Forex Vantage is marketed as a highly effective analytical tool designed for automated trading on the Forex and cryptocurrency markets. Built for the MetaTrader 4 platform, Vantage EA claims to utilise a specialised algorithm that analyses price action over specific time intervals to identify market strength and amplitude.

According to the developer’s description, the bot’s operating principle focuses on trend reversals, closing positions when a trend loses strength and opening new ones in the opposite direction. It also reportedly utilizes overbought and oversold signals to execute trades with confirmation from a main signal system.

Key Parameters

- General – Magic Number, Comments, ECN Mode, Asynchronous Mode.

- Money Management (MM) –

EnabledMM(Automatic risk calculation),MyVolume(Fixed lot size). - Grid/Martingale Settings –

LimitOrdersSeries(Max orders in a basket),ExponentOrdersSeries(Multiplier for lot sizes). - Signals –

PolyParamsAthroughPolyParamsH(likely coefficients for the internal signal algorithm).

Please test in a demo account for at least a week first. Then, please familiarize yourself with and understand how this Vigorous Robot works before using it in a real account.

Recommendations Vantage EA

- Minimum cent account balance of 100$ or equivalent standard account. (The developer states that it can function with a standard account of $1,000.)

- Works best on EURUSD, AUDCHF, AUDJPY, CADJPY, GBPUSD, NZDUSD, USDCAD, USDCHF, USDJPY. (Work on any Pair)

- It works best on H1. (Work on any TimeFrame)

- Vantage EA should work on VPS continuously to reach stable results. So we recommend running this Forex Vantage on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread, Slippage, and quick execution account is recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Analysis of the Forex Vantage

