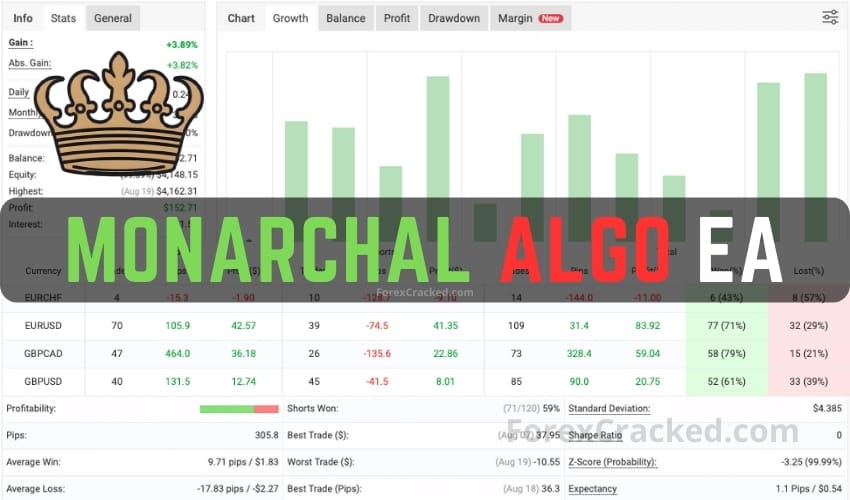

The Monarchal Algo EA is a MetaTrader 4 expert advisor developed with a focus on risk-managed automation. Utilizing averaging and hedging strategies, this EA is structured to assist traders seeking a methodical, rules-based approach to navigating sideways or choppy markets. Positioned as a tool for both beginner and experienced traders, Monarchal Algo aims to offer precision through customizable controls and automation logic.

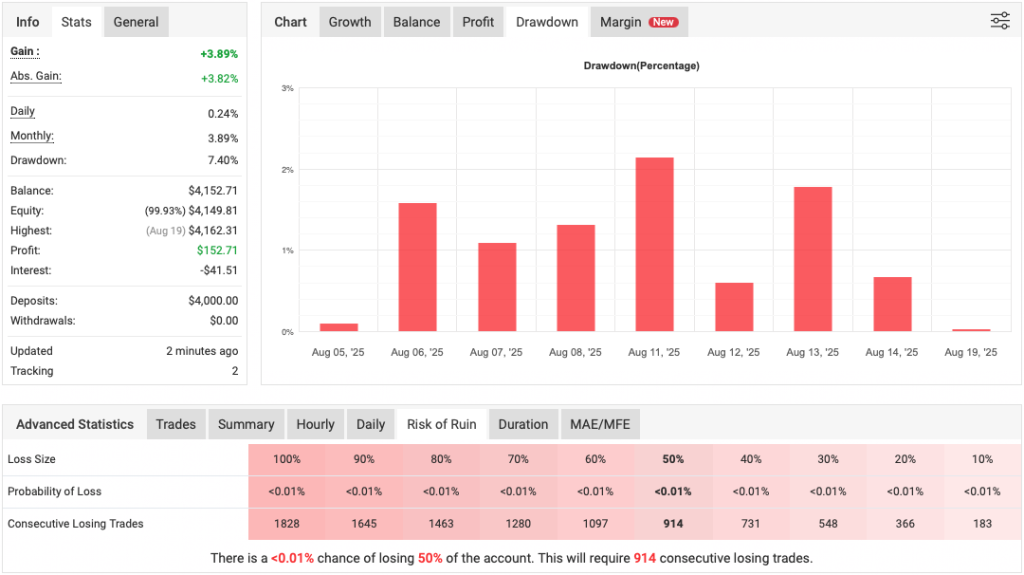

This MetaTrader 4 expert advisor is not designed for breakout or momentum trading strategies. Instead, its core function is centered around trade recovery through averaging and hedging techniques. When the market moves against a trade, the EA can open additional positions at calculated intervals, adjusting lot sizes based on predefined multipliers. This method aims to capitalize on market retracements or mean reversion patterns. However, it can also be highly dangerous and lead to significant drawdowns.

The hedging component helps to manage exposure by balancing open positions under certain conditions. Meanwhile, the EA’s filtering mechanism works to evaluate market behavior before initiating or stacking trades.

