Bitcoin Robot Grid is a specialized Grid EA developed for the MT4 platform. Designed specifically to handle the volatility of the crypto market, this robot serves as a comprehensive solution for Automated BTCUSD Trading. By employing a structured series of buy and sell orders at predefined price levels, the system aims to capitalize on market fluctuations without requiring manual execution from the trader.

Core Grid EA Strategy

The fundamental mechanism behind this Bitcoin Robot Grid software is the classic Grid EA strategy. This method involves creating a “grid” of orders above and below a set price. As the market price fluctuates, these orders are triggered mechanically.

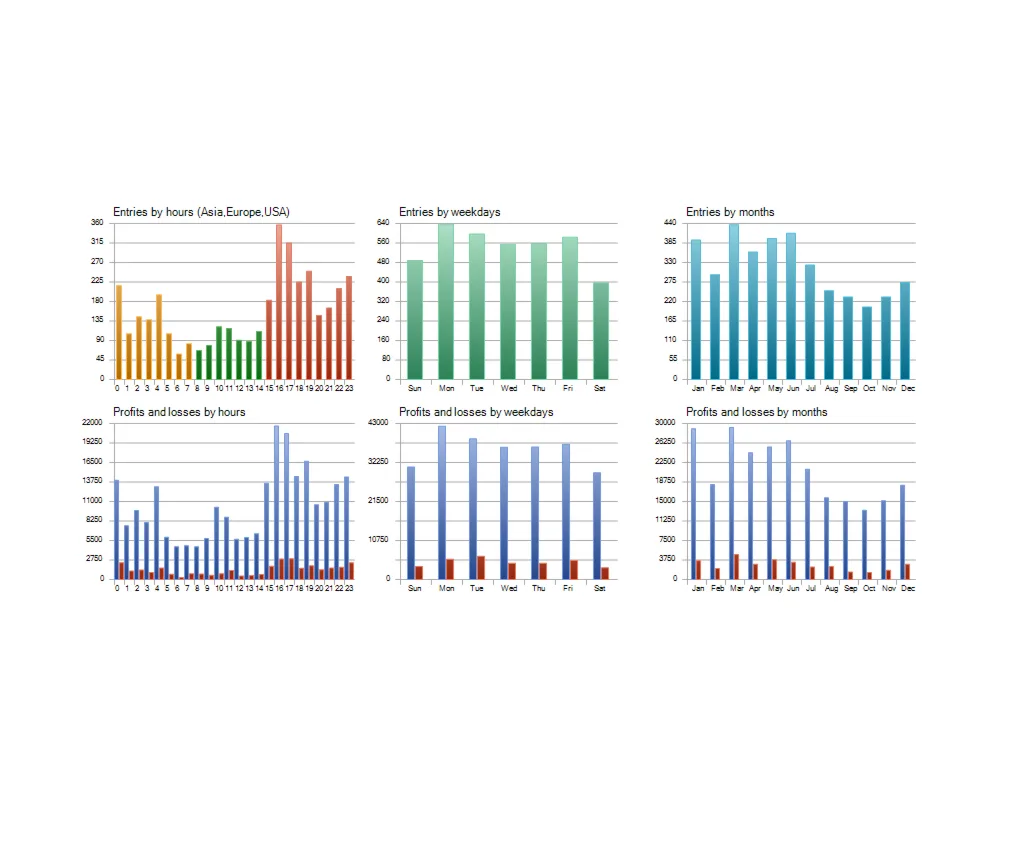

The robot continuously monitors market conditions to execute these trades according to preset parameters. This approach is designed to take advantage of the natural volatility of Bitcoin, aiming to profit from price movements in either direction. The system operates 7 days a week, engaging with the crypto market’s continuous hours, or it can be configured to trade on specific days and hours.

Key Features of this Bitcoin Robot Grid

This Grid EA includes several technical features designed to manage entry points and risk during Automated BTCUSD Trading:

- News Filter – To mitigate risks associated with high-impact economic events, the robot includes a news filter. This feature prevents the system from opening new positions 60 minutes before and 60 minutes after significant news releases, protecting the account from unpredictable volatility spikes.

- ADX Filter – The system utilizes the Average Directional Index (ADX) to gauge trend strength before executing trades, adding a layer of technical analysis to the grid logic.

- Risk Management – All positions are designed to be protected by Take Profit and Stop Loss levels. Additionally, the system includes a MaxDD% (Maximum Drawdown) parameter to limit exposure.

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this Grid Robot works, then only use it in a real account.

Recommendations for Automated BTCUSD Trading

- Minimum account balance of 1000$.

- It is specifically made to trade on BTCUSD (Bitcoin).

- It works on H1. (Work on any TimeFrame)

- Automated BTCUSD Trading should work on VPS continuously to reach stable results. So we recommend running this Grid EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- The EA is NOT sensitive to spread and slippage. But We advise using a broker that supports BTCUSD. (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Performance Analysis

