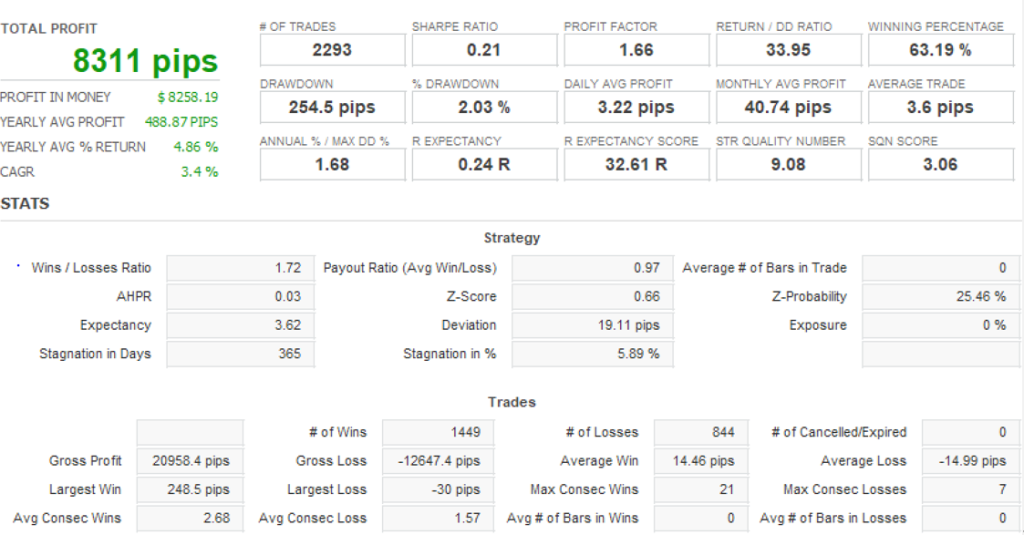

Hydrangea EA is designed for trading the USD/JPY currency pair using a blend of day trading and scalping techniques. It operates on the M5 chart and is characterized by a distinct trading logic rooted in what’s known as “anomaly based” trading. Unlike many commercial EAs that tend to rely on deeper stop losses to inflate backtest performance metrics, Hydrangea EA takes an alternative route by applying a more conservative approach, capping the maximum stop loss at 30 points.

Strategy and Trading Logic

Hydrangea EA operates on what is described as an “anomaly based” model. This means it seeks to capitalize on specific and repeatable price movements within certain market conditions, typically through identifying behavioral patterns driven by supply and demand in the trading of USDJPY.

Conventional anomaly EAs tend to execute trades at fixed times, based on historical tendencies of market direction during those hours. However, this can lead to rigid decision making and potentially unfavorable entries or exits depending on current market volatility or sudden news events.

Hydrangea attempts to build a more flexible system by incorporating technical conditions as part of its entry and exit logic:

- Entries may occur before or after the “set” anomaly time if technical confirmation is present.

- Entries can be skipped entirely if the technical setup appears unfavorable, even during the typical window.

- Exits are governed by a combination of parameters, including time-based conditions, take profit triggering, and technical indicators.

This strategy departs from the traditional “fixed time” model often seen in anomaly EAs and aims to increase adaptability.

Hydrangea EA can endure up to 30-point spreads, suggesting that the system may tolerate periods of low liquidity or higher volatility without triggering stop losses too easily.

Another design element includes the inclusion of gotobi (Japanese end of month/quarter business days) and middle price anomalies, as well as weekly/monthly supply demand metrics. This fusion aims to reinforce trade logic with identifiable macro timing effects, although it adds complexity to how the EA might behave around such periodic events.

Please test in a demo account first for at least a week. Also, please familiarize yourself with and understand how this Hydrangea Robot works, then only use it in a real account.

Recommendation for Hydrangea EA

- Minimum account balance of 100$

- It only work on USDJPY and M5 Timeframe.

- Hydrangea EA should work on VPS continuously to reach stable results. So we recommend running this free forex EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- The EA is NOT sensitive to spread and slippage. But We advise using a good ECN broker (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

