The Auto Breakouts and Retests Indicator offers a technical approach to analyzing price behavior, focusing specifically on identifying swing points and potential breakout or retest scenarios. Available for free download, this tool is structured to assist traders in marking key levels of interest on their charts while offering a notable degree of customization.

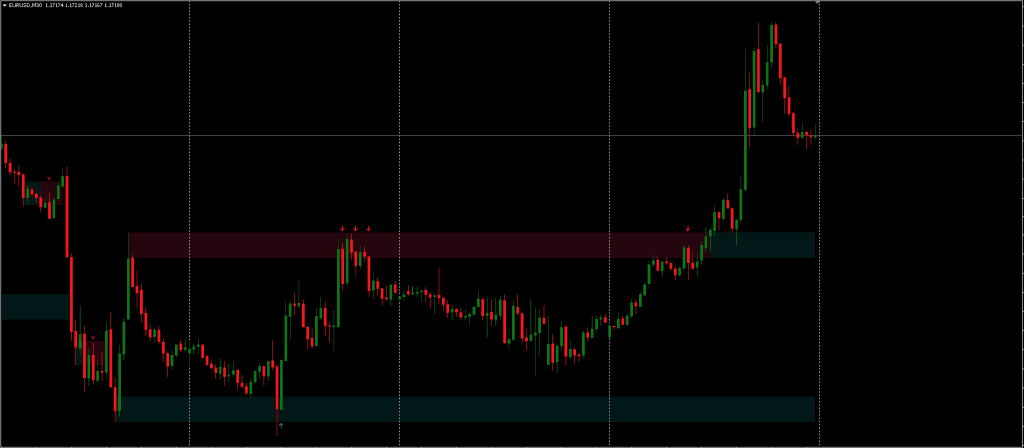

Designed to flag potential price movements, the indicator tracks swing highs and lows to establish zones where market reactions might occur. These “areas of interest” are marked visually and can change color when breakouts are detected. This visual feedback is intended to help users monitor price reactions and adjust their strategies accordingly.

The breakouts and retests areas are built around price swings, local highs and lows that may influence future movement. When these points are established, the indicator outlines configurable zones that are monitored for price engagement such as tests and retests.

Display, Patterns, and Detection of Auto Breakout

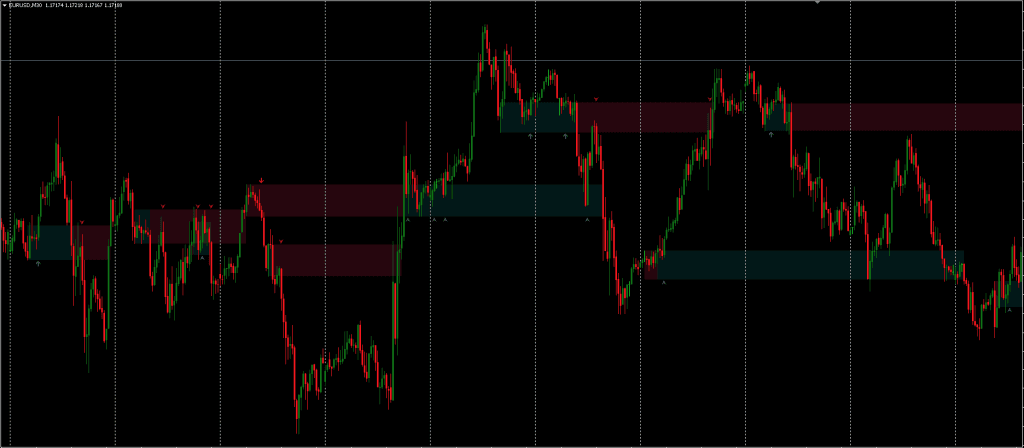

A key functionality of the Auto Breakout Indicator is the ability to display bullish and bearish swing patterns, with user-defined preferences allowing them to:

- Show both bullish and bearish patterns simultaneously

- Display only bullish or only bearish patterns

- Focus on either pattern as necessary

These display settings provide filtering options that can change the way a chart is presented, depending on the type of activity being focused on.

Breakout tests and retests markers are also built in, and users can refine how frequently these are displayed. There is a setting that limits labels to the most recent test/retest or waits for a certain number of bars to pass before identifying a new one.

Another configurable parameter is the “Maximum Number of Bars” without activity, which determines the valid period of an area of interest. This setting also includes an option to reposition the area to the last known valid test/retest, potentially keeping the signals more current.

Breakout Indicator MT5 isn’t a standalone trading indicator System. Still, it can be very useful for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

Breakout Indicator MT5 Configuration Options

The breakout tests indicator provides several settings that allow traders to tailor it to different charting preferences and trading styles. These include:

- Display – Determines the visibility of swing zones, with the ability to follow default or user selected settings.

- Width – Affects how wide the swing areas appear on the chart.

- Maximum Bars – Controls how long to consider a zone active during price inactivity.

- Display Test/Retest Labels – Options to show all labels or limit them by recency.

