As we head into 2026, the landscape of algorithmic trading continues to evolve. Traders are increasingly moving away from “black box” systems that promise impossible returns and looking for transparent, robust tools that can survive shifting market conditions. While the market is flooded with heavily advertised bots, some of the most effective tools are often the ones flying under the radar.

In this guide, we have isolated 5 Underrated Profitable Forex Expert Advisors that have shown promise in late 2025 and are primed for the 2026 trading year. Whether you are looking for a safe scalper for a small account, a volatility-loving Gold bot, or a high-yield automated system, this list covers the “hidden gems” you can download and test today.

Table of Contents

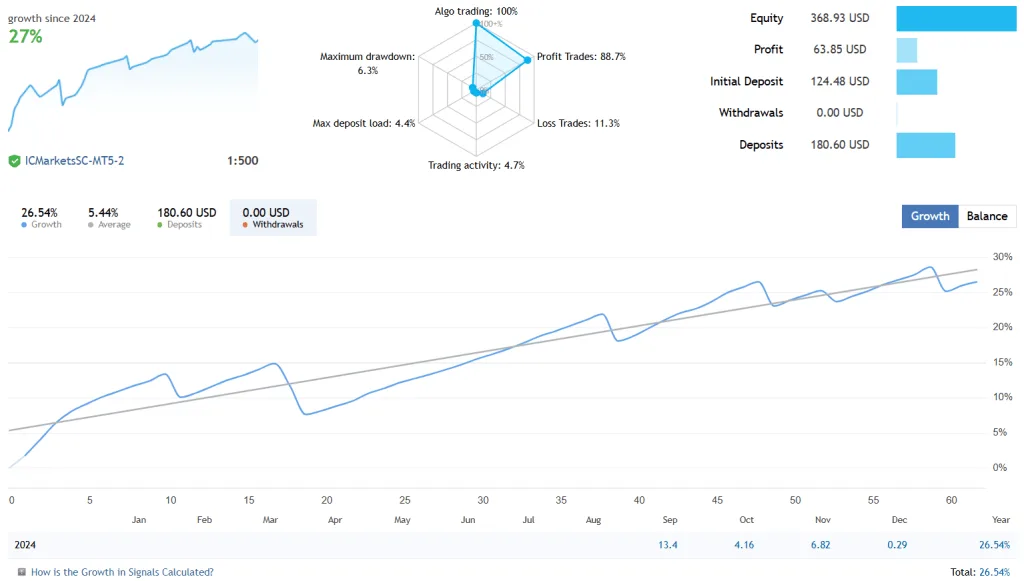

1. Forex Scalper EA: The Safe Haven for Small Accounts

For traders entering 2026 with a focus on capital preservation, the Forex Scalper EA stands out as a top contender. Unlike the vast majority of “get rich quick” bots that flood the market with risky grid systems, this EA is distinguished by a strictly defined safety protocol.

The “No Martingale” Advantage

The most significant selling point of the Forex Scalper EA is its refusal to use dangerous recovery methods. The developer explicitly excludes Martingale and Grid strategies. In a typical Martingale system, the bot doubles the lot size after a loss to recover equity—a strategy that often leads to catastrophic “margin calls”.

Instead, this EA utilizes a Hard Stop Loss on every trade. This makes it an ideal candidate for a “safe forex robot for small accounts,” as it limits the downside risk on a per-trade basis.

Performance Analysis: The “Scalper’s Trap”

To use this EA successfully in 2026, you must understand its risk profile, which acts as a classic “high-frequency scalper”.

- Win Rate: The system relies on high precision, boasting a win rate of approximately 79.67%.

- Risk-to-Reward: It has a negative risk-reward ratio. The average profit is $1.67, while the average loss is -$4.46.

- The Math: Essentially, the EA risks about $2.70 to gain $1.00. This means the system must maintain a win rate above ~73% to remain profitable. If the win rate drops, the strategy will lose money.

Despite this, the EA has shown a Profit Factor of 1.47, indicating a sustainable edge over the market. Its Recovery Factor of 4.65 is particularly impressive, suggesting that for every $1 of drawdown, it has historically generated $4.65 in profit, proving its ability to dig itself out of holes without blowing the account.

Critical Requirements for Success

Because this EA targets very small gains (avg $1.67), it is extremely sensitive to broker conditions.

