ForexCracked Gold Vortex EA is a fully automated expert advisor for MetaTrader 4, designed exclusively for scalping gold (XAUUSD) on the H1 timeframe. this EA combines a controlled martingale and averaging grid system with hard stop-loss protection on every trade. The developer describes the underlying logic using terms like “neural architecture” and “deep learning pattern recognition” claims we examine more closely below.

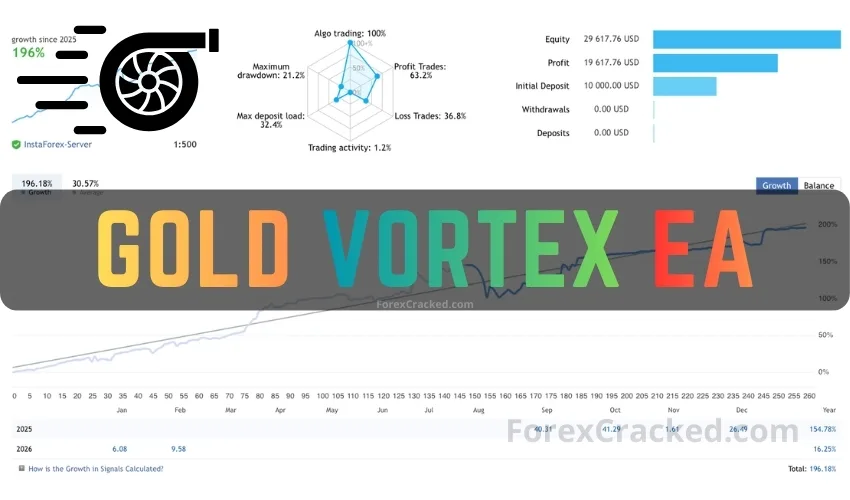

The live signal account attached to this EA shows 196% total growth over approximately 6 months (since September 2025), with a $10,000 initial deposit growing to $29,617. On the surface, those numbers are strong. However, the system’s reliance on martingale mechanics and averaging introduces a specific risk profile that traders need to understand before deploying capital. This article provides a data-driven breakdown of the EA’s live performance, an honest assessment of its “AI” marketing claims, and a direct download link for testing.

Core Strategy and Logic

Despite the heavy “AI” and “neural network” terminology in the marketing material, the actual trading mechanics of the Vortex Turbo EA are built on a well-understood foundation: controlled martingale with an averaging grid, applied specifically to gold scalping.

- Martingale + Averaging Grid – The EA opens initial positions based on its entry logic and, if the market moves against the position, adds subsequent trades at measured intervals to average down the entry price. This is the core engine behind the growth numbers, and the primary risk factor.

