The Dark EA is an automated trading solution designed for the Metatrader 4 platform. Marketed as a “set-and-forget” system, this EA Trading Strategy utilises a unique non-linear formula for market entries without relying on dangerous recovery methods like Martingale.

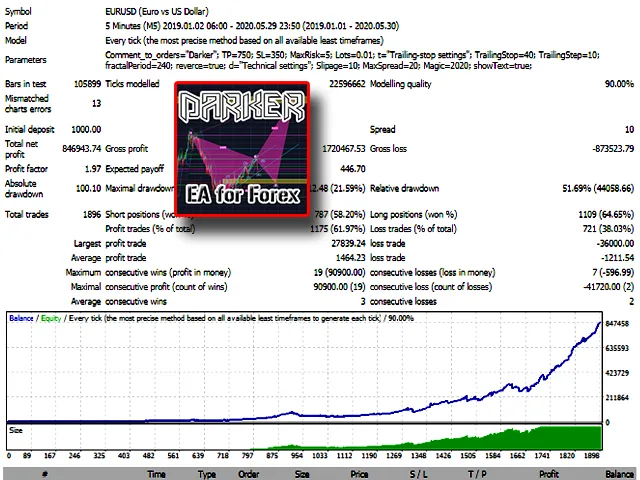

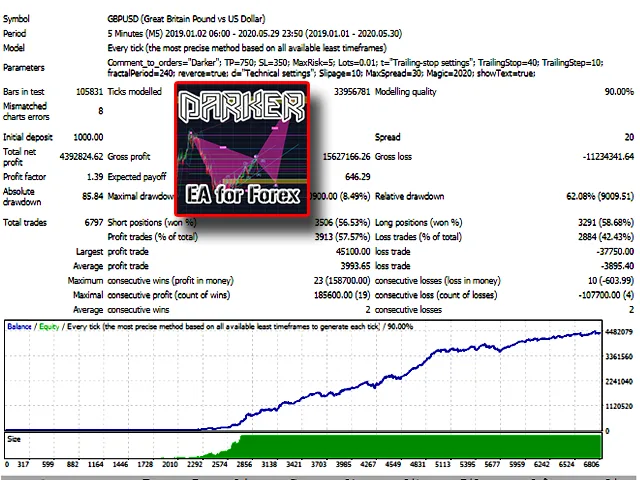

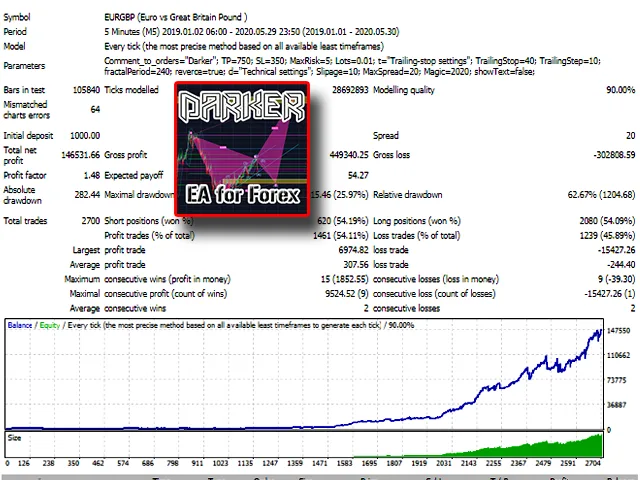

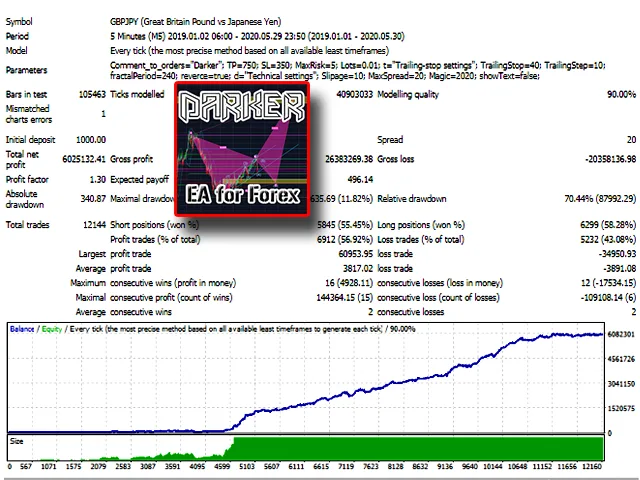

This article provides a neutral technical analysis of the strategy, a breakdown of its backtest performance, and a comparison between the developer’s descriptions and the actual trading logs.

