to get into forex trade, then place your stop loss(SL) at least 10-20 pips above the price high or the bearish reversal chart candlestick (for a sell trade) and place your stop loss(SL) 10-20 pips below the low of the bullish reversal chart candlestick for a buy trade.

Advantages Of The Forex Trendline Trading System

- Great risk to reward(RR) ratio.

- Pretty easy trading system to understand even for beginner forex traders once you know how to draw a proper trendline.

- A trendline gives structure to the price where you can watch that structure form and take advantage of it.

Disadvantages Of The Trendline Trading System

- Trendlines always get broken. It is not a line drawn in concrete. That is just how price works in forex trading.

- Sometimes, the price will spike past the chart trendline and hit your stop loss(Sl), and then head in the direction you were looking.

Read More: 38.2 Fibonacci Level Forex Trading Strategy

[…] trendline trading strategy […]