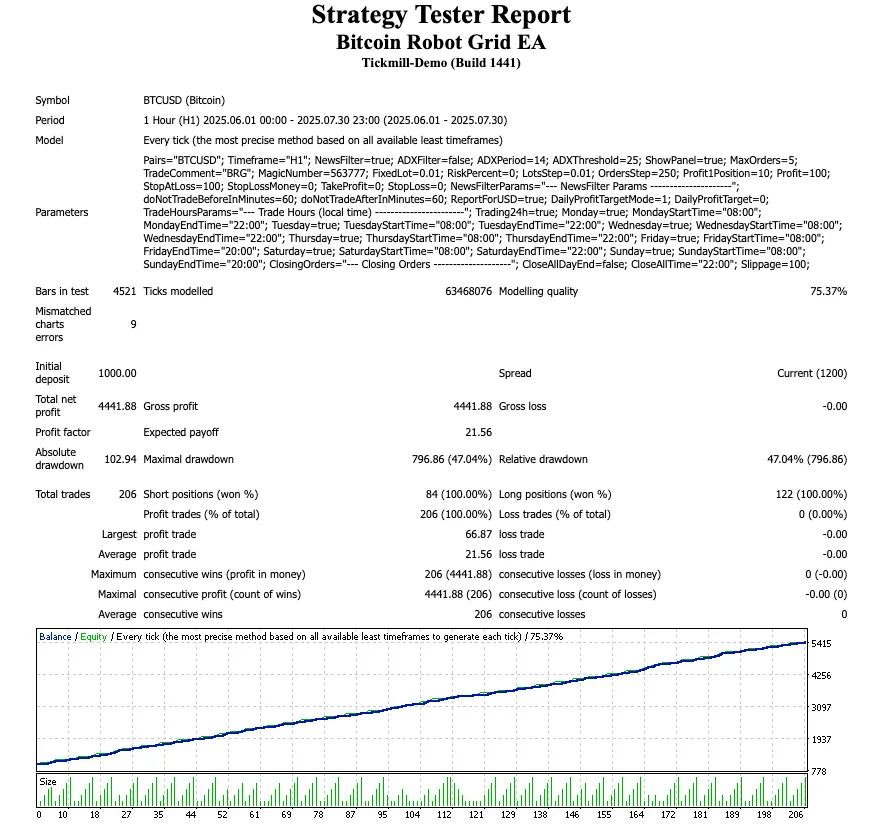

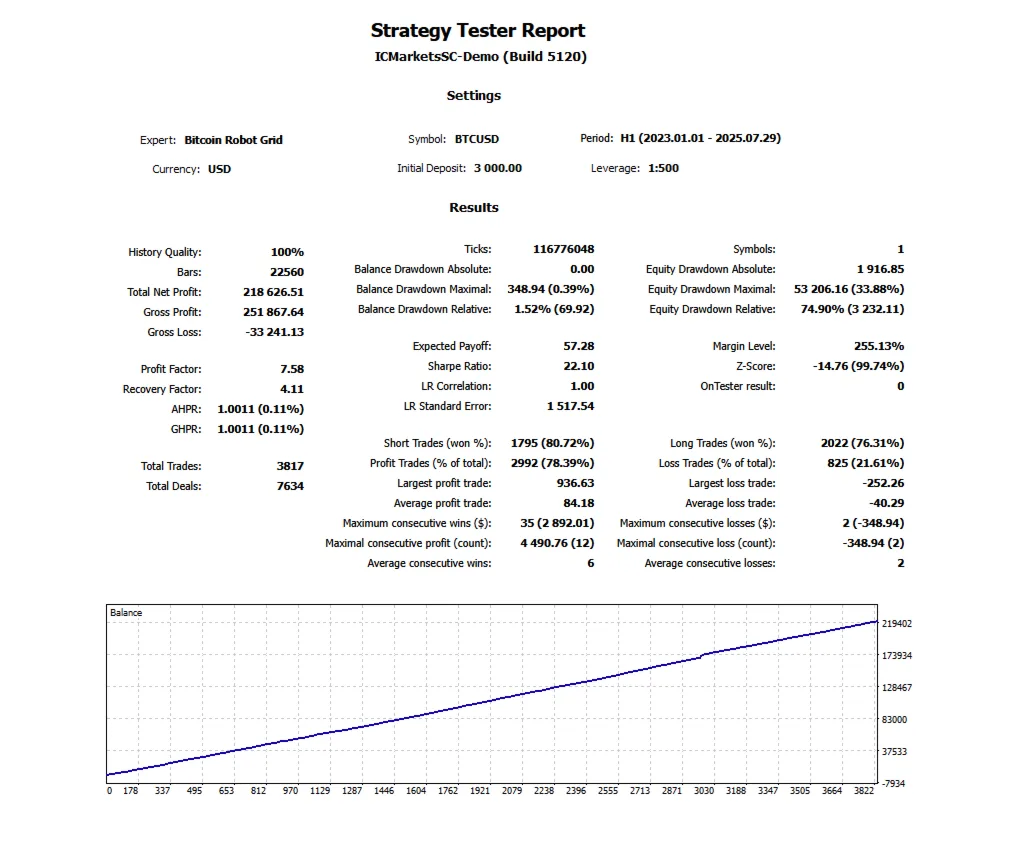

Strategy Tester data reveals a high-risk, high-reward profile typical of aggressive grid EA strategies. Over a two-month test period, the robot demonstrated exceptional capability in favorable conditions, effectively quadrupling the initial deposit. The system executed over 200 trades with a theoretical 100% win rate, indicating a strategy that likely holds positions through market fluctuations until they return to profitability rather than accepting small losses.

However, this aggressive growth came with substantial risk exposure. The simulation recorded a maximum drawdown of approximately 47%, meaning that nearly half of the account balance was at risk during open trading cycles. This suggests that while the Bitcoin Robot Grid can generate significant returns by capitalizing on Bitcoin’s volatility, it requires a robust capital buffer to withstand deep market retracements without liquidation.

Conclusion

The Bitcoin Robot Grid serves as a specialized tool for Automated BTCUSD Trading on the MetaTrader 4 platform. By leveraging a robust Grid EA framework and integrated filters like ADX and news protection, it aims to streamline market participation. While performance simulations demonstrate the system’s capacity for high returns in volatile environments, the associated drawdown levels underscore the inherent risks of aggressive automated strategies. Traders considering this software should approach it with a clear understanding of the balance between potential gains and capital exposure.

no SL in this EA. so dangerous