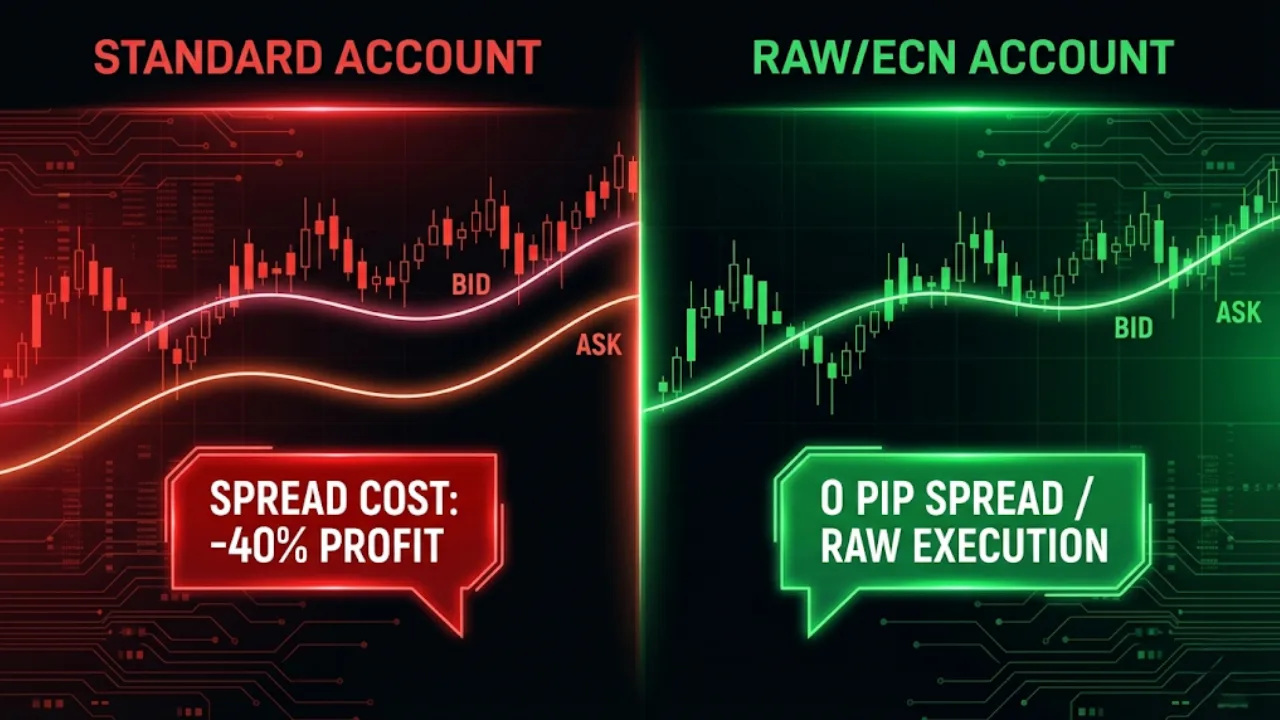

- Broker: You must use a Raw Spread / ECN account. Standard accounts with high spreads will eat your entire profit margin.

