If you’ve been staring at charts long enough, you’ll start noticing the market has a habit of repeating itself, especially around certain price levels. One of the cleanest and most reliable reversal signals I look for is the Triple Top or Triple Bottom pattern. And that’s exactly what the Triple Top/Bottom Patterns Indicator for MT4 is built to catch.

Whether you’re into scalping or swing trading, this indicator saves you the trouble of constantly scanning for these formations manually—and trust me, it does a solid job.

What Is the Triple Top/Bottom Pattern?

Before we dive into how the indicator works, let’s break this down:

- A triple top occurs when the price reaches the same resistance level three times but fails to break through it. That’s a strong sign that the bulls are losing steam, and a bearish reversal could be on the way.

- A Triple Bottom Line is the exact opposite. Price tests support three times and fail to break lower, often hinting at a bullish reversal.

Now, spotting these chart patterns in real-time can be hard, especially with all the market noise. That’s where the Triple Top Bottom Patterns Indicator comes in handy—it automatically detects these setups and marks them clearly on your chart.

Download a Collection of Indicators, Courses, and EA for FREE

How the Triple Top Bottom Indicator Works

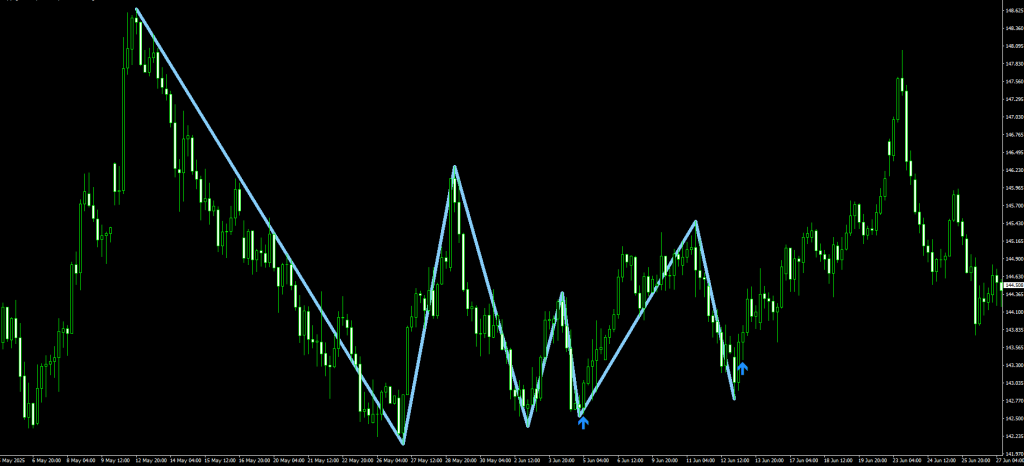

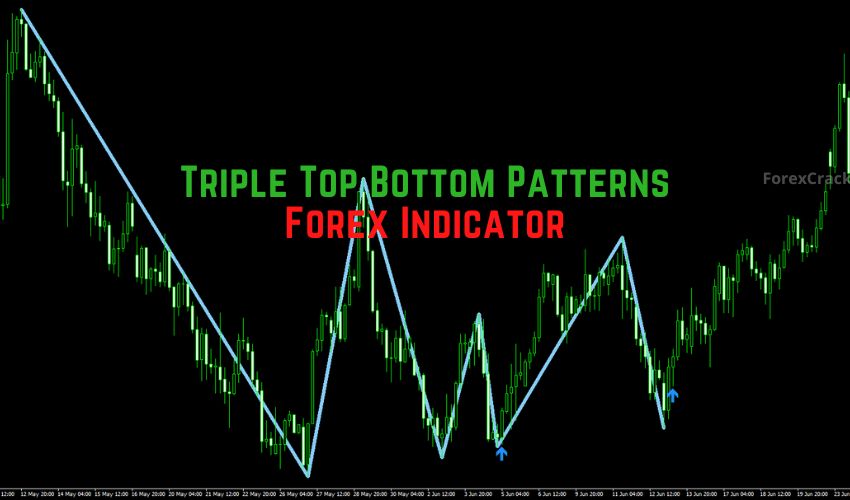

Once loaded into your MetaTrader 4 platform, this indicator scans your chart in real-time and identifies the classic triple top and triple bottom patterns.

Here’s what it does:

- Detects three clear swing highs or lows that form around the same price level

- Confirms the pattern and plots arrows to indicate a potential reversal

- Works across any timeframe and currency pair, which makes it highly versatile

What I like is the simplicity. You’ll see green arrows for long opportunities and red arrows for short opportunities—no guesswork.

How I Use It in My Trading

The indicator is great, but no single tool should work in isolation. Here’s my real-world way of using it:

1. Let the Pattern Form Fully

I always wait until the third touch is confirmed. The indicator helps here by only signaling completed triple tops or bottoms, so I’m not jumping in too early.

2. Confirm with Momentum

I usually check RSI or MACD to confirm if momentum is diverging. If the price is hitting that third level but the oscillator shows weakening strength, it’s gone time.

3. Enter with Stop Placement

For a triple top, I short after confirmation and place my stop above the highest peak. For a triple bottom, I buy and place my stop just below the lowest trough.

4. Target Previous Structure or Risk-Reward

I aim for a minimum 1:2 R/R ratio, but often, the reversal has room to run, especially if it aligns with a daily support or resistance level.

Why I Recommend This Indicator

There’s no shortage of indicators out there, but the Triple Top Bottom Patterns Indicator is one of those no-frills tools that gets the job done.

Here’s why I keep it in my toolkit:

- No repainting after confirmation

- Great for reversal trades

- Perfect for beginners and experienced traders alike

- Helps clean up chart analysis and saves time

You can run it on H1, H4, or Daily charts if you prefer swing setups—or even M5/M15 for quick scalps. It’s clean and accurate, and you don’t have to second-guess your pattern recognition.

Free Download Triple Top Bottom Patterns Indicator

Read More VR Lollipop – Trend EA MT4/MT5 FREE Download

Final Thoughts

The Triple Top Bottom Patterns Indicator for MT4 is exactly the indicator I wish I had when I started. It cuts the learning curve, helps you spot high-probability reversals, and fits perfectly into any technical strategy—especially if you love structure-based trading like I do.

If you’re serious about improving your timing and catching turning points early, go ahead and add this to your MT4 setup. It’s free to download, lightweight, and worth it.

Admin this looks good