The Quantum AUDCAD Grid Bot is a fully automated trading system designed specifically for the AUDCAD currency pair on the M5 timeframe. This EA utilizes a hybrid algorithm that merges structured Grid trading with adaptive Martingale recovery logic.

This article provides a neutral analysis of the system’s live track record, technical specifications, and a link to download the AUDCAD EA for free.

How the Quantum Grid EA Works

The core logic of the Quantum Grid EA is built around capturing price movements within a defined range. It does not rely on predicting long-term trends but rather exploits market volatility.

- Grid Structure – The EA places orders at fixed intervals above and below the current market price. This allows the system to profit from normal market noise and consolidations.

- Adaptive Martingale – When the market moves against a trade, the system employs a Martingale recovery method. It opens subsequent trades with calculated lot size increases to lower the average entry price, aiming to close the “basket” of trades at a net profit once a retracement occurs.

- Volatility Adjustments – The algorithm is reported to expand or contract its grid spacing based on current market volatility, theoretically reducing exposure during high-impact news events.

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this Quantum King Robot works, then only use it in a real account.

Recommendations for Grid Bot

- Minimum Account Balance of 500$.

- Currency Pair – AUDCAD (Primary), USDCAD (Secondary observed in tests)

- It works best on M5. (Work on any TimeFrame)

- This Grid Bot should work on VPS continuously to reach stable results. So we recommend running this Quantum Grid on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- For the best result, a Low Spread ECN account is Recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Live Performance Review of AUDCAD EA

Based on the live signal results provided in the below screenshots, we can analyze the actual behavior of the AUDCAD EA compared to its theoretical description.

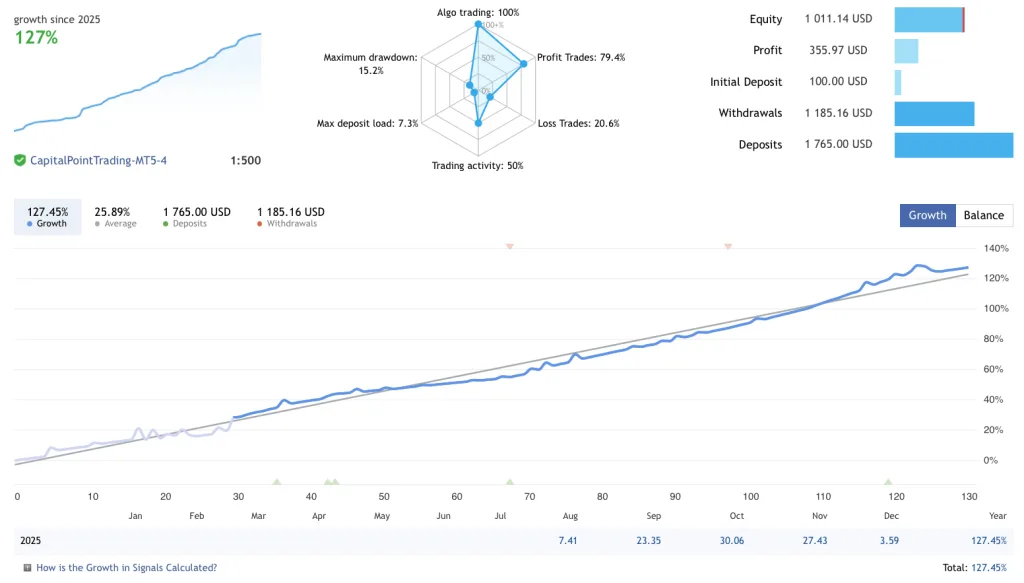

1. Growth vs. Profitability

The signal shows a Growth rate of 127.45% for the year 2025. However, a closer look at the raw numbers reveals a discrepancy common in signal monitoring:

- Total Profit – $355.97

- Total Deposits – $1,765.00

- Withdrawals – $1,185.16

- Current Equity – ~$1,011.14

While the “Growth” percentage looks high (often calculated using time-weighted returns on the initial balance), the absolute Return on Investment (ROI) based on the total capital flowed through the account is more modest. The system is profitable, but the high percentage is partly due to the calculation method used by the tracking platform.

2. Risk and Drawdown

- Maximal Drawdown – 15.2% (by Equity). This is a moderate risk level for a Martingale system. It indicates that while the balance curve (blue line) goes up smoothly, the equity curve (green line) experiences dips where floating losses accumulate before closing.

- Deposit Load – The maximum deposit load is 7.3%, which suggests the bot uses relatively conservative lot sizing relative to the account balance, avoiding “all-in” scenarios.