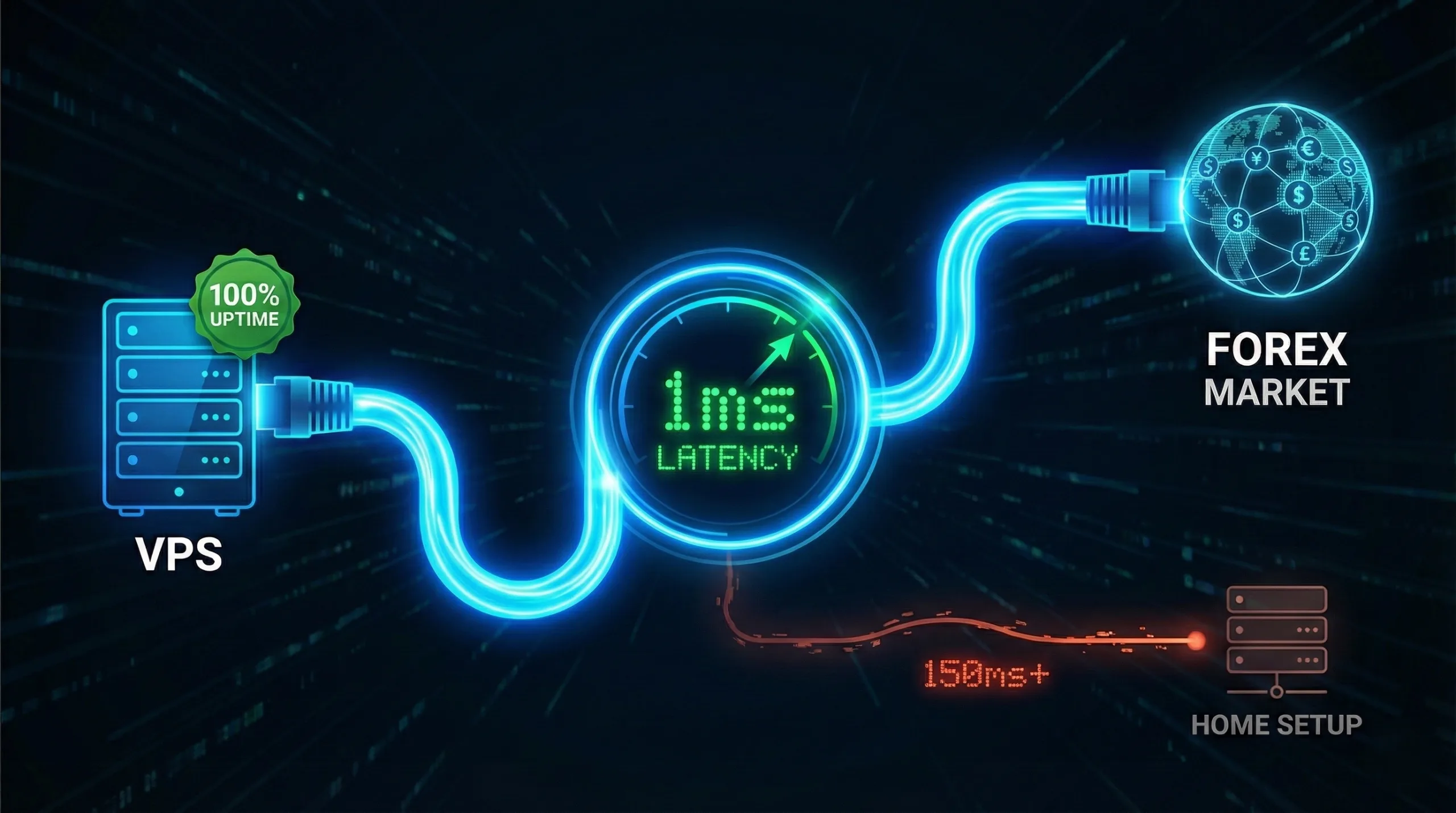

- VPS: A low-latency VPS is required to ensure instant execution.

- Pairs: Optimized for EURUSD, USDJPY, and GBPUSD.

2. Gold Trend Scalping EA: The Disciplined Trend Follower

Gold (XAUUSD) remains a favorite asset for traders due to its volatility, but it can destroy accounts just as quickly as it builds them. The Gold Trend Scalping EA (Trend Following EA) offers a structured, disciplined alternative to the chaotic Gold bots often found on forums.

Strategy: Riding the “Super Trend”

This EA is built on trend-following principles, which are particularly effective in the gold market where strong directional moves are common.

- Indicator Logic: It employs a Super Trend indicator to identify the main trend on larger timeframes, then executes trades on smaller timeframes (best on M15) to align with that momentum.

- Risk Management: Like the Forex Scalper EA, this bot avoids high-risk tactics. There is no Martingale, no Grid, and no Hedging.

- Protection: Every trade carries a fixed stop loss of 100 pips, ensuring that a sudden Gold spike doesn’t wipe out the account.

Why It’s Underrated

Users have described this EA as a “Hidden Gem”. Unlike many scalpers that fail when spreads widen, the Gold Trend Scalping EA is not sensitive to spread or slippage. This makes it much more accessible for traders who may not have access to ultra-premium institutional broker accounts.

While it doesn’t promise a 100% win rate (which is impossible), it offers a realistic approach to capturing Gold volatility. It also includes an automatic lot-sizing feature based on account balance, simplifying the setup for beginners.

