The Currency Strength Meter Indicator is a technical analysis tool designed for forex traders who want a comparative view of currency performance across multiple pairs. It measures the historical relative strength of five user-defined currencies over a selected timeframe, providing insights through both numerical indicators and visual formats such as a scatter plot. Offered as a free download, the currency strength indicator includes various customizable features suited for different trading strategies.

Core Functions of the Currency Strength Meter

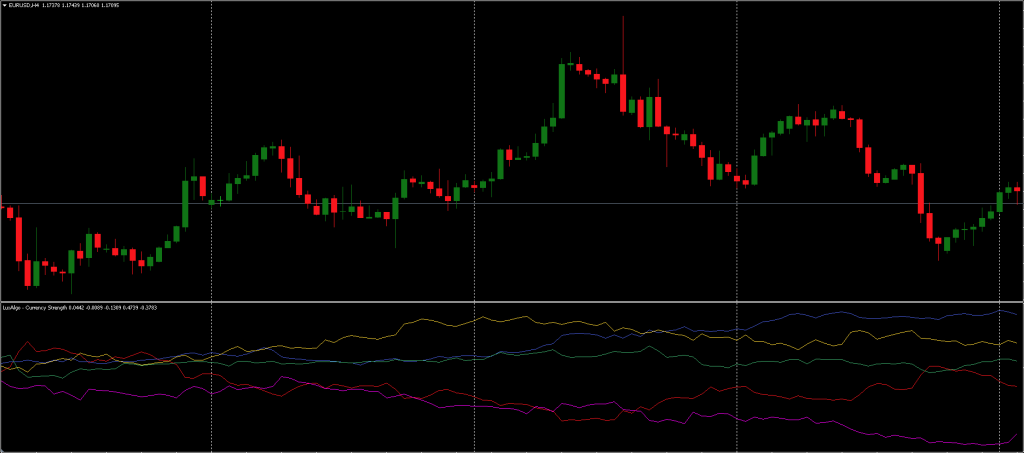

At its foundation, the Currency Strength Meter Indicator is built to show how one currency performs in relation to others. It accommodates user preferences by providing two main modes of visual analysis:

- Trailing Relative Strength View: This mode tracks the performance trend of selected currencies over time.

- Scatter Plot Visualization: This graphical view positions currencies based on their strength and momentum, helping traders detect potential shifts or consolidations.

Both options serve as tools to assess the comparative strength within a given set of currencies but may appeal to different analytical styles.

Configurable Features and Visual Controls

The currency strength indicator allows a range of user adjustments to tailor the display and data resolution:

- Timeframe Selection: Users can define how far back the relative strength calculation considers. The chosen period can influence how responsive the strength meter is to recent market activity.

- Currency Selection: Only five currencies can be analyzed simultaneously, so traders must choose which currencies are most relevant to their strategy.

- Resolution Options: Users can increase or decrease the strength meter’s chart resolution to analyze fluctuations on a micro or macro scale.

This currency strength meter indicator isn’t a standalone trading indicator System. Still, it can be very useful for your trading as an additional chart analysis, for finding trade exit positions (TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

Technical Methodology Behind the Indicator

The calculation method behind the indicator is based on relative performance between currency pairs. For any two currencies – for example, base (B) and quote (Q) – the exchange rate BQ(t) is observed over time. The indicator computes:

IRS(t) = [close(t) – open(t)] / open(t) * 100

This formula offers a percentage-based value for how much a currency has appreciated or depreciated within the timeframe. Each currency is evaluated against others in the selected list, and then an aggregate score forms the Composite Relative Strength (CRS). Over the defined time period, the CRS is accumulated to assess overall performance.

Download a Collection of Indicators, Courses, and EA for FREE

Practical Use in Currency Strength Indicator

The utility of the Currency Strength Indicator depends largely on how traders interpret and apply the data it generates. At a basic level, the tool helps identify stronger and weaker currencies, which may assist with decisions about pair selection. For instance, pairing a strong currency with a weak one could align with mean reversion or trend following strategies.

However, it’s important to note that the currency strength meter is not a signal generator. It operates as an analytical tool, and its results are only as meaningful as the context in which they are used. Its performance relies heavily on user input, particularly which currencies are selected and the timeframe chosen.

Conclusion

The Currency Strength Meter Indicator offers a structured way to explore relative strength across various currencies. Through adjustable settings and visual representations like scatter plots, traders can form a picture of where individual currencies stand in comparison to others. The information output can support decisions but requires critical application and may be influenced by trading style, market conditions, and interpretation.

As a free tool with a flexible framework, the Currency Strength Indicator sits at the intersection of simplicity and technical versatility. Nonetheless, traders should remember that no single indicator provides full insight, and this one is no exception.

Can you do the one that has GOLD? Currency Strength Exotics to be exact

Currency Strength Exotics please dear…

could you make a version of currency strength exotic pls

gold impulso is not updated, please post exotic