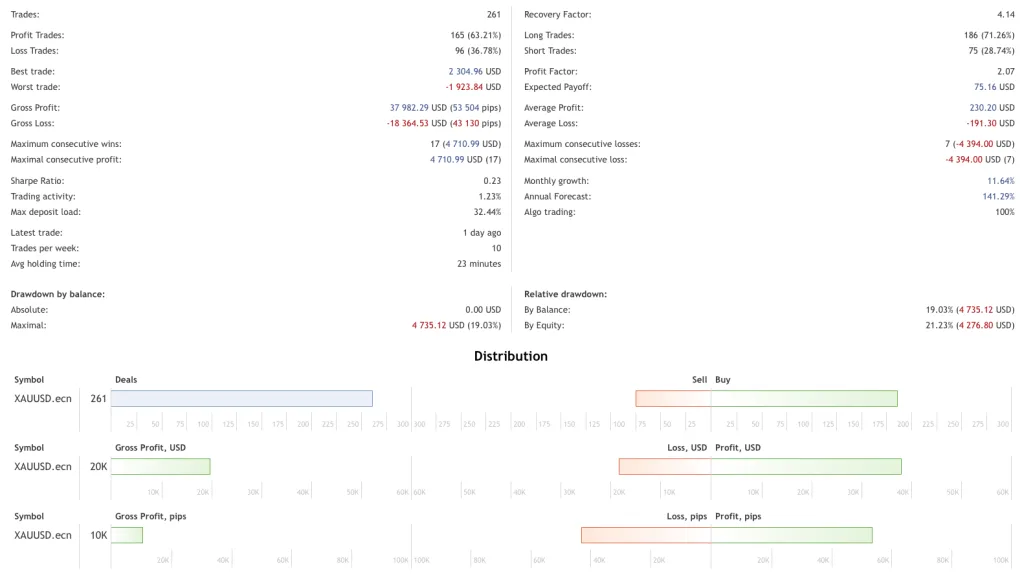

- Hard Stop-Loss on Every Position – Unlike many grid/martingale EAs that operate without any stop-loss, this system places a defined SL on every trade. The developer notes these are intentionally wide to give trades “room to breathe during volatility.” The live data confirms this, the worst single trade was -$1,923.84 USD.

- Scalping Framework – The average holding time of 23 minutes confirms genuine scalping behavior. Trades are opened and closed quickly, with the grid/averaging mechanism handling trades that don’t immediately go in the intended direction.

- Long Bias – The live data shows 186 long trades (71.26%) versus only 75 short trades (28.74%). This suggests the EA has a structural bias toward buying gold. During the tracked period (late 2024 through early 2026), gold has been in a general uptrend, which would naturally benefit a long-biased system. Whether this bias persists into bearish conditions is an open question. For a contrasting approach, the Dark Gold EA uses a more balanced directional approach to gold scalping.

- Session and Volatility Adaptation – The developer claims the EA adjusts its internal parameters in response to liquidity, volatility, and session dynamics. The live data’s low trading activity (1.23%) suggests the EA is selective about when it enters, which is consistent with some form of session or volatility filtering.

A Note on the “AI” Claims

The marketing references “Tri-Layer Neural Logic,” “deep learning,” and “predictive intelligence.” However, the observable trading behavior, averaging, grid entries, martingale sizing, is consistent with conventional algorithmic strategies, not neural network systems. The MQL5 description also references “Aura Ultimate” by name (a different EA), suggesting portions were copy pasted. Traders should evaluate this as a martingale/grid scalper with session filtering rather than an AI-powered system. Similar branding is common across the marketplace, as we’ve noted in reviews of the AI Price Action Robot.

Key Features of ForexCracked Gold Vortex EA

- Fully automated XAUUSD (gold) scalping on MT4

- Controlled martingale and averaging grid system

- Hard stop-loss and take-profit on every trade

- H1 timeframe operation

- Pre-optimized risk profiles (conservative, balanced, aggressive)

- Session and volatility adaptive filtering

- FIFO-compliant, compatible with US brokers

- Low spread ECN broker recommended

- Average trade duration: 23 minutes

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how the Vortex Turbo EA works, then only use it in a real account.

Recommendations for ForexCracked Gold Vortex EA

- Minimum account balance of $1,000 USD (developer recommended).

- Works exclusively on XAUUSD (Gold).

- Recommended timeframe: H1.

- Minimum leverage: 1:30 (low risk only); recommended 1:100 or higher. Use our Leverage Calculator to understand how leverage affects your margin requirements.

- ForexCracked Gold Vortex EA should work on VPS continuously to reach stable results. So we recommend running Vortex Turbo EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM).

- Low spread ECN account is also recommended (Find the Perfect Broker For You Here). For a broader overview of gold-optimized EAs, see our Best Gold Robot for MT4/MT5 guide.

Download a Collection of Indicators, Courses, and EA for FREE

Performance Review: Live Signal Analysis

The following analysis is based on a verified live trading signal running on an InstaForex server with 1:500 leverage, starting from a $10,000 initial deposit. All data is from the EA’s connected signal account, not backtesting.

1. Growth and Returns

| Metric | Value |

|---|---|

| Total Growth | 196.18% |

| Net Profit | $19,617.76 |

| Initial Deposit | $10,000.00 |

| Current Equity | $29,617.76 |

| Monthly Growth (avg) | 11.64% |

| Annual Forecast | 141.29% |

The account has nearly tripled over approximately 6 months (since September 2025). A 196% return is strong, but the signal runs on 1:500 leverage, which significantly amplifies both gains and losses. At standard 1:100 or 1:30 leverage, the growth curve would be substantially flatter. Model your own expectations using the Compounding Calculator.

