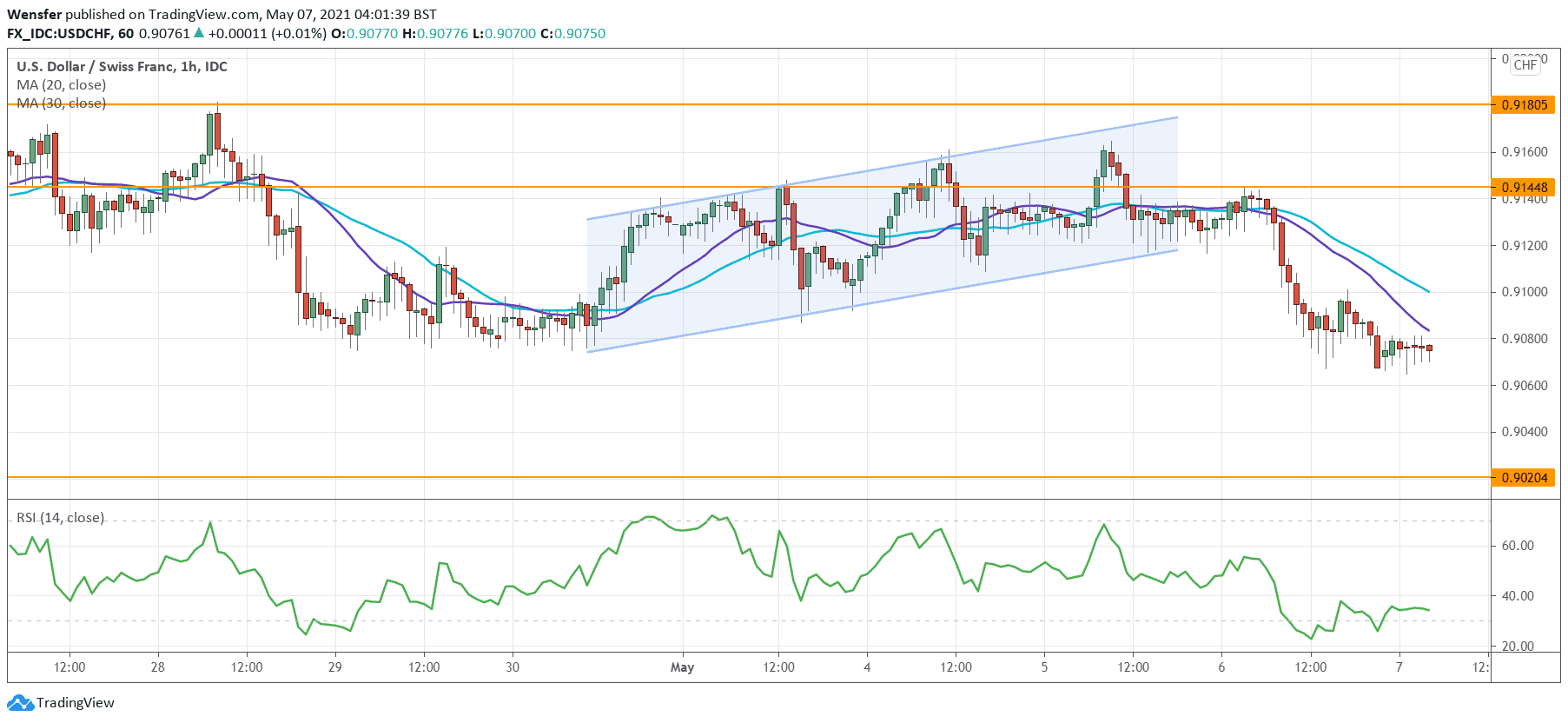

USDCHF tanks to new lows

The US dollar falls as higher continuing jobless claims point to volatility in the labour market. The bearish MA cross from the daily chart is a reminder of the US dollar’s weakness across the board.

The latest consolidation has ended up with a breakout below 0.9110 in continuation of the downtrend. As the RSI shows an oversold situation, profit-taking could lead to a short rebound towards the resistance at 0.9145.

However, this might turn out to be a dead cat bounce if trend followers seize it as an opportunity to sell into strength. 0.9020 would be the next target in the next round of sell-off.