- Minimum Bars – Adjusts how frequently retests are displayed.

- Set Back To Last Retest – Repositions an area based on the most recent price interaction.

Swing and Style Customization

Traders can adjust swing point sensitivity using the “Swings” setting, which requires prices on either side of a core bar to meet defined visual criteria in terms of wick height. Sensitivity tweaks can impact how frequently new swing areas are formed.

Visual settings offer changes in triangle color, label sizing, and differentiation between test and retest areas:

- Bullish areas are typically shown in green

- Bearish areas are marked in red

- Solid triangles indicate tests

- Hollow triangles represent retests

These elements are controlled through the style section, which includes color and text options designed for clarity.

Download a Collection of Indicators, Courses, and EA for FREE

Trading With the Breakouts and Retests Indicator

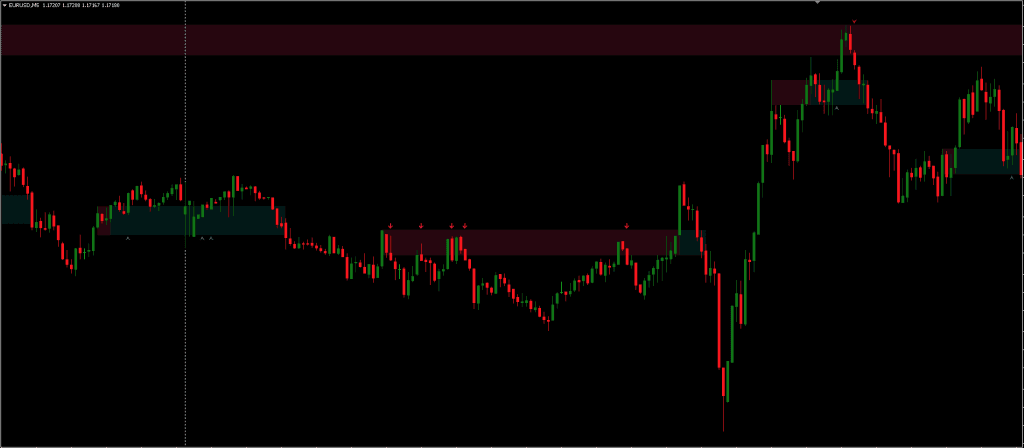

In practice, the Breakouts and Retests Indicator establishes a zone after a swing, which then becomes a focal point for future price action. When price enters this area and closes in a way that aligns with the swing direction, a test is marked. Conversely, if price closes on the other side of the swing area, it marks a breakout. If the price returns into this zone and closes in the direction of the breakout, it’s flagged as a retest.

The mechanic behind this relies on candle open and close data, meaning price wicks are ignored for decision making in these scenarios. This can influence how some price structures are interpreted by the indicator compared to traditional human analysis.

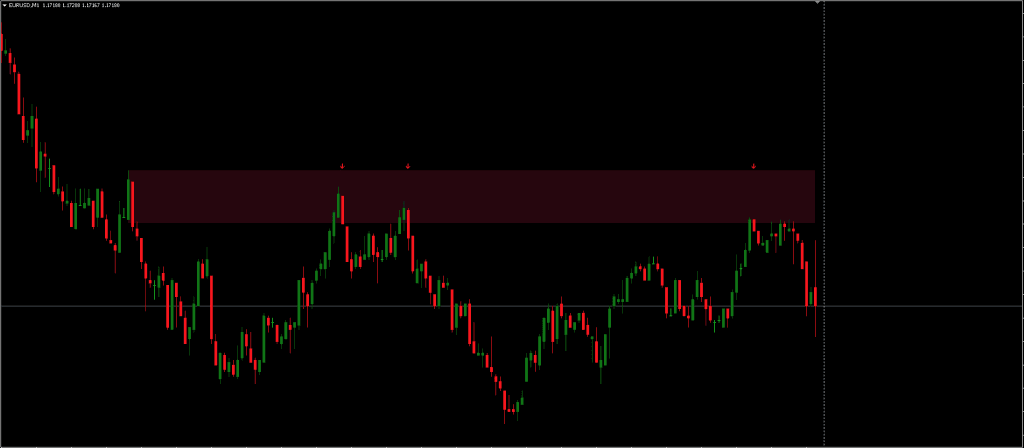

Adjusting Area Width

A configuration feature named “Width” allows the user to modify the swing area’s width. Larger values expand the area, potentially capturing additional price movements and increasing the likelihood of test and retest signals. Depending on how an individual uses the indicator, this can either clarify or clutter the chart with more zones and labels.

Conclusion

The Auto Breakouts and Retests Indicator provides a structured approach to identifying price swings and potential trading zones. Through customizable parameters, it supports a degree of flexibility for different trading styles and analysis goals. While Breakout Indicator MT5 offers several features for ongoing refinement of signals and visualization, much of breakout tests indicator utility will depend on how it’s integrated within a trader’s broader strategy and market awareness. As with many technical tools, effectiveness may vary based on settings, market conditions, and interpretation.