The ICT Kill Zones Indicator is a trading tool designed to assist traders in identifying potentially favorable entry points based on specific time intervals known as “ICT Killzones”. Rooted in trading concepts developed by Inner Circle Trader (ICT), the indicator overlays distinct trading zones on the chart and employs Fibonacci retracement levels within these zones to provide contextual insights into potential price action.

How the ICT Killzones Indicator Works

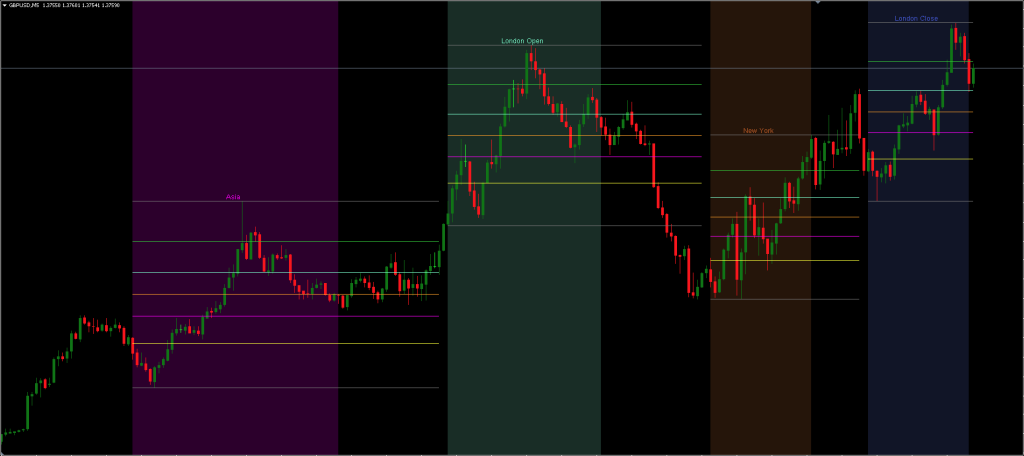

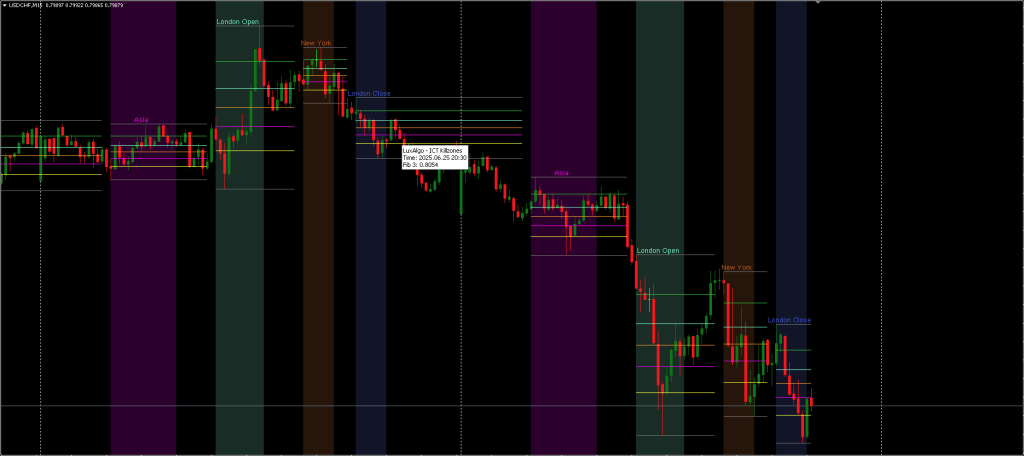

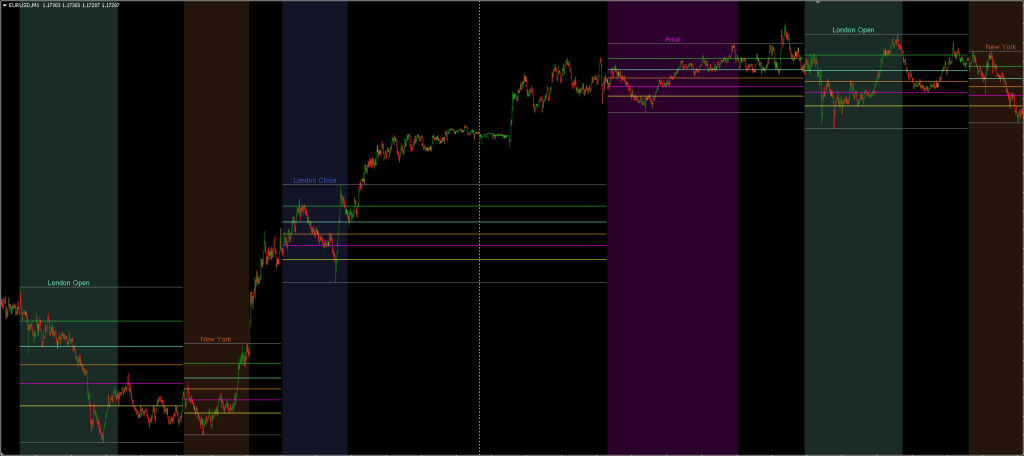

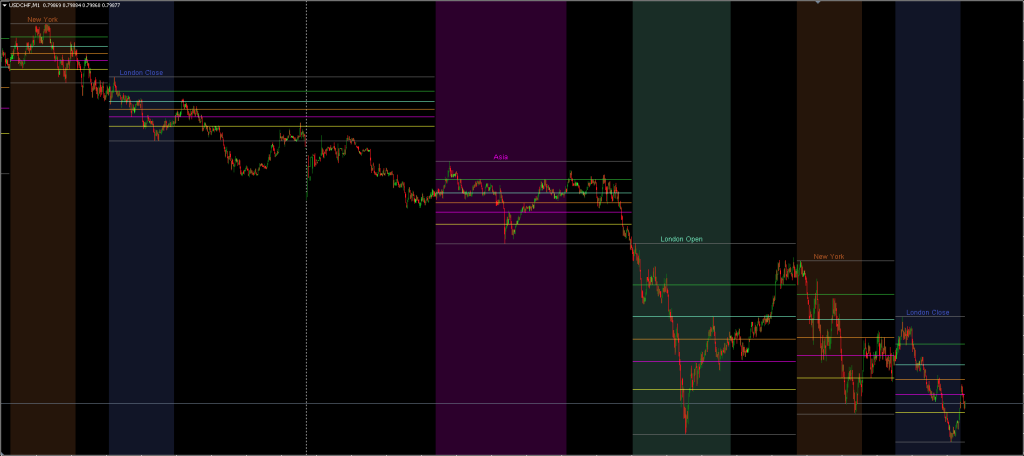

The indicator plots color-coded zones on the chart corresponding to each Killzone. Within each zone, Fibonacci retracements are applied using the high and low of price action during that time range. These retracements aim to highlight areas where price may react or reverse, offering traders reference points for potential entries or exits.

When there are no active Killzones on the chart, the Fibonacci levels remain fixed based on the last completed zone’s price action. This provides ongoing reference levels even when the market transitions out of an active trading range.

Users can manually enable or disable specific Killzones and extend the corresponding Fibonacci retracements beyond the original zone. This flexibility offers opportunities for customized analysis, such as focusing only on select sessions or observing price behavior relative to historical retracements.

This Smart Money Concept Indicator isn’t a standalone trading indicator System. Still, it can be very useful for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

What Are ICT Killzones?

Killzones are predefined time intervals during which market volatility and liquidity are thought to increase, making them of interest for identifying trading opportunities. The ICT methodology outlines the following major Killzones:

- New York Killzone: 7:00 – 9:00 ET

- London Open Killzone: 2:00 – 5:00 ET

- London Close Killzone: 10:00 – 12:00 ET

- Asian Killzone: 20:00 ET onward

These time slots coincide with major forex market openings or transitions, where increased institutional activity could drive price movement. The indicator is particularly aligned with forex trading, as these are the sessions during which the markets typically see notable volume and volatility.