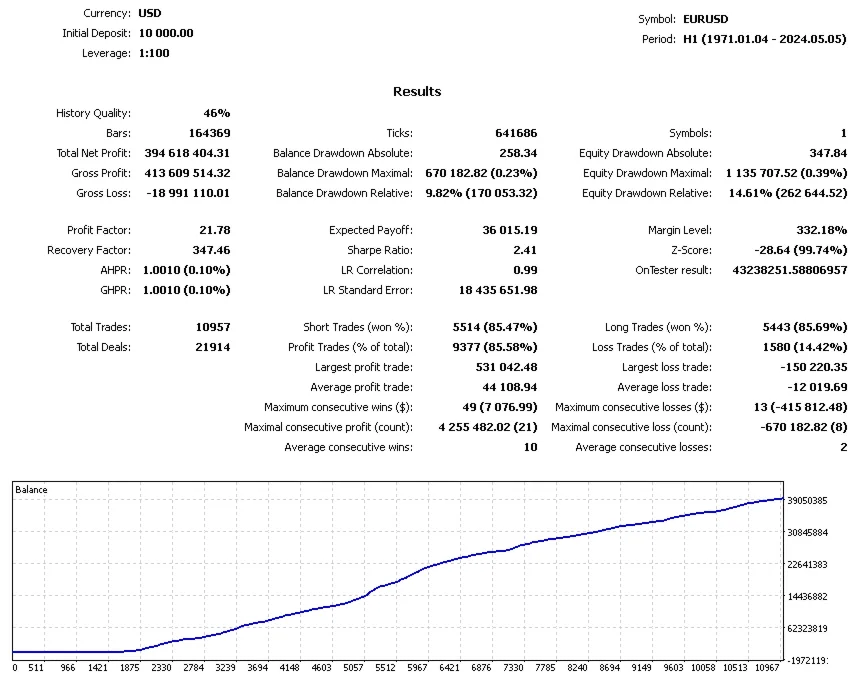

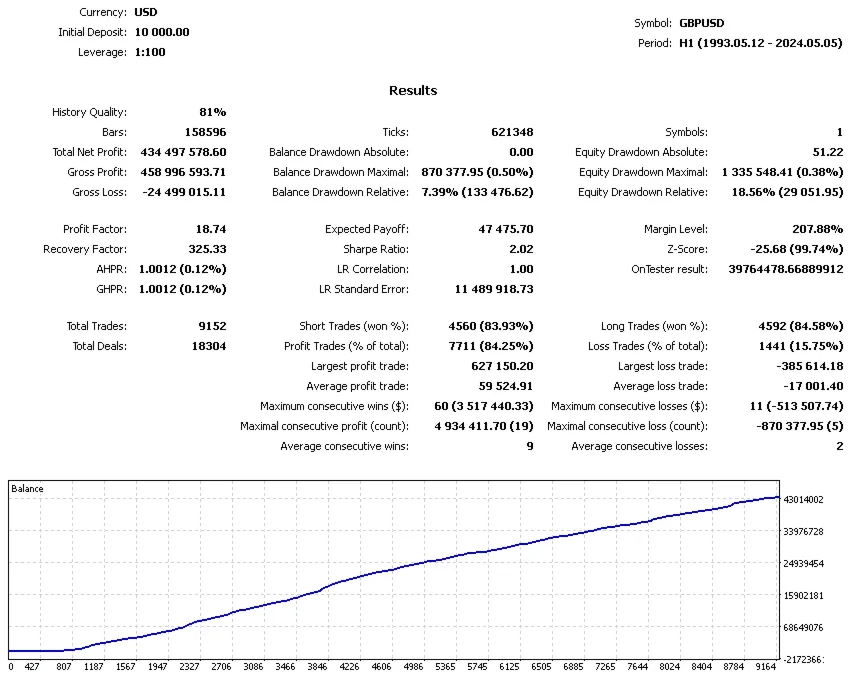

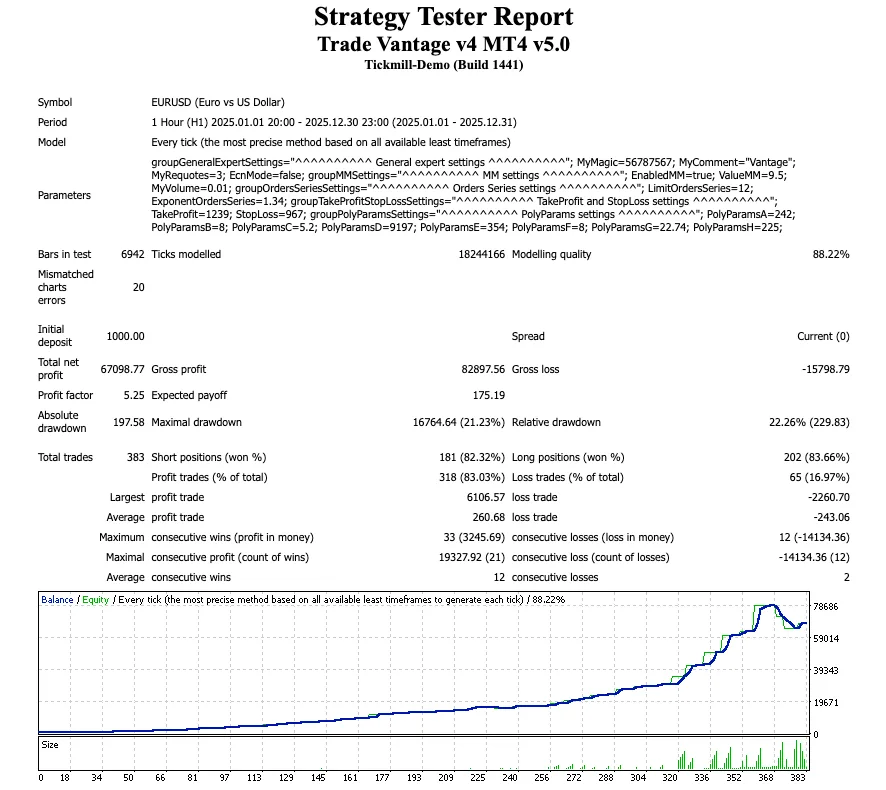

We analyzed a backtest report for Forex Vantage running on EURUSD H1 for the period of 2025.01.01 to 2025.12.31. The results provide significant insight into the actual behavior of the bot, which differs notably from its marketing description.