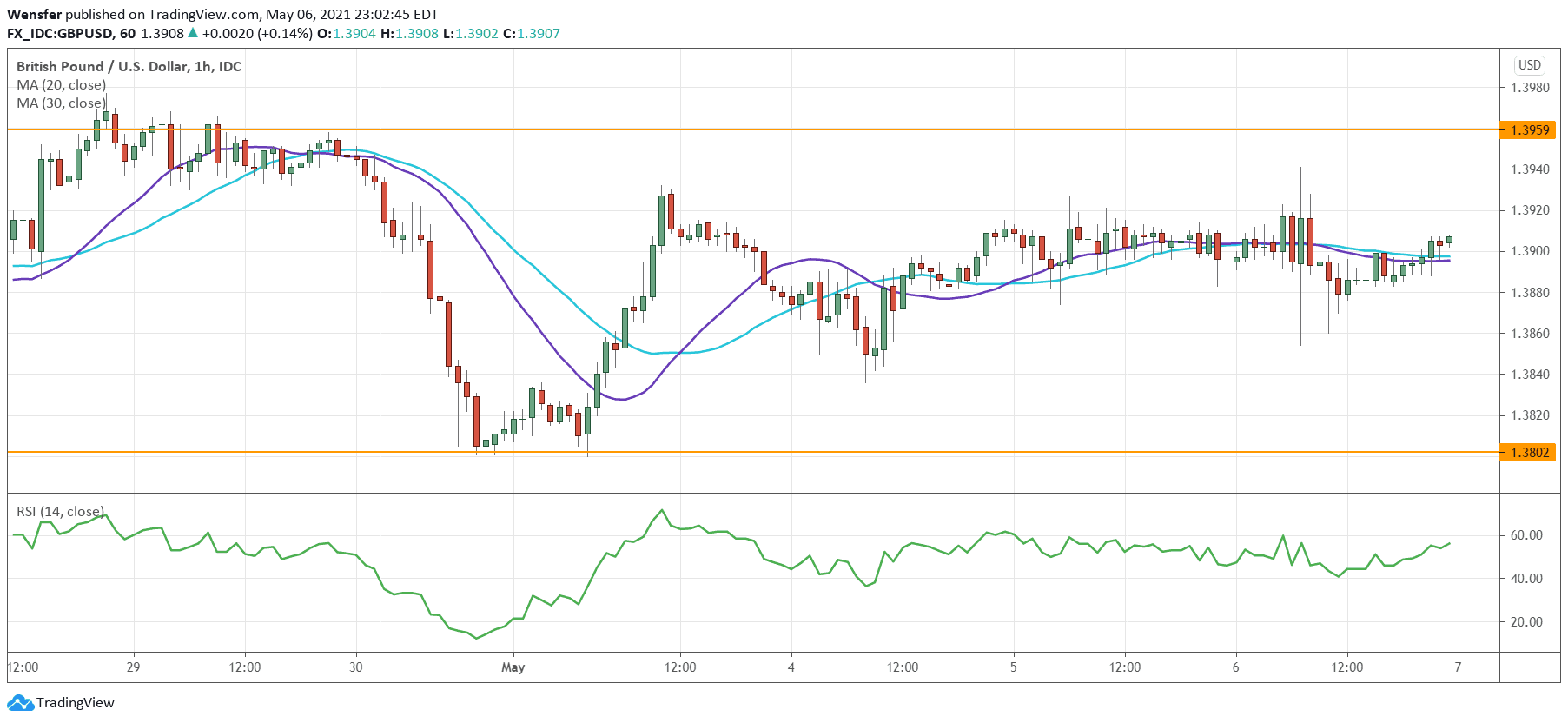

GBPUSD consolidates recent gains

Sterling found support after the BoE raised its forecast for Britain’s economy and hinted at reducing its stimulus programme.

The bullish MA cross on the daily chart may give buyers an edge as the price action wraps up its sideways action. A confirmation may come in with a breakout above 1.3960.

Strong momentum above the psychological level of 1.4000 could prompt short-term sellers to bail out. This would resume the pair’s upward trajectory.

On the downside, the demand zone between 1.3800 and 1.3840 is of interest for those wishing to bet against a soft greenback.

