Finding a reliable Automated Gold Strategy can be difficult in a market flooded with high-risk bots. The Gold Cycle Trader (originally known as XG Gold Robot MT4) aims to solve this by offering a specialized solution for precious metals. Designed to trade the XAUUSD, GOLD, and XAUEUR pairs, this software is more than just a simple execution tool, it is a comprehensive system built for volatility.

The Gold Cycle Trader distinguishes itself from other algorithms by integrating features that assist manual traders, such as visible Weekly Gold Levels. Whether you are looking for fully automated execution or supportive analysis tools, this Automated Gold Strategy claims to offer a professional edge. Below, we provide a neutral, in-depth analysis of its mechanics, strategy tester performance, and execution logic.

Note: The EA is available for free download at the bottom of this article.

Key Features of the Gold Cycle Trader

The Gold Cycle Trader comes packed with customizable settings, making it a flexible choice for traders seeking a robust Automated Gold Strategy.

- Optimized Trading Pairs – Specifically tuned for the unique movements of XAUUSD, GOLD, and XAUEUR.

- Weekly Gold Levels – A standout feature that displays minimum and maximum weekly levels on the chart panel. This visual aid makes the EA valuable even for manual analysis of support and resistance zones.

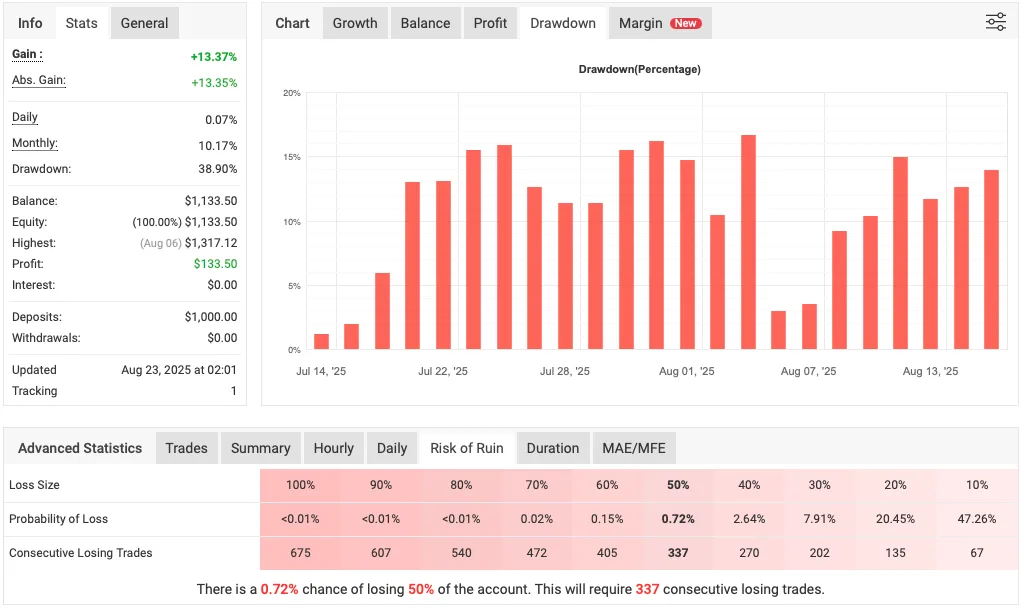

- Risk Management – The system includes a Risk percent function (auto-lot based on balance) and three selectable risk modes (Low, Medium, High).

- Advanced Filters

- News Filter – Crucial for any Automated Gold Strategy, this stops trading 60 minutes before and after high-impact news to avoid slippage.

- Spread Filter – Prevents the EA from entering trades when broker spreads widen.

- Time & Volume Filters – Defines specific trading windows and checks volume size on Gold before entering.

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this Automated XAUUSD Strategy works, then only use it in a real account.

Recommendations for Automated Gold Strategy

- Minimum account balance of 1000$.

- Designed to work on XAUUSD (GOLD) or XAUEUR.

- It works best on H1. (Work on any TimeFrame)

- Latency Matters – As with any scalping-based Automated Gold Strategy, a fast VPS is mandatory. (Reliable and Trusted FOREX VPS – FXVM)

- Spread Sensitivity – The profitability of the Gold Cycle Trader relies on tight spreads. If spreads are wide, the breakout “trap” may trigger prematurely.

