If you love the classic SuperTrend but often get caught in false flips, the SuperTrend Strategy gives you a smarter, cleaner solution. With this advanced SuperTrend Oscillator indicator for MT4 and MT5 converts traditional SuperTrend logic into an oscillator view complete with a main line, signal line, histogram, and built-in false-signal statistics. It helps you instantly read trend direction, strength, and reliability, while filtering out weak or choppy setups.

In this guide, you’ll learn:

- What makes the SuperTrend Oscillator unique

- How to interpret its main line, signal line, histogram, and accuracy metrics

- A complete Trend-Plus-Pullback SuperTrend Strategy

- Recommended settings, risk management, and best market conditions

- And finally, where to download the indicator and test it on your charts

Table of Contents

What Is the SuperTrend Oscillator Indicator?

The SuperTrend Oscillator is an ATR-based momentum and trend tool built from the standard SuperTrend indicator. Instead of drawing a trailing line on your chart, it compresses all that information into an oscillator in a separate window.

Core design:

- Main oscillator line

- Derived from the distance between price and the SuperTrend line, normalized into a fixed range (typically –100 to +100).

- Above 0 → price is above the SuperTrend (bullish bias).

- Below 0 → price is below the SuperTrend (bearish bias).

- Signal line

- A smoothed version of the main oscillator, computed with an adaptive exponential filter.

- Stays closer to the main line during strong trends, smooths more when markets are quieter.

- Histogram

- Shows the difference between the main line and the signal line (similar to MACD’s histogram).

- Used to anticipate potential crosses of price and SuperTrend, and to filter false signals when the sign of the histogram disagrees with the main line.

- False-signal analytics

- The indicator can tag historical SuperTrend signals with checkmarks (valid) and crosses (false), plus a percentage of false signals over the visible chart.

It works on any symbol and timeframe supported by MT4/MT5: Forex, indices, commodities, crypto, metals, and more.

How to Read the SuperTrend Oscillator

1. Trend Direction

- Main line > 0

- Price trades above the SuperTrend line

- Market bias: bullish

- Main line < 0

- Price trades below the SuperTrend line

- Market bias: bearish

For a simple trend filter:

- Only look for buys when the main line stays above 0.

- Only look for sells when the main line stays below 0.

2. Trend Strength

Because the oscillator is normalized, the distance from 0 gives a quick view of strength:

- +70 to +100 → strong bullish trend

- –70 to –100 → strong bearish trend

- Values closer to 0 → weaker or undecided conditions

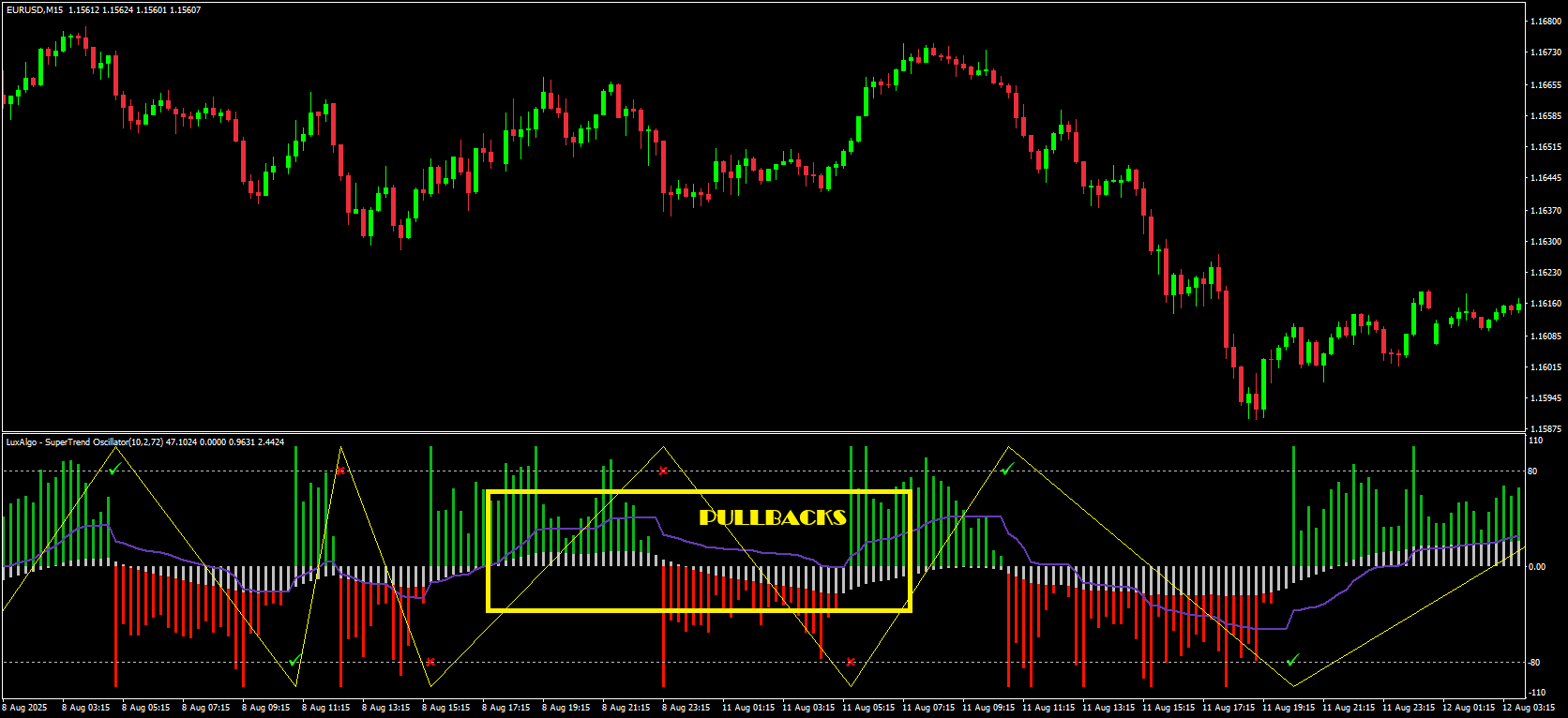

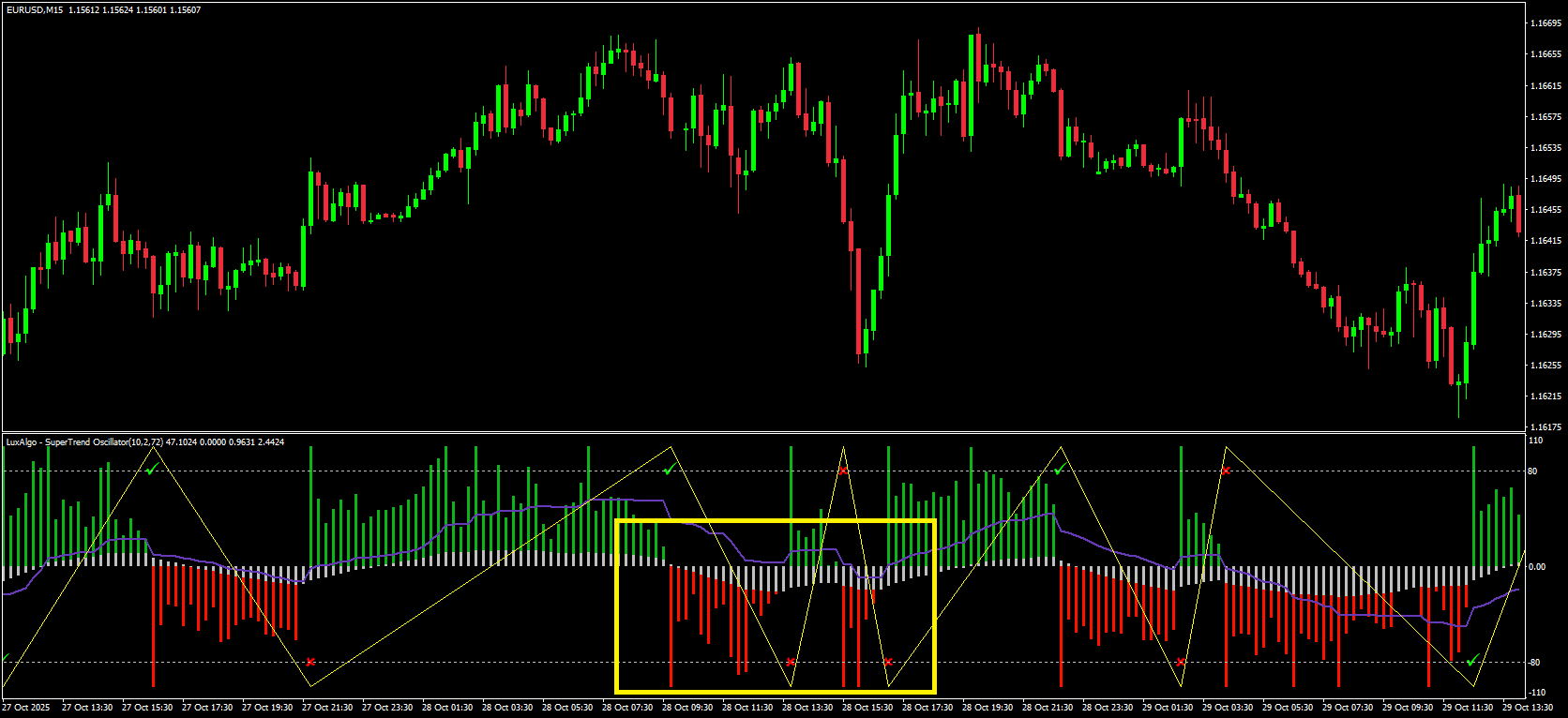

3. Retracements and Ranging Markets

When the main line oscillates in the –50 to +50 zone, the indicator often interprets that as:

- A pullback inside a larger trend, or

- A sideways/ranging phase with no clear momentum edge

This “mid-zone” is crucial for pullback strategies: you use it as your setup area, then wait for the oscillator to re-align with the dominant trend before entering.