Developer Claims & Features of Dark EA

According to the documentation, the Dark EA operates on a specific set of principles designed to minimise user intervention while maximising stability.

Key Features

- Non Linear Entry Logic – Uses a unique formula to calculate entry points rather than standard indicators.

- Safety First – Explicitly states it does not use volume increases (Martingale) to recover losses.

- Risk Management – Mandatory Stop Loss (SL) and Take Profit (TP) on every trade.

- Spread Protection – Includes a spread filter to pause trading during high volatility or broker manipulation.

- Optimised Pairs – EURUSD, GBPUSD, GBPJPY, EURGBP, EURJPY.

- Timeframe – M5 (5-minute chart).

- Plug-and-Play – No optimisation or .set files required.

Please test in a demo account for at least a week first. Then, please familiarize yourself with and understand how this Robot Trading Strategy works before using it in a real account.

Recommendations

- Minimum cent account balance of 1000$.

- Works best on GBPUSD, GBPJPY, EURUSD, EURGBP, EURJPY (Work on any Pair).

- It works best on M5. (Work on any TimeFrame)

- VPS (Virtual Private Server) – Mandatory. The frequent order modifications require a <10ms latency connection to the broker. (Reliable and Trusted FOREX VPS – FXVM)

- Account Type – ECN or Raw Spread account. Do not use Standard accounts with high spreads. (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

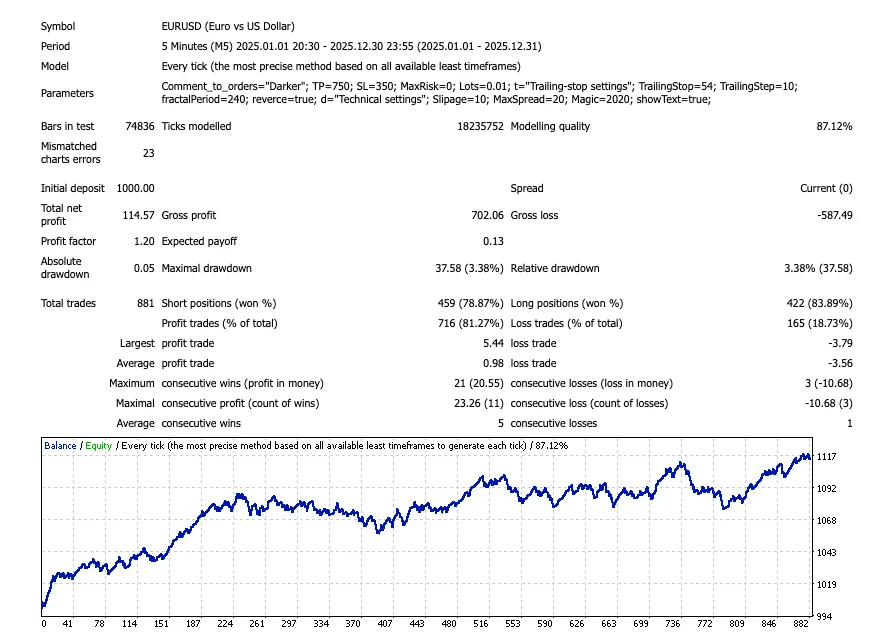

Technical Analysis of EA Trading Strategy

We analyzed how the EA works to verify the claims made about this EA Trading Strategy. Below is the breakdown of the actual trading behavior observed in the data.

1. Verification of “No Martingale”

Claim – The EA does not increase transaction volume to block unprofitable positions.

