Best Forex Analysis Indicators – Technical Tools

Looking for powerful forex analysis indicators? Browse our collection of 100+ verified technical analysis tools for MetaTrader 4 and MT5. From oscillators to volatility detectors, these indicators help you analyze market conditions and identify trading opportunities.

Popular Analysis Indicator Types:

🏆 Top 5 Analysis Indicators (Editor’s Pick)

| Indicator | Type | Platform | Best For |

|---|---|---|---|

| ZeroLag MACD | Momentum | MT4/MT5 | Trend Reversals |

| SMI Ergodic Oscillator | Oscillator | MT4/MT5 | Momentum Analysis |

| SuperTrend Oscillator | Trend | MT4/MT5 | Trend Direction |

| Volatility Ratio V2 | Volatility | MT4 | Market Volatility |

| Market Structure Oscillator | Structure | MT4/MT5 | Market Structure |

💡 Pro Tip: Combine multiple analysis indicators for confirmation—use a trend indicator with an oscillator for best results.

320 posts found

Bullish Pennant Chart Pattern Forex Trading Strategy

Pin Bar Forex Trading Strategy

Support And Resistance Forex Trading Strategy

Support Turned Resistance Forex Trading Strategy

Ascending Triangle Chart Pattern Forex Trading Strategy

London Breakout Forex Trading Strategy

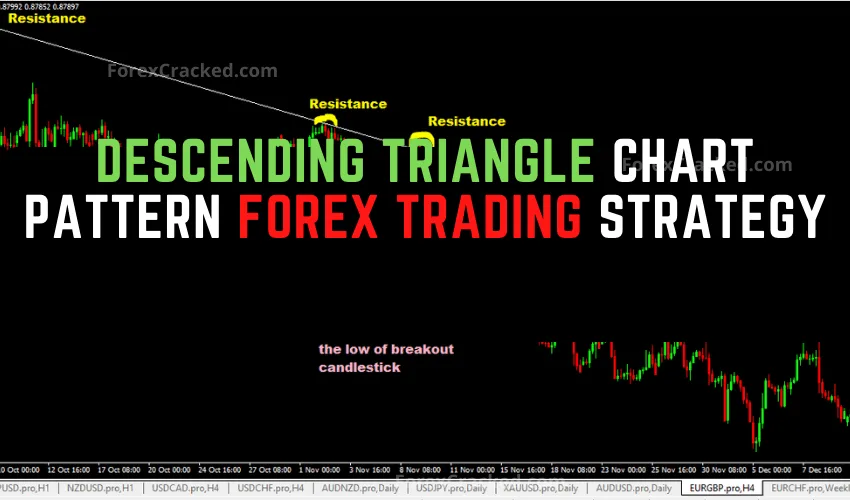

Descending Triangle Chart Pattern Forex Trading Strategy

Buy-Sell Forex Indicator FREE Download

Double Top Chart Pattern Forex Trading Strategy

Diagonal Price Channel Forex Trading Strategy

Trendline Retest Forex Trading Strategy

Simple Trendline Breakout Forex Trading Strategy

Simple GBPUSD Breakout Forex Trading Strategy

123 Chart Pattern Forex Trading Strategy

38.2 Fibonacci Level Forex Trading Strategy

Buy and Sell Currency Pairs in Forex

What Traded in Forex?

What is Forex Trading?

Forex Market Analysis – Types of Analysis

Frequently Asked Questions about Analytic Indicators

A forex analysis indicator is a technical tool that processes price data to help traders identify trends, momentum, volatility, and potential reversals. Examples include MACD, RSI, Bollinger Bands, and custom oscillators.

Trend indicators (like Moving Averages, SuperTrend) identify market direction and work best in trending markets. Oscillators (like RSI, Stochastic) measure momentum and identify overbought/oversold conditions, better for ranging markets.

Yes, combining 2-3 complementary indicators provides better confirmation. For example, use a trend indicator (SuperTrend) with an oscillator (RSI) and a volatility tool (ATR). Avoid using too many indicators that show the same thing.

Many analysis indicators in this category are non-repainting, meaning signals don't change after they appear. Check each indicator's description—we note repainting status in our reviews.

Start with classic indicators like MACD, RSI, or Moving Averages. These are well-documented, easy to understand, and form the foundation of technical analysis. Add more complex tools as you gain experience.