2. Win Rate and Profitability

| Metric | Value |

|---|---|

| Total Trades | 261 |

| Win Rate | 63.21% (165 wins / 96 losses) |

| Average Profit / Loss | $230.20 / -$191.30 |

| Profit Factor | 2.07 |

| Expected Payoff | $75.16 per trade |

| Recovery Factor | 4.14 |

| Trades Per Week | ~10 (avg hold: 23 min) |

The 63.21% win rate is moderate, but the EA earns roughly 1.2x per winner what it loses per loser, producing a profit factor of 2.07, above the sustainable viability threshold. For context, the IS Best Gold EA operates in a similar range on gold. The recovery factor of 4.14 indicates the EA recovers well from drawdowns.

Notably, 71% of trades are long positions. Gold’s uptrend during the Sep 2025 – Feb 2026 tracking period naturally benefited this bias, how the EA handles a sustained gold sell off remains an open question. Traders wanting a more balanced directional approach may compare with the MT4 Gold Robot.

3. Drawdown and Risk Exposure

| Metric | Value |

|---|---|

| Max Drawdown (Equity) | 21.23% ($4,276.80) |

| Max Deposit Load | 32.44% |

| Max Consecutive Losses | 7 (-$4,394.00) |

| Sharpe Ratio | 0.23 |

A 21.23% equity drawdown is significant, the martingale/grid footprint. At peak exposure, nearly a third of the account’s margin was committed to open positions. The worst consecutive loss streak of 7 trades totaling -$4,394 shows the system can take substantial hits. Model what this means for your account using the Drawdown Calculator.

Monthly returns also fluctuate considerably, November 2025 returned only $318 compared to December’s $5,335. This volatility is typical of grid/martingale systems. Traders should assess their personal risk of ruin before deploying with real capital.ersonal risk of ruin before deploying with real capital.ccasional large drawdown events.

ForexCracked Gold Vortex EA

ForexCracked Gold Vortex EA is a fully automated XAUUSD scalping robot for MetaTrader 4 that uses controlled martingale and averaging grid mechanics with hard stop-loss on every position. The live signal shows 196% growth, a 63.21% win rate, and a profit factor of 2.07 over ~6 months of trading on gold.

✓ Pros

- 196% verified live growth over ~6 months

- Profit factor of 2.07 with recovery factor of 4.14

- Hard stop-loss on every trade

- Average profit ($230) exceeds average loss ($191)

✗ Cons

- Uses martingale and averaging — inherent account-wipe risk

- 21.23% max equity drawdown with 32.44% max deposit load

- "AI/Neural Network" claims appear unsubstantiated

- Strong long bias (71%) — vulnerable to sustained gold sell-offs

Summary

Rapid live growth numbers and a decent profit factor, but the use of martingale and averaging grid mechanics introduces elevated risk. The "AI" claims in the marketing appear to be largely cosmetic. Best suited for traders who understand grid/martingale risk profiles and can tolerate 20%+ drawdowns.

Frequently Asked Questions

Conclusion

ForexCracked Gold Vortex EA delivers objectively strong live performance numbers, 196% growth, a 2.07 profit factor, and a 4.14 recovery factor over ~6 months of verified trading on gold. The inclusion of hard stop-loss on every trade is a meaningful safety feature that many martingale/grid EAs omit entirely. However, the system’s core risk profile remains that of a martingale, averaging grid, which means the possibility of a large drawdown event, potentially exceeding the 21% already observed, cannot be ruled out during extreme gold volatility. The “AI” and “neural network” claims in the marketing should be treated as branding rather than a technical description of the system’s actual mechanics. Traders considering this EA should deploy it on a demo account first, use the recommended leverage settings, and size their accounts to withstand a 30%+ drawdown scenario before committing live capital.