Analysis – The transaction logs confirm this claim. Throughout the testing period, the lot size remained consistent (e.g., 0.01 lots) across consecutive trades. There is no evidence of a geometric progression (0.01, 0.02, 0.04) typically associated with Grid or Martingale systems. This indicates a fixed-lot or risk-based money management system, which is significantly safer for lower equity accounts.

2. The “Unique” Exit Algorithm

Claim – Uses a unique algorithm for fixing the result of work.

Analysis – The log files reveal a very specific behavior regarding order modification.

- Observation – The logs show frequent

modifycommands occurring within the same minute (e.g.,2025.12.18 17:40). - Mechanism – The Dark EA employs an aggressive Dynamic Trailing Stop.

- Example An order at

1.17194had its SL modified from1.17229to1.17240within seconds.

- Example An order at

- Interpretation – Once a trade moves into profit, the strategy aggressively moves the Stop Loss to a breakeven plus profit position. It then “trails” the price very tightly. This explains the “fixing the result” claim, it attempts to lock in micro-profits rapidly rather than waiting for a distant Take Profit target.

3. Entry Logic & Discrepancies

Claim: Unique non-linear formula.

Hypothesis: While “non-linear” is a vague marketing term, the behaviour on the M5 timeframe combined with the tight trailing stop suggests a Mean Reversion or Volatility Breakout strategy.

- How it likely works – The EA Trading Strategy detects a spike in volatility (non-linear price movement). It enters in the direction of the momentum. If the momentum sustains, the trailing stop rides the wave. If the price snaps back (common in “choppy” markets), the tight SL cuts the trade.

- Discrepancy Check – The description implies a “set and forget” calmness, but the logs show hyper-active management. Users should be aware that this strategy generates high server load due to constant modifications.

Performance Summary: Pros & Cons

Based on our tests and the operational logic of the Dark EA

Pros

- Low Drawdown Risk – By strictly avoiding Martingale and using tight Stop Losses, the risk of blowing an account in a single trend is minimal.

- Profit Locking – The aggressive trailing stop ensures that winning trades rarely turn into losing trades.

- Broker Protection – The spread filter is crucial for this M5 strategy, preventing entries during expensive liquidity gaps.

Cons

- Execution Risk – The strategy relies heavily on the speed of order modification. High latency (ping) or a slow broker could result in the trailing stop failing to trigger, leading to losses where backtests showed wins.

- Broker Sensitivity – ECN brokers with commission might eat into the profits if the “micro-wins” (e.g., 1-2 pips) are too small to cover the spread + commission.

- Curve Fitting Warning -+ “No optimization required” often implies the parameters are hard-coded inside the EA. If market conditions change (volatility shifts), the hard-coded values may stop working, and the user has no external settings to adjust them.

- Read More Forex Vantage EA FREE Download

Conclusion

The Dark EA appears to be a legitimate scalping tool that honors its promise of avoiding Martingale. Its strength lies in its aggressive trade management and profit-locking mechanism. However, this EA Trading Strategy is not a “magic bullet.” Its success is highly dependent on broker conditions (spread/latency). It is recommended for traders who have access to low-latency VPS environments and competitive ECN brokers.

cannot download

@silent unable to download

same here

does not wanna download

it appears it leads to the link for Vantage EA to download! its NOT Dark EA….

hello ADMIN, download link leads to FOREX VANTAGE EA, please fix it

Fixed Please try again now.

Not working, invalid license!

invalid license. please fix admin.

the download is working now, everyone

thank you admin

yes the download is working, but the license is not valid, it does not work on the chart. please fix admin. thank you!

it opens trades for me

is this even real? hows the result?

Invalid License please do fix this!

its trading all the pairs in the recommendations, with the recommended settings, but mostly losses for now, been 2 days

Don’t you get an error that says invalid license? How did you fix that ?

Don’t you get an error that says invalid license? How did you fix that ?

Shyt

i never got any errors, didnt have to fix anything

i am running it on axi trader demo

3 days now and not looking that great, still in minus

hello dear editor i lost download links on every item. only articles to read!!

I would really like the source code for this.