in an era where global financial markets are facing growing uncertainty, traders are increasingly turning to automated solutions to maintain control and efficiency in their strategies. The Adaptive Forex Trading EA is one such tool, now available for free download, that aims to address some of the key challenges traders are encountering in today’s volatile economic climate.

Recent world events have put even more pressure on foreign exchange markets. For example:

- The reelection of Donald Trump has brought back aggressive trade policies and tariffs, adding new layers of complexity to global markets.

- Tensions in the Middle East, most notably between Israel and Iran, have caused instability in commodity prices such as oil, which in turn affects currency valuations.

- The ongoing war between Russia and Ukraine continues to cast uncertainty over European economies and energy supply chains.

- Economic nationalism is becoming more prominent, as governments shift away from international cooperation in favor of self reliance.

- Global supply chains are still under strain, and inflation is placing additional pressure on many major economies.

Market dynamics like these have made traditional trading methods less reliable for many participants. As fluctuations become more frequent and harder to predict, traders face the need for Forex Trading EA that offer more than just basic trade execution.

Adapting to Uncertainty: What Adaptive Forex EA Offers

Adaptive Forex EA has been developed to meet some of the key requirements of modern day trading: the ability to handle volatility, mitigate risk, and adjust to individual trading preferences. It integrates three core components:

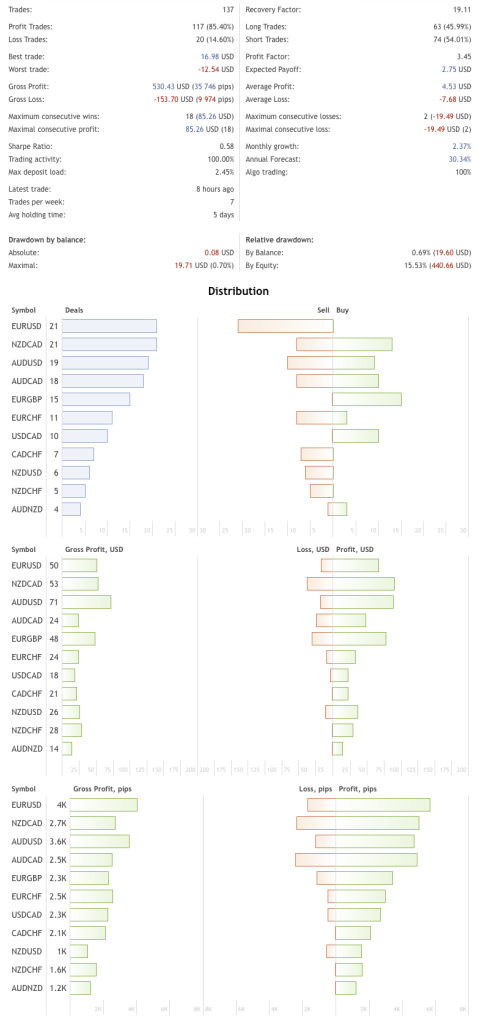

Diversification: Diversified Currency Pair Coverage

Unlike systems that trade only a handful of forex pairs, this EA operates across 10 or more major and minor currency pairs. By spreading exposure, traders aren’t solely dependent on specific regions or economic developments. This approach is designed to smooth out overall performance and stabilize results, especially during periods when one currency market may be experiencing unusually high volatility due to geopolitical or macroeconomic events.

Risk Control: Group Stop-Loss Functionality

One standout feature of this Forex Trading EA is the use of a pip based group stop-loss system. Instead of reacting individually to losing trades, the system reacts based on the combined performance of a group of trades. If the total pip loss exceeds a defined threshold, all trades within that group are automatically closed. This represents a method of capital control that some traders may find useful in managing broader positional risk, particularly when facing incorrect market assumptions.

Customization: High Level of Customization

The Adaptive Forex EA allows for complete parameter customization. Users can change settings for trade frequency, risk levels, preferred direction (long or short), and the reliability of entry signals. This can be particularly helpful for traders wanting to tailor the EA to fit different strategies, be it high frequency trading, trend following, or more conservative long-term approaches.

Trading Strategy Compatibility

Adaptive Forex Trading EA reportedly integrates several strategy types:

- Momentum based entries

- Supply and Demand zones

- Fibonacci retracement levels

- “Artificial intelligence” for signal filtering

This breadth means that the EA doesn’t rely on only one mechanism for market entries or exits. However, with so many layers at play, identifying the root cause of losses (or gains) from trade logs may be challenging for users without a technical background.

