If you’ve been in the forex game for even a short while, you’ve probably been stopped out before the market moved in your direction. Sound familiar? That’s not bad luck. That’s liquidity manipulation, and now, thanks to tools like the Buyside & Sellside Liquidity Indicator by LuxAlgo, we can finally see those traps coming before we fall into them.

If you follow ICT (Inner Circle Trader) concepts or any smart money methodology, this indicator is a total game-changer. It plots real-time liquidity zones where stop hunts are likely, where institutional players are lurking, and where retail traders are often caught off guard.

What Does the Indicator Do?

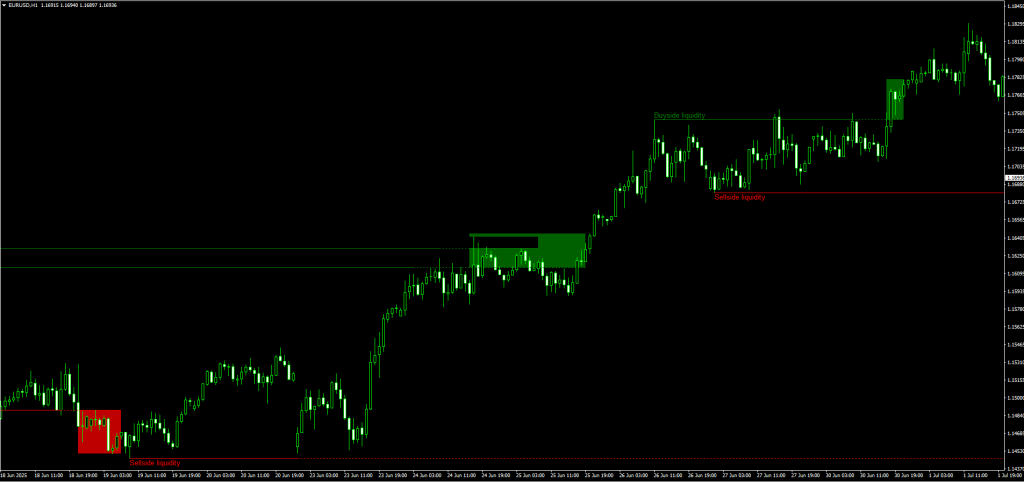

The Buyside & Sellside Liquidity Indicator highlights the most critical zones on your chart:

- Buyside Liquidity (Above Highs): Think of it as a cluster of stop-loss orders from short sellers and breakout buy orders.

- Sellside Liquidity (Below Lows): These are stop zones for long traders and potential breakout sell orders.

When price approaches these zones, expect volatility, fakeouts, and sometimes clean breakouts. Either way, something big usually happens here, and with this indicator, you’ll see those areas ahead of time.

How I Use It In My Trading

As a trader who’s made the journey from indicator chaser to price action focused Forex trader, this Forex indicator has earned a place on my mt4 chart.

1. Watch for Sweeps

If price sweeps a liquidity zone (like a buyside level above a high), I wait to see if it holds or rejects. If it rejects, that’s my cue to short—with confirmation from something like a bearish engulfing candle or a shift in structure.

2. Avoid Bad Entries

Have you ever entered a trade and wondered why it instantly reverses? That’s because you entered into liquidity, not with it. This indicator helps you avoid that by showing where not to enter blindly.

3. Confluence With Market Structure

I like to combine these liquidity zones with other concepts, such as break of structure (BOS), order blocks, or even simple trendlines. The more confluence I get, the stronger the setup.

4. Scalping & Swinging

It works just as well on M5 for scalping as it does on H4 or Daily for swings. Adjust your expectations and adjust your stop-loss placement accordingly.

Download a Collection of Indicators, Courses, and EA for FREE

Real-Time Alerts and Multi-Timeframe Support

One thing I love is the alert system. You don’t have to babysit the mt4 chart all day. Set up alerts for when the price nears a liquidity pool, and jump in when you’re ready. It works across all chart timeframes, so you’re covered whether you’re day trading or holding long term positions.

Who Should Use This?

- ICT Followers: It’s tailor-made for smart money concepts.

- Price Action Traders: Offers another layer of high-probability zones.

- Volume/Order Flow Traders: Combine it with volume spikes for sniper entries.

- Beginners: If you don’t yet understand liquidity, this tool provides a visual explanation.

Free Download Buyside & Sellside Liquidity Indicator

Read More FX Fractal MT4 Forex Indicator FREE Download

Final Thoughts

Trading is a game of probabilities, and aligning with institutional flows is one of the best ways to improve your odds. The Buyside & Sellside Liquidity Indicator helps you do just that. It doesn’t predict the market, it shows you where the game is being played, and that’s often enough.

If you’ve ever been frustrated by being “stopped out to the pip” or entering right before a reversal, this indicator will change how you see price action. It’s not just about seeing lines on a chart; it’s about understanding why the market moves the way it does.

Add this to your toolkit, combine it with your strategy, and you’ll start trading with the smart money, not against it.

can use demo for limited time?

plz add arrows at its alerts ,