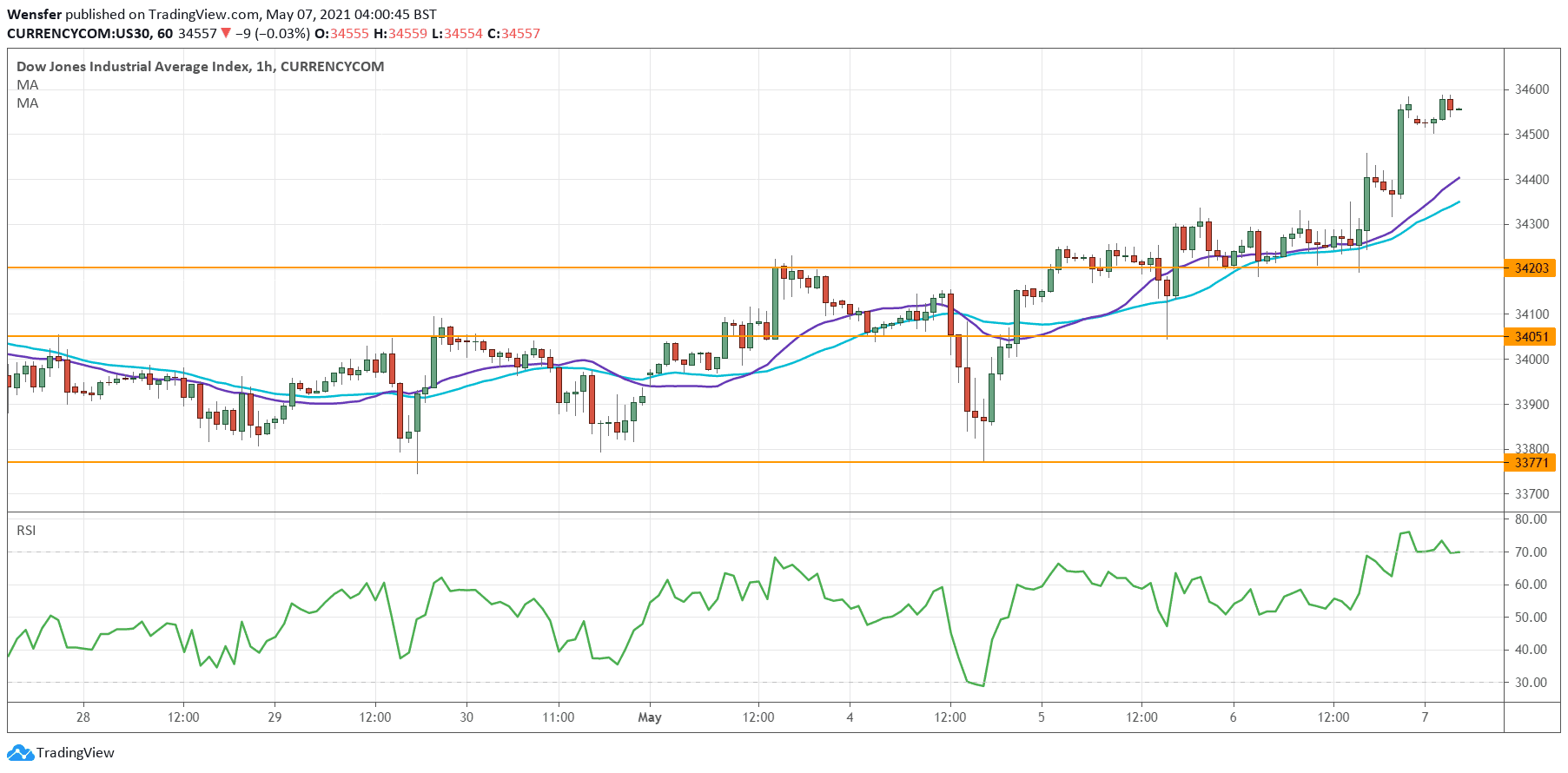

US 30 extends all-time high

The Dow extended gains to an all-time high as investors rebalance assets away from over-stretched growth stocks.

The index continues to grind higher along the 20-day moving average as a sign of optimism.

Following its breakout above the 33700-34250 range, buyers seem to have regained control of the price action. A runaway rally gained traction after sellers closed their positions when it was still cheap to do so.

An overbought RSI may suggest a temporary pullback. 34200 is the immediate support in case of a pullback. Further down, 33770 would be a critical level to maintain the short-term bullish fever.