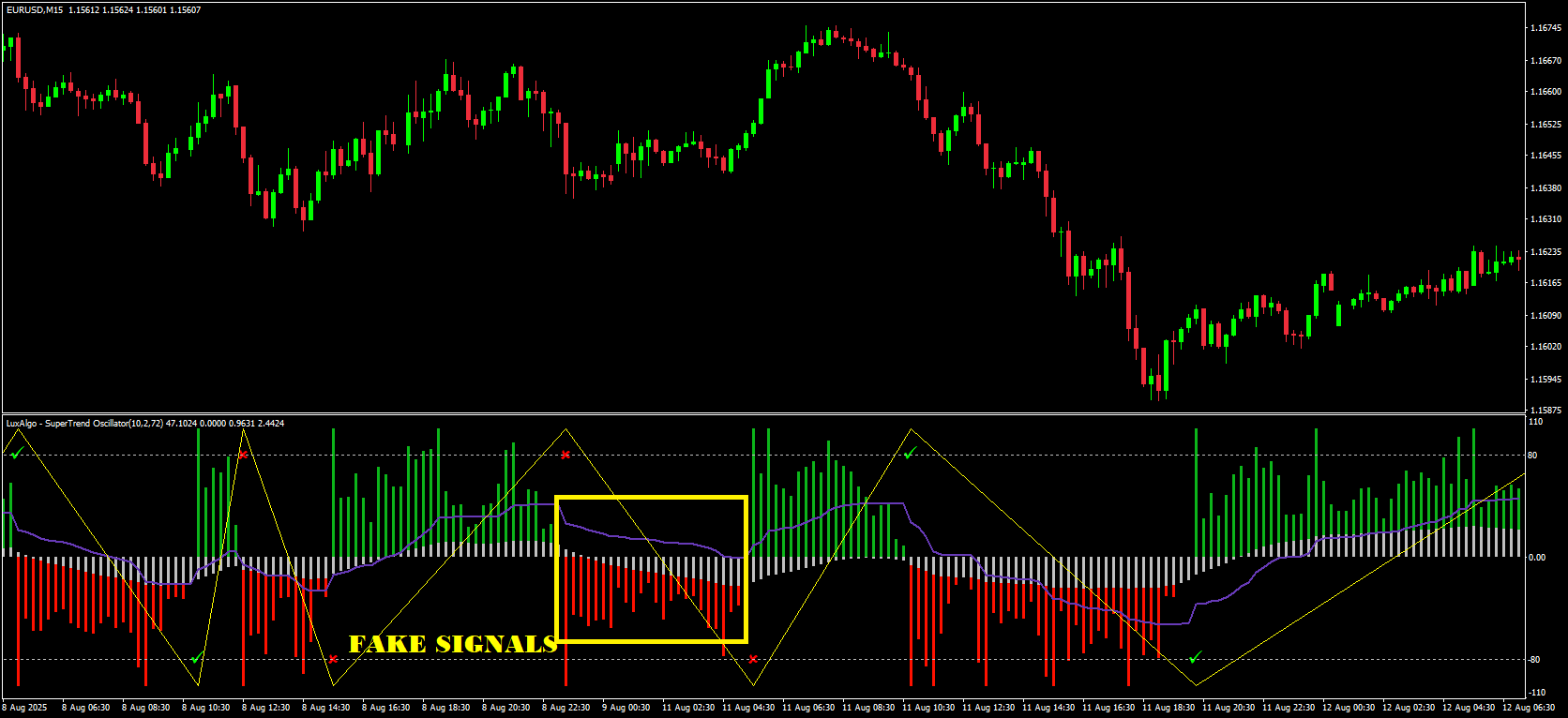

4. Histogram and False-Signal Filter

The histogram compares the main oscillator to its signal line. You can treat it as a quality control layer:

- Main > 0 and Histogram > 0

- Bullish pressure confirmed

- Main < 0 and Histogram < 0

- Bearish pressure confirmed

- Main and Histogram with opposite signs

- Potential fake SuperTrend cross → many traders ignore those signals.

Add to that:

- Checkmark ✔ above/below price → previous SuperTrend signal ended up valid.

- Cross ✖ above/below price → previous signal was false.

This gives you something most “raw” trend indicators don’t: historical reliability feedback right on the chart.

Recommended SuperTrend Oscillator Settings for MT4/MT5

Exact defaults can vary by implementation, but they all rely on the Average True Range (ATR) length and a multiplier (factor), inherited from the underlying SuperTrend. A very common starting point for SuperTrend-type tools is:

- Length (ATR period): 10

- Mult (ATR factor): 3.0

- Smooth (histogram smoothing): 2–5 (higher = cleaner, but a bit slower)

Practical tuning:

- For scalping / fast intraday

- Slightly lower Length (7–10) and moderate Mult (2.5–3.0).

- Aim for faster turns but be ready for more signals.

- For swing trading on H1–H4 / D1

- Standard Length ≈ 10–14, Mult ≈ 3.0–4.0.

- Fewer flips, more stable trend legs.

If you see constant choppy flips around 0, either:

- Increase Length or Mult to smooth things, or

- Move up one timeframe.

Download a Collection of Indicators, Courses, and EA for FREE

The Core SuperTrend Oscillator Strategy (Trend + Pullback + Filter)

Below is a simple, rules-based strategy built for Forex pairs on MT4/MT5, but the logic works on indices and crypto too. The idea:

Use the SuperTrend Oscillator to define trend, wait for a mid-zone pullback, then enter when momentum re-aligns and the histogram confirms.

