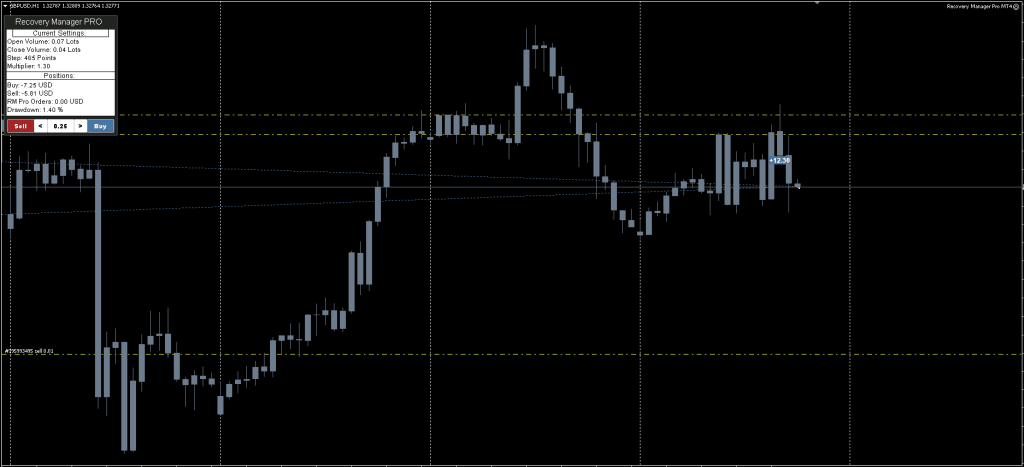

Recovery Manager EA designed to help traders recover from drawdowns. It works by managing losing positions, either from other automated advisors or from trades opened manually by the user. The EA offers a fully automated system that starts working once a pre-set level of drawdown occurs.

Recovery Manager EA operates in two main modes: drawdown recovery mode and standby mode. In standby mode, it monitors trading activity and waits for a drawdown to happen. Once a drawdown reaches a certain threshold, It intervenes by taking over order management.

In this situation, it disables the other EA, locks the losing positions, and starts a recovery process. This recover from drawdowns includes opening averaging orders (additional trades in the same direction as the original losing trade) and using partial closures to reduce negative positions.

The system uses several technical techniques to manage trades,

- Smart averaging – A method of spacing out additional entry points to reduce the average entry price.

- Locking – Placing counter-trades to hedge losses temporarily.

- Partial closure – Gradually closing parts of a losing trade as conditions improve, instead of closing the entire position at once.

EA also includes a custom trend indicator. This indicator helps the EA determine market direction and adapt its trading decisions accordingly.

Key Features of Recovery Manager EA

Here are the main capabilities of Recovery Manager EA,

- Designed to restore drawdowns from losing positions.

- Begins operating when a user-defined drawdown level is reached.

- Uses techniques like partial closure and averaging to manage recovery.

- Can handle both manually placed trades and trades from other automated advisors.

- Follows a trend-based logic using a custom indicator.

- Can manage both single trade positions and a grid of multiple trades.

- Runs on the symbol (currency pair or asset) currently selected.

- Adjusts its operation based on a selected risk level.

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this Recovery Manager Robot works, then only use it in a real account.

Recommendations to Recover from Drawdowns

Using an EA like Recovery Manager EA can be part of a larger strategy to recover from drawdowns. Here are some general recommendations to consider when managing or Recover from Drawdowns,

- Evaluate the Cause of the Drawdown

Identify whether the drawdown resulted from poor strategy performance, market conditions, or over-leveraging. This helps determine whether to keep using the same approach or make changes. - Use Standby Mode Wisely

If you’re operating multiple EAs, activating the EA in standby mode allows it to intervene only when needed. This can minimize interference during normal trading while still offering a safety net. - Test Before Live Deployment

It’s important to test Recovery Manager EA using historical data and the visualization tool in MetaTrader to understand how it behaves during different market conditions. - Adjust Risk Settings Properly

Risk control is crucial, especially when trying to recover losses. EA allows users to set risk levels, so ensure these match your account size and tolerance. - Avoid Adding New Risk During Recovery

Allow EA to handle recovery without introducing new trades or activating new EAs. Mixing strategies during recovery can complicate management and reduce the likelihood of success. - Consider Manual Intervention Only if Necessary

Although EA is automated, monitoring progress is recommended. In certain cases, manual decisions such as adjusting order size or pausing new trades may be beneficial. - Stay Informed About System Behavior

Read the instructions, understand how Recovery Manager EA behaves in different phases (initialization, locking, partial closure), and know what actions it will take before letting it operate on a live account.

Download a Collection of Indicators, Courses, and EA for FREE

- Read More TH100 Elite Indicator FREE Download

Conclusion

Recovery Manager EA is intended for traders who want automated help when trades go against them. It is built to take over when losses grow beyond a certain limit, Recover fromDrawdowns through averaging, locking, and partial closures. Its trend-based strategy and standby mode allow it to remain inactive until needed, making it suitable for traders using other advisors or trading manually. While EA is not guaranteed to eliminate loss altogether, it provides tools aimed at improving the chances of deposit recovery during drawdowns.

Good tool! I liked the mechanism that automatically calculates the risk of operations. This is very useful because it prevents you from making mistakes in this calculation. I’ve tried several similar ones: Open Lock EA, Brainy Locker EA, Hedging Zone Recovery EA, AW Recovery EA, Forex Free Zone Recovery EA, and RobotFX Auto Recovery EA. But in my opinion, the best of all is the RobotFX tool, which works with hedging “channel” instead of averaging. Good luck!

Does someone know how it can be set in good settings for a $1000 gold account?

For Gold, choose the risk and adjust the TAKE PROFIT, “…setting at least two spreads to avoid accidental slippage. The value is measured in points.”

[…] Automated Recovery – The grid system successfully recovered losing initial entries without blowing the account in this specific data set. […]

I used this EA on XAUUSD with a $1,000 account, setting the recovery trigger at 15% drawdown.

The setup was very well planned:

I ran my own EA on one chart, which performs exceptionally well in ranging markets and low-volatility conditions.

On a second chart, I deployed the Recovery EA as a protection and recovery layer.

Once my account drawdown reached 15%, the Recovery EA automatically disabled all other EAs and took full control. It executed the recovery process smoothly and recovered the entire $150 loss within just one hour. Most importantly, it closed all trades in net profit, without overexposure or unnecessary risk.

From a risk-management and capital-protection perspective, this EA performed exactly as intended. The automation, timing, and recovery logic were precise, making it an excellent tool for drawdown control on volatile instruments like Gold (XAUUSD).

i can guide anyone like to use it.

Hi, what configuration do you use to perform a recovery in XAUUSD? What timeframe?