The IS New Project EA is an another addition to the “IS EA” series that specifically designed for the BTCUSD pair. According to the developer, BTCUSD EA functions best with a minimum deposit of $100 and employs a scalping strategy incorporated within a grid trading model. While it’s presented as a high profit, low drawdown system, a closer look at its design and the attached Myfxbook statistics presents a more nuanced picture.

At its core, the IS New Project EA uses a grid trading strategy with wide order spacing, which means it opens multiple positions at incremental distances as price moves. Each trade includes a fixed take profit target and a trailing stop, providing a method for locking in gains on longer trades while reducing risk exposure. All trades are also protected by a defined stop loss, a standard but crucial risk management tool in an automated system.

The BTCUSD EA incorporates market filters, evaluating average bar percentage and minimum bar size before initiating trades. This mechanism aims to filter out high volatility environments or contexts deemed unsuitable for the strategy, a move to enhance selectivity and reduce unnecessary risk.

Performance Metrics of IS New Project EA

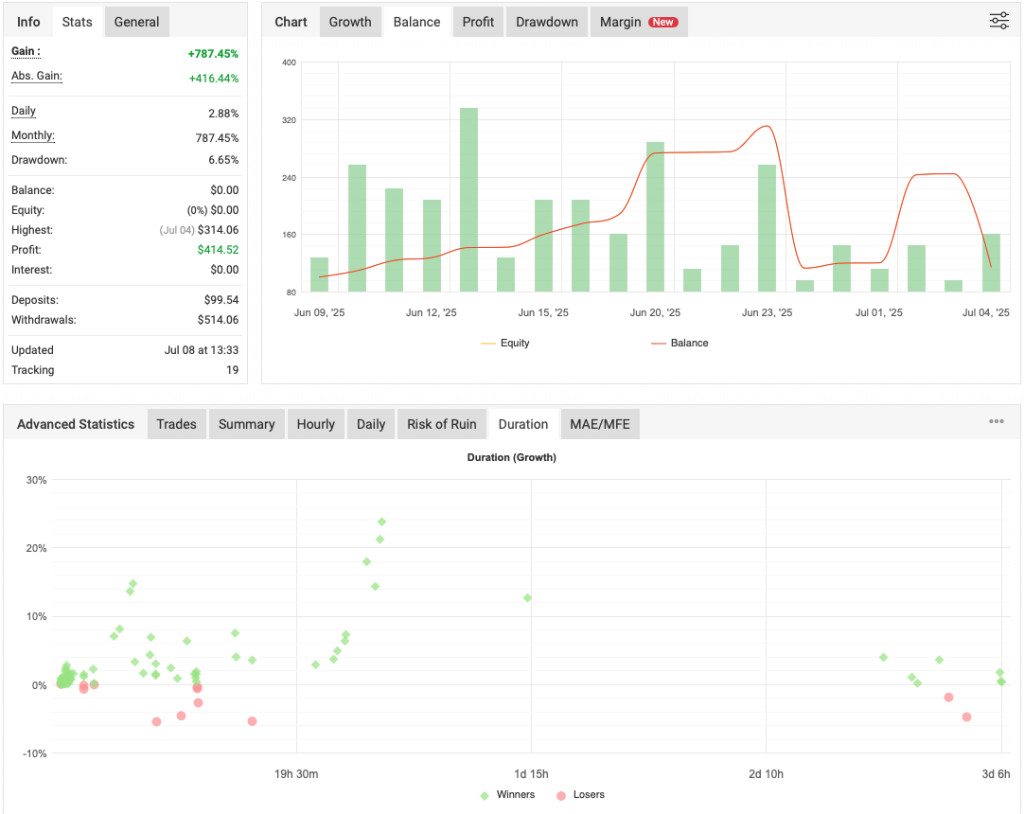

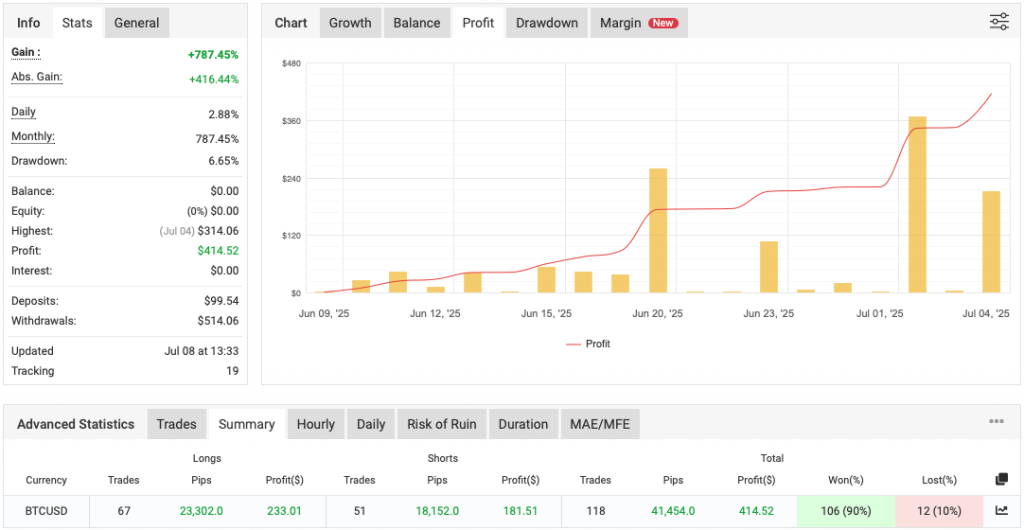

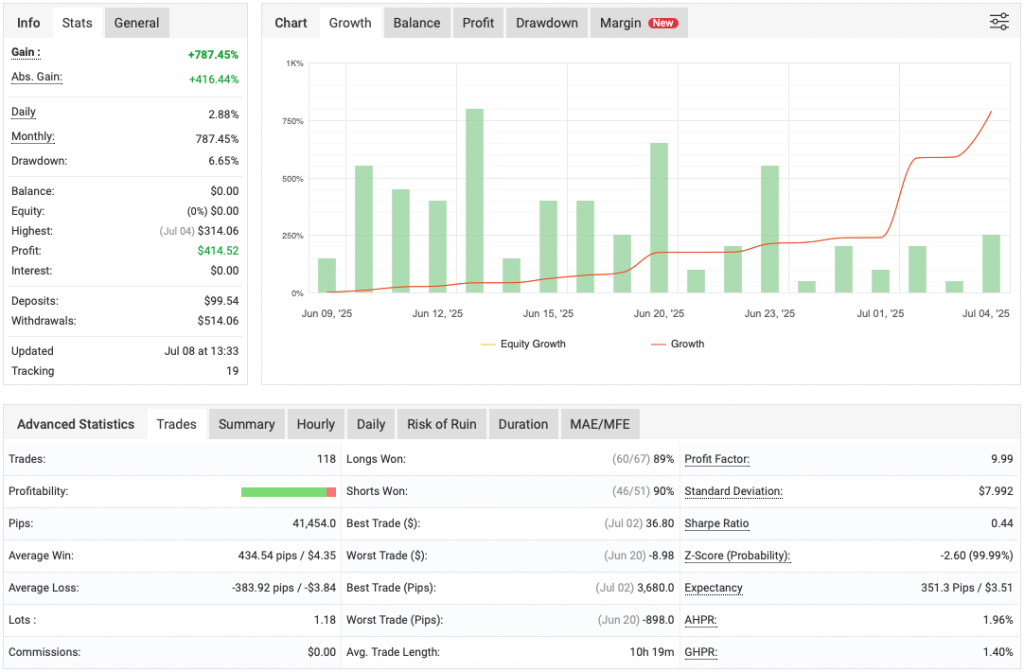

According to the IS New Project EA live Myfxbook account:

- Gain – +787.45% (absolute gain: +416.44%)

- Drawdown – 6.65%

- Profit – $414.52 on a deposit of $99.54

- Win Rate – 90% (106 wins / 118 trades)

- Profit Factor – 9.99

These numbers suggest that, over a relatively small sample of 118 trades, the EA has been extremely profitable, maintaining high win rates for both long (89%) and short (90%) positions. The drawdown remains low, hinting at a tightly controlled risk profile during this short window of activity.