EA Configuration and Position Management

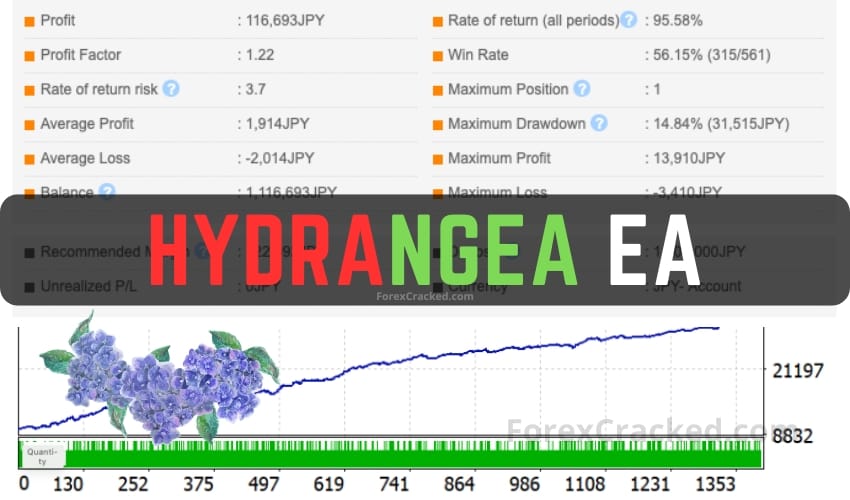

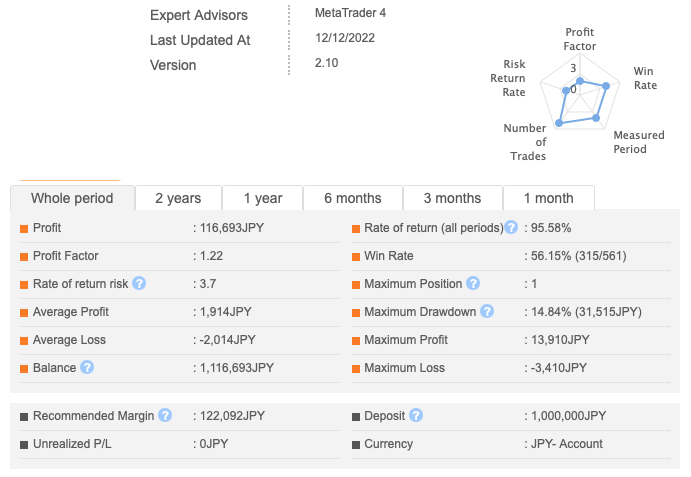

The system opens a maximum of one position at a time and avoids straddle trading. It targets a high take profit (up to 1000 points), paired with a relatively tight stop loss cap of 30 points. This unusually small SL for an anomaly-based system shapes how risk is managed.

An important aspect of Hydrangea EA’s risk model is the fixed SL30 setup. A key point raised by users is that this tighter stop loss allows traders to use significantly larger lot sizes compared to EAs with wider SLs (often found at 100 points in commercial settings), without increasing the percentage of total capital at risk. For example, with a 1 million yen account and a 2% risk per trade, a typical SL100 EA could open a 0.2 lot trade, whereas an SL30 system like Hydrangea could allow approximately 0.66 lots under the same risk parameters. This translates to potentially greater profits when trades are successful, assuming the win rate and market conditions support such risk allocation.

Conclusion

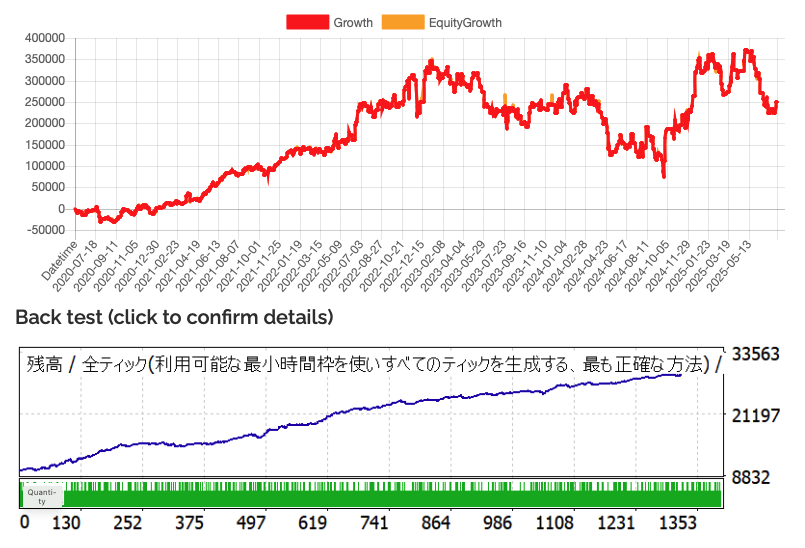

Hydrangea EA represents a niche approach within the world of forex expert advisors. With its focus on a tight stop-loss structure, integration of historical trading anomalies, and an aim to optimize real performance rather than just backtest appeal, it offers a contrast to common commercial EAs. However, its complexity and reliance on specific market behaviors imply that it may be better suited for experienced traders familiar with EA behavior, position sizing, and volatility risk. Whether it outperforms more traditional systems in practice depends heavily on execution quality and ongoing market dynamics.