Eclipse Trading EA is a fully automated expert advisor built for MetaTrader 4, designed around a price action-based scalping strategy. It targets forex majors and gold (XAUUSD), with support for up to 28 currency pairs. The developer markets it as a high win-rate system with built-in capital protection through hidden stop-loss mechanics and a trailing stop.

The EA follows a fairly standard scalping architecture – enter on short-term price action signals, ride momentum via a trailing stop, and exit quickly. What makes it worth examining is the combination of hidden SL, aggressive trailing, and the claim of 80%+ win rate. We ran a full-year backtest on Tickmill demo data to verify those claims, and the results are covered in detail below.

This article provides a technical breakdown of Eclipse Trading EA’s strategy, an independent backtest analysis comparing results against the developer’s claims, recommended settings, and a direct download link for testing.

Core Strategy and Logic

Eclipse Trading EA operates on a scalping framework driven by price action signals. Based on the backtest logs and parameter structure, here’s how the system appears to function:

- Price Action Entry – The EA monitors for short-term price patterns on M5 or M1 timeframes and opens trades when conditions align. It trades both long and short.

- Hidden Stop Loss – Orders are placed with S/L set to 0 in the broker’s system. The actual stop loss is managed internally by the EA, which prevents broker-side stop hunting. The backtest confirms this – orders consistently show 0.00000 for S/L at entry.

- Trailing Stop Mechanism – Once a trade moves into profit by a set number of pips (TralStart parameter), the EA begins trailing the stop-loss upward (for longs) or downward (for shorts). The backtest log shows dozens of sequential modify orders per trade – each incrementing the S/L by 1 pip – which confirms an active pip-by-pip trailing system.

- Spread Filter – The

abcdparameter (set to 40 in the test) acts as a spread limit. The EA skips entries when the spread exceeds this threshold. - Money Management – When MM is enabled, lot size scales with account equity based on the Risk parameter. When disabled, it uses a fixed manual lot size.

The price action approach is conceptually similar to the AI Price Action Robot, though Eclipse focuses exclusively on scalping with a trailing stop rather than swing-based entries. Traders who prefer a manual price action approach may also find the Atomic Analyst indicator useful for identifying the same types of setups Eclipse automates.

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this Eclipse Trading EA Free Download works, then only use it in a real account.

Key Features of Eclipse Trading EA

- Fully automated 24/5 operation on MT4

- Price action-based scalping strategy – no indicators required

- Supports XAUUSD (gold) and 28 forex pairs

- Hidden stop-loss to prevent broker stop hunting

- Built-in trailing stop (configurable start distance)

- Money management with adjustable risk percentage

- Spread filter to avoid high-spread entries

- Magic number support for multi-EA setups

Recommendations for Low Risk Forex EA

- Minimum account balance of $200 USD.

- Works best on EURUSD, but supports any low-spread pair and gold. If you’re specifically looking for a gold-focused EA, check out our Best Gold Robot for MT4/MT5 guide.

- Recommended timeframe: M5 or M1.

- Eclipse Trading EA should work on VPS continuously to reach stable results. So we recommend running this EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread account is also Recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Backtest Analysis: Verifying the Developer’s Claims

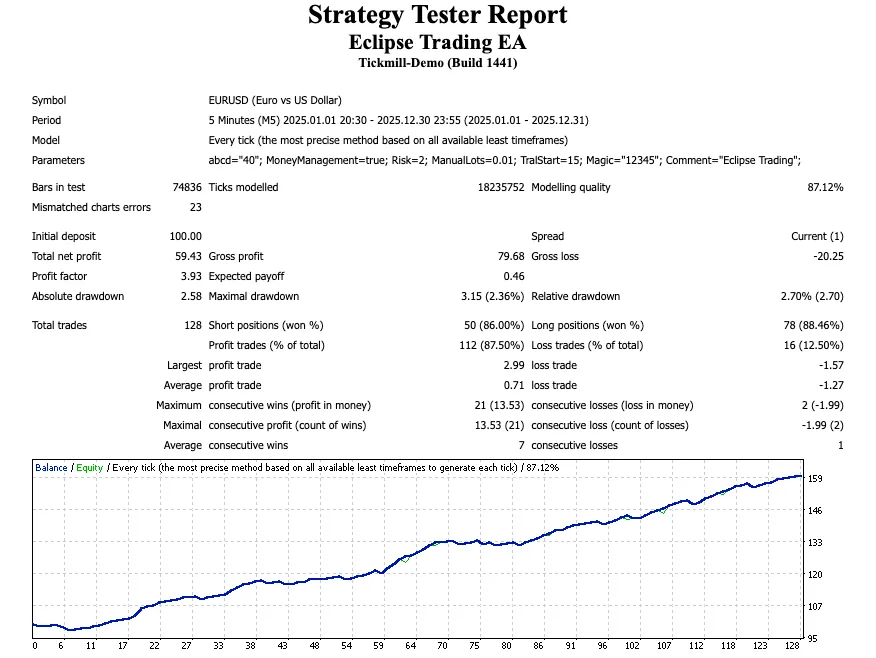

We ran Eclipse Trading EA on EURUSD M5 using Tickmill demo data for the full year of 2025 (January 1 – December 30), using Every Tick mode at 87.12% modelling quality. Parameters: MM=True, Risk=2.0, TralStart=15, Spread Limit=40. Starting balance: $100.