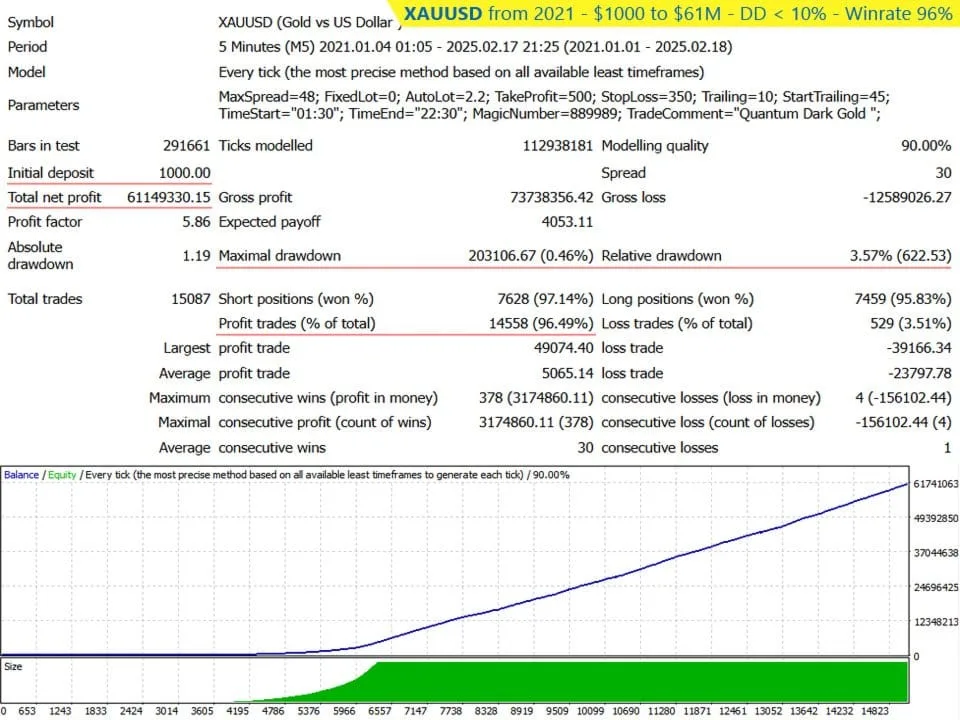

3. Gold Quantum EA: The “Straddle” Breakout Specialist

If you are looking for a more aggressive approach to Gold in 2026, the Gold Quantum EA offers a unique mechanism, though it requires a critical eye regarding its marketing.

De-bunking the “Quantum” Myth

The developer markets this as a “quantum strategy” involving superposition, but our analysis suggests this is largely creative branding. The underlying logic is actually a Straddle Breakout Method.

- The Mechanic: When a signal is detected, the robot opens both a Buy Stop and a Sell Stop order simultaneously.

- The Execution: The idea is that price momentum will trigger one of the orders, while the other is deleted. This allows the trader to catch sharp moves in either direction without predicting the direction in advance.

Essential Setup for 2026

This EA is considered “underrated” but comes with technical caveats that users must address to avoid losses.

- Decimal Places Matter: The default settings assume Gold is quoted in two decimal places. If your broker uses three decimals (e.g., 2230.123), you must multiply the Take Profit, Stop Loss, and Entry Distance values by 10. Failing to do this can lead to erratic behavior.

- User Feedback: Mixed reviews exist. While some users found good results by avoiding the New York session and Fridays, others noted that frequent stop-loss hits could consume profits. This suggests the EA requires optimization rather than “set and forget” usage.

- Platform: Note that as of late 2025, this version is only available for MT4.