Features of MetaTrader 4 Expert Advisor

- International Compatibility – The algorithm has reportedly been tested across a range of brokers and is said to perform across varied trading environments. While results may differ across institutions and execution models, its adaptability is a key part of this MetaTrader 4 Expert Advisor design identity.

- Automated Trade Management – Once active, Monarchal Algo can fully handle position entries, set stop loss and take profit levels, and manage trailing stops according to user specifications. These trading operations are carried out continuously during trading hours, offering users a largely hands-off experience.

- Risk Management Tools – Built-in risk management includes adjustable lot sizes, equity protection functions, and limits on the number of open trades. Users can also define the maximum drawdown level they are willing to tolerate. While not foolproof, these features are intended to provide a structured framework for capital preservation.

- Configuration and Control – Monarchal Algo EA gives traders access to a range of adjustable parameters including:

- Entry Distance between trades

- Lot Multiplier for scaling up position sizes

- Maximum Number of Open Trades

- Take Profit and Stop Loss Levels

- Trailing Stop Parameters

These modular options allow for tailoring the EA’s behavior to align with different trading preferences and risk appetites.

Please test in a demo account for at least a week first. Then, please familiarize yourself with and understand how this Monarchal Algo Robot works, and only use it in a real account.

Recommendations for Monarchal Algo

- Minimum cent account balance of 100$ or equivalent standard account.

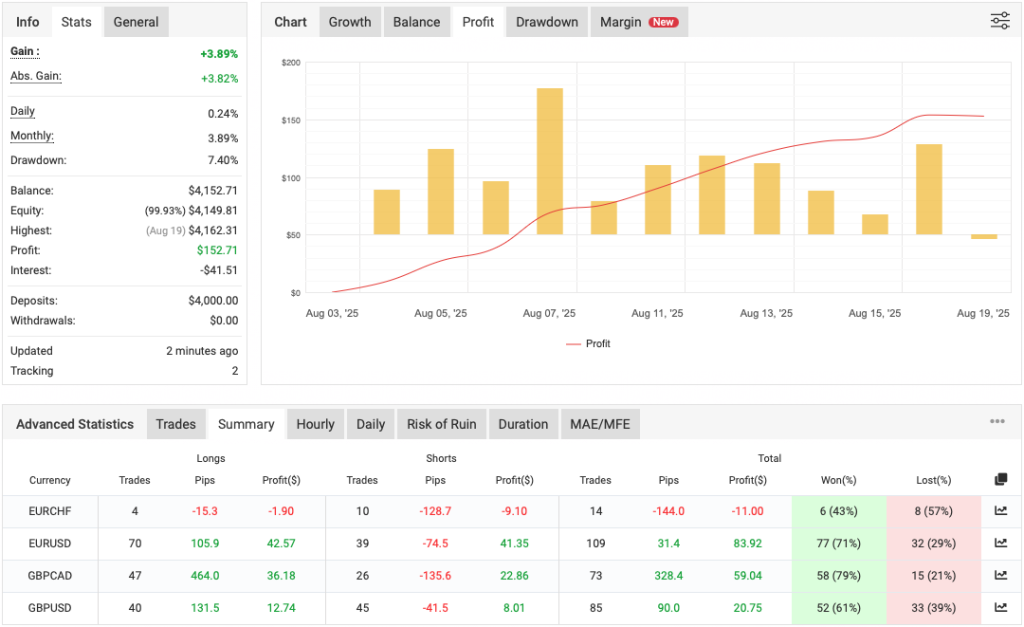

- Works Best on EURUSD, GBPUSD, GBPCAD, EURCHF. (work on any pair)

- It works best on the H1 Timeframe. (work on any timeframe)

- The Monarchal Algo EA should work on VPS continuously to reach stable results. So we recommend running this MetaTrader 4 Expert Advisor on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- The FREE Trading EA is NOT sensitive to spread and slippage. But we advise using a good ECN broker (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

- Read More Eagle Scalper – Best Forex Indicator

Conclusion

Monarchal Algo EA presents itself as a systematic tool for those interested in automated trading strategies that rely on mean reversion and market range behavior. With a blend of averaging, hedging, and dynamic trade management, it offers a structured alternative to discretionary trading, particularly for users who prefer logic-driven automation.

That said, this MetaTrader 4 Expert Advisor reliance on trade stacking and increasing exposure means it may not be suitable for all market conditions or trader profiles. As with all trading tools, careful configuration and real-time monitoring remain important components of effective implementation.