From a statistical viewpoint, key values such as the Profit Factor close to 10 and a Sharpe Ratio of 0.44 imply opportunistic gains but without significant consistency in return to risk performance. The Z-score at -2.60 (with a high 99.9% significance level) might indicate some form of streak based performance, which could reflect a patterned behavior rather than purely random wins.

Please test in a demo account for at least a week first. Then, Familiarize yourself with and understand how the BTCUSD Robot works, and only use it in a real account.

Recommendations for BTCUSD EA

- Minimum account balance of 100$.

- Work Best on the BTCUSD pair. (Work on any pair)

- The default setting is not optimized well. Please use the given .set files or try to optimize it.

- Work Best on M1 TimeFrames

- To reach stable results, BTCUSD EA should work on VPS without interruption with low latency. So IS New Project EA should run on a low latency reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread, Slippage, and quick execution account is recommend for this EA(Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Observations and Considerations

There are a few important points worth highlighting without drawing conclusions in either direction:

- Initial Deposit and Withdrawals – The BTCUSD EA was funded with just under $100, which is the minimum as specified by the developer. Withdrawals exceeded $500, which technically represents a return above 400%. However, the balance as of the last update is now at zero, making sustainability over time hard to evaluate based on this sample alone.

- Short Testing Window – The trades span a relatively short testing period and a small number of total trades (118), making it difficult to determine how the system would perform in prolonged unfavorable conditions or in a sudden shift in Bitcoin market volatility.

- Use of Grid Strategy – While the grid system can be effective in managing range bound or trending environments, it often carries risk if not tightly monitored, especially in volatile environments like Bitcoin, where strong directional moves can stretch grid-based setups.

- Historical Equity vs. Withdrawals – Sharp increases in equity are evident in bursts on the charts, with prolonged periods of modest movement. Profit realization appears to occur in clusters, not a steady incline, which may suggest the IS New Project EA capitalizes on specific conditions rather than functioning well in all BTCUSD environments.

Conclusion

The IS New Project EA demonstrates strong short-term results on paper, particularly considering the restricted starting capital and the unusually high gain figures. However, it is based on a high engagement grid model with a focus on scalping, a combination that typically calls for constant monitoring or careful risk control in live conditions.

The results suggest potential for profitability, at least in favorable conditions, but the limited track record, modest sample size, and sharp equity growth patterns may raise questions about long term behavior, drawdown risk under pressure, or adaptability to varied market conditions.

In conclusion, BTCUSD EA presents itself as a well filtered, scalping oriented grid system for BTCUSD with initial success but would require a larger and longer dataset to verify consistency and robustness across market cycles.

Who is the dev of this algo ?

Why do you need this information?

hi. is this for mt4 or mt5?

MT4

No trade being open on live account, any advise?

You know why no tradeson live account? All looks ok but is not opening any trades.

[…] (Gold) market. According to the developer, this Gold Scalping Robot is an evolution of the “IS New Project EA,” refined to capture the best qualities of its predecessor while focusing exclusively on Gold […]

Yesterday i tried it on BTCUSD i used the same set file attached in the download folder, i just changed the lot size from 0.01 to 0.25

it gave me aroud 881 profit in 8 hrs. ( maximu drawdown 192) but ea can cover it easily due to Averaging trades.

friends: ANY BODY TRIED IT ON XAUUSD OR ANY OTHER PAIR????

Result is attached for my BTCUSD trading with lot 0.25