Step 1 – Choose Timeframes

- Higher-timeframe trend filter: H4 or H1

- Entry timeframe: M15, M30, or H1

Example:

- Trade entries on M15

- Confirm larger trend with the H1 SuperTrend Oscillator

Step 2 – Define the Higher-Timeframe Bias

On the higher timeframe (e.g. H1):

- Bullish bias:

- Main oscillator above 0

- Ideally above +20 for a clear slope

- Bearish bias:

- Main oscillator below 0

- Ideally below –20

You only trade with this bias on your entry timeframe.

Step 3 – Wait for a Pullback on the Entry Timeframe

On your entry chart (e.g. M15):

For long setups:

- Higher-timeframe bias is bullish

- On M15, the main oscillator has been:

- Above 0 previously (trend in place), then

- Dips back into the +50 to –20 zone (shallow pullback) without spending much time far below –20

For short setups:

- Higher-timeframe bias is bearish

- On M15, the main oscillator:

- Was below 0, then

- Pulls back into the –50 to +20 zone

Think of this as the “discount / pullback” phase inside a larger trend.

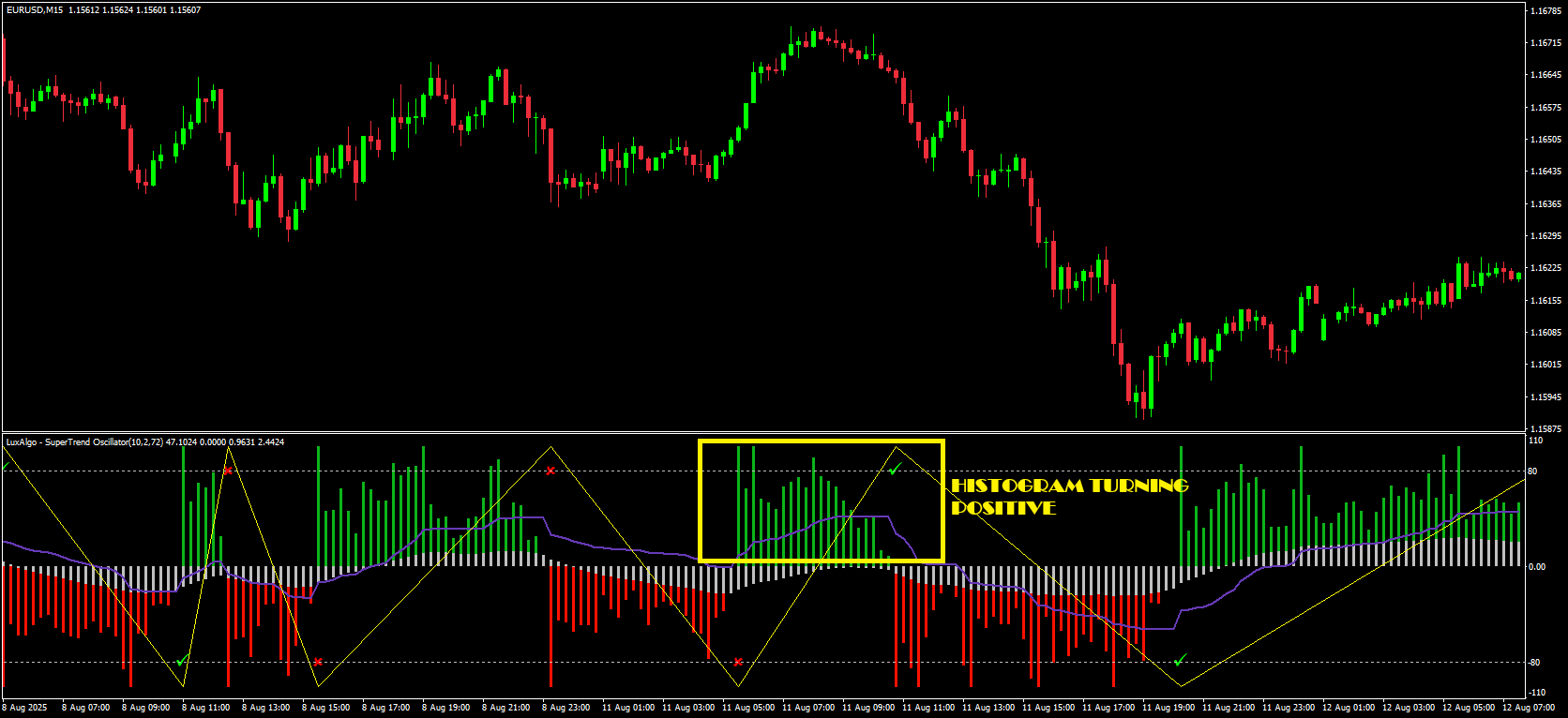

Step 4 – Entry Trigger with Histogram Confirmation

Long entry rules

Once the pullback is visible:

- Wait for the main oscillator to cross back above 0 on the entry timeframe.

- Confirm that the histogram turns positive (same sign as the main).

- Ideally, the last SuperTrend signal on the chart is marked with a checkmark rather than a cross.

- Enter long at the close of that confirmation candle.

Short entry rules

Mirror of the above:

- Main oscillator crosses below 0 after a pullback.

- Histogram turns negative.

- Recent SuperTrend signal on the chart was validated (checkmark).

- Enter short at candle close.

This way you:

- Trade in trend direction

- Enter only after a controlled pullback

- Use the histogram and false-signal logic to filter weak flips

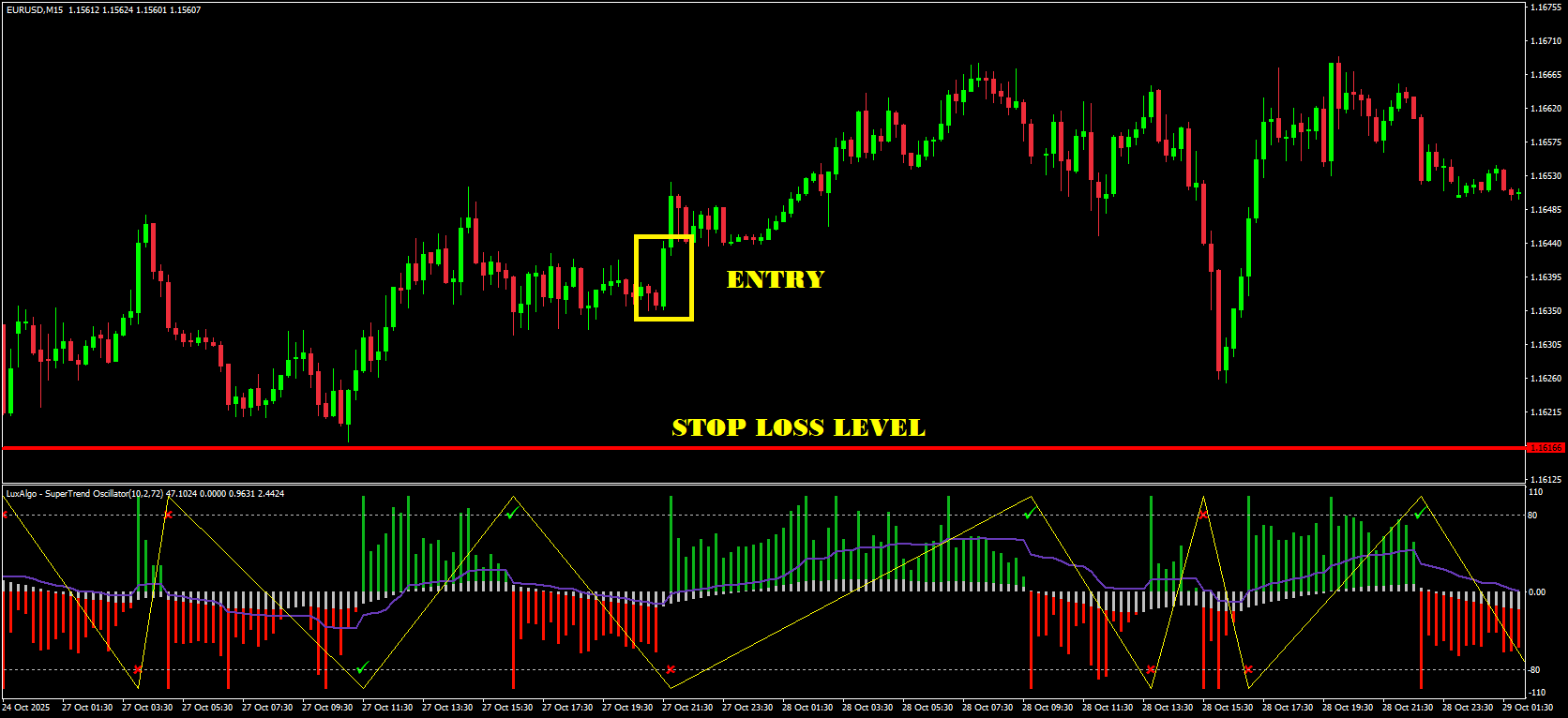

Step 5 – Stop Loss and Trade Management

Initial stop-loss:

- Conservative approach:

- Place SL just beyond the underlying SuperTrend line or beyond the recent swing high/low.

- Faster approach:

- Use a multiple of ATR (e.g. 1.5–2 × ATR(10)) beyond entry.

Risk per trade:

- Keep risk 0.5%–1% of account per trade for swing/intraday, especially when testing.

Trade management:

- Once price moves 1R in your favor, consider:

- Moving SL to breakeven, or

- Scaling out partial size and letting the rest run.

Step 6 – Exit Rules Using the Oscillator

You can exit using the same tool that got you in:

For longs:

- Take partial or full profits when:

- Main oscillator climbs into +80 to +100 (extended trend zone), or

- Main oscillator crosses back below 0, or

- Histogram flips negative and stays negative for 2–3 candles.

For shorts:

- Mirror logic:

- Main oscillator hits –80 to –100, or

- Crosses back above 0, or

- Histogram turns positive for several candles.

Alternative: trail your stop behind the SuperTrend line itself; exit when price closes on the opposite side.

When the SuperTrend Strategy Works Best

This SuperTrend Strategy is at its strongest when:

- Markets are trending cleanly (London/NY sessions, volatile pairs, strong macro moves).

- You combine it with basic structure:

- Support/resistance

- Session highs/lows

- Breakouts from well-defined ranges