Performance Metrics (2025 Data)

- Initial Deposit – $1,000.00

- Total Net Profit – $67,098.77

- Profit Factor – 5.25 (Extremely High)

- Total Trades – 383

- Win Rate – ~83% (Short: 82.32%, Long: 83.66%)

- Maximal Drawdown – $16,764.64 (21.23%)

Strategy Logic: Claims vs. Reality

The Claim: The description states that the EA “closes the previous position and opens a new one” when a trend changes direction. It positions itself as an analytical tool based on price action analysis.

The Reality (Strategy Tester Findings): The actual trading behavior observed in the report strongly suggests a Grid and Martingale strategy, rather than a simple trend-reversal system.

- Averaging Down – The report shows clusters of trades where the EA opens multiple positions in the same direction when the market moves against it. For example, on 2025.01.06, multiple Sell orders (orders 14-19) were opened consecutively as the price moved up.

- Exponential Lot Sizing – The parameter

ExponentOrdersSeries=1.34is clearly visible in the trade list. Lot sizes increase exponentially to recover losses. We see sequences like0.01 -> 0.03 -> 0.05 -> 0.07 -> 0.09and later much larger sizes like0.04 -> 0.12 -> 0.20 -> 0.28. - Group Closures – Losing trades are not closed immediately upon trend reversal. Instead, they are held in a “basket” until the total net profit of the series turns positive, at which point all trades in the series are closed simultaneously.

Risk Analysis

- High Drawdown Risk: While the relative drawdown was listed as 21.23%, the absolute drawdown value was $16,764. This indicates that if the drawdown event had occurred early in the testing period (before the account grew from $1,000 to over $20,000), the account would have been blown.

- Aggressive Scaling: By the end of the test, the Forex Vantage was opening positions as large as 4.41 lots. This requires a substantial account balance to sustain the margin requirements.

- Profitability: The profit factor of 5.25 is impressive, turning $1,000 into over $67,000 in one year. However, this “smooth” equity curve (visible in the provided graph) is typical of Martingale strategies right up until they encounter a trend strong enough to margin call the account.

Pros and Cons

Pros

- High Reward Potential – In the backtest, the ROI was massive (over 6000%).

- High Win Rate – A win rate of over 80% can be psychologically satisfying for traders.

- Automated Recovery – The grid logic allows the Vantage EA to recover from losing positions without manual intervention, assuming the market ranges or retraces.

Cons

- Hidden Martingale Risks – Contrary to the description implies, this is a high-risk strategy. The increasing lot sizes can deplete an account rapidly during strong, unidirectional trends.

- Capital Intensive – While it allows a start of $1,000, the safe operation of this strategy (to withstand the drawdowns seen in the report) effectively requires a much higher balance.

- Description Mismatch – Users expecting a bot that purely “analyzes price” and cuts losses quickly may be surprised by the holding of large losing baskets.

- Checkout Our new Web Tools HERE

Conclusion

Forex Vantage demonstrates the capability to generate substantial profits under specific market conditions, specifically ranging markets or those with frequent retracements. Its “PolyParams” likely help it enter trades during overbought/oversold conditions as claimed.

However, traders must be aware that Vantage EA operates as a Martingale Grid system. If the market description suggests safety based on “price analysis,” the execution reveals an aggressive recovery method that increases risk exposure significantly during drawdowns.

I’ve got invalid license.

Invalid license!

Thank you admin, please crack parlamore Vertigo Ea

Not working.

please update licence because mt4 been change for new ea working on old mt4 not new..

Thanks

ANOTHER DATA READER …