Additional Features

- Symbol Scope – Single symbol per chart; multiple installations required for multi-pair operation

- Take Profit – Uses trailing take profit mechanisms

- Stop Loss – Fixed stop-loss per trade and group based stop-loss system

- Risk Management – Configurable drawdown limits and reactive trade closure logic

- Optional Features – Grid and Martingale strategies available

- User Control – Full customization: signal filters, trading frequency, direction, TP/SL, volume, and more

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this Forex Trading Robot works, then only use it in a real account.

Recommendations for this Forex Trading EA

- Minimum account balance of 1000$, but depending on the how many currency pairs you want to run it changes. (it is recommend to run on at least 3 pairs at same time.)

- $1000 – AUDCAD, NZDCAD, AUDNZD

- $1500 – AUDCAD, NZDCAD, AUDNZD, AUDUSD, NZDUSD

- $2000 – AUDCAD, NZDCAD, AUDNZD, AUDUSD, NZDUSD, EURCHF, EURGBP

- $2500 or more – All 11 supported pairs — AUDCAD, NZDCAD, AUDNZD, AUDUSD, NZDUSD, EURCHF, EURGBP, EURUSD, USDCAD, CADCHF, NZDCHF

- It works on M5. (Work on any TimeFrame)

- This Forex Trading EA should work on VPS continuously to reach stable results. So we recommend running this Adaptive Forex EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread, Slippage, and quick execution accounts are also recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Navigating Unstable Markets with Automated Tools

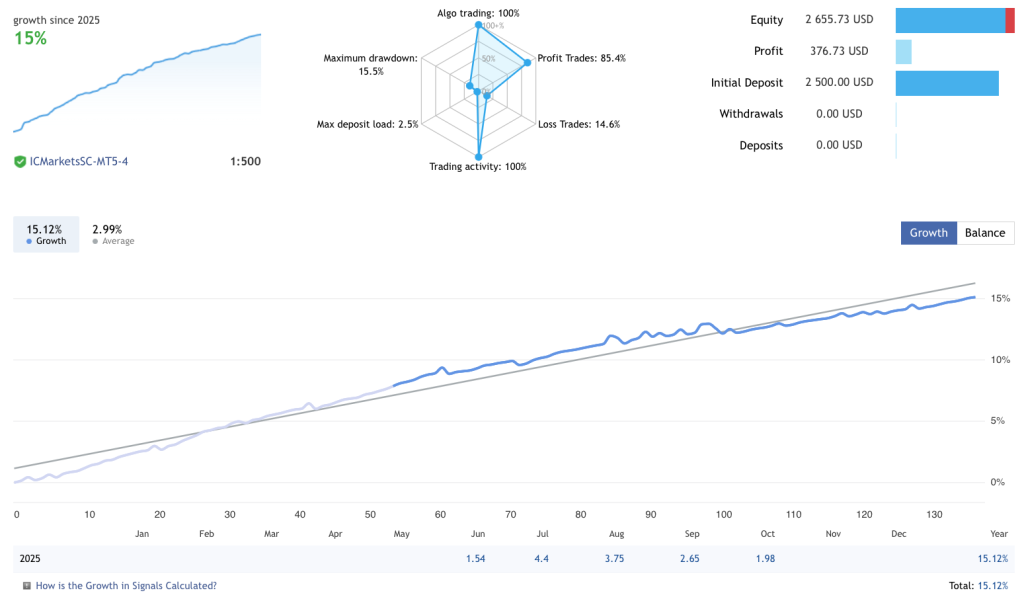

While the EA does not guarantee success, and results can vary based on usage and market conditions, the flexible structure of the Adaptive Forex Trading EA is designed with today’s dynamic environment in mind. It can be adjusted as conditions change, and its multi-pair strategy may be useful for those seeking broader market exposure without needing to watch multiple charts manually.

Whether a trader finds it effective will largely depend on how it’s configured and what expectations are set. Still, for those looking for a potentially adaptive response to a fast-changing market landscape.

Ultimately, the Adaptive Forex Trading EA represents one of many ways traders are responding to a global economy where the old rules often no longer apply, and where flexibility and risk management remain critical.

Conclusion

This Forex Trading EA isn’t promoted as a magic bullet for beating the forex markets. Instead, it attempts to provide a framework that responds to volatility with a blend of broader market coverage, group based risk protection, and adjustable settings. For some, it might serve as a useful part of their trading system. For others, it may require more familiarity and active management than initially expected.

Traders considering this Adaptive Forex EA should carefully test it on demo environments and evaluate how its structure fits with their risk tolerance and trading goals. In today’s fast changing markets, adaptability is certainly valuable, but tools remain just one part of a much larger decision-making process.