The Forex Market Sentiment Indicator is a technical analysis tool available for traders using the MT4 and MT5 platforms. Designed to combine price and volume data over various anchored periods, the Forex Liquidity indicator aims to provide an enhanced understanding of market behavior by visualizing liquidity and sentiment levels directly on the chart. It does not guarantee predictive accuracy but instead serves as an additional analytical resource for those looking to assess areas of market interest.

Key Functions of Liquidity Sentiment Profile

At its core, the Liquidity Sentiment Profile indicator integrates two primary market concepts:

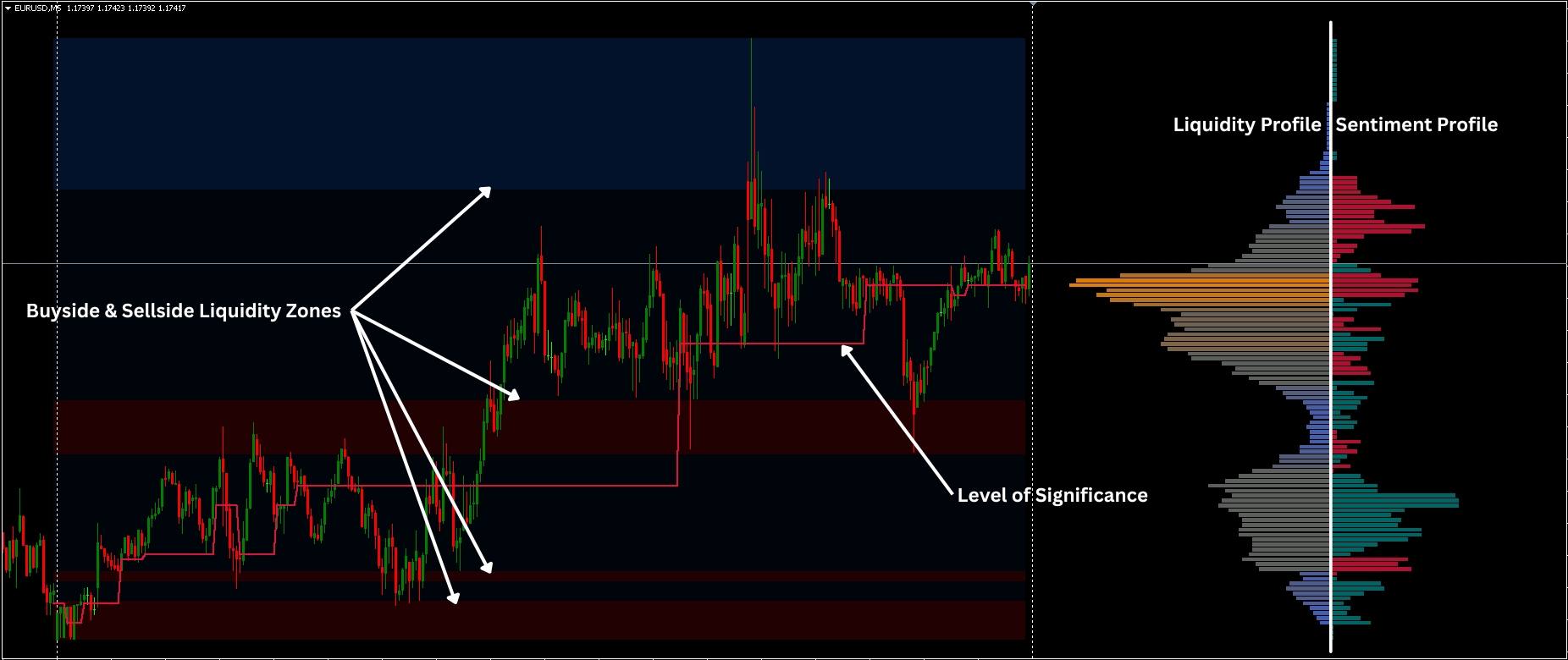

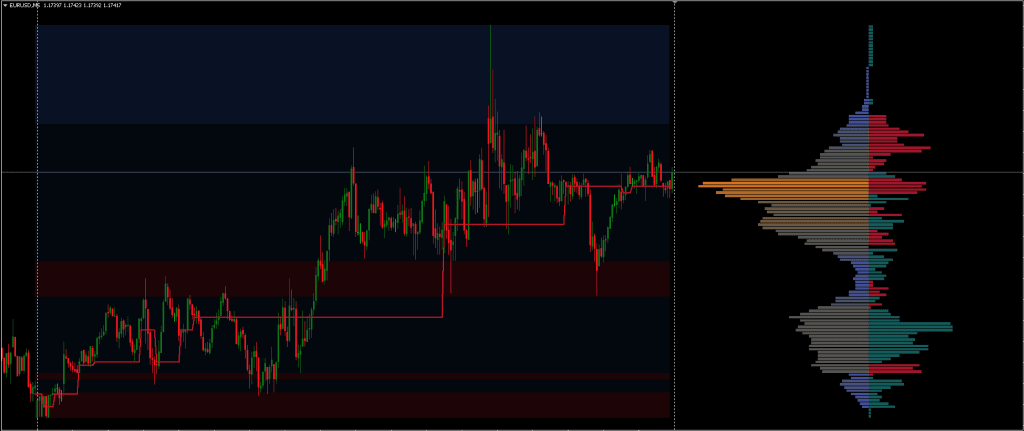

- Liquidity Profile – This represents the concentration of trading activity at specific price levels. Essentially, it shows where trading volumes have been the most and least dense, helping users see the most “active” price regions over a selected period.

- Sentiment Profile – This shows the relative buying and selling pressure at different price levels. By examining shifts in sentiment, traders can attempt to interpret whether a particular price zone is being favored by bulls or bears.

The Forex Market Sentiment Indicator builds on an earlier version known as the Liquidity Sentiment Profile by introducing customizable anchoring periods. This enhancement enables users to adapt the tool to various trading strategies, ranging from short term scalping to long term positional trading.

This Forex Liquidity indicator for MT4 isn’t a standalone trading indicator System. Still, it can be handy for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