You should be more selective when:

- The oscillator whipsaws tightly around 0 with tiny ranges.

- The false-signal percentage shown by the indicator is unusually high over your visible history.

In those conditions, consider:

- Moving up a timeframe

- Increasing Length / Mult

- Or simply skipping that market until volatility normalizes

Advanced Tips: Combining SuperTrend Oscillator With Other Tools

You can enhance the base strategy with:

- Price action filters

- Only take long entries after a bullish engulfing or a break of a minor high.

- Only take shorts after clear lower-high structure.

- Volume or session filters

- Focus on the main liquid sessions (London, New York).

- Avoid low-volume chop where oscillators tend to fake out.

- Confluence with the base SuperTrend line

- Use the SuperTrend line on the chart as:

- Dynamic support/resistance

- A trailing stop

- A visual confirmation that matches your oscillator bias

- Use the SuperTrend line on the chart as:

Final Thoughts + Download

The SuperTrend Oscillator indicator for MT4/MT5 is basically a “SuperTrend control panel” in one window. It tells you:

- Direction (above/below 0)

- Strength (how close it is to ±100)

- Pullbacks (mid-zone swings)

- Reliability (histogram alignment + false-signal stats)

Used with a simple trend–pullback–confirmation framework and sensible risk management, it can help you ride cleaner moves and ignore a good chunk of fake SuperTrend flips.

To put this strategy to the test:

may i know where to download the indicators ?

I found it ! sorry for my mistake ..