The Kill Zones Indicator can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best.

Download a Collection of Indicators, Courses, and EA for FREE

Practical Considerations

Traders applying the ICT Killzones Indicator should be aware of the importance of chart timeframes. The script is not optimized for timeframes greater than one hour, as the designated intervals may become inaccurately represented. It is recommended to use the indicator on charts of 1-hour or lower timeframe for faithful alignment with each Killzone’s intended range.

Additionally, while the Fibonacci integration aims to reinforce trade decision logic, its effectiveness will depend on the user’s grasp of ICT concepts, overall strategy, and market conditions. The indicator itself doesn’t generate buy or sell signals but rather provides a visual structure for market interpretation.

Customization Features

In operation, users can tailor the indicator by selectively hiding certain Killzones, as in examples where the New York or Asian sessions are not included. This selective view can be helpful when traders wish to focus solely on specific markets or remove potentially less relevant data from their analysis.

Extending the Fibonacci retracements also allows for a broader examination of price behavior post-Killzone, potentially offering insights into longer-term support or resistance levels. Though this feature may result in visual clutter if not managed carefully, it can aid in aligning short-term price action with broader market structures.

- Read More Mustang EURUSD Bot FREE Download

Conclusion

The ICT Killzones Indicator serves as a structural tool intended for traders employing time-based market analysis. It emphasizes the role of liquidity windows and Fibonacci-based retracement patterns within those windows. Rather than providing direct trade setups, the script supports planning and visualization efforts, especially for those familiar with ICT methodologies. Kill Zones Indicator utility depends largely on the trader’s interpretation and how the data is incorporated into a broader trading plan.

The best in the game 🎱