The SuperTrend Oscillator Indicator for MetaTrader 4 and MetaTrader 5 is a technical analysis tool designed to interpret and expand upon the well-known SuperTrend indicator. SuperTrend Indicator introduces a different dimension to trend-following strategies by offering an oscillator based approach, aimed to assist traders in assessing market momentum, identifying retracements, and estimating the potential reliability of SuperTrend signals.

Key Features and Functionality of SuperTrend Indicator

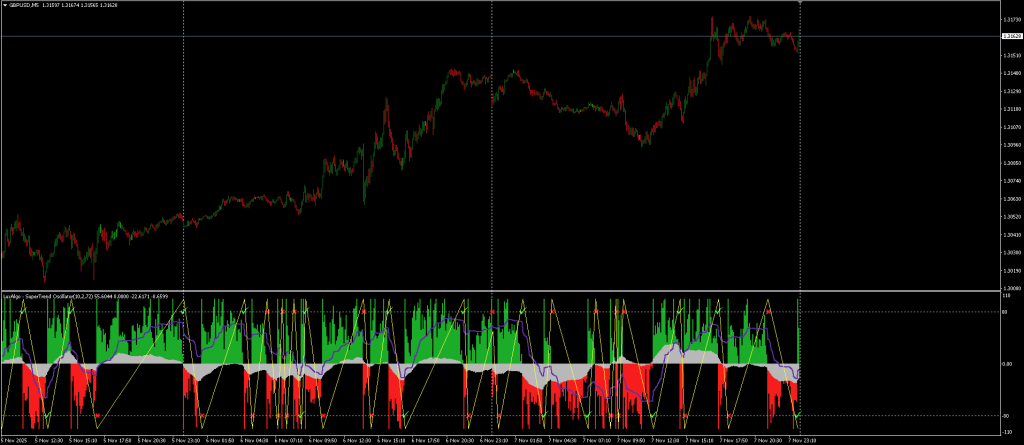

This SuperTrend Indicator is constructed from three interrelated components derived from the original SuperTrend: a primary oscillator, a smoothed Signal line, and a Histogram that reflects the divergence between the two. It operates within a normalized range of -100 to 100. Movement toward either extreme may suggest a strong market trend, while values around the midrange can indicate a ranging market or a potential retracement.

When the main oscillator value is above zero, it implies that the current price is above the SuperTrend line; a reading below zero suggests the opposite. The range of 50 to -50 is interpreted as a buffer zone, potentially signaling consolidation or pullback phases in a trending market.

This tool can potentially support traders in determining before the fact clues about price interactions with the SuperTrend line. It also evaluates historical SuperTrend signals by tagging them as either false or valid, and calculates the percentage of false signals during the period displayed on the chart.

Technical Framework

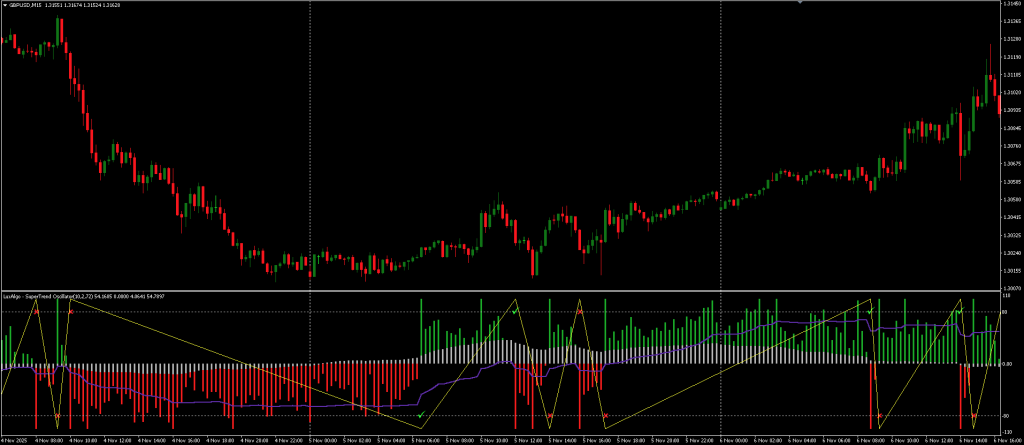

The SuperTrend Oscillator output is calculated based on the relative distance between price and the SuperTrend line, normalized similarly to a max-min scaling process. To prevent skewing due to extreme market moves, values beyond the (-1, 1) range are clipped with boundary conditions when price crosses above or below the SuperTrend.

The Signal line is generated using an exponentially weighted moving average, with a smoothing factor that adjusts dynamically based on the squared value of the main oscillator and its defined length. This adaptive smoothing attempts to preserve the responsiveness of the oscillator during strong trends, while reducing noise in quieter conditions.

SuperTrend Indicator can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

The SuperTrend Oscillator Indicator can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. It can also be used on any time frame that suits you best, from the 1-minute to the 1-month charts.

Customization Options

Several parameters allow users to adapt the SuperTrend Indicator to different trading preferences or asset classes:

- Length – Controls the period for the Average True Range (ATR), which is core to SuperTrend calculations.

- Mult – Serves as a multiplier applied to the ATR, influencing the threshold for detecting trend changes.

- Smooth – Determines the smoothing applied to the histogram, which can help clarify visual outputs.

- Fixed Transparency – Sets the oscillator’s visibility on the chart.

- Show Lines and Labels – Enables or disables visual aids, including lines and descriptive markers.

These adjustable settings can assist traders in tailoring the oscillator to align better with their strategy or market conditions.

Download a Collection of Indicators, Courses, and EA for FREE

Usage Approach for SuperTrend Oscillator

The SuperTrend Oscillator structure bears similarities to the Moving Average Convergence Divergence (MACD) indicator, particularly in its use of a main line, signal line, and histogram. Traders may apply it to identify potential trend strengths, retracements, or possible points of reversal.

The histogram is used for evaluating confluence or divergence between price and indicator behavior. For example, if the histogram and the main oscillator move in opposite directions (e.g. histogram is negative while the main oscillator is positive), this mismatch may suggest that a crossover event isn’t valid. The purpose of this feature is to help users avoid reacting to potentially misleading or premature SuperTrend crossovers.

In addition, the indicator displays checkmark (✔) or cross (✖) symbols toward the upper or lower edges of the chart to indicate whether past SuperTrend signals proved valid in hindsight.

Conclusion

The SuperTrend Oscillator for MT4/MT5 is an alternative way to analyze trend information originally provided by the SuperTrend indicator. It gives users tools to assess trends, examine potential reversals, filter out inconsistent signals, and review the historical accuracy of those signals.

While SuperTrend Indicator includes a variety of customization options and visual aids, its effectiveness largely depends on how it is integrated into a broader trading system. As with any indicator, it does not provide guaranteed or self sufficient buy and sell signals but instead offers data that may contribute to more structured trading decisions.