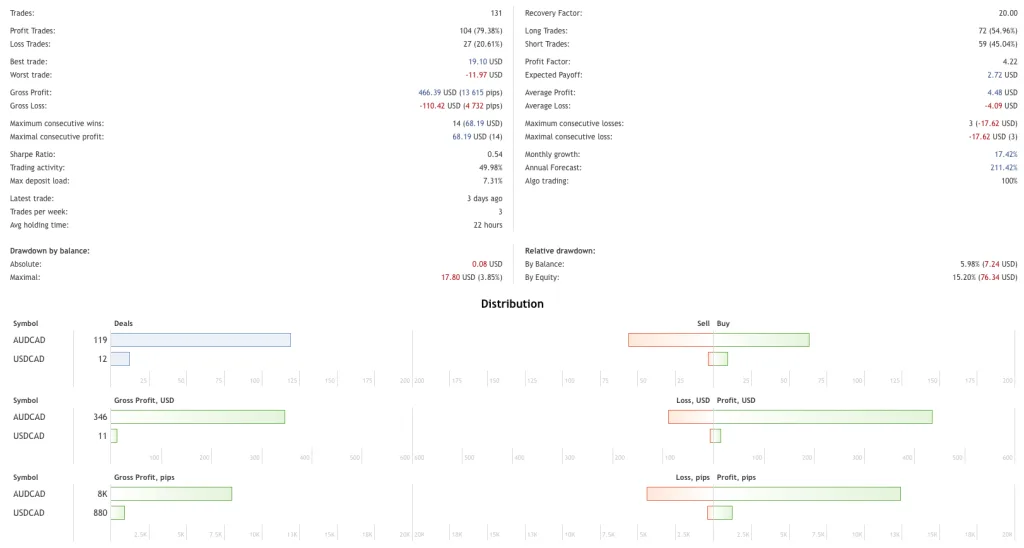

3. Trade Statistics & Efficiency

- Win Rate – The system boasts a high win rate of 79.38% (Profit Trades). This is characteristic of Grid systems that close small profits frequently and hold losing trades until they recover.

- Profit Factor – At 4.22, the gross profit is more than four times the gross loss, which is statistically strong.

- Sharpe Ratio – The Sharpe Ratio is 0.54. This is relatively low and indicates that the returns, while positive, come with a degree of volatility or inconsistency. A Sharpe ratio below 1.0 often suggests the risk-adjusted return is not optimal.

- Recovery Factor – A score of 20.00 is excellent, meaning the system has been very effective at recovering from its drawdowns so far.

Pros and Cons (Based on Live Results)

Pros

- High Recovery Ability – With a Recovery Factor of 20.0, the bot effectively manages to exit drawdown periods.

- Consistent Activity – A trading activity of roughly 50% ensures the capital is frequently utilized.

- Controlled Exposure – The max deposit load of 7.3% is safer than many aggressive Martingale bots that max out margin.

- High Win Rate – Nearly 80% of trades end in profit, providing a smooth balance curve.

Cons

- Dependence on Deposits – The account history shows frequent deposits ($1,765 total) and withdrawals. This heavy cash flow can mask the true organic growth of the initial $100 deposit.

- Martingale Risk – The “Maximal consecutive wins” (14) vs. “Maximal consecutive losses” (3) confirms the strategy holds losers. If a trend does not retrace, the 15% drawdown could theoretically increase.

- Low Sharpe Ratio – The 0.54 score suggests that for every unit of risk taken, the reward is somewhat marginal compared to safer investment vehicles.

Final Thoughts

The Quantum AUDCAD Grid Bot operates exactly as a modern Grid-Martingale system should, it generates a high win rate and a smooth balance chart by managing losing trades through averaging. While the Profit Factor of 4.22 is impressive, users should remain aware of the 15% drawdown and the inherent risks of Martingale strategies during strong, one way market trends.

It hides all the history results from September to December lol. Typical scammer

This robot has many positive user reviews on the developer’s page. It seems genuine. It generates few trades during a week. I think it’s necessary to put it on a demo account for a while and see the result. It opens trades after resistance/support breakouts, uses stop loss and take profit, and has good money management. From yesterday until today it generated one trade for me and it’s currently in profit. So far, it seems okay to me.

Something I forgot to mention, this EA is a grid + martingale strategy. This means that the loss recovery system involves a significant amount of risk. Perhaps in AUDCAD this risk can be mitigated and controlled by the EA. In other pairs, in my backtest, it led to the account being wiped out.

hello sir

seems like you know how things work in the markets,

do you recommend any good eas that actually work here, and that are not going to blow an account ?

i have been testing and searching for a while here but its all mostly no good

if you dont mind sharing anything from your experience, would be appreciated

Hello. All the EAs I know and use are similar to those you find on this site. And they all have their risks and can blow up accounts if not used with caution. The “good” EAs I know are all grid, martingale, averaging, or hedge types. They are similar to this Quantum Audcad. Therefore, I can’t suggest any EA that is completely safe. And that doesn’t mean they’re bad. It all depends on the size of the BALANCE you allocate to run them. That’s a trick: you put a BALANCE in the account capable of withstanding market fluctuations, and make some adjustments to the settings to reduce risks (decrease the lot size, reduce the martingale multiplier, expand the grid range, replace the pair, etc.). This is done after backtesting and then letting it run on a Demo account. That’s what I’m doing right now: I installed Quantum Audcad on a Demo account and I’ll let it run for a while until I’m sure it works for me or not. Do the same! Start with Quantum-Audcad and, if it doesn’t work for you, try others until you find one that suits you. Good luck and happy trading!

i have backtested this EA from 2020 until today’s date, so far so good, no MC even with extreme settings, always deposit small with money that you can afford to lose for such type of EA

ok

thank you for your reply and advices

much appreciated

It says “invalid license”. What is the problem here?