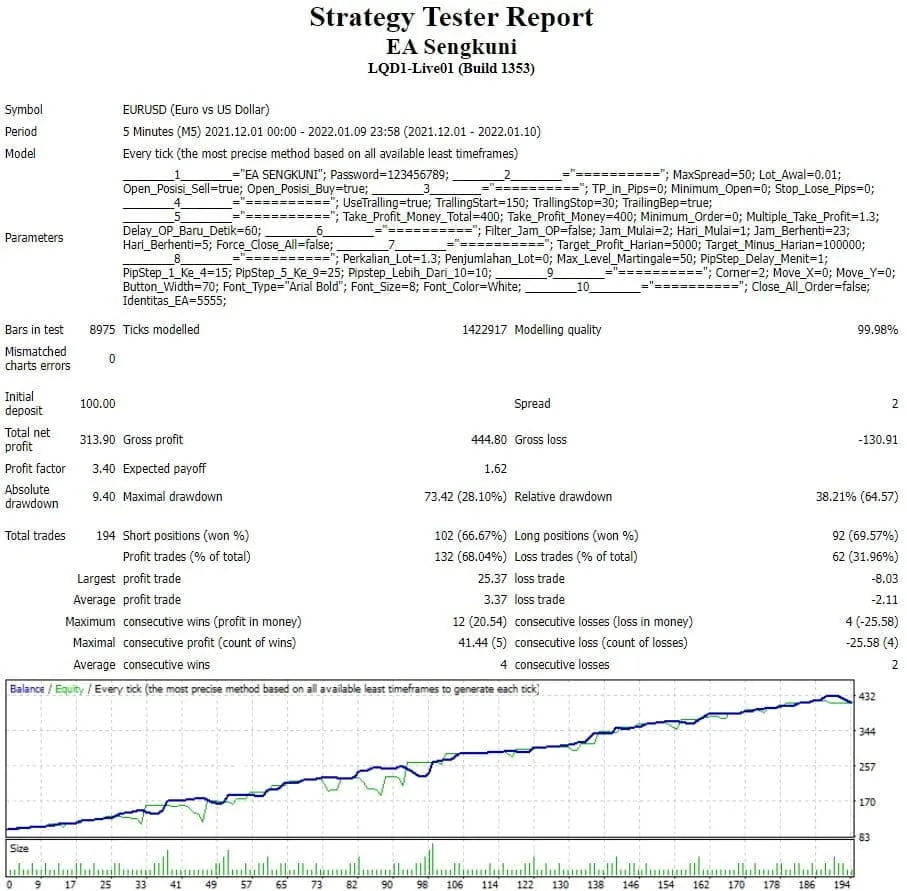

4. Sengkuni MT4 EA: The High-Yield Hybrid

For traders with a higher risk tolerance looking for aggressive growth in 2026, the Sengkuni MT4 EA presents a powerful, albeit dangerous, combination of strategies.

The Power of Martingale + Hedging

Sengkuni attempts to balance risk and reward by combining two controversial strategies:

- Martingale: It doubles down on losing positions to recover losses plus profit.

- Hedging: It opens offsetting positions to cushion against the drawdown caused by the Martingale logic.

The developers claim this allows for a very high ROI, and tests have shown it can potentially double a $100 account in just two weeks. However, this “miracle” performance comes with the risk of blowing the account entirely.

Managing the Beast

To make this underrated EA profitable in 2026, you cannot simply leave it running 24/7.

- News Filtering: It is heavily recommended to turn off the EA and close all trades during volatile markets or high-impact news events.

- Pairs: It works best on EURUSD and USDCAD.

- Capital: While it can run on $100, using a Cent Account is safer to absorb the drawdowns inherent in Martingale strategies.

Warning: This EA has shown errors (Error 4200) in the past related to broker message limits, so monitor it closely.

