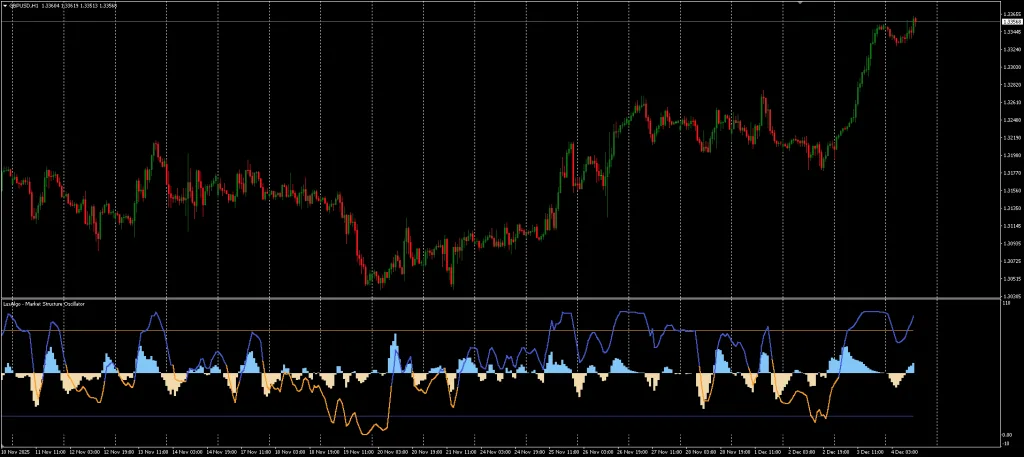

The Market Structure Oscillator is a technical analysis tool available for MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Designed to interpret market dynamics, this indicator visualizes shifts and breaks in price structure across multiple timeframes. It aims to provide traders with data regarding trend reversals, trend strength, and general market momentum without relying on subjective interpretation.

Below is a detailed breakdown of how the indicator functions, its technical components, and the available customization options.

This indicator was featured in our Top 10 Best Free MT4 Indicators for 2026 — read the full comparison with expert reviews and trading strategies.

Technical Functionality

The core function of the Market Structure Oscillator is the detection of swing levels. The script operates by identifying specific price points to map out the market structure:

- Swing Point Detection – The process begins by identifying short-term swing points based purely on price movement. These short-term highs and lows serve as the baseline data.

- Multi-Timeframe Analysis – Using the short term points as a reference, the swing trading oscillator indicator subsequently derives intermediate and long term swing points. This creates a tiered analysis framework intended to provide objective data on market structure.

- Structure Shifts and Breaks – The tool analyzes these swing points to detect Market Structure Shifts (MSS), also known as Change of Character (CHoCH), and Breaks of Structure (BoS). An MSS typically suggests a potential change in trend direction, while a BoS indicates that the price has surpassed a previous swing high or low, suggesting trend continuation.

The result of this calculation is a specific oscillator value that aggregates short, intermediate, and long-term market data.

MT4 Market Structure Indicator can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

The Market Structure Oscillator Indicator can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. It can also be used on any time frame that suits you best, from the 1-minute to the 1-month charts.

Configuration and Customization of MT4 Market Structure Indicator

MT4 Market Structure Indicator allows for extensive modification to fit specific trading strategies. Users can adjust the weight of different timeframes or toggle specific visual elements.

General Options

- Term Weights – Traders can assign specific weight values to Short-Term, Intermediate-Term, and Long-Term structures to prioritize specific data points in the calculation.

- Oscillator Smoothing – Adjusts the sensitivity of the oscillator line to reduce noise.

- Gradient Colors – Allows for the customization of colors representing bullish and bearish trends.

Cycle Oscillator Settings

- Histogram Display – Toggles the visibility of the Cycle Oscillator histogram.

- Cycle Signal Length – Defines the lookback period for generating cycle signals.

Visual Display Settings

- Independent Oscillators – This option plots individual oscillator lines for different time periods (short, intermediate, long) with distinct colors for granular analysis.

- Market Structures on Chart – Users can choose to overlay the detected market structures directly onto the main price chart.

Download a Collection of Indicators, Courses, and EA for FREE

Market Structure Oscillator Usage in Trading

The Market Structure Oscillator converts price action into a visual format to assist with market analysis.

- Divergence and Thresholds – Similar to standard oscillators, this tool can be monitored for threshold crossings or divergence between price and the oscillator line, which serve as technical signals for potential entry or exit points.

- Trend Identification – By monitoring structure breaks (BoS), the indicator tracks the persistence of the current trend. Conversely, structure shifts (MSS) are displayed to highlight potential changes in market sentiment.

- Momentum and Cycle Analysis – The indicator includes a Cycle Oscillator component displayed as a histogram. This feature allows users to view market cycles and gauge momentum.

Conclusion

The Market Structure Oscillator serves as a technical aid for traders utilizing the MetaTrader 4 and MetaTrader 5 platforms. By automating the identification of swing points, market structure shifts, and breaks of structure, it provides a structured method for analyzing price action and market momentum. With its adjustable weighting systems and visual customization options, the swing trading oscillator indicator can be adapted to suit various analytical approaches. It remains a complimentary tool available for download for those looking to incorporate automated structure analysis into their trading workflow.