1. Win Rate – Claim: >80%

The backtest returned 128 total trades with 112 winners and 16 losers, yielding an 87.50% win rate. Short positions won 86% of the time (43 of 50), longs won 88.46% (69 of 78). This aligns with the developer’s claim of >80% and actually exceeds it. The EA clearly has a statistical edge in identifying favorable short-term entries.

2. Profitability and Growth

| Metric | Value |

|---|---|

| Net Profit | $59.43 |

| Gross Profit | $79.68 |

| Gross Loss | -$20.25 |

| Profit Factor | 3.93 |

| Expected Payoff | $0.46/trade |

| ROI (12 months) | 59.43% |

A profit factor of 3.93 is strong – substantially above the 2.0 threshold most traders consider viable. Expected payoff of $0.46 per trade on micro lots confirms consistent edge. For comparison, Smart Machine EA – another top-rated forex robot – trades more frequently but with a different risk profile.

3. Risk Profile and Drawdown

| Metric | Value |

|---|---|

| Absolute Drawdown | $2.58 |

| Maximal Drawdown | $3.15 (2.36%) |

| Relative Drawdown | 2.70% |

| Max Consecutive Losses | 2 |

| Max Consecutive Loss ($$) | -$1.99 |

The drawdown numbers are notably low. A maximum drawdown of 2.36% over a full year of trading suggests conservative position sizing – you can verify your own account’s risk tolerance using our Drawdown Calculator. The longest losing streak was just 2 trades, which indicates the EA does not enter reckless clusters of positions when wrong. If drawdown management is a priority for you, the Drawdown Recovery EA can serve as a complementary tool.

4. Trailing Stop Verification

This is where the backtest log is most revealing. Examining the trade history, each profitable trade shows a sequence of modify orders – typically 15-50+ per trade – where the stop-loss is incrementally moved by 1 pip at a time in the direction of profit. For example, Order #7 (sell at 1.02533) generated over 40 modify orders, trailing the S/L from 1.02518 down to 1.02477 where it was closed at breakeven-plus. This confirms the trailing stop operates exactly as described.

5. Trade Frequency – A Concern

128 trades over 12 months works out to roughly 10-11 trades per month, or about 2-3 per week. For a scalping EA, this is notably low. The spread filter and price action conditions appear to be quite selective. This isn’t necessarily bad – it suggests the EA waits for high-probability setups rather than overtrading – but users expecting daily signals may find it underwhelming. Traders wanting higher frequency scalping may want to compare with Vigorous FX or the SCARLET EURUSD EA, both of which generate significantly more trades on similar pairs.

6. Risk-Reward Imbalance

Average winning trade: $0.71. Average losing trade: -$1.27. The EA’s losses are nearly 1.8x its wins. This is a common characteristic of high-win-rate scalpers – they depend on frequency of wins to overcome larger individual losses. If the win rate drops below approximately 64% in live conditions (due to slippage, wider spreads, or requotes), the strategy could become unprofitable. You can model your specific risk scenario using our Risk of Ruin Calculator.

Eclipse Trading EA

Eclipse Trading EA is a fully automated price action scalper for MetaTrader 4 that trades EURUSD, gold (XAUUSD), and up to 28 currency pairs on the M5 timeframe. It uses hidden stop-loss mechanics to prevent broker stop hunting and features a pip-by-pip trailing stop system to lock in profits. The EA includes built-in money management with adjustable risk percentage and a spread filter to avoid poor market conditions.

✓ Pros

- 87.5% win rate in backtest, consistent with the 80%+ claim

- Very low drawdown (2.36% max)

- Trailing stop confirmed in trade log

✗ Cons

- Only 128 trades in 12 months — low frequency

- Average loss nearly double the average win

- Backtest on 1-pip spread may not reflect live conditions

Summary

Solid backtest numbers on EURUSD with low drawdown and high win rate. The trailing stop system works as described, but the EA trades infrequently and profitability depends heavily on low-spread conditions.

Frequently Asked Questions

Conclusion

Eclipse Trading EA delivers what its description promises in backtesting – a price action scalper with a high win rate, low drawdown, and functional trailing stop mechanics. The 87.5% win rate and 3.93 profit factor on EURUSD M5 are strong numbers that exceed the developer’s stated claims. However, the EA’s profitability hinges on maintaining that win rate in live market conditions, where spreads are wider and slippage is real. The unfavorable risk-reward ratio (average loss nearly double the average win) means any significant drop in accuracy could turn the strategy negative. Traders interested in testing this EA should start on a low spread ECN demo account and monitor results for at least one month before considering live deployment.