- Broker Requirements – Because the EA places and modifies orders rapidly (often within the same minute), you need an ECN broker with low spreads and no restrictions on order modification rates. (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Strategy Analysis – How this Automated Gold Strategy Works

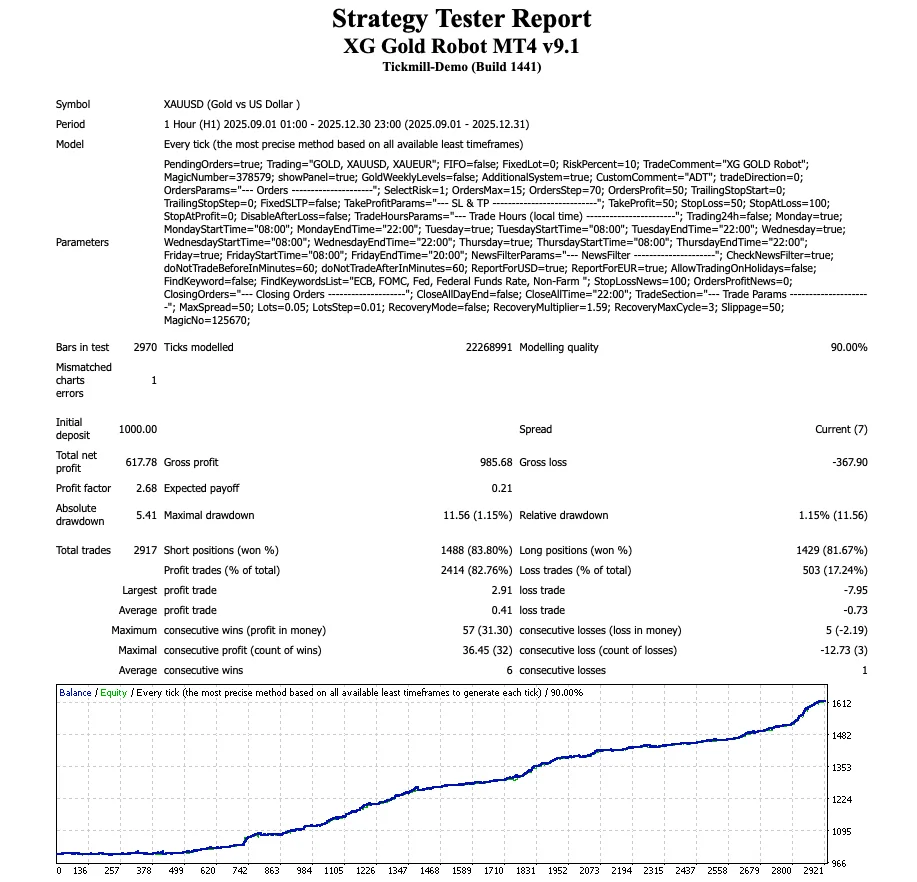

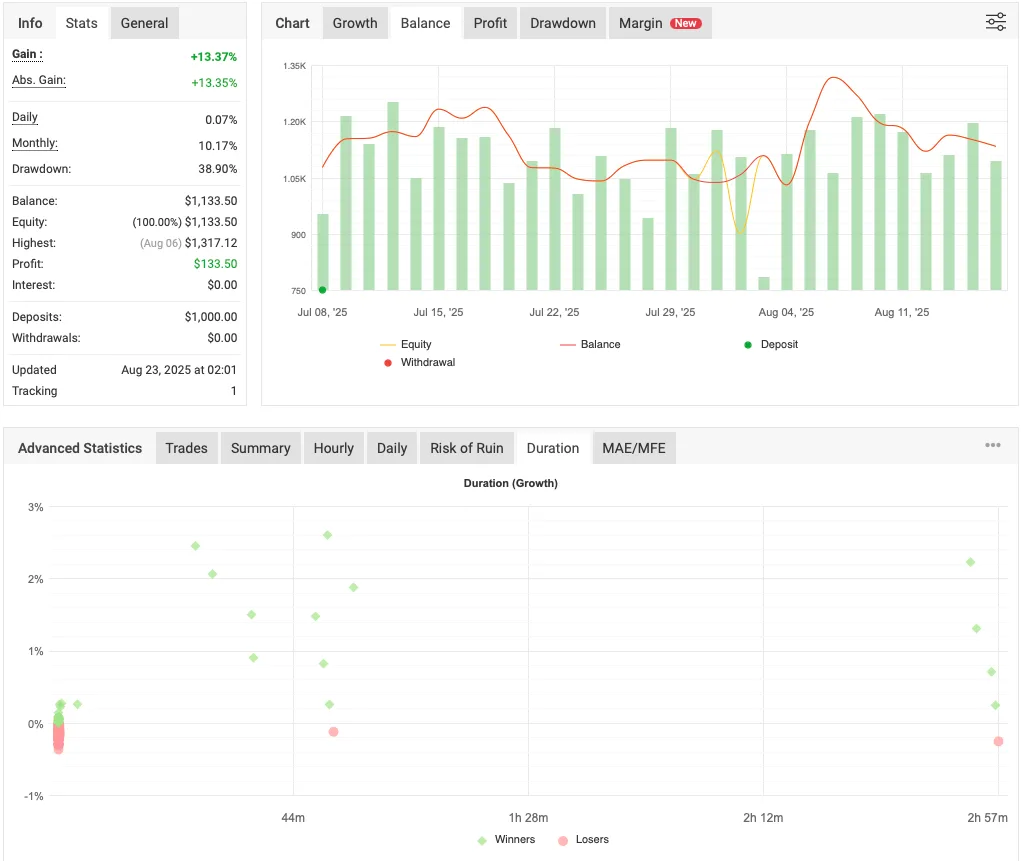

The developer describes the Gold Cycle Trader as relying on “Price Action, Cycle Strength, SMA Strength, RSI, and custom indicators.” Typically, an Automated Gold Strategy using these inputs would wait for a confirmed trend signal before opening a market order.

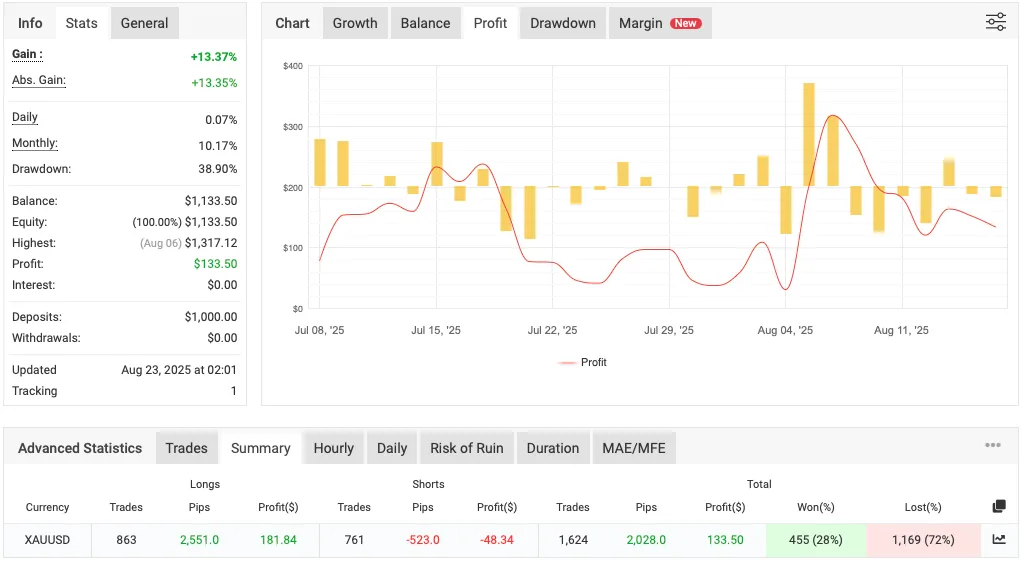

However, our analysis of the EA strategy tester reports reveals a more sophisticated execution style hidden beneath the surface.

The Pending Order Execution Logic

A closer look at the backtest logs shows that this EA does not rely on simple market execution. Instead, it uses a high-frequency pending order approach:

The EA employs a Pending Order Scalping or Breakout Trap mechanism:

- The Setup – When indicators (Cycle Strength, SMA) align, the EA identifies a potential move.

- The Trap – Rather than guessing, this Automated Gold Strategy places a Buy Stop or Sell Stop order slightly away from the current price.

- The Chase – If the price breaks out aggressively, the order triggers. If momentum fades, the Gold Cycle Trader immediately deletes the pending order to prevent false entries.

Pros and Cons of the Gold Cycle Trader

Pros

- News Protection – The built-in News Filter is essential for any Automated Gold Strategy trading XAUUSD, which is highly sensitive to economic data.

- Hybrid Utility – The “Weekly Gold Levels” panel provides value beyond automation.

- No Dangerous Grids – The EA does not appear to use dangerous Martingale recovery, making it a safer compared to grid bots.

Cons

- Broker Dependent – Success with the Gold Cycle Trader requires premium broker conditions.

- Execution Intensity – The high volume of order modifications might be flagged by some prop firms.

- Complex Logic – While marketed as simple Price Action, this Automated Gold Strategy is actually a complex breakout scalper.

Conclusion

The Gold Cycle Trader is a sophisticated tool that stands out in the crowded market of XAUUSD robots. By utilizing a pending order “trap” mechanism, this Automated Gold Strategy forces the market to prove its direction before capital is committed. While it requires a high-quality broker and VPS environment, the EA offers a professional approach to trading Gold volatility.

Please release the MT5 version

Please put set files and news url

No matter what settings I enter the results all come up the same…it losses all trades. Anyone can help with this?

useless robot

we need mt5 version! works very well on mt4

what settings do you use because I make changes to the settings and it does not change how the bot trades.