How Forex Market Sentiment Indicator Works

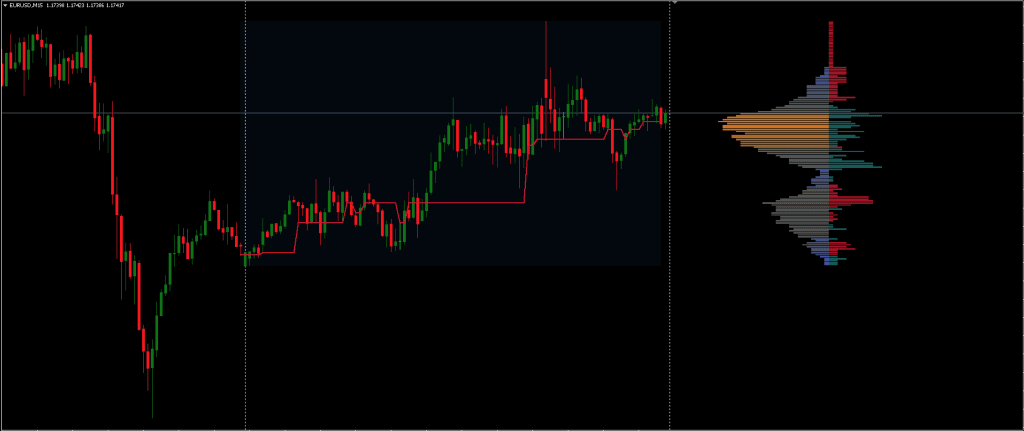

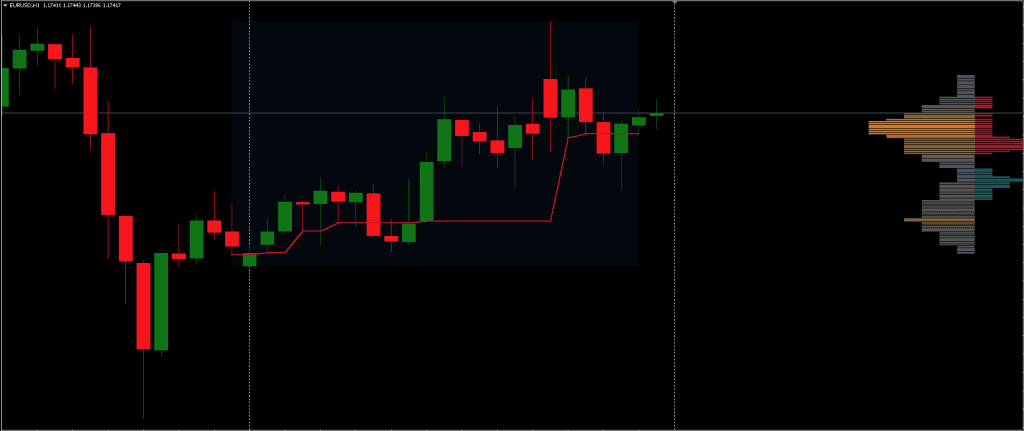

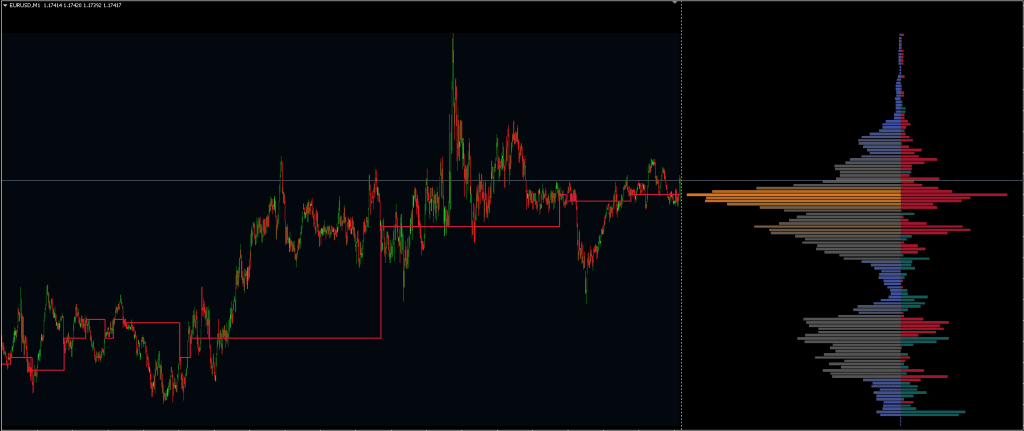

Upon application to a chart, the Liquidity and Market Sentiment Indicator generates histograms or profiles along the price axis:

- The right side of the profile shows the liquidity distribution, indicating where heavy trading concentrations have occurred.

- The left side presents market sentiment, which can reflect whether buying or selling was more dominant at those particular levels.

Color coding is used to differentiate key zones, allowing for quicker visual analysis.

Download a Collection of Indicators, Courses, and EA for FREE

Trading with the Forex Liquidity indicator

The Forex Liquidity indicator supports trade planning by helping identify critical market levels, including:

- Support and Resistance Levels – Determined from zones with notable trading density or repeated reactions.

- Supply and Demand Zones – Highlighted through areas known as Buyside and Sellside Liquidity Zones, which suggest where unfilled buy or sell orders may exist.

- Consolidation Zones – These are price levels where the market has moved sideways with high liquidity, often signaling indecision or accumulation/distribution phases.

Additionally, a Level of Significance Line is displayed – similar to a developing Point of Control (POC). This line marks the price level with the highest trading activity during the selected anchor period, potentially serving as a dynamic reference point for ongoing market behavior.

Liquidity Sentiment Profile attempts to assist in recognizing “value areas” – price ranges where significant trading occurred. By focusing on recurring value zones, traders might identify areas where price commonly returns, offering opportunities for entry or exit depending on the broader context.

Conclusion

The Forex Liquidity Indicator for MT4 and MT5 is a data driven tool that blends volume, price, and sentiment to outline key market zones. While it can offer useful visualizations of liquidity dynamics and potential trading areas, it should not be used in isolation. Instead, the indicator is best applied alongside other methods of analysis and within a broader trading plan. Forex Market Sentiment Indicator value largely depends on the trader’s strategy, understanding of volume dynamics, and ability to interpret sentiment shifts over time.