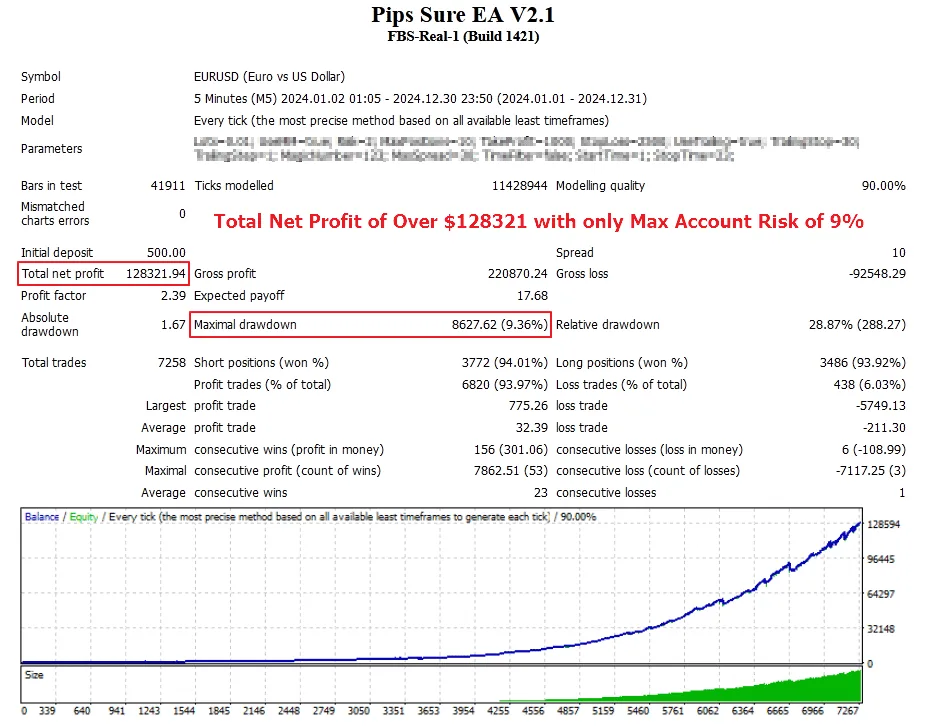

5. Sure Pips EA: The Automated Technical Analyst

The Sure Pips EA is a great entry-point for traders who want a fully automated system that mimics manual technical analysis.

The 3-Indicator Strategy

This purely automated robot merges three different technical indicators to validate trades.

- Long-term Trend: Determines the major market direction.

- Short-term Trend: Identifies precise entry points.

- Confirmation: Trades are only taken when both trends align, creating a higher probability of success.

The Risk Factor: Hidden Martingale

While it is user-friendly and includes standard risk management (Stop Loss, Trailing Stop), it does employ a Martingale Recovery System. If a trade goes against you, the EA will increase lot sizes to attempt a recovery. While this helps “fix” bad trades, it creates the risk of large drawdowns if the market trends strongly against you without reversing.

Troubleshooting for Users

Some users have reported a “lotsize is too small” error. If you encounter this in 2026, the fix is simple: select “Auto Lot” in the EA settings rather than using a manual lot size. This EA works best on EURUSD on the M5 timeframe.

Technical Infrastructure for 2026 Success

Regardless of which of these 5 underrated EAs you choose, your success in 2026 depends heavily on your trading environment. The sources consistently highlight two non-negotiable requirements:

1. The Right Broker (ECN/Raw Spread)

Most profitable EAs, especially scalpers like the Forex Scalper EA and Gold Quantum EA, require razor-thin spreads.

- Why: If your EA targets a 5-pip profit but your broker charges a 2-pip spread, you are giving away 40% of your profit instantly.

- Recommendation: Use a Raw Spread or ECN account. Avoid Standard accounts for scalping. Brokers like Forex Pharaon or specific low-spread options are often recommended for these tools.

2. Low-Latency VPS (Virtual Private Server)

You cannot run these EAs from a home laptop that might lose internet connection or power.

- Why: EAs like Sengkuni and Forex Scalper need to run continuously to manage open trades and execute stops instantly.

- Recommendation: A reliable VPS with 1ms latency to your broker is standard practice for professional algo trading. Services like FXVM are frequently cited as trusted options for maintaining 100% uptime.

Conclusion: Which EA is Right for You?

As we look toward 2026, these five underrated Expert Advisors offer different paths to profitability, each with its own risk profile:

- For Safety First: Choose Forex Scalper EA. It avoids the “ticking time bomb” of Martingale and offers a robust recovery factor.

- For Gold Traders: Choose Gold Trend Scalping EA for a disciplined, trend-following approach, or Gold Quantum EA if you prefer breakout strategies and know how to configure technical settings.

- For High Risk/High Reward: Sengkuni MT4 EA offers explosive potential but requires active management to avoid blowing accounts.

- For Beginners: Sure Pips EA offers a balanced automation of technical indicators, provided you have the capital to withstand its recovery mechanism.

Final Reminder: No EA is a money-printing machine. Always test these robots in a Demo Account for at least one week before risking real capital. Understand the logic, adjust the settings to your broker, and never trade with money you cannot afford to lose.

Disclaimer: Trading Forex involves substantial risk. The performance figures cited (e.g., 79.67% win rate